简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Abstract:When traders ask, "Is ZarVista Safe or Scam?" the answer needs careful research based on facts. After looking at lots of user reviews, government records, and official reports, ZarVista (used to be called ZaraFX) appears to be very risky for any investor. This conclusion isn't just an opinion - it's based on real facts that show serious warning signs. The biggest red flag is an extremely low score on WikiFX, an independent website that rates brokers. ZarVista currently gets only 2.07 out of 10 points. This terrible score comes mainly from many serious user complaints. This article will break down the evidence behind this rating by looking at the company's official information, its government oversight, and real experiences from users to give you a clear picture of the risks.

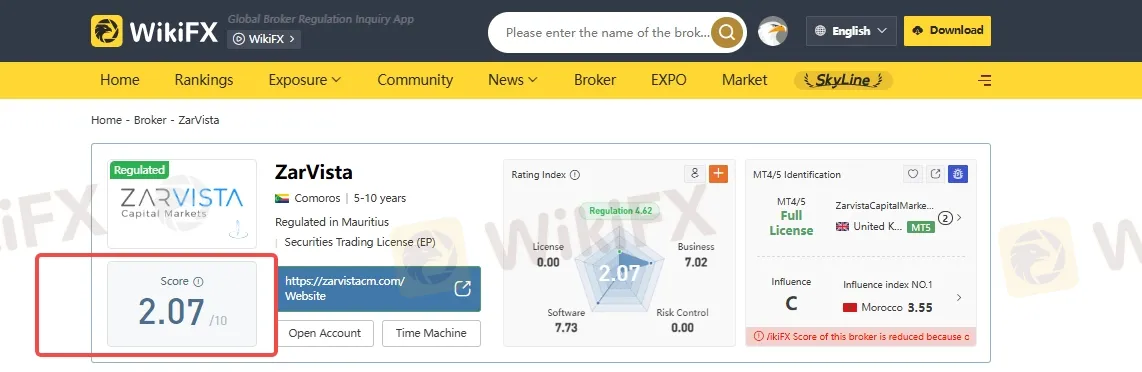

When traders ask, “Is ZarVista Safe or Scam?” the answer needs careful research based on facts. After looking at lots of user reviews, government records, and official reports, ZarVista (used to be called ZaraFX) appears to be very risky for any investor. This conclusion isn't just an opinion - it's based on real facts that show serious warning signs. The biggest red flag is an extremely low score on WikiFX, an independent website that rates brokers. ZarVista currently gets only 2.07 out of 10 points. This terrible score comes mainly from many serious user complaints. This article will break down the evidence behind this rating by looking at the company's official information, its government oversight, and real experiences from users to give you a clear picture of the risks.

Official Warning Signs We Found

To understand If Is ZarVista Safe or Scam, we need to first look at how it's set up and regulated. Checking real, verifiable information about a broker is the first way to protect your money. The information we found about ZarVista shows several major warning signs.

• Weak Offshore Regulation

ZarVista is mainly registered in the Comoros and regulated by the Mwali International Services Authority (MISA). This is a big problem. Offshore regulators like MISA are known for providing very little oversight and weak protection for traders' money. Unlike top-quality regulatory bodies such as the FCA in the UK or ASIC in Australia, offshore locations often don't have strong enforcement, capital requirements, or separated fund protections. This leaves traders with very little help if there's a dispute or if the broker goes out of business. While the company also has a Securities Trading License from the FSC in Mauritius, the main registration in Comoros and the nature of user complaints match the higher risks typical of offshore operations.

• Extremely Low Trust Score

The broker's WikiFX score is a shocking 2.07 out of 10. This score isn't random - it's calculated from five areas: license, business, risk management, software, and regulatory oversight. A score this low is a clear tells you Is ZarVista Safe or Scam. The platform clearly states, “The WikiFX Score of this broker is reduced because of too many complaints!” This directly connects the poor rating to a pattern of bad user experiences, which we'll explore in detail later.

• Direct Risk Warnings

Beyond the low score, the broker's profile has clear warnings for potential users. These aren't subtle hints but direct advice to be extremely careful. The platform clearly states: “Warning: Low score, please stay away!” and labels the broker as a “High potential risk.” Such direct warnings from an independent evaluation service are among the most serious signs of potential danger for traders.

• Failed Physical Verification

To make this review detailed and answer your Is ZarVista Safe or Scam? Question . Field survey was conducted by WikiFX investigators at listed addresses for ZarVista's previous identity, Zara FX, found troubling results. The reports for addresses in both Canada and Cyprus concluded with “No Office Found.” The inability to verify a physical office raises serious questions about the company's legitimacy and transparency. It suggests that the listed addresses may be for registration purposes only, with no actual staff or operations present, making accountability even more unclear.

Deep Look into ZarVista Complaints

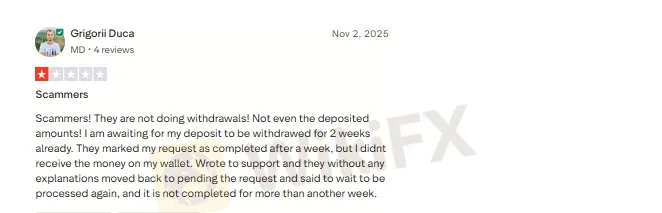

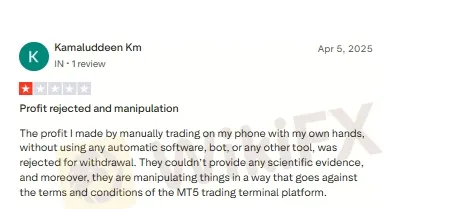

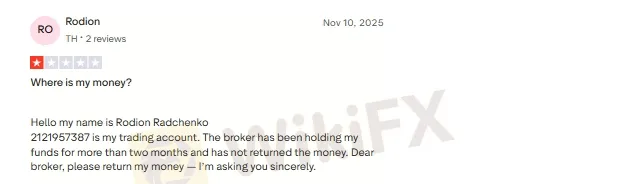

While regulatory data points to structural risk, user voices provide direct evidence of how that risk shows up in reality. Looking at complaints filed against ZarVista reveals Is ZarVista Safe or Scam to avoid . The complaints disclose the consistent and severe issues, mainly focused on accessing funds.

Serious Withdrawal Problems

A common theme among user complaints is the inability to withdraw funds. Multiple users report that their withdrawal requests are systematically rejected or declined without a valid explanation. In one specific case, a user from the United States noted that while the broker's claims of low spreads were true, withdrawal attempts were consistently met with declines. The broker allegedly shifted the blame, telling the user that the refund was “declined by the bank” and advising them to contact their card company. This tactic of shifting responsibility is a common strategy used by problematic brokers.

The issue goes beyond simple delays or rejections. A user from Nigeria reported an even more alarming situation. After initially facing withdrawal problems, the user found themselves completely locked out, unable to access the ZarVista website at all due to a persistent error message. This effectively cuts off the user's connection to their account and their money, turning a withdrawal issue into a total loss of access.

Claims of Stolen Funds

The most serious claims against ZarVista involve the outright theft of client funds and the subsequent destruction of evidence. One user from India, under the ID Ashrf7670, has filed multiple detailed complaints claiming a sophisticated scheme. The user claims to have invested $50,000 USD into a social trading PAMM account managed by the broker's own traders.

According to the user's report, after a period of poor performance, the funds were recovered within the platform, bringing the balance to approximately $75,000 USD. However, the broker then allegedly performed a “self-withdrawal,” effectively stealing the entire account balance. To hide this action, the user's MT4 account and all platform details were subsequently deleted. When the user demanded their money back, the broker reportedly refused. The severity of this claim is emphasized by the fact that the user has filed a police case in Kerala, India, and has submitted all evidence to the authorities in an attempt to recover the investment.

A Critical First Step

These types of complaints, especially those involving withdrawal obstruction and claims of theft, are the most serious red flags a trader can encounter. They suggest that the fundamental agreement between a client and a broker—the ability to access one's own money—is not being honored.

These user-submitted complaints are publicly documented. To see these 'Exposure' reports for yourself and assess their details, we strongly advise checking the ZarVista profile on WikiFX before making any decisions.

Looking at Positive Reviews

To stay objective, it's important to acknowledge and analyze the positive and neutral feedback that exists. A balanced investigation considers all available information, which ultimately strengthens the final conclusion. Some users have reported positive experiences with ZarVista's platform and services.

What Some Users Like

Praise for the broker often focuses on its trading technology and promotional offers.

• Platform Features: Several users have praised the use of the MetaTrader 5 (MT5) platform. One user from New Zealand specifically praised its useful tools, customizable charts, and wide range of indicators, which made the trading experience feel personalized.

• Platform Performance: A user from Nigeria highlighted the platform's speed and stability. They noted that even during periods of high market volatility, the platform remained fast and easy to navigate, with minimal slippage.

• Bonuses & Support: The New Zealand user also mentioned receiving a $300 trading bonus, which they found encouraging. In another instance, the Nigerian user reported a positive customer service interaction where an order execution issue was resolved in under 10 minutes, which they described as a “superhero” level of support.

The Double-Edged Sword

Neutral reviews often provide the most revealing insights, as they tend to present a more balanced picture. These reviews frequently praise certain aspects of the service while simultaneously pointing out critical flaws. For example, the user who stated, “Low spreads is true, but when withdrawing you may come across couple of decline withdrawals,” perfectly captures the core risk. Excellent trading conditions are rendered meaningless if a trader cannot access their profits.

Another neutral review from a user in the Netherlands praised the “chic platform” and competitive spreads but noted the need for a “faster withdrawal process.” This comment, while framed politely, points directly to the same underlying problem of fund accessibility that is detailed in the more severe negative complaints.

Weighing Pros and Cons

When we weigh the reported benefits against the documented risks, a clear imbalance emerges. The positive attributes, such as a functional MT5 platform or deposit bonuses, are standard offerings in the competitive brokerage industry. The negative issues, however, strike at the very heart of a trader's financial security.

| Reported Positives | Reported Negatives (High-Impact Risks) |

| Advanced MT5 Platform | Inability to Withdraw Funds |

| Potentially Low Spreads | Claims of Stolen Capital ($50k+) |

| Fast Platform Execution | Accounts Being Deleted Without Warning |

| Deposit Bonuses | Offshore Regulation (Low Protection) |

| Responsive Support (in some cases) | “No Office Found” in Physical Audits |

This table visually demonstrates that the risks associated with ZarVista are fundamental and severe, while the benefits are superficial and can be found at countless other, more reputable brokers.

Putting It All Together

Connecting the individual data points—regulatory status, user complaints, and company behavior—reveals a coherent and troubling story. It's not a story of isolated incidents but of systematic issues enabled by a weak operational framework.

The pattern across the complaints is clear: a focus on withdrawal obstruction. From declined requests and shifting blame to outright account deletion and blocking website access, the evidence points to a systematic problem preventing users from accessing their money.

The choice of Comoros as a primary regulatory base is the key enabler of this behavior. This weak regulatory environment creates a scenario where a broker can operate with minimal accountability and face few, if any, consequences for misconduct. When users, like the one who allegedly lost $50,000, have their accounts and trading histories erased, their options for legal or regulatory help are practically non-existent. Top-tier regulators have established compensation schemes and strong dispute resolution processes; offshore regulators typically do not.

Furthermore, the company's rebranding from ZaraFX to ZarVista in September 2024 is noteworthy which tells you Is ZarVista Safe or Scam. While companies can rebrand for legitimate strategic reasons, a name change in the context of mounting complaints and a poor reputation can also be a tactic to distance a business from its negative history and confuse potential new clients conducting research.

Understanding the link between a broker's regulatory status and its reputation is vital. While some users praise the platform, a comprehensive view is crucial. You can weigh the positive reviews against the numerous negative exposures and check the full regulatory details directly on the ZarVista profile on WikiFX.

Final Decision and Protection

After a thorough analysis of the evidence, the conclusion is unavoidable. The combination of weak offshore regulation, official risk warnings, failed physical verifications, and a significant volume of severe user complaints claiming withdrawal blocking and fund theft overwhelmingly indicates that ZarVista is a high-risk broker. Now , You have got your answer, Is ZarVista Safe or Scam? The potential benefits it offers, such as an MT5 platform or low spreads, are completely overshadowed by the fundamental and demonstrated risk to a trader's money. The attractive features are bait, but the hook is the potential loss of your entire investment.

Your first and most important line of defense in the world of online trading is independent verification. Brokers will always present themselves in the best possible light, but their marketing promises must be checked against objective facts and real user experiences.

Before you deposit funds with *any* broker, not just ZarVista, make it a mandatory, non-negotiable step to conduct a thorough background check. Use a comprehensive regulatory inquiry tool like WikiFX to view their license, read unfiltered user reviews, and see any warnings issued against them. You can view the full, detailed report on ZarVista that we used for this analysis by searching for the broker on the WikiFX app or website. This simple step can be the difference between a successful trading journey and a devastating financial loss.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Retiree’s Tabung Haji Savings Gone: Elderly Retiree Loses RM277,000 After One Whatsapp Message

Oil prices jump above $100 for first time in four years

Forex Brief: Dollar Dips Ahead of NFP; RBA Bets Lift AUD

Crude Oil Rallies to $85 on Escalating Middle East Geopolitical Risks

China Signals Tolerance for Slower Growth with Revised 2026 Outlook

Oil Surges as Qatar Warns of $150 Crude and 'Force Majeure' Across Gulf Exporters

JRJR Review: Safety, Regulation & Forex Trading Details

HeroFx Review: Withdrawal Problems, Scam Alert & Risks

Forex Brief: Yen Weakens Past 157.75 as BoJ Policy Hopes Dim

Canadian Regulators Say More Than 7,500 Fraudulent Investment and Crypto Websites Were Taken Down

Currency Calculator