简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

VCP Markets Review: The 2026 Trap for Unsuspecting Traders

Abstract:VCP Markets is a regulatory ghost ship launched in 2024, currently sinking under the weight of severe fraud allegations involving equity theft and unauthorized account manipulation. With a pathetic WikiFX score of 1.22, this broker is effectively a black hole for depositor funds.

VCP Markets is a masterclass in how to launch a financial predator in the modern age. Established in 2024, this entity presents itself as a sleek, digital-first broker, yet the reality hidden behind its MT5 interface is a systematic engine for capital destruction. While it targets Southeast Asian markets, specifically Thailand and Vietnam, its lack of oversight makes it a lethal gamble for anyone seeking a legitimate Forex partner.

The Zero-Sovereignty VCP Markets Regulation Audit

If you are looking for safety, you are looking in the wrong place. The regulation status of this entity is non-existent. Despite claiming an Australian origin, there is zero evidence of an ASIC license or any other Tier-1 oversight.

| Regulator | License Type | Status |

|---|---|---|

| ASIC (Australia) | Financial Services | Not Found / Unregulated |

| Global Regulators | Any | No Valid License |

The regulation deficit here is not a minor oversight; it is a deliberate choice. Operating without a leash allows this broker to engage in practices that would result in immediate criminal prosecution in any transparent jurisdiction.

The Nightmare Behind the Login Page

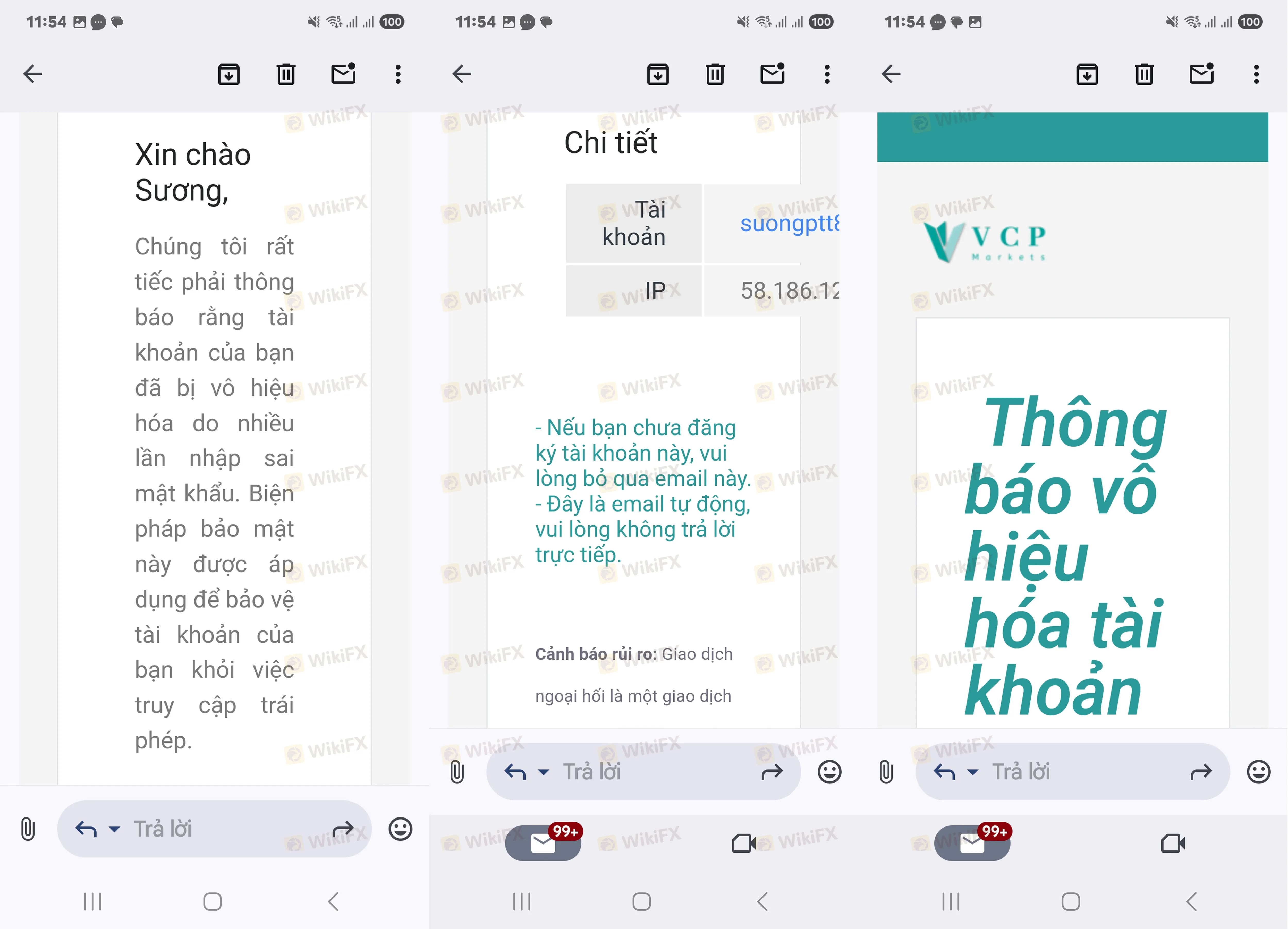

The most terrifying aspect of the VCP Markets review isn't just the lack of a license—it's what happens after you provide your login credentials. Investigative data reveals a recurring pattern of “equity assassination.” Victims report that once they achieve profitability, the broker's back-end staff or “IBs” (Introducing Brokers) take over.

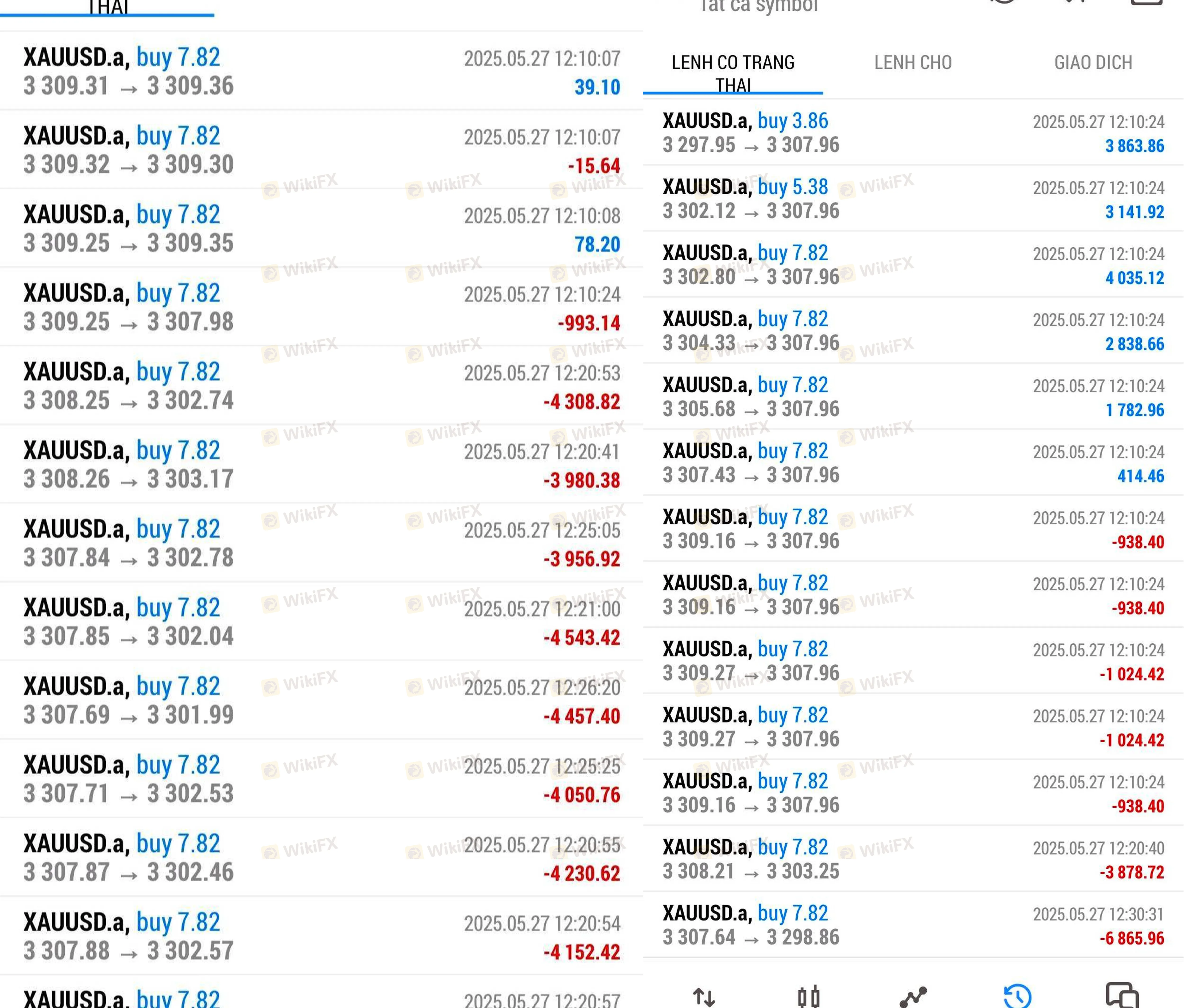

In multiple documented cases, traders with balances exceeding $40,000 found their accounts suddenly flooded with massive, unauthorized trade lots (e.g., 7.82 lots per trade) that liquidated their entire balance in under 15 minutes. This isn't market volatility; it's a manual heist performed through the login portal by the house itself.

Systematic Withdrawal Sabotage

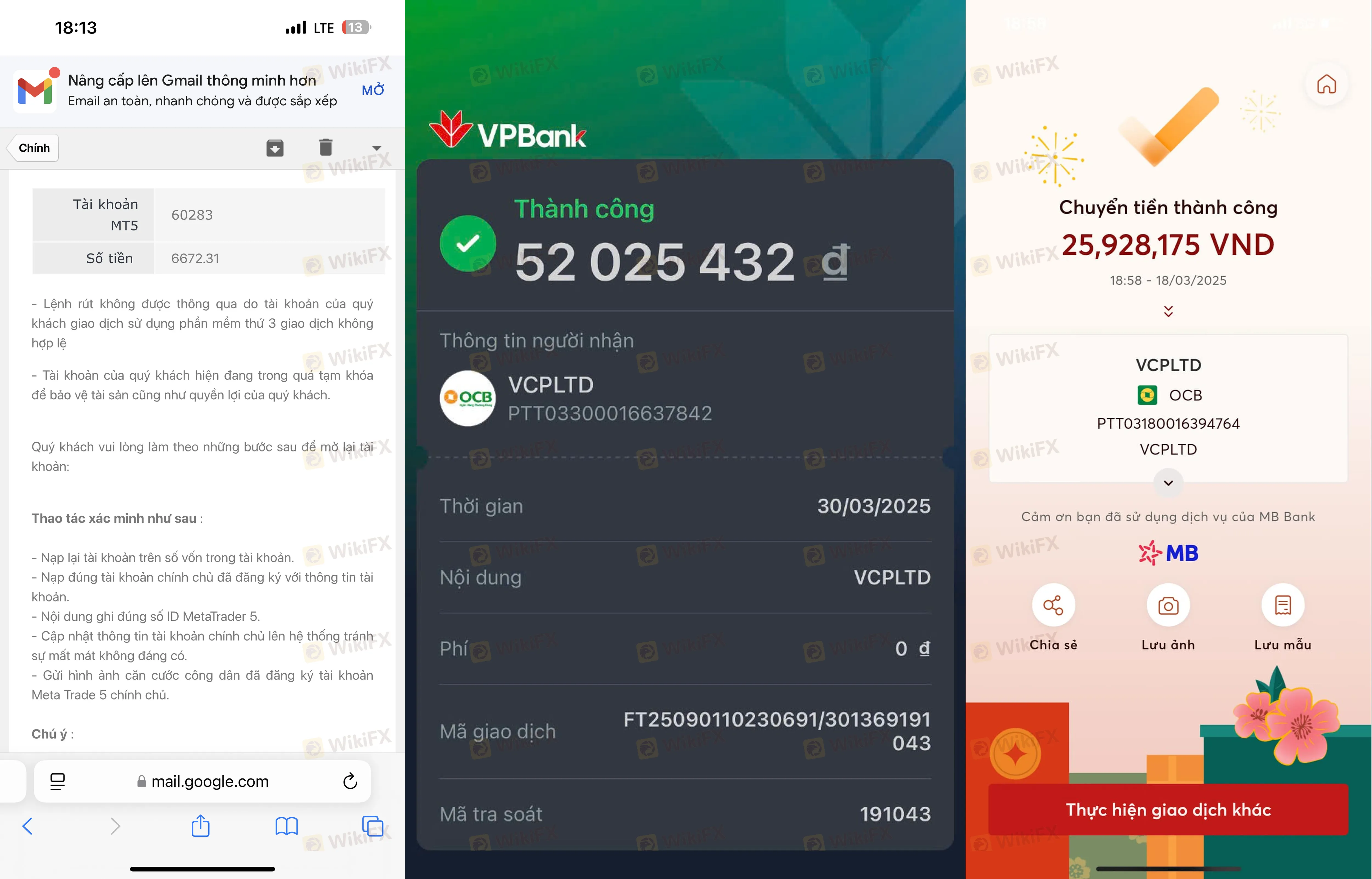

If the broker fails to “burn” your account through forced trades, they simply lock the gates. We have analyzed reports where users were asked to deposit more money just to verify their account for a withdrawal—a classic “advance-fee” scam tactic.

- The Verification Trap: Users are told their login is locked until a fresh “authentication deposit” is made.

- Support Ghosting: While they claim to provide service in English and Thai, victims find that support emails are ignored the moment a withdrawal request is filed.

- Copytrading Corruption: Many victims were lured via copytrading, only to have the “Master Account” execute suicidal trades specifically to drain the followers' equity.

Forensic Conclusion on Forex Trading via VCP

Engaging in Forex trading is risky enough without the house actively robbing you. VCP Markets provides a textbook example of a “burn-and-churn” operation. They offer high leverage (up to 1:1000) not to help you win, but to ensure that when they manipulate your account, the margin call happens instantaneously.

Internal reports suggest that the login security is intentionally weak, lacking two-factor authentication (2FA), which conveniently allows the platform operators to claim “hacker activity” when they manually wipe out a client's 15,000 USD deposit.

Risk Warning: Do not be deceived by the 2024 launch date or the professional website. The WikiFX data is clear: this is a 1.22-rated entity with a growing list of fraud victims. If you have funds remaining, attempt a withdrawal immediately, though the data suggests your login access may already be on the chopping block. Avoid this broker at all costs.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Kudotrade Review: Safety, Regulation & Forex Trading Details

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Why Opofinance’s Dual Licensing Looks Weak, Not Reassuring

Is Toyar Carson Limited Legit? A 2026 Investigation into Scam Allegations

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Currency Calculator