Riepilogo dell'azienda

Generaleinformazioni e regolamento di SBI FXTRADE

SBI FXTRADEè stata fondata nel 2011 11, con sede a tokyo, in giappone, con un capitale sociale di 960 milioni di yen, con sede centrale membro della japan financial futures trading association (membro n. 1588), membro della japan crypto asset trading association (membro n. 1026). SBI FXTRADE attualmente detiene una licenza di cambio al dettaglio dall'agenzia di servizi finanziari del Giappone, con numero regolamentare 2010401096907.

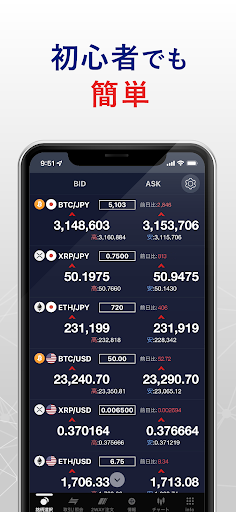

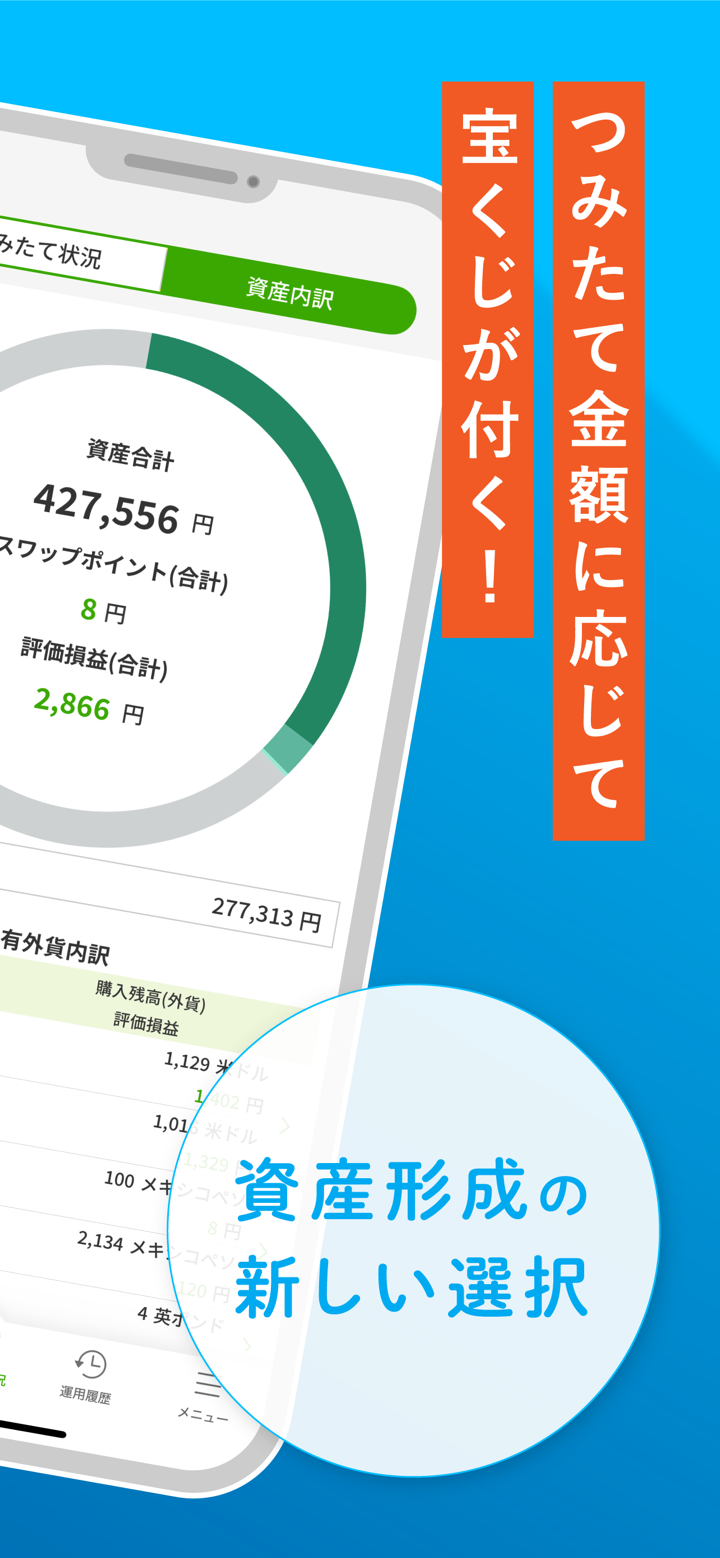

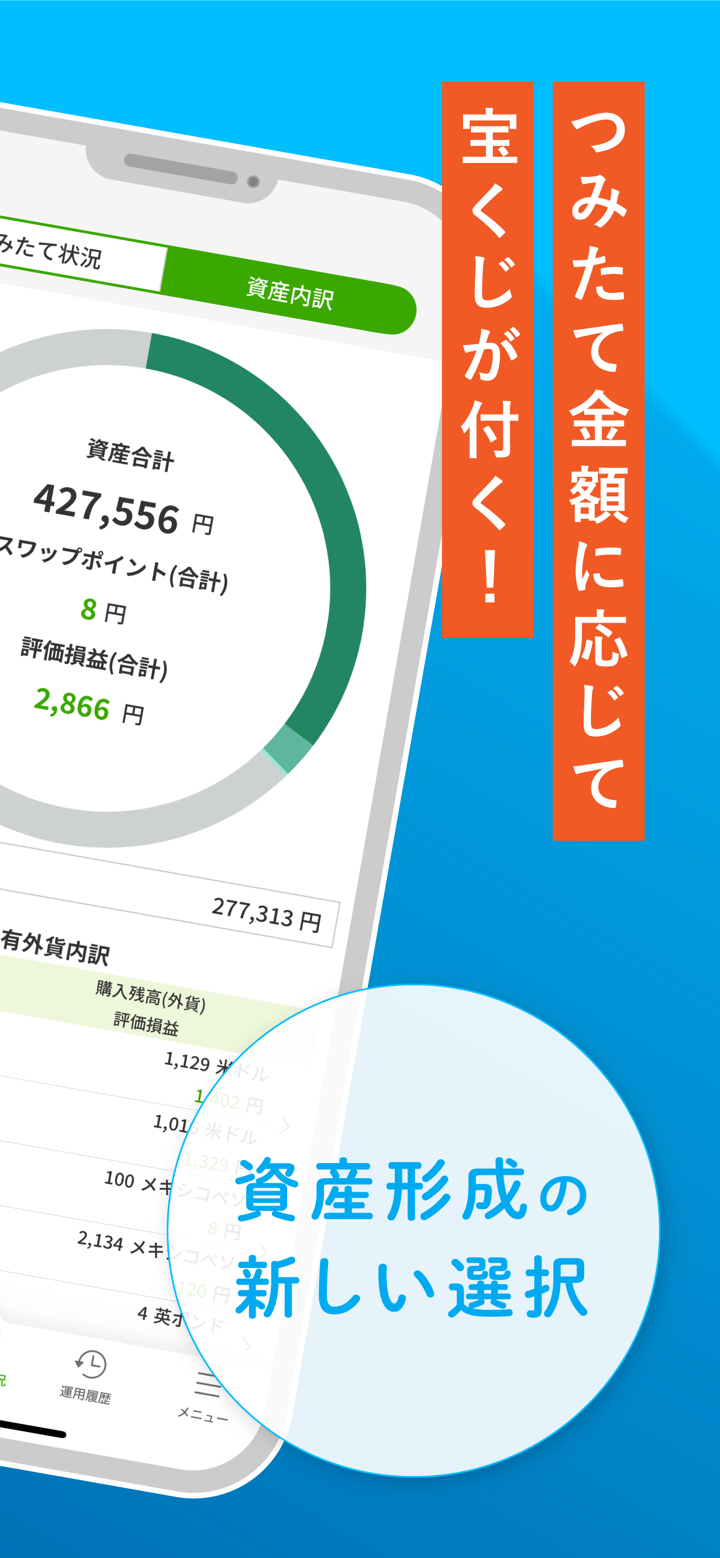

prodotti e servizi di SBI FXTRADE

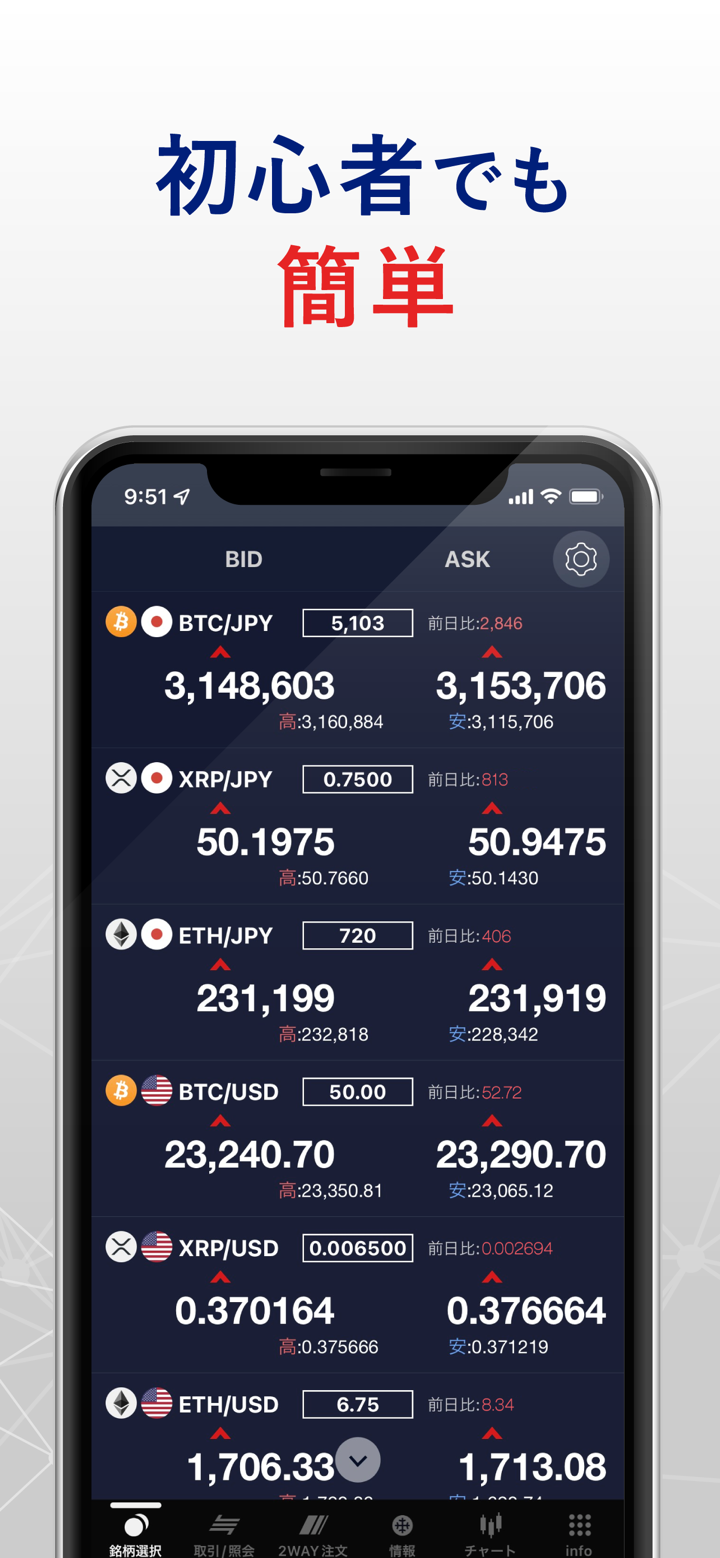

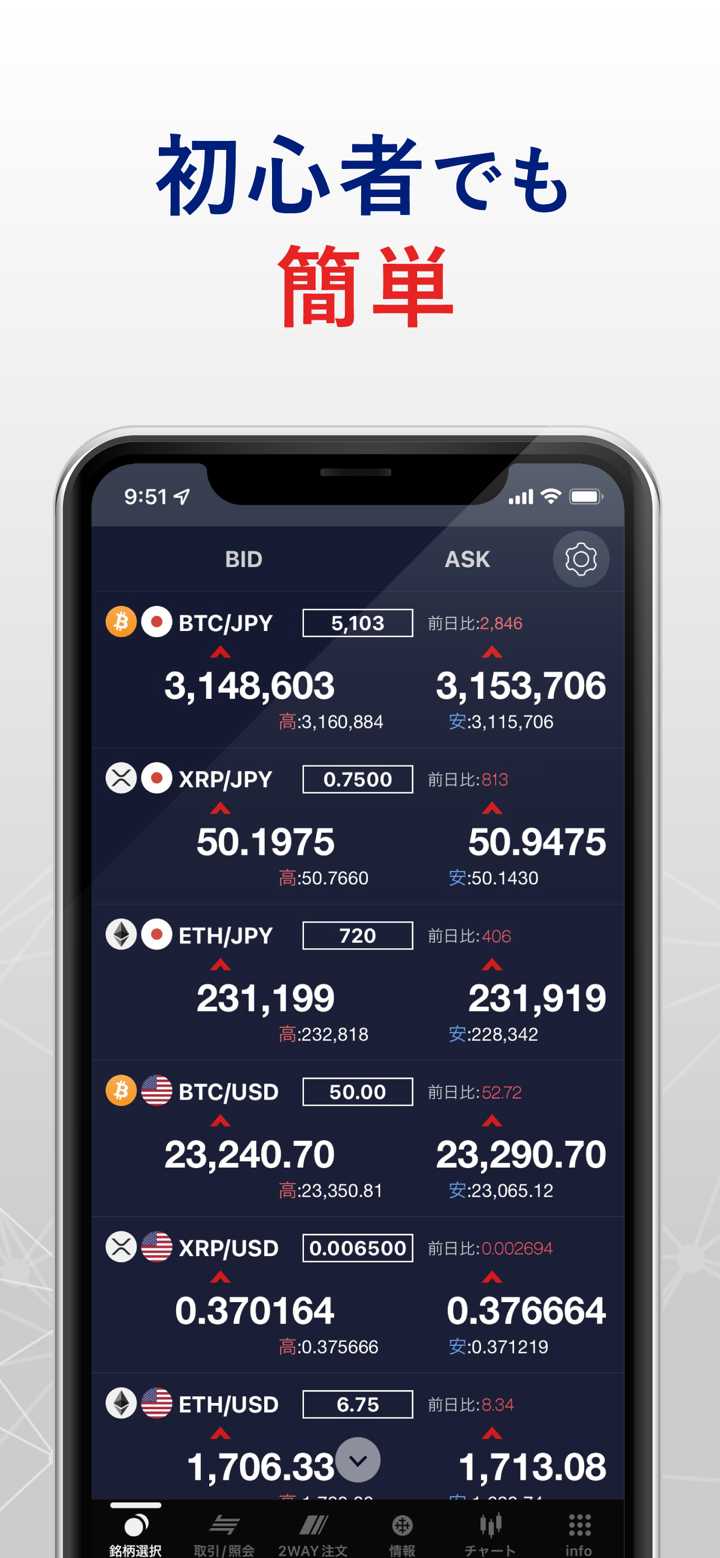

SBI FXTRADEfornisce agli investitori prodotti e servizi finanziari come la negoziazione di margini di cambio over-the-counter, opzioni, cambi di riserve valutarie e CFD su criptovalute.

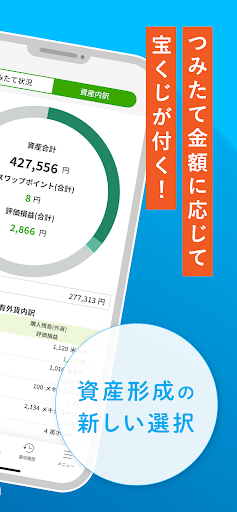

deposito minimo di SBI FXTRADE

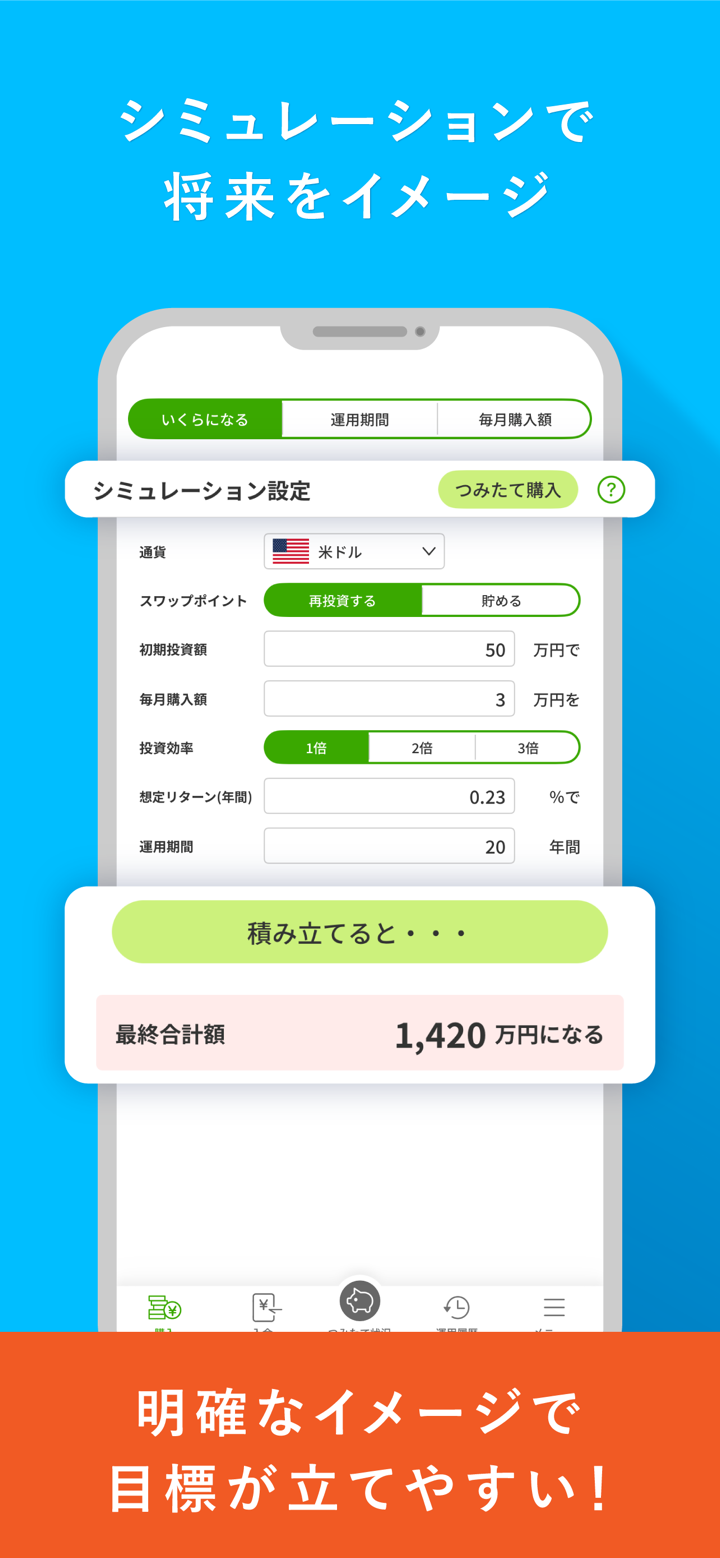

come quanto annunciato sul SBI FXTRADE sito web, il forex trading può iniziare con un deposito minimo di $ 1, che sembra abbastanza ragionevole per i principianti per iniziare. inoltre, è disponibile anche un conto demo per i trader.

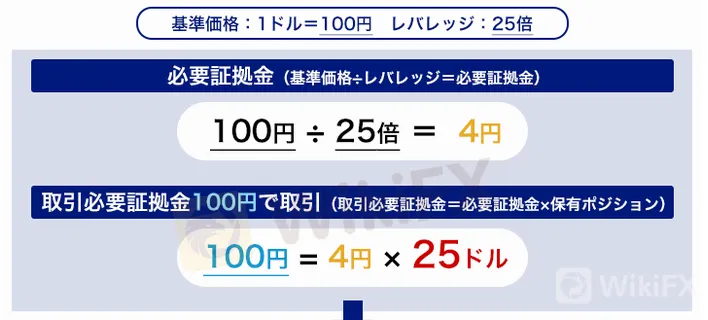

leva di SBI FXTRADE

Secondo le leggi giapponesi, la leva di trading massima per un conto di trading forex individuale è limitata a 1:25. Si consiglia ai nuovi trader di non utilizzare una leva di trading elevata, poiché la leva finanziaria può amplificare i rendimenti ma anche i rischi.

regole commerciali di SBI FXTRADE

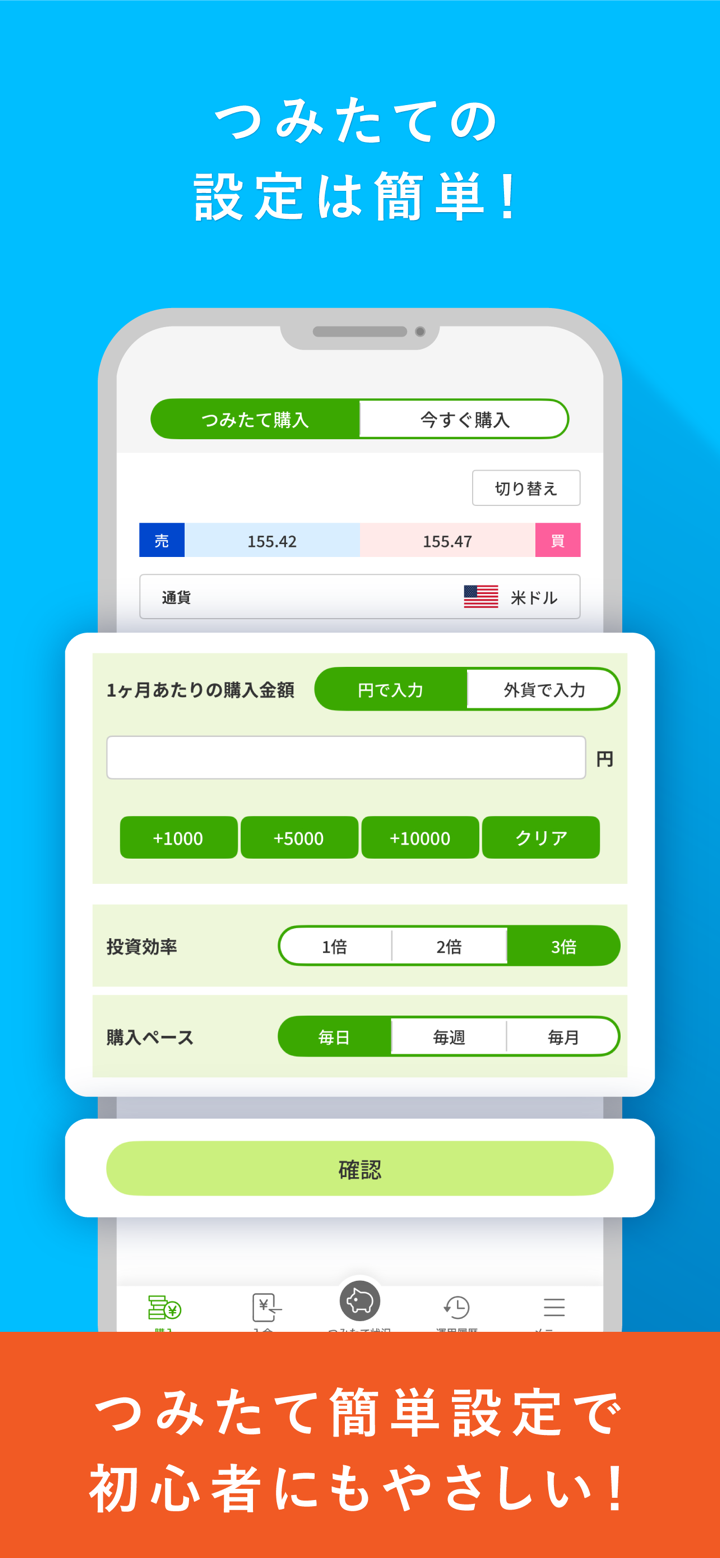

Il trading di valuta estera da banco è disponibile dal lunedì alle 7:00 al sabato alle 5:30 ora giapponese (ora legale) e dal lunedì alle 7:00 al sabato alle 6:30 ora invernale. Non esiste un limite minimo di deposito e la valuta di deposito è lo yen giapponese, la leva per i conti individuali è di 10x e 25x, le commissioni di transazione sono gratuite e le spese di gestione del conto sono gratuite. Gli orari di trading per le opzioni FX (opzioni put, opzioni call) sono dal lunedì al venerdì (JST): 08:30-05:30. L'orario di trading per i CFD su criptovalute è dalle 7:00 alle 6:30 (mattina presto) tutti i giorni con leva 2x.

spread di SBI FXTRADE

Lo spread per USD/JPY è 0,05 JPY, per GBP/JPY è 0,3 JPY, per AUD/JPY è 0,2 JPY, per NZD/JPY è 0,3 JPY, per CAD/JPY è 0,3 JPY, per HKD/JPY è 0,05 JPY e per RMB/JPY offshore è 0,1 JPY.

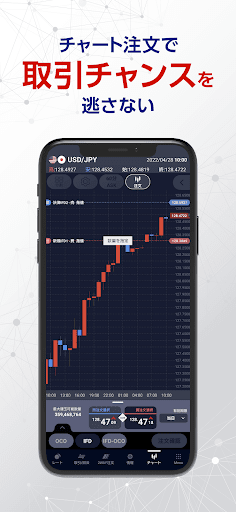

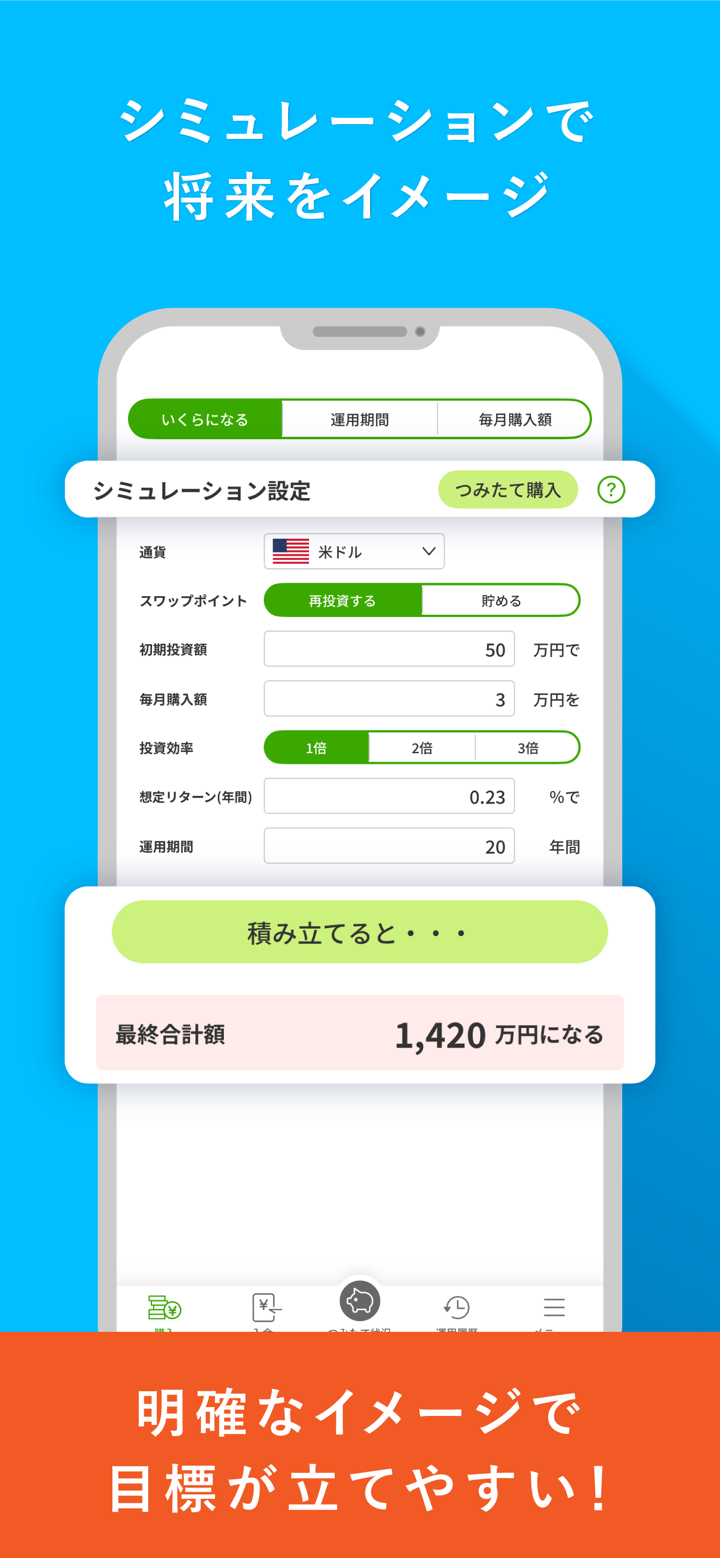

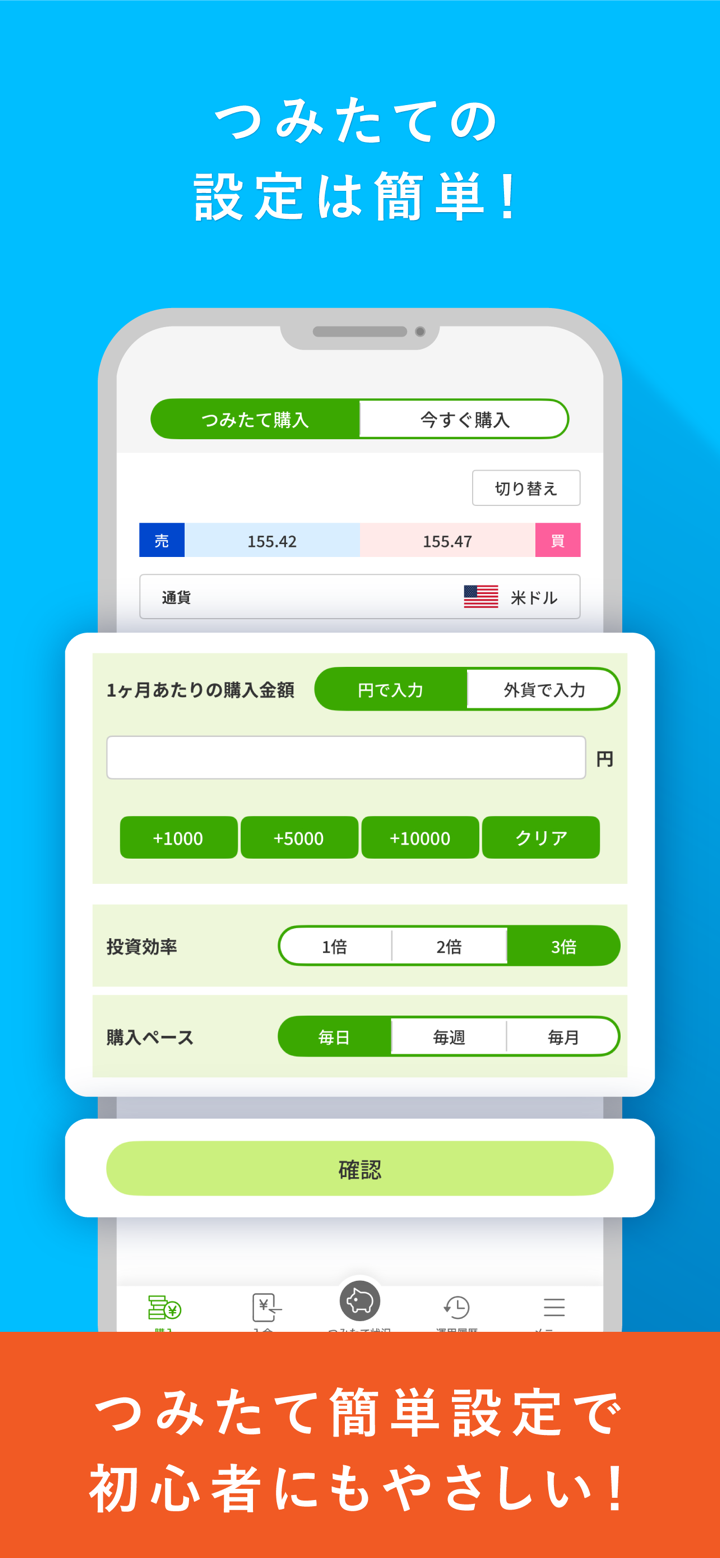

Piattaforma di trading disponibile

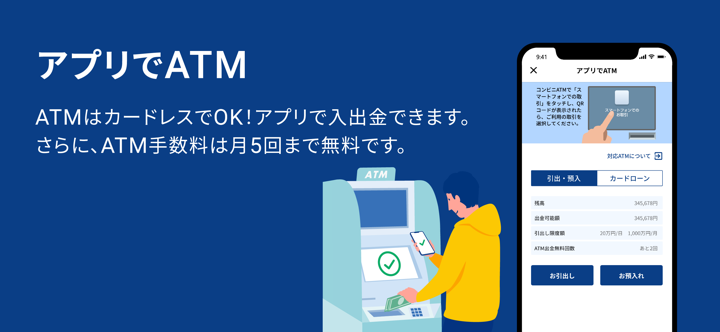

SBI FXTRADEoffre software di trading per Windows, Web e smartphone.

deposito e prelievo di SBI FXTRADE

SBI FXTRADEoffre due modi per depositare fondi sul tuo conto in forex: deposito normale o deposito rapido. in caso di deposito normale tramite bonifico bancario o online banking, il deposito arriverà entro 1-3 ore (dopo le 15:30 del giorno successivo) a spese del commerciante. in termini di deposito veloce, gli investitori possono effettuare un deposito tramite software di trading, immediatamente disponibile in 24 ore e gratuito per depositi superiori a 1.000 yen. dopo che il deposito è stato effettuato sul conto forex, può essere depositato sul conto forex opzione tramite bonifico.