简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Wealthengine Review: The "Hacker" Excuse and the 10% Unfreezing Trap

Abstract:Our investigation into the Wealthengine broker reveals a critical peril: the platform has frozen client funds globally seeking a "verification fee" to restore access. Victims report paying an initial $100 demand only to be targeted with a secondary request for 10% of their total balance, while withdrawals remain completely blocked.

“They claimed a hacker attack stole 12 million USDT, froze our money, and then asked us to pay to get it back.” This is the harrowing reality reported by a Wealthengine user from Spain.

Our investigation reveals a massive surge in complaints against Wealthengine broker, with over 200 reports in just three months. The narrative is consistent and terrifying: first, the trading platform freezes accounts; second, they blame external “hackers”; third, they demand fresh deposits to “verify” the user.

If you are currently trading with this entity or cannot access your Wealthengine login, read this urgent report immediately.

Wealthengine Regulation Reality Check

The first step in our audit was to verify the legal standing of this entity. Despite claiming a headquarters in Australia and an establishment year of 2024, our regulatory database exposes a dangerous truth.

Wealthengine holds no valid financial licenses. They are operating without oversight, meaning there is no legal safety net for your funds when they disappear.

| Regulator | License Type | Real Status |

|---|---|---|

| ASIC (Australia) | None | Unauthorized |

| Global Regulators | N/A | Unregulated |

Because there is no valid Wealthengine regulation, the platform acts as judge, jury, and executioner of your money. A WikiFX score of 1.23 (Grade E) confirms this is a high-risk environment.

The “Hacker” Narrative and Withdrawal Blockade

The primary weapon used against traders in this case is a fabricated crisis. According to official notices cited by victims (Case 84), Wealthengine claimed that “hackers conducted bulk verification,” forcing them to freeze all assets.

The Double-Dip Extortion Scheme

Our analysis of 206 distinct complaints reveals a systematic trap designed to extract the last remaining capital from victims:

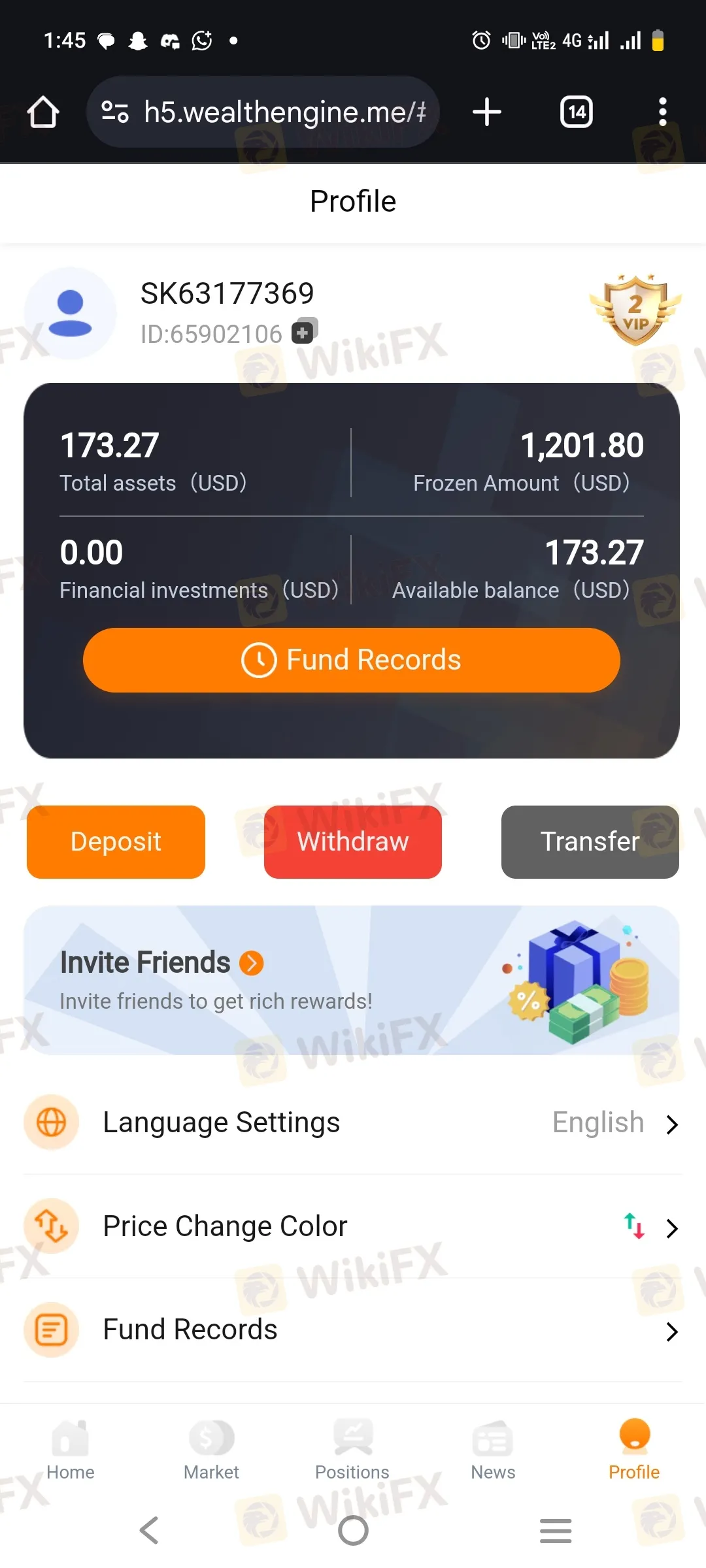

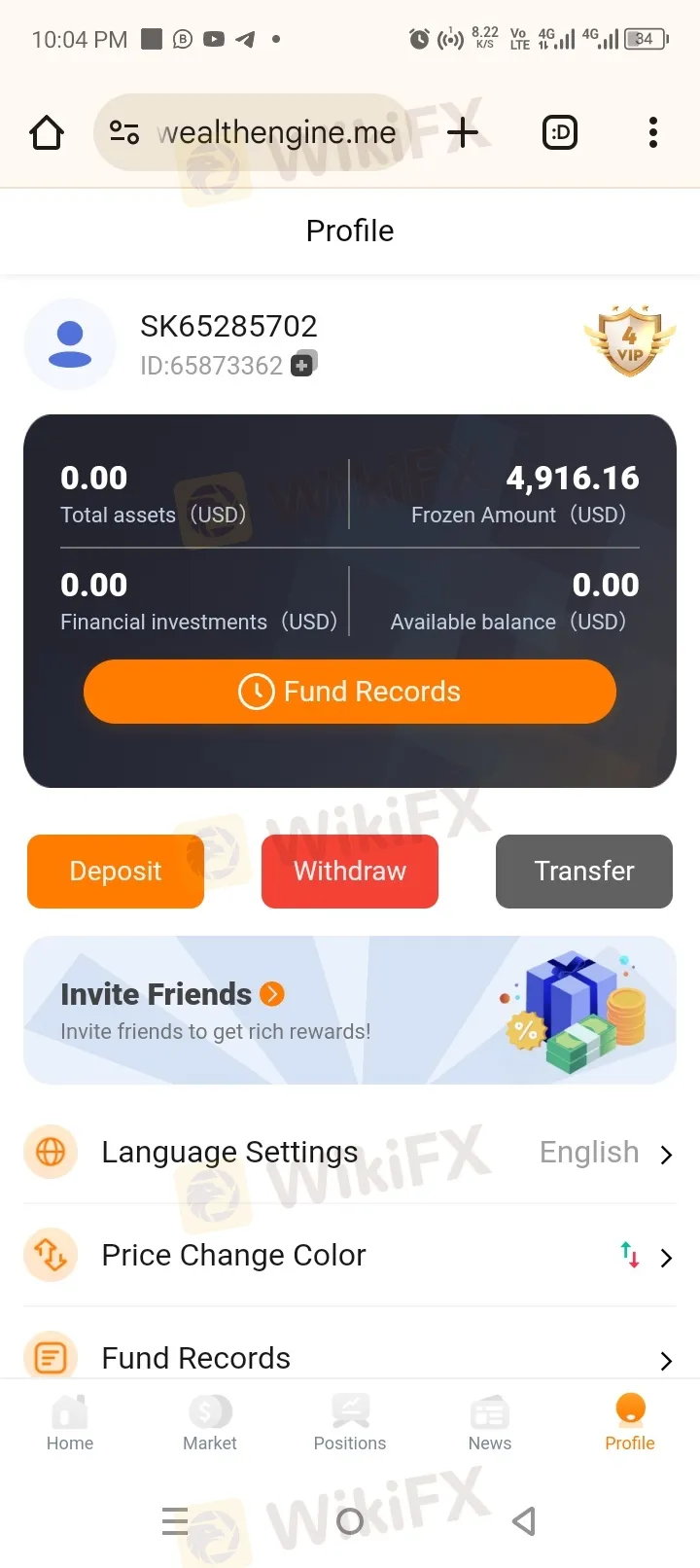

1. The Freeze: Users log in to find their funds “frozen” or the Wealthengine login disabled entirely.

2. The $100 “Verification” Bait: The broker demands a $100 deposit to “verify the account” and unfreeze funds. Many users, desperate to retrieve their savings, paid this amount (Cases 1, 6, 14, 50).

3. The 10% Escalation: Once the $100 is paid, the goalposts move. The broker then demands 10% of the total frozen balance as a second verification step (Cases 20, 22, 30, 41).

As one victim from Pakistan reported: “They asked us to deposit $100 to unfreeze. We deposited it. Then they asked for 10% of our frozen funds. While we struggled to pay, the app closed.”

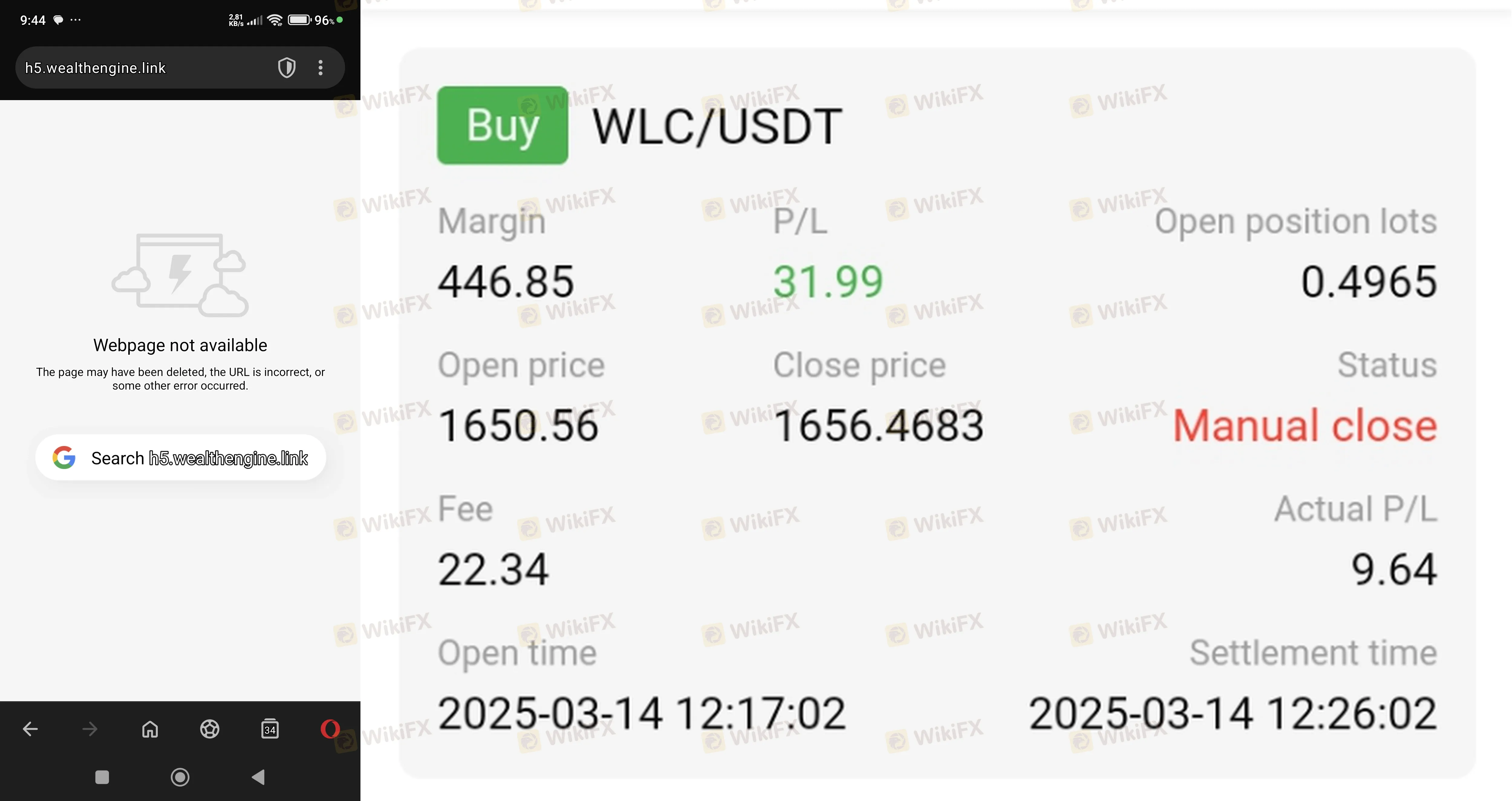

Wealthengine Login Issues and Platform Collapse

The situation has escalated beyond simple withdrawal delays. Reports from March and April 2025 indicate a total service collapse.

Victims in Algeria, Bangladesh, and France refer to the platform “going offline” or the app showing a blank screen (Case 6). This effectively locks traders out of the Forex market and their capital simultaneously.

When a broker disables login access while demanding crypto deposits via chat or email, it is a definitive sign of a “rug pull” event.

Key Red Flags Identified

- Sequential Extortion: Demanding fees to release funds is a hallmark of financial fraud. legitimate brokers never charge to unfreeze an account.

- Regulatory Void: No license exists to validate their operations.

- Mass Complaints: 206 severe complaints filed within 90 days.

- Inconsistent Excuses: Shifting blame from “hackers” (Case 61) to “verification updates” (Case 84) to simply going silent.

Final Verdict

The evidence suggests Wealthengine is not a safe environment for trading. The pattern of freezing assets followed by demands for “verification payments” is a classic tactic used to defraud investors of additional capital before a final exit.

Do not deposit the $100 or the 10% fee. History shows that these payments rarely lead to the release of funds. If you are a victim, preserve all chat logs and transaction records immediately.

WikiFX will continue to monitor this unauthorized Forex entity. Stay vigilant.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Renewable Grid Integration: Economics and Technology

Gold Rally Validated as Miners Forecast Doubled Earnings

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Bitcoin Reclaims $71,000: Volatility as a Proxy for Global Risk Appetite

Currency Calculator