简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

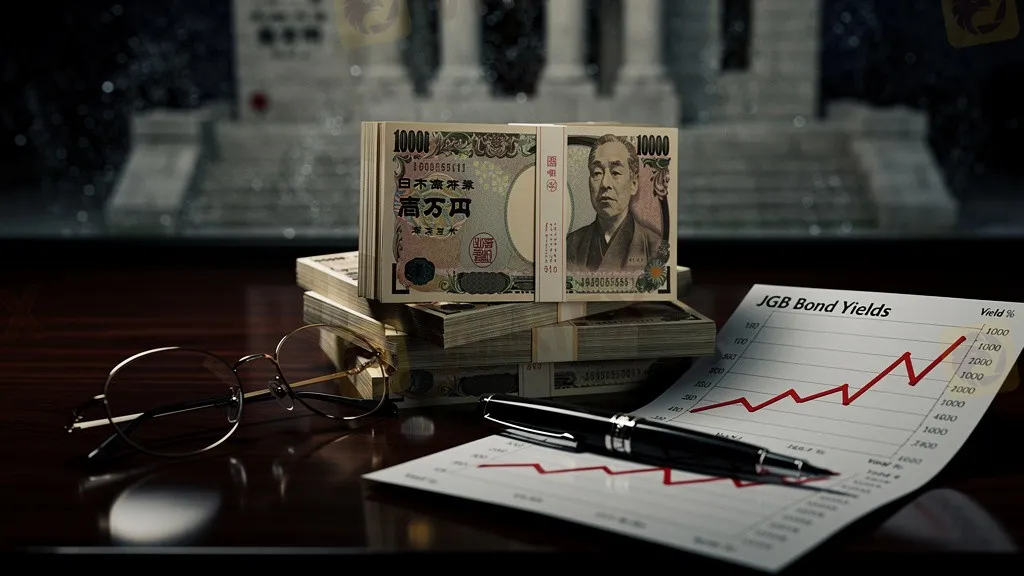

Yen on Edge: BOJ Decision Looms Amidst Bond Market Jitters

Abstract:The Japanese Yen remains trapped in a volatile range as traders weigh receding global trade risks against a domestic bond market rout. All eyes are on Friday's BOJ decision for signs of policy normalization.

The Japanese Yen (JPY) is trading in a tight deadlock, caught between improving global risk sentiment and deepening instability in domestic sovereign debt markets. As investors await Fridays Bank of Japan (BOJ) interest rate decision, the currency faces opposing forces that have neutralized directional momentum.

The Tug-of-War

External pressure on the Yen has eased slightly following indications that the US administration may delay tariffs on European allies, sparking a risk-on rally in global equities. However, a sharp sell-off in Japanese Government Bonds (JGBs)—driven by fears of fiscal expansion under Prime Minister Sanae Takaichi—has pushed yields to historic highs.

“The market is balancing the threat of official intervention against the reality of capital outflows,” notes a Tokyo-based strategist. While Finance Minister Satsuki Katayama has hinted at joint intervention with the US, the bond market rout is testing the limits of policy control.

Friday's Showdown

Market consensus expects the BOJ to hold the overnight rate at 0.75%, a 30-year high established in December. The critical variable will be Governor Kazuo Ueda's guidance regarding future hikes.

With inflation swiftly outpacing the 2% target for four consecutive years, hawkish voices are reportedly pushing for a rate hike as early as April.

Technicals

- USD/JPY is hovering above critical support at the 100-hour moving average.

- A breach of 159.00 could signal a breakout, but fragile equilibrium remains until the BOJ clarifies its stance.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Currency Calculator