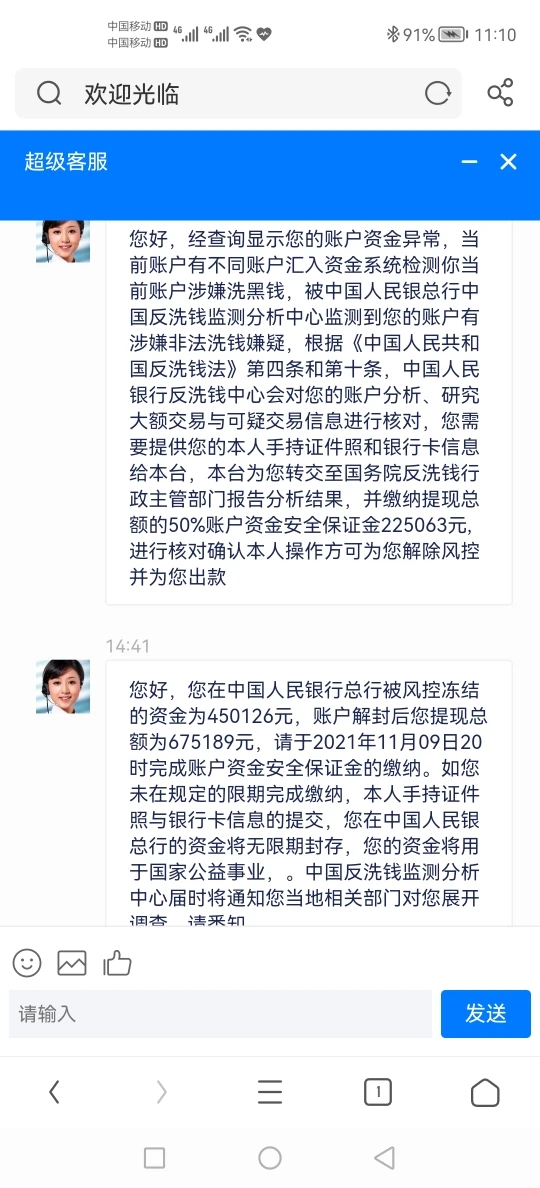

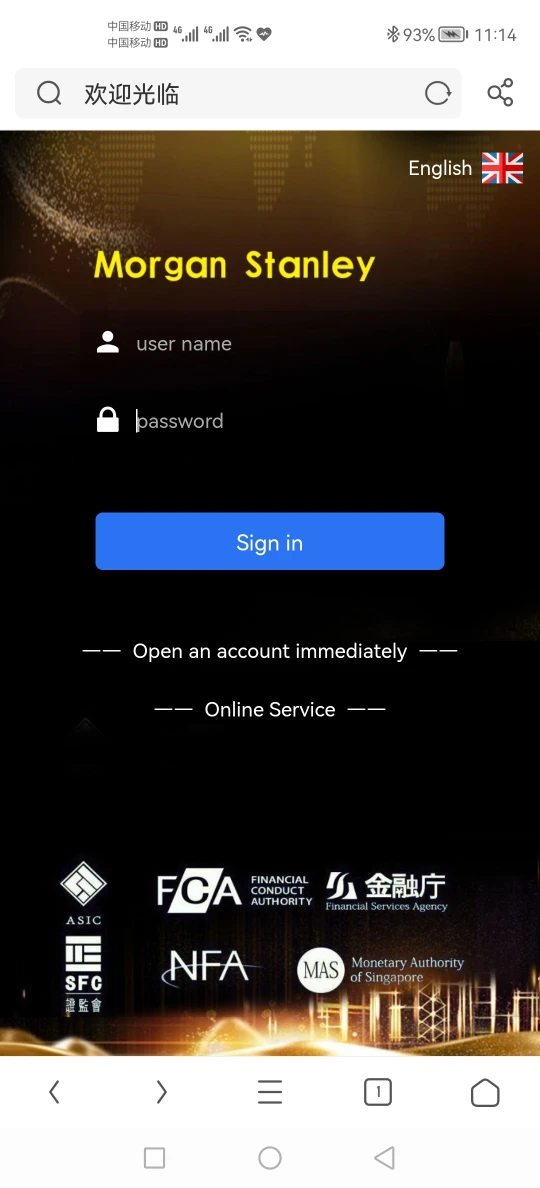

Riepilogo dell'azienda

informazioni generali di Morgan Stanley

Morgan Stanley(nyse: ms), una società internazionale di servizi finanziari fondata a New York nel 1935, ha nove divisioni sotto la sua sede centrale, tra cui ricerca azionaria, investment banking, gestione patrimoniale privata, cambi/obbligazioni, commercio di materie prime, ricerca sul reddito fisso, investimenti management, investimenti diretti e partecipazioni istituzionali, fornitura Morgan Stanley offre una vasta gamma di servizi finanziari, tra cui titoli, gestione patrimoniale, fusioni e acquisizioni aziendali e carte di credito. Morgan Stanley è attualmente rappresentata in più di 600 città in 27 paesi e impiega più di 60.000 persone in tutto il mondo. L'elenco Fortune 500 è stato pubblicato il 7 giugno 2017 e Morgan Stanley si è classificato 76 °. nell'ottobre 2019, Morgan Stanley si è classificata al 69° posto nella lista dei 100 migliori marchi globali di interbrand.

Regolamento

Morgan Stanleyè attualmente regolamentato dall'organizzazione di regolamentazione del settore degli investimenti del Canada (iiroc) e detiene una licenza completa sotto la sua autorità.

gestione patrimoniale di Morgan Stanley

Morgan Stanleyprivate wealth management è un team di consulenti specializzati in consulenza finanziaria e soluzioni di gestione degli investimenti per individui con un patrimonio netto elevato, famiglie e trust che controllano importanti asset investibili, fornendo soluzioni finanziarie personalizzate per i clienti.

Banche di investimento e mercati dei capitali

Morgan Stanleyfornisce una gamma di servizi di consulenza e raccolta di capitali a società, organizzazioni e governi di tutto il mondo. Morgan Stanley Il gruppo di fusioni e acquisizioni di fornisce soluzioni personalizzate per i clienti che si occupano di acquisizioni, cessioni, fusioni, joint venture, ristrutturazioni aziendali, riorganizzazioni patrimoniali, spin-off, offerte di scambio, acquisizioni con leva finanziaria, difesa delle acquisizioni e relazioni con gli azionisti. Morgan Stanley Il gruppo Global Capital Markets (gcm) di fornisce consulenza continua ai clienti con giudizio di mercato e reattività alle loro esigenze di capitale.

Vendite e commercio

Morgan Stanleyfornisce servizi di vendita e trading a istituzioni globali, innovatori del settore e hedge fund.

ricerca di Morgan Stanley

Morgan Stanleyfornisce anche una serie di ricerche che forniscono un'analisi approfondita di aziende, industrie, mercati e dell'economia mondiale.

gestione degli investimenti di Morgan Stanley

Morgan Stanleyfornisce prestazioni di investimento a lungo termine, servizi e una suite completa di soluzioni di gestione degli investimenti a una base di clienti diversificata che include governi, istituzioni, società e individui.

investimento sostenibile di Morgan Stanley

Morgan Stanleyha istituito l'istituto per gli investimenti sostenibili per guidare il lavoro della sua azienda, dei suoi clienti e delle istituzioni accademiche nel trasferire capitali verso imprese sostenibili attraverso i mercati e gli investitori globali.