简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Abstract:Deriv masks a trail of frozen accounts and predatory slippage behind a facade of multi-jurisdictional regulation. The data confirms a systematic pattern of blocking withdrawals once traders become profitable, proving that their real business model is capital retention, not facilitation.

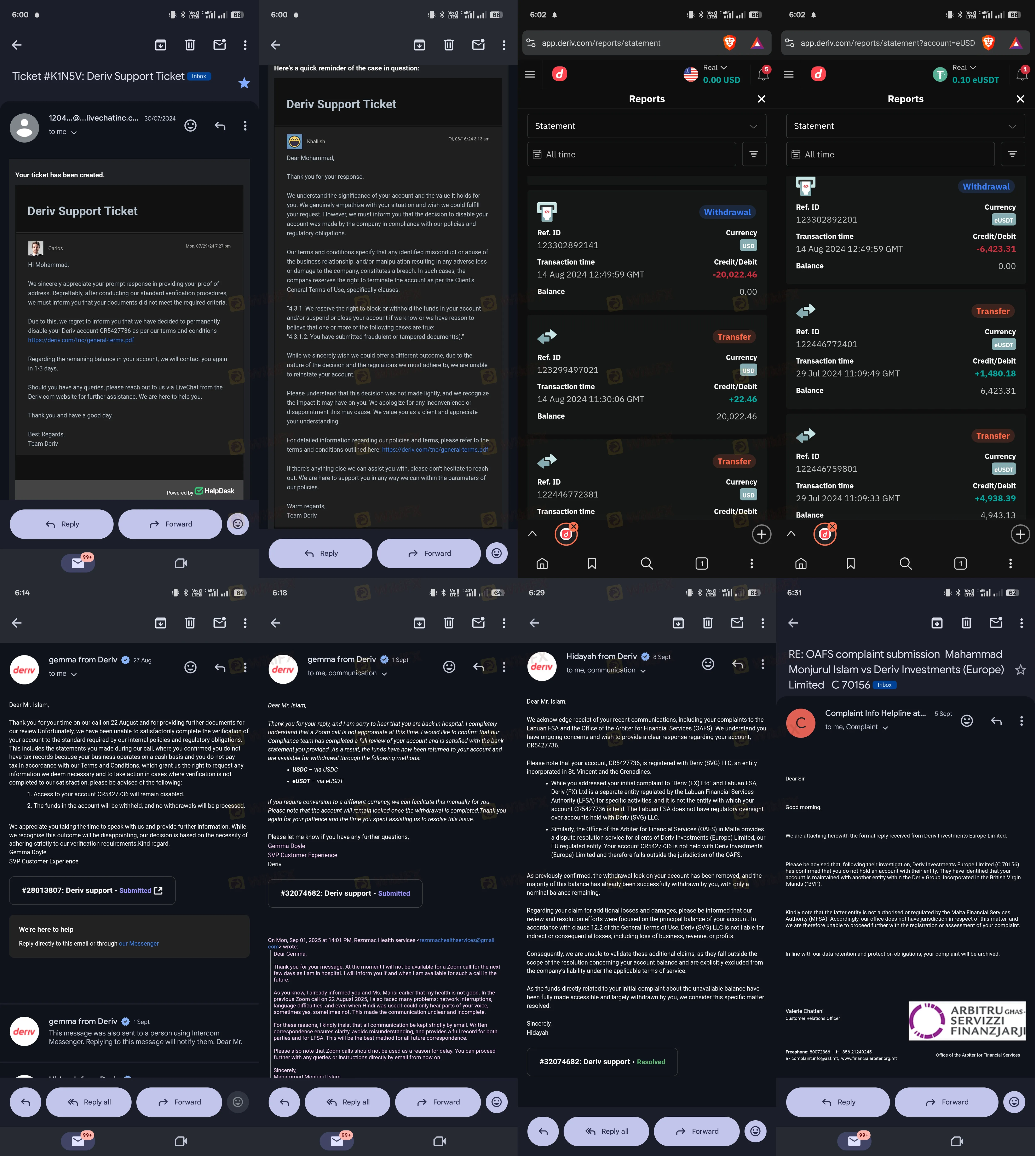

On paper, Deriv looks like a titan of the industry. They boast multiple licenses, an “AAA” influence rank, and a history dating back to 2019. But the gloss on their marketing materials is currently being dissolved by the acid of over 50 formal complaints in the last three months alone. If you are looking for a honest deriv review, you won't find it in their sponsored advertisements. Youll find it in the bank statements of traders who have seen thousands of dollars vanish into “offshore adjustments.”

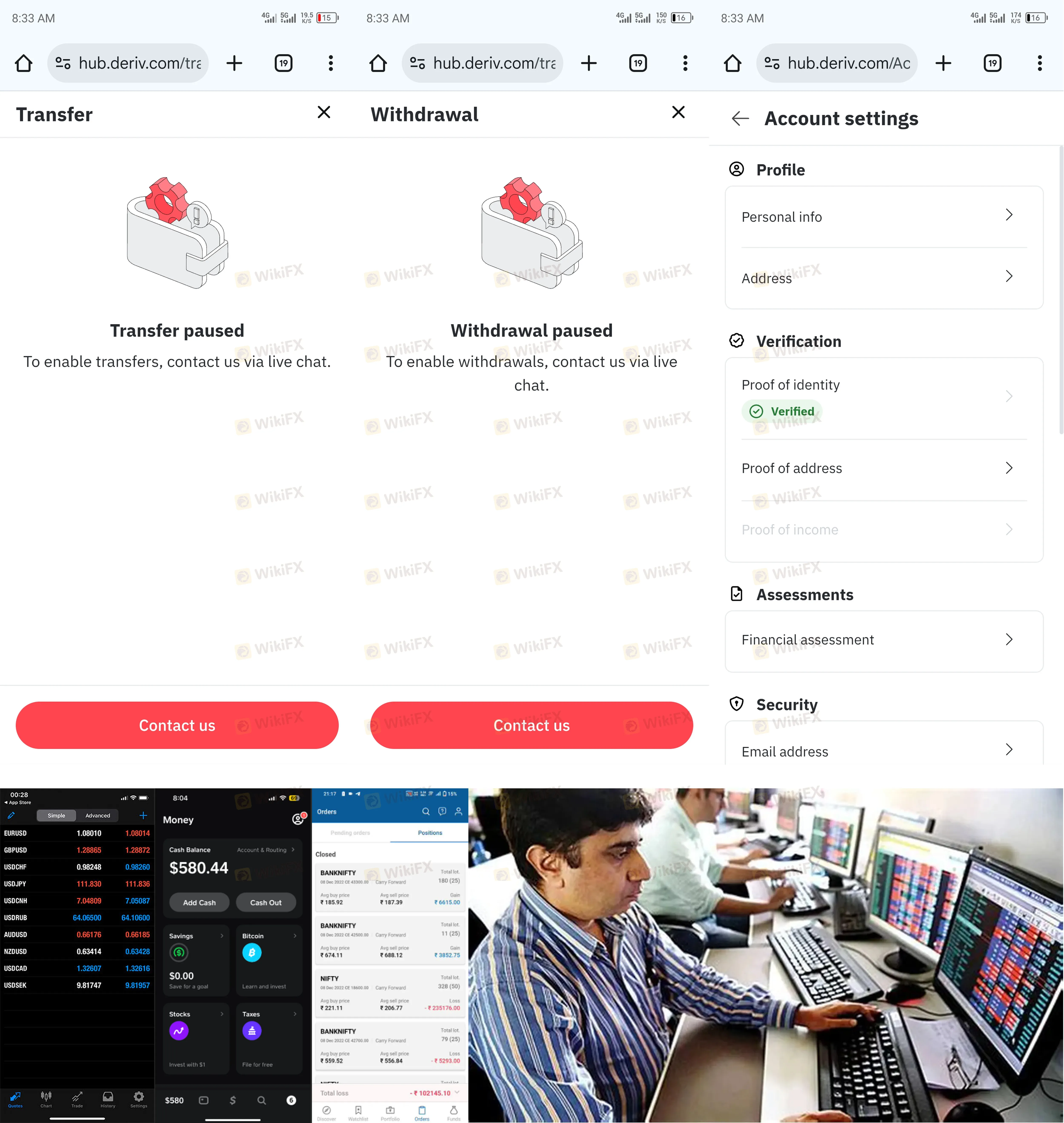

From Nigeria to Indonesia, the story is the same: the platform works perfectly until you actually win. As soon as a trader attempts a significant withdrawal, the iron curtain falls. Accounts are disabled under the guise of “fraud investigations” or “identity updates,” and the broker suddenly becomes a digital ghost.

The Regulation Trap: More Isn't Always Better

One of the cleverest tricks in the book is “regulatory layering.” By holding several offshore licenses, a firm can claim to be “heavily regulated” while funneling high-risk clients into the least restrictive jurisdictions.

| Regulator | License Type | Status |

|---|---|---|

| Malta MFSA | Investment Services (C 70156) | Regulated |

| British Virgin Islands FSC | Offshore Regulatory | Regulated |

| Vanuatu VFSC | Offshore Regulatory | Regulated |

| Cayman Islands CIMA | Offshore Regulatory | Regulated |

| United Arab Emirates CMA | General Regulation | Regulated |

| Indonesia BAPPEBTI | Commodities/Futures | Blacklisted/Blocked |

While the primary regulation might look legitimate, the Indonesian regulator BAPPEBTI has repeatedly flagged and blocked Deriv domains for operating without local authorization, labeling them as high-risk entities. This discrepancy is a massive red flag. A legitimate regulation should provide protection, but victims report that Deriv only responds to regulatory pressure after months of stalling—sometimes up to 13 months for a simple refund.

The Login Deadlock and Systemic Failures

The technical infrastructure of many brokers is designed to fail at the most profitable moments for the house. Traders have reported a specific nightmare regarding their login access. In several documented cases, accounts were disabled while positions were still open. This effectively locks the trader out of their own burning house, forced to watch their equity evaporate as they are unable to close positions or manage risk.

One trader in South Asia noted that while their login credentials worked for the website, the MT5 trading functions were “systematically disabled” during high-volatility events, but only when the trade was in the customer's favor. This isn't a glitch; it's a strategic “error.”

Evidence of Predatory Execution

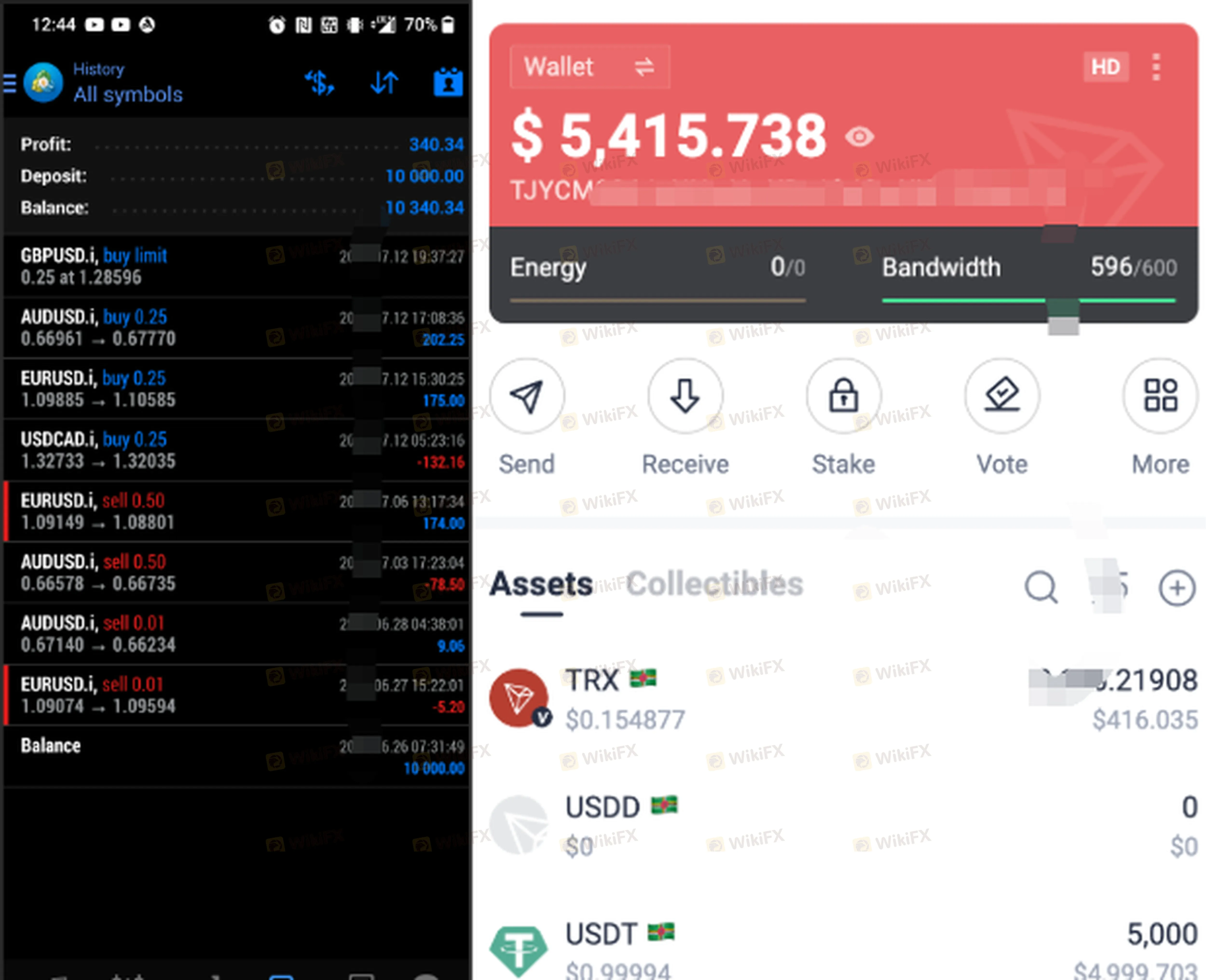

The Forex market is volatile by nature, but Deriv takes it to a theatrical level. Our investigation into the Forex execution on the platform revealed massive slippage—often as high as 150 points. One Indian trader reported a stop-loss set at 1.2600 that was mysteriously executed at 1.2450. When questioned, the broker hides behind a wall of “market conditions.”

Furthermore, the “probability gap” on their proprietary contracts is alarming. While a contract might advertise a theoretical 55% payout, monitored win rates consistently hover around 48%. This 7% discrepancy is the house edge that keeps the broker profitable while the individual trader bleeds out.

Global Complaints: A Pattern of Abuse

The volume of complaints is not localized. It is a global epidemic of “missing” funds.

- Nigeria: Transfers and withdrawals blocked for over three weeks post-verification.

- Indonesia: A trader with 150 million rupiah saw their account frozen and was asked for a “10% verification fee”—a classic move from the scammer's handbook.

- India: Sudden leverage reductions from 1:200 to 1:50 at 3:00 AM, triggering forced liquidations.

Final Verdict

The current review of Deriv paints a picture of a company that has outgrown its ethics. Despite the various licenses, their operational behavior in offshore regions suggests a disdain for retail traders. They rely on “hidden service fees” and “identity update” loops to prevent capital outflow.

If you value your capital, look past the AAA rating and the long list of regulators. The real data—the 50 complaints and the forged compliance allegations—tells the only story that matters. Stay away from the login page, and keep your deposits in institutions that don't treat your profit as their personal loss.

Risk Warning: Trading involves significant risk. The presence of multiple regulators does not guarantee the safety of your funds when a broker exhibits a pattern of blocking withdrawals. Always use a WikiFX-verified, high-score broker with a proven track record of timely payouts.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Currency Calculator