Abstract:UbitMarkets review reveals no valid license and direct links to a fraudulent project, raising serious concerns over investor fund safety.

UbitMarkets, registered in Saint Lucia in 2024, presents itself as an online trading platform offering forex and crypto-related products. However, a growing body of evidence suggests that interacting with this platform carries significant financial risk, and investors are strongly advised to avoid engaging with it.

From the absence of regulatory authorization to its documented connections with a crypto project already identified by police as a fraud scheme, UbitMarkets displays patterns commonly associated with high-risk offshore investment operations rather than legitimate brokerage firms.

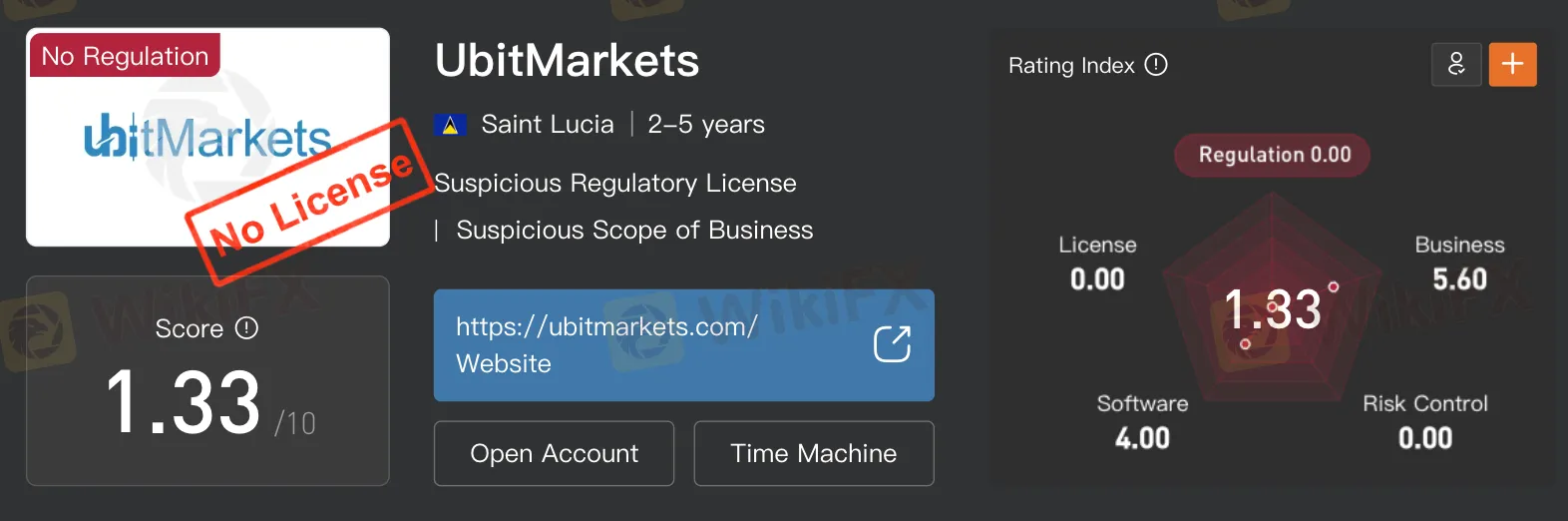

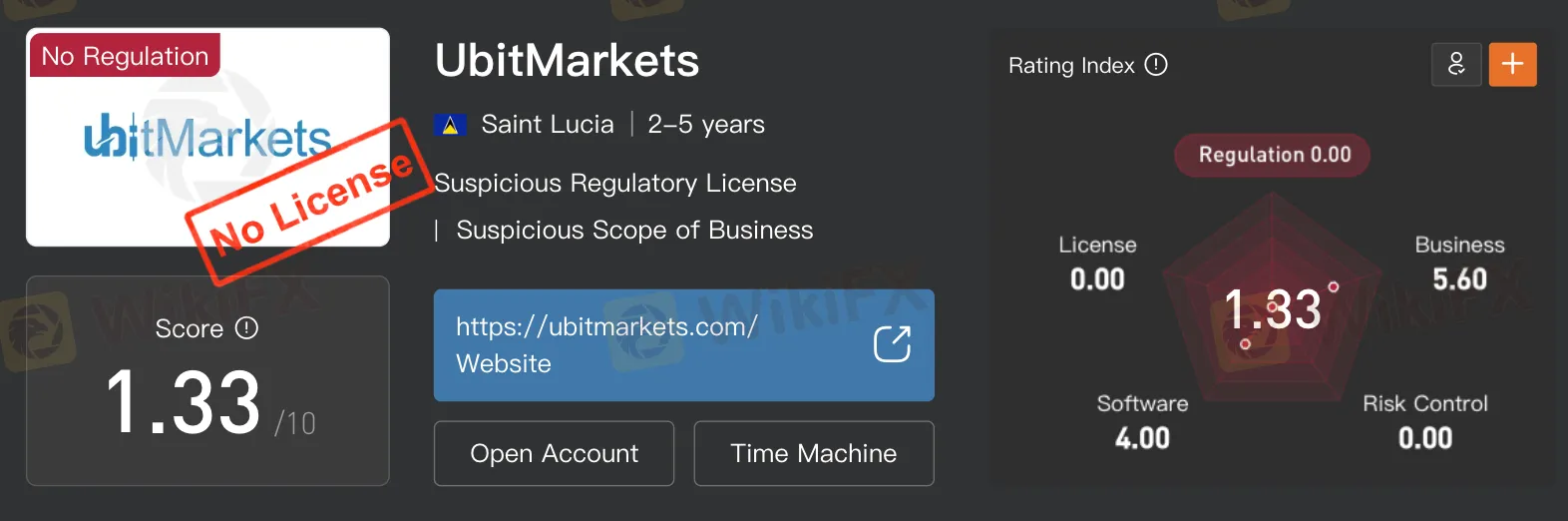

No Valid License and a Critical Risk Rating on WikiFX

Regulatory oversight is the most fundamental safeguard for retail traders. In the case of UbitMarkets, independent verification shows that the platform does not hold any valid forex or financial services license issued by recognized regulatory authorities.

According to data published by WikiFX, UbitMarkets currently receives an overall safety score of 1.33 out of 10, with a regulation score of 0.00, indicating the complete absence of verified licensing. The platform is also flagged for suspicious business scope and operational risks.

Such a low rating places UbitMarkets in the highest-risk category among retail trading platforms. Without regulatory supervision, traders are not protected by standard mechanisms such as mandatory fund segregation, regulated complaint handling, or independent dispute resolution procedures.

Readers can review the full verification record and risk indicators on WikiFX here: https://www.wikifx.com/en/dealer/1235086418.html

In practical terms, this means that once funds are deposited, all account rules, trading conditions, and withdrawal approvals are controlled entirely by the platform itself, with no external authority overseeing its conduct.

Direct Brand Binding With UBIT Coin — A Project Identified as a Fraud Scheme

Regulatory absence alone would already justify serious caution. What further escalates the risk profile of UbitMarkets is its repeated and public association with UBIT Coin (also known as Ubitcoin) — a crypto project that has been officially investigated and classified as a fraudulent scheme by law enforcement in India.

In 2024, police in Indias Telangana state carried out multiple arrests linked to the promotion of UBIT Coin. Authorities described the operation as a classic multi-level marketing (MLM) and Ponzi-style structure, using promises of guaranteed returns and daily staking income to attract new investors.

According to police findings reported by Indian media, thousands of individuals were affected, with estimated losses reaching tens of millions of rupees. Funds were allegedly transferred through complex channels, making recovery extremely difficult for victims. Investigators identified Brij Mohan Singh (also reported as Brij Mohan Kumar Singh)as the key organizer behind the network, describing him as a repeat offender involved in multiple financial fraud cases.

Several promoters, including public servants and former military personnel, were arrested for recruiting new participants and collecting funds. Police officially categorized UBIT Coin as a fraudulent investment operation rather than a legitimate crypto project.

UbitMarkets‘ Own Social Media Confirms the Connection

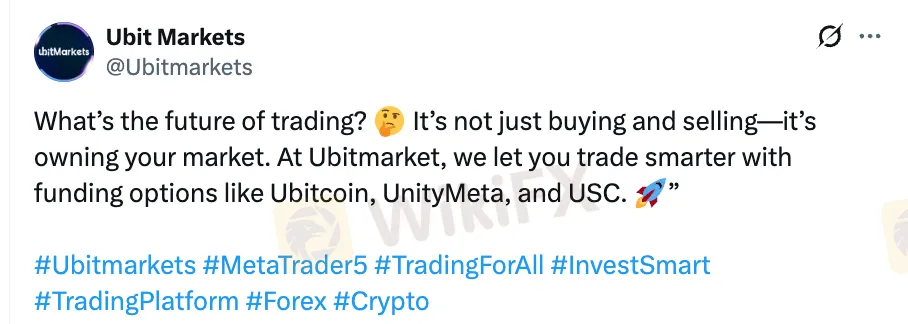

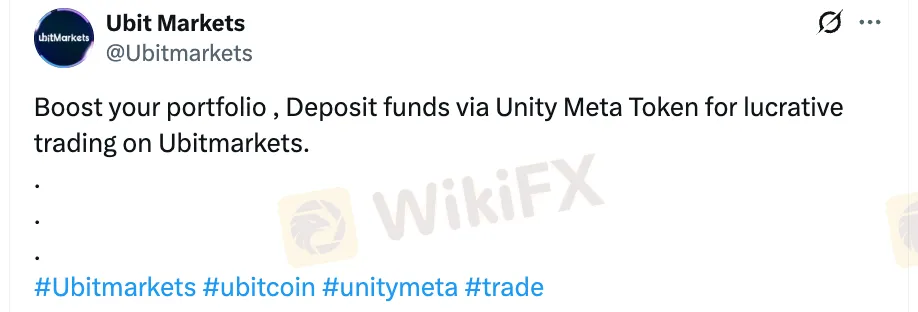

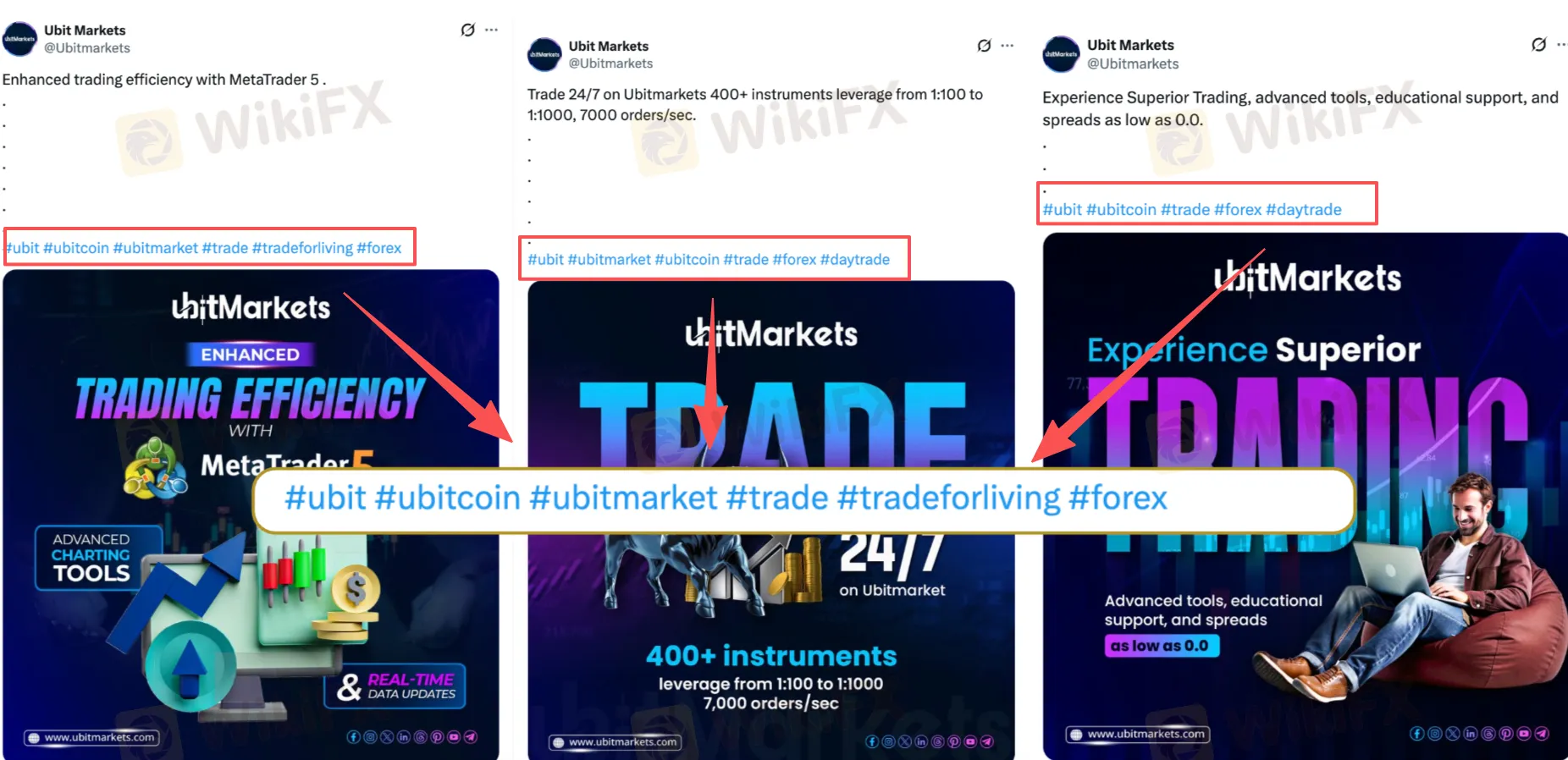

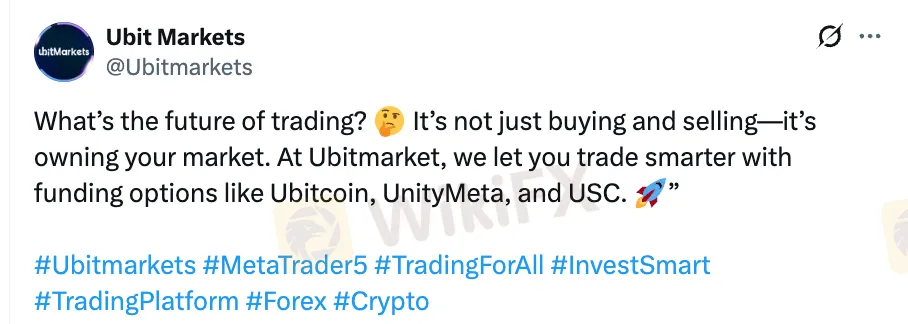

What makes this situation especially alarming is that the link between UbitMarkets and UBIT Coin is not based solely on external accusations. The platform’s official X (Twitter) account, @Ubitmarkets, repeatedly promotes UBIT Coin as a funding method for trading on the platform.

In one of the most explicit examples, a post published in September 2025 stated that traders on UbitMarkets could use “funding options like Ubitcoin, UnityMeta, and USC.” This statement directly identifies Ubitcoin as part of the platforms payment and trading ecosystem.

Similar promotional content appeared in other posts, often repeating nearly identical wording and continuing to reference Ubitcoin as an accepted funding option.

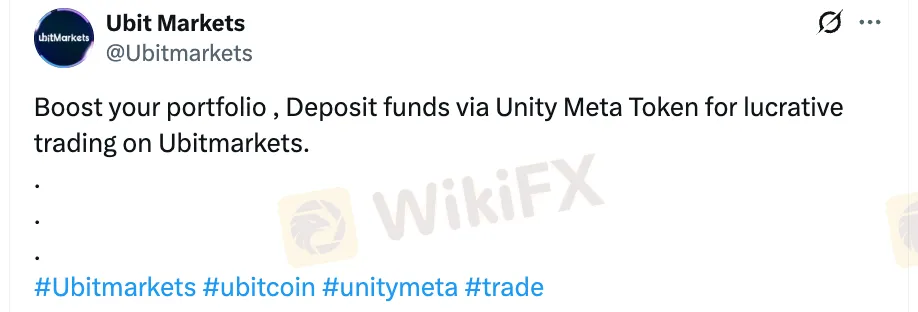

Even in posts where Ubitcoin was not mentioned directly in the text, hashtags such as #ubitcoin appeared frequently, reinforcing brand association and cross-promotion between the trading platform and the crypto token.

Taken together, these posts demonstrate that UbitMarkets is not merely indirectly linked to the UBIT ecosystem. Instead, it actively integrates and promotes the same token that has already been identified by police as part of a fraudulent MLM structure. For any trading platform, such a connection represents an extremely serious warning sign.

Website Signals and Offshore Structure Add to the Risk

Further concerns arise when examining the operational disclosures presented on UbitMarkets website. Public information shows a registration address in Saint Lucia, while other contact and operational references point to different jurisdictions. However, no licensed regulatory entity is clearly identified as supervising trading activity.

While global operations are not unusual in financial services, legitimate brokers typically operate under clearly defined licensed entities that fall under specific regulatory frameworks. In contrast, offshore registration combined with a lack of regulatory oversight and reliance on crypto-based funding ecosystems is frequently seen in schemes designed to avoid jurisdictional accountability.

Such structures make it extremely difficult for clients to pursue legal remedies if disputes or losses occur.

Why These Signals Should Not Be Ignored

When evaluating online trading platforms, experienced risk analysts look not for a single red flag, but for patterns. In the case of UbitMarkets, several high-risk indicators appear simultaneously: the absence of licensing, an extremely low third-party safety score, direct operational ties to a crypto fraud case, and offshore registration without clear regulatory supervision.

Individually, each of these would already warrant caution. Together, they form a risk profile commonly associated with platforms where investors face serious difficulty recovering funds once problems arise.

In such environments, trading rules, account conditions, and withdrawal approvals are governed entirely by internal policies, with no external authority capable of intervening on behalf of clients.

Final Assessment: A Platform Investors Should Avoid

Based on available verification data, law enforcement findings, and the platforms own promotional behavior, UbitMarkets presents multiple overlapping and severe risk factors.

The confirmed lack of regulation combined with direct promotional ties to an already exposed crypto fraud network significantly elevates the probability of financial harm for retail traders.

For anyone considering opening an account or transferring funds, the safest conclusion is clear:

UbitMarkets is not a platform suitable for investment and should be avoided.

Additional reports and background analysis on UbitMarkets are available in the following WikiFX articles:

https://www.wikifx.com/en/newsdetail/202506301594383710.html

https://www.wikifx.com/en/newsdetail/202507089904974018.html

About WikiFX

WikiFX is a global broker information platform specializing in regulatory verification, risk monitoring, and broker behavior analysis. By aggregating licensing records, operational indicators, and exposure reports, WikiFX helps traders identify potential risks before interacting with online trading platforms.

In todays online trading environment, verifying regulatory status through independent databases remains one of the most effective ways to reduce the risk of financial loss.