Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Thinking about investing in FirewoodFX? Attracted by its no-deposit bonus offers? Stop for a while and evaluate many of the complaints concerning FirewoodFX bonus, verification, withdrawal denials, fund scams, etc. These alleged issues have grabbed significant traction on broker review platforms. In this FirewoodFX review article, we have investigated all of these allegations, shared bonus promotions claimed by the forex broker, and explained its regulatory status. Keep reading!

Thinking about investing in FirewoodFX? Attracted by its no-deposit bonus offers? Stop for a while and evaluate many of the complaints concerning FirewoodFX bonus, verification, withdrawal denials, fund scams, etc. These alleged issues have grabbed significant traction on broker review platforms. In this FirewoodFX review article, we have investigated all of these allegations, shared bonus promotions claimed by the forex broker, and explained its regulatory status. Keep reading!

FirewoodFX claims to be offering the best forex service providers globally by having processed 200+ million withdrawals over 12 years. By offering forex trading opportunities to users across 230+ countries, the company has expanded its reach. As far as trading platforms are concerned, FirewoodFX offers the most popular MetaTrader 4 across mobile and desktop applications. However, the most advanced version, i.e., MetaTrader 5, is missing. This platform offers enhanced market analysis for a more effective forex trading experience. On the other hand, the forex broker offers two types of trading accounts - Cent and Pro, with a minimum deposit of USD 1 and USD 10, respectively.

As most users have complained about the bonus schemes offered by the broker, examining what it actually claims on its official website makes sense. Let’s check out the features.

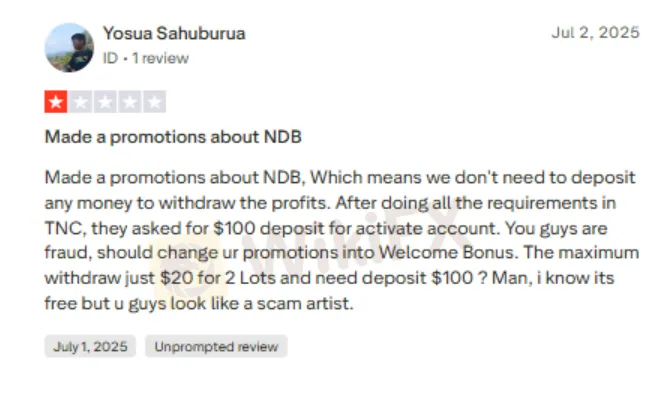

A trader from Indonesia accused FirewoodFX of misleading NDB promotion, claiming that traders could withdraw profits without making any deposit. After completing all the required terms and conditions, the client was reportedly asked to deposit $100 to activate the account before withdrawal. The complainant argued that this contradicts the “No Deposit Bonus” offer and suggests the promotion should instead be labeled as a “Welcome Bonus.” The trader also expressed dissatisfaction with the withdrawal limit of $20 after trading 2 lots, calling the offer deceptive and potentially fraudulent.

The screenshot below perfectly captures the essence of the complaint. Take a look.

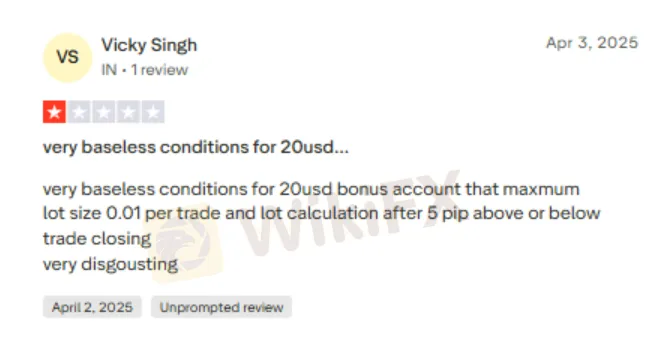

An India-based trader termed FirewoodFXs terms and conditions for availing a bonus account baseless. Sharing the story, the trader expressed frustration over the maximum lot size of 0.01 per trade to be maintained, with the lot getting calculated based on 5 pips above or below the trade closure. Dissatisfied with the overall experience, the trader vented out with this negative FirewoodFX review.

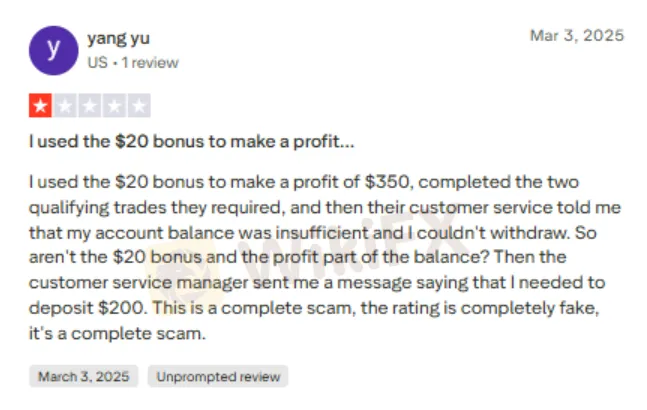

This complaint demonstrates the helplessness of a US-based trader, who after utilizing the $20 bonus, made profit of $350, visible on the FirewoodFX login, and completed the qualifying trades was denied withdrawal on the grounds of insufficient account balance by FirewoodFX. The trader questioned whether the bonus and profit were not part of the account balance. Subsequently, the customer service manager texted a message to the trader requiring him to deposit $200. Felt deceived, the trader chose to make his negative comments live. Have a look at what the trader said.

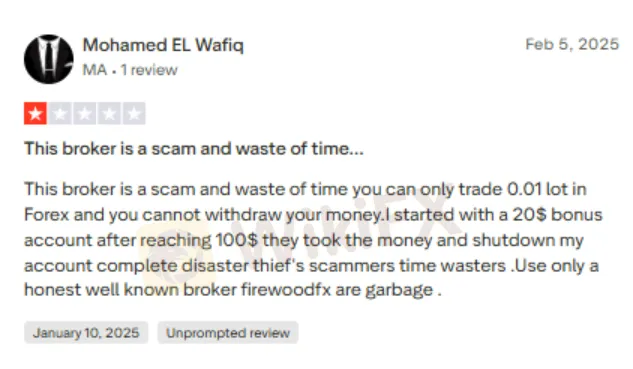

Another trader made a similar allegation against FirewoodFX after being restricted to trade just 0.01 lot and failing to withdraw from his $20 bonus account that grew to $100 over time. However, as the account balance reached this point, the broker ran away with the funds, as claimed by the trader. What‘s worse, the broker was accused of even deleting the trader’s account, resulting in this fiery FirewoodFX review.

A FirewoodFX client warned others against using the brokers $20 bonus account, alleging that after making profits, he faced continuous issues with account verification. Despite submitting three different selfies holding their ID and a handwritten note as requested, the verification was repeatedly rejected without a clear explanation. As a result, the account remained unverified, preventing the trader from withdrawing profits. The trader reckoned that the company intentionally delayed or denied verification to avoid paying out earnings from the bonus account and expressed frustration over the lack of transparency and support. This was a more in-depth problem narration regarding KYC hassles. There are a few more traders who expressed frustration over the same.

Check out the multiple FirewoodFX reviews, demonstrating traders wrath following the verification hassles.

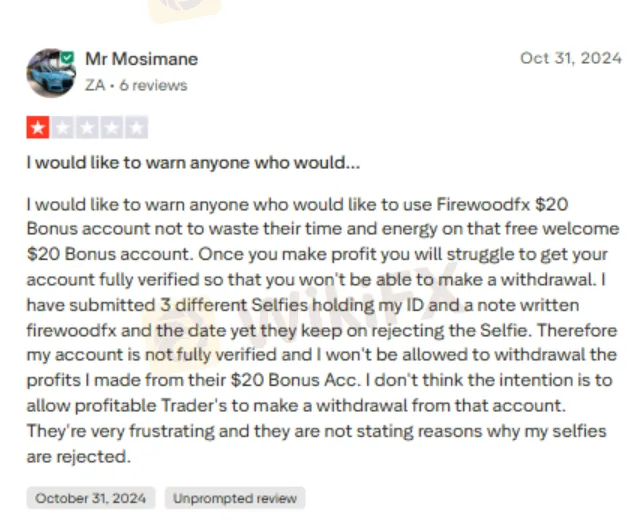

The growing complaints concerning FirewoodFXs bonus terms and conditions, withdrawal denials, and the never-ending KYC verification made it imperative for the WikiFX team to investigate its regulatory status. The Saint Vincent and the Grenadines-based forex broker did not have a valid forex license. Also, brokers across this region remain largely unregulated or offshore regulated. Neither of the two is good for your trading interest. While unregulated is a clear deal breaker, offshore regulated entities do not offer the level of investment protection available to traders tied up with brokers regulated by authorities such as the FCA (UK) and ASIC (Australia).

Amid safety concerns, the WikiFX team gave FirewoodFX a score of just 2.25 out of 10.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.