Abstract:Safest forex broker selection: Check regulation, spot scams, read reviews, and verify licenses via the WikiFX app. Avoid fraud—trade securely today!

Forex trading offers opportunities but also carries significant risks, especially from unscrupulous brokers who scam traders out of millions of dollars each year. Choosing safe forex brokers starts with rigorous checks into their regulatory oversight to protect your capital from fraud. This guide outlines practical steps to spot regulated forex brokers, avoid forex scams, and use tools like the WikiFX app for verification.

Broker Regulation Essentials Guide

Regulation ensures that brokers follow strict rules that protect traders. Bodies such as the UK‘s Financial Conduct Authority (FCA) require client fund segregation, transparent pricing, and negative balance protection, thereby minimizing losses in the event of a broker's failure. Australia’s ASIC has mandated minimum capital of $1 million and leverage limits for retail clients since 2021, enforcing fair trading and swift action against misconduct.

The US National Futures Association (NFA), under CFTC oversight, registers brokers, audits compliance, and limits leverage to 50:1 on major currency pairs. These regulators impose fines or bans for violations, creating accountability absent in unregulated markets.

Compliance builds trust; for example, FCA rules ban hidden fees so traders can focus on the markets.

Spot Red Flags of Forex Scams

Scammers lure with guaranteed profits or high returns with no risk, a classic tactic that defies market realities. Pressure selling urges quick deposits to “secure limited offers,” blocking rational decisions.

Fake websites mimic legit brokers, while clone firms steal identities of regulated ones. Watch for unregulated status, opaque fees, or withdrawal hurdles, such as sudden “taxes” on profits.

Suspicious support—vague responses or no documentation—signals trouble. For instance, signal sellers or fake bots promise easy wins but then vanish after the deposit is made.

Read Real Trader Reviews Safely

Authentic reviews reveal execution issues or payout delays, while fake testimonials ignore them. Cross-check on independent sites like WikiFX to avoid broker-sponsored praise.

Look for patterns: repeated withdrawal complaints outweigh isolated positives. WikiFX aggregates user feedback and flags brokers with scores below 5/10 as risky.

Verify reviewer history; long-term users carry more weight than new accounts. Combine with regulation checks for balanced views.

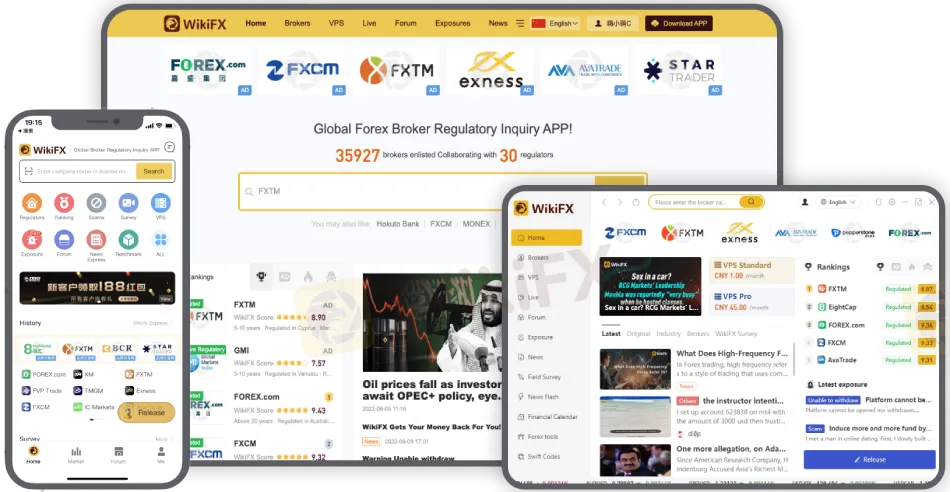

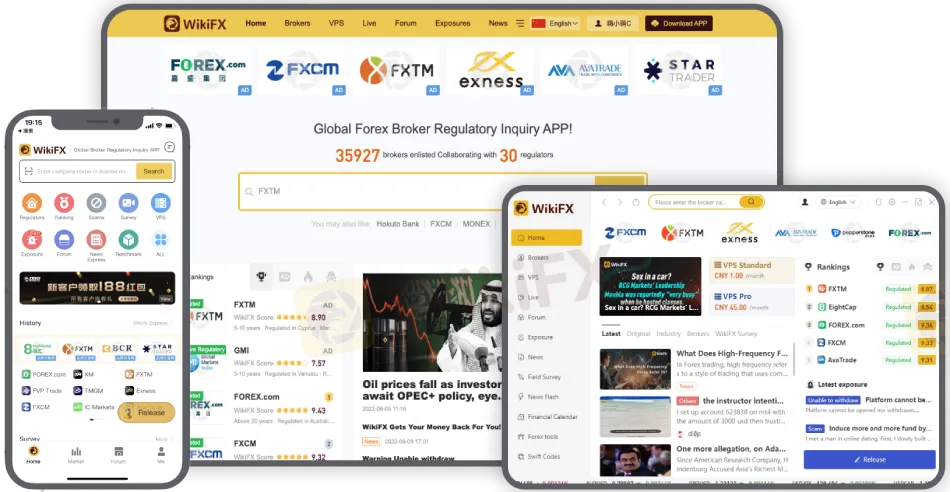

Verify Licenses with the WikiFX App

Get WikiFX from app stores or wikifx.com to access global broker data. Search a brokers name for licenses, ratings, complaints, and exposures.

Tap “Licenses” to view FCA numbers or ASIC AFSL status with expiry dates. Check “Exposures” for scam alerts and surveys verifying offices.

WikiFX ratings weigh regulation, user feedback, and complaints; low scores alert to risk. For ASIC, match AFSL via WikiFXs regulator page.

Avoid Unregulated Brokers Now

Unlicensed brokers offer high leverage but no fund protection, enabling outright theft. Traders face manipulated prices, blocked withdrawals, or platforms that have vanished.

In one case, a victim deposited thousands into a fake binary/forex firm showing fake profits, then paid invented “taxes” before trades failed and funds were locked, losing $50,000. Vietnams $200M scam by Pho Duc Nam and Le Khac Ngo targeted forex with phony platforms, wiping billions in dong.

Offshore “regulators” lack enforcement. Choose tier-1 oversight, such as FCA, ASIC, or NFA.

Use WikiFX for Scam Alerts

WikiFX flags brokers based on low scores, high complaint volumes, and investigations. Recent exposures include HTFX (score 2.45) for withdrawal blocks and MultiBank Group (2.59) despite longevity, with 700+ complaints.

Get alerts on new risks; “Rights Protection” tracks resolutions worth millions. Real-time rankings show stop-outs and spreads, helping you choose brokers based on data.

Make Safe Choices with Data

Statistics like WikiFX scores prioritize regulated forex brokers over promises. NFAs BASIC tool verifies US firms; matches IDs across CFTC/NFA databases.

Compare spreads, leverage via tables:

Ratings and complaints guide beyond marketing.

Diligence through regulation and tools like WikiFX protects capital in volatile forex markets. Verify every broker before depositing. Download WikiFX today, check licenses, and trade only with safe forex brokers—secure your funds from scams.