简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KIRA Review for GCC Traders

Abstract:Key services include access to over 10,000 CFD trading instruments, which covers many different types of investments. Traders can use two different platforms, MetaTrader 5 (MT5) and CQG, from one account. Understanding what its customers need, KIRA offers dedicated Arabic language support and Islamic accounts that follow Sharia law. This article aims to give you a complete and balanced review of KIRA's trading conditions, platform features, regulatory status, and overall suitability for traders in the GCC, helping you make a smart decision.

Introduction to KIRA Brokerage

KIRA is a trading company based in the UAE, located in Dubai. It operates in the financial center of the Gulf Cooperation Council (GCC). This review gives a detailed and fair analysis for traders looking at their options in the region. The company focuses on serving the local market and is regulated by the UAE Securities and Commodities Authority (SCA).

Key services include access to over 10,000 CFD trading instruments, which covers many different types of investments. Traders can use two different platforms, MetaTrader 5 (MT5) and CQG, from one account. Understanding what its customers need, KIRA offers dedicated Arabic language support and Islamic accounts that follow Sharia law. This article aims to give you a complete and balanced review of KIRA's trading conditions, platform features, regulatory status, and overall suitability for traders in the GCC, helping you make a smart decision.

Trust and Regulation Analysis

For any trader, the main concern is keeping their money safe and making sure their broker is legitimate. This section looks at KIRA's regulatory framework and the steps in place to protect client money. A broker's following of strict financial oversight is the foundation of trader confidence.

Significance of SCA Regulation

KIRA is regulated by the Securities & Commodities Authority (SCA) of the United Arab Emirates. The SCA is the federal financial regulatory agency responsible for watching over and monitoring the UAE's capital markets. KIRA holds a Category 1 license, which is the highest level of licensing given by the authority. This category allows a broker to conduct a full range of financial activities, but it also puts them under the strictest compliance, reporting, and capital requirements.

This level of oversight ensures the broker operates with transparency and follows strict codes of conduct designed to protect investors. For verification purposes, KIRA's stated SCA license number is 20200000244. This local regulation provides accountability and legal protection within the UAE, which is important for traders based in the region.

How Trader Funds Are Protected

A key part of regulatory compliance is protecting client money. KIRA states that all client funds are held in completely separate accounts within secure UAE banks. The principle of separation is a critical safety measure. It means that client money is kept entirely separate from the company's own business funds.

In practice, this ensures that the broker cannot use client deposits for its own business expenses, such as paying salaries or marketing costs. More importantly, if the brokerage faces financial problems or bankruptcy, the money in these separate accounts belongs to the clients and is protected by law from being treated as company assets. This separation is a fundamental pillar of financial security in the brokerage industry.

The Essential Step of Verification

While a broker's regulatory claims are important, they should not be the final word. Doing independent research is essential for any trader before putting in funds. It is a best practice to double-check all information provided by a brokerage with independent, third-party sources.

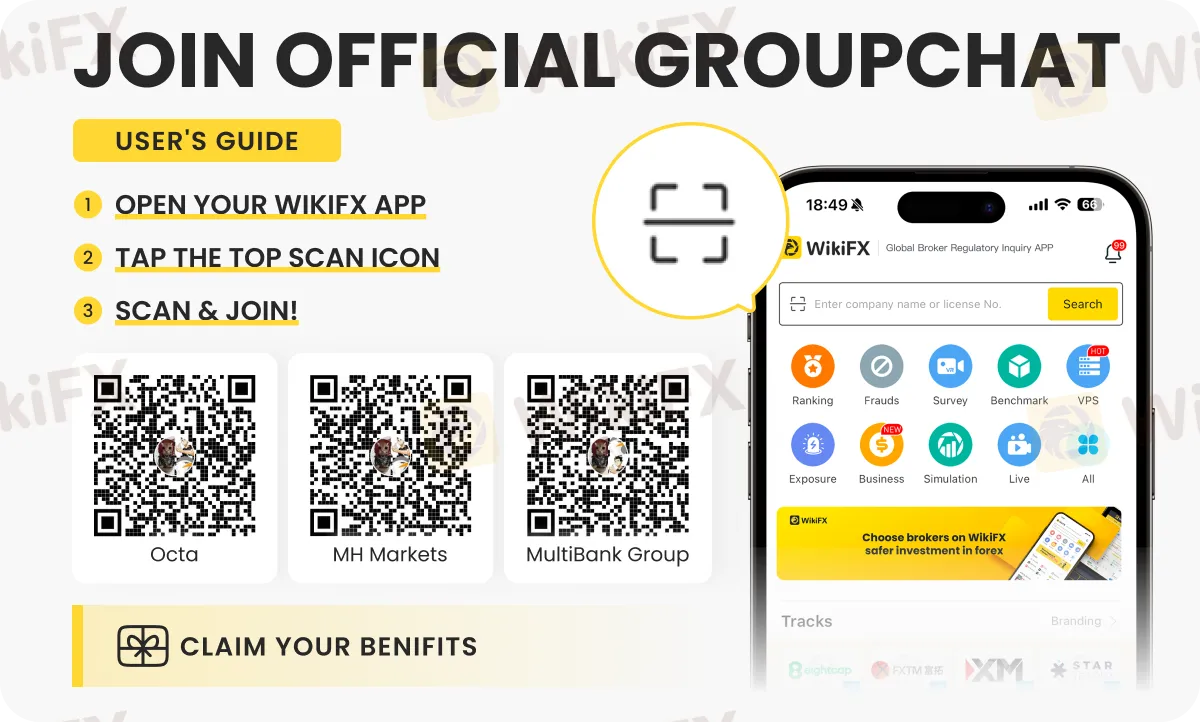

We recommend that potential users visit a third-party verification platform like WikiFX. Such platforms collect regulatory data, license statuses, and user feedback, offering an external view of a broker's history and operational integrity. Checking these resources before opening an account is a smart measure to protect your interests.

Exploring KIRA's Trading Conditions

A broker is ultimately defined by the trading environment it provides. This section breaks down the core components of KIRA's offering, from its trading platforms and market access to its account structure and leverage policies. These factors determine whether a broker's infrastructure matches a trader's strategy and experience level.

Platform Power: MT5 and CQG

KIRA provides access to two distinct and powerful trading platforms, serving a wide range of traders. The unique benefit is that both can be accessed from a single account, giving traders significant flexibility.

• MetaTrader 5 (MT5): As the successor to the globally popular MT4, MT5 is a favorite among retail traders. It is known for its user-friendly interface, advanced charting capabilities, extensive library of technical indicators, and support for automated trading through Expert Advisors (EAs). Its versatility makes it suitable for traders of all levels.

• CQG: This platform is a powerhouse often preferred by professional and institutional traders. CQG is recognized for its high-performance trading infrastructure, sophisticated analytical tools, and fast execution speeds, often with direct market access capabilities. Its inclusion indicates a focus on serving serious, high-volume traders.

Market Access Over 10,000 Instruments

The range of tradable instruments is a major difference for any broker. KIRA offers an extensive range of over 10,000 Contracts for Difference (CFDs), allowing traders to diversify their portfolios and access opportunities across global markets from one account. The available asset classes include:

• Forex: Over 330 currency pairs, including majors, minors, and a wide selection of exotics.

• Stocks: Over 7,000 CFDs on global stocks, providing access to a vast array of individual companies.

• Indices: Over 90 CFDs on major worldwide market benchmarks, allowing traders to speculate on the performance of entire economies or sectors.

• Commodities: Over 110 CFDs covering energy products (like oil and gas), precious and industrial metals, and agricultural goods.

• ETFs: Over 2,000 CFDs on Exchange-Traded Funds, offering diversified exposure to various market segments, industries, or strategies.

Account Tiers for Traders

KIRA structures its offering across three distinct account tiers, designed to match the needs and experience levels of different traders. This tiered approach allows clients to select a plan that aligns with their trading volume, support requirements, and strategic complexity.

| Feature | Standard Account | Pro Account | Premium Account |

| Target User | Beginners and new traders | Full-time, professional traders | High-volume, institutional traders |

| Leverage | Up to 1:400 | Up to 1:400 | Up to 1:400 |

| Support Level | 24x5 Customer Support | Dedicated Relationship Manager | Dedicated RM & Sales Trader |

| Key Benefit | Full tool access for live markets | Enhanced tools, speed, and support | Elite-level speed and personal service |

Understanding Leverage

Leverage of up to 1:400 is available across all account types offered by KIRA. Leverage is a powerful tool that allows traders to control a large position in the market with a relatively small amount of capital. For example, a 1:400 leverage ratio means that for every $1 in your account, you can control a position worth $400.

It is crucial to approach leverage with caution. While it can significantly increase potential profits, it also carries a high degree of risk and can equally increase losses. A small adverse market movement can result in the loss of the entire invested capital. Responsible risk management is essential when trading with high leverage.

KIRA Pros and Cons

To provide a clear and balanced perspective, this section summarizes the key findings of our analysis into a direct comparison of KIRA's strengths and potential drawbacks. This summary helps traders quickly weigh the factors most relevant to their decision-making process.

The Strengths (Pros)

• Strong Local Regulation: Being licensed and regulated by the UAE's Securities & Commodities Authority (SCA) as a Category 1 broker provides a high level of trust and accountability, particularly for traders within the GCC.

• Tailored for the GCC Market: As a Dubai-based entity, KIRA demonstrates a deep understanding of the regional market. The provision of Arabic language support and services designed for local needs is a significant advantage.

• Extensive Market Access: The availability of over 10,000 tradable instruments is a major strength, offering traders vast opportunities for diversification and strategy implementation across numerous asset classes.

• Powerful Platform Combination: Offering both the retail-friendly MT5 and the professional-grade CQG platform from a single account caters to a broad audience, from beginners to institutional-level traders.

• Sharia-Compliant Options: The availability of swap-free Islamic accounts is a critical feature for many traders in the region, allowing them to trade in compliance with Sharia principles.

• Fund Security: A clear policy of holding client funds in segregated bank accounts within the UAE provides a robust layer of protection for trader capital.

The Considerations (Cons)

• Pricing Transparency: While the broker mentions “low rates” and “transparent pricing,” the provided information lacks specific details on typical spreads, commissions, or other trading fees. Users would need to conduct further investigation on a demo or live account to determine the true cost of trading.

• Support Hours: Customer support is available 24/5 (Monday to Friday), which is the industry standard. However, some global brokers offer 24/7 support, which may be a consideration for traders who are active during weekends, particularly in the crypto CFD markets.

• Geographic Focus: The broker's core strengths and identity are heavily concentrated on the GCC region. Traders located outside of this area may not find the localized advantages, such as the specific regulator and Arabic support, as beneficial as those within it.

Reminder to Cross-Verify Claims

Before making a final decision based on these pros and cons, it is wise to consult independent sources. A platform like WikiFX can provide an external perspective on a broker's operational history and user-reported experiences, which can help validate the strengths and investigate the potential considerations listed here.

Is KIRA the Right Broker?

This section moves beyond a general analysis to assess KIRA's suitability for specific trader profiles. By examining how its features apply to different needs, readers can better determine if the brokerage is a good fit for their personal trading journey and strategic objectives.

For Beginners in the GCC

For a trader just starting out in the UAE or a neighboring country, KIRA presents several appealing features. The onboarding process is described as a simple 3-step sign-up, which can be completed in minutes, reducing the initial barrier to entry. The Standard account is designed for this demographic, providing full access to live markets and all necessary tools without the complexity of more advanced tiers. Perhaps most importantly, the availability of local, 24/5 customer support in Arabic can be a major confidence booster, ensuring that help is accessible and understandable when needed.

For Experienced and Professionals

Experienced and full-time traders will likely be drawn to the Pro and Premium accounts. The key benefit at this level is the provision of a Dedicated Relationship Manager. This offers a single, expert point of contact for complex queries, platform support, and other high-level needs, streamlining communication and problem-solving. The powerful combination of MT5 for its analytical depth and CQG for its execution speed allows professionals to deploy sophisticated strategies using their preferred high-performance tools. The high leverage and vast instrument list further support the execution of complex, multi-asset trading plans.

For Sharia-Compliant Traders

For a significant portion of the trading community in the GCC, following Sharia law is a non-negotiable requirement. KIRA directly addresses this need with its Islamic Account feature. These accounts are structured to be swap-free, meaning they do not charge or pay overnight interest (riba) on positions held open, which is forbidden in Islamic finance. This makes KIRA a viable and considerate option for traders who need to ensure their financial activities align with their faith, without compromising on access to markets or platforms.

Who Might Consider Alternatives?

To maintain a balanced view, it's also important to identify who might not be the ideal customer for KIRA. For instance, a trader based in Europe or the Americas may find a broker regulated by a more geographically relevant authority, such as the FCA (UK) or CySEC (Cyprus), to be a better fit. These traders would not benefit from the localized Arabic support or the specific legal protections of the SCA. Similarly, traders who absolutely require 24/7 customer support for weekend trading might look for brokers that explicitly offer this service.

Final Verdict and Crucial Reminder

This final section provides a brief summary of the entire review and concludes with a critical piece of advice for ensuring trader safety. It aims to leave the reader with a clear takeaway and an actionable step to protect their capital.

Concluding Thoughts on KIRA

Based on this comprehensive analysis for 2025, KIRA establishes itself as a strong and credible brokerage, specifically positioned to serve traders within the UAE and the broader GCC region. Its most significant strengths are rooted in its local, high-tier SCA regulation, which provides a solid foundation of trust and accountability.

This is complemented by an extensive market offering of over 10,000 instruments, a flexible and powerful platform combination (MT5 and CQG), and services thoughtfully tailored to the regional audience, such as dedicated Islamic accounts and Arabic language support. For traders based in the Gulf who value local regulation and specialized service, KIRA presents a compelling and well-rounded option that warrants serious consideration.

Your Final Check: Verify Independently

No single review, no matter how thorough, should ever be a substitute for your own personal verification. The financial markets are dynamic, and a broker's status can change. Therefore, we deliver this final call to action with the utmost seriousness.

Before opening an account or depositing funds with any broker, including KIRA, we strongly recommend you perform a thorough check on a trusted, independent platform. Using a tool like WikiFX to verify the latest regulatory data, license validity, and real user feedback is an essential step to protect your capital and ensure you are partnering with a reliable broker. This final act of due diligence is the most critical part of your decision-making process.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Currency Calculator