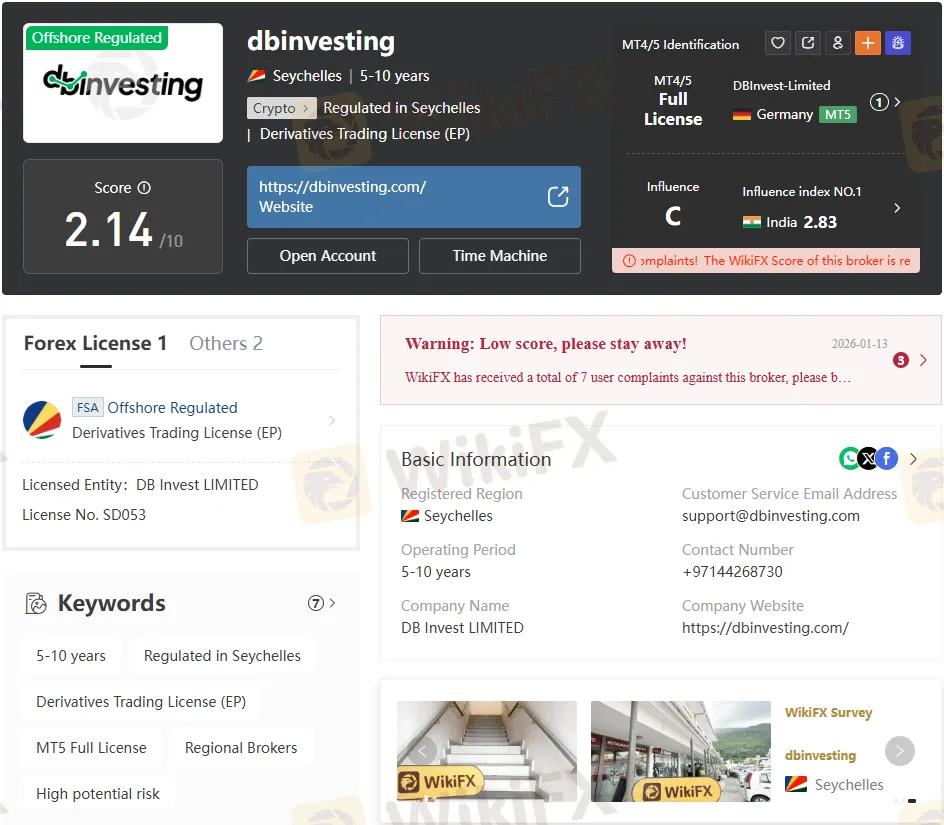

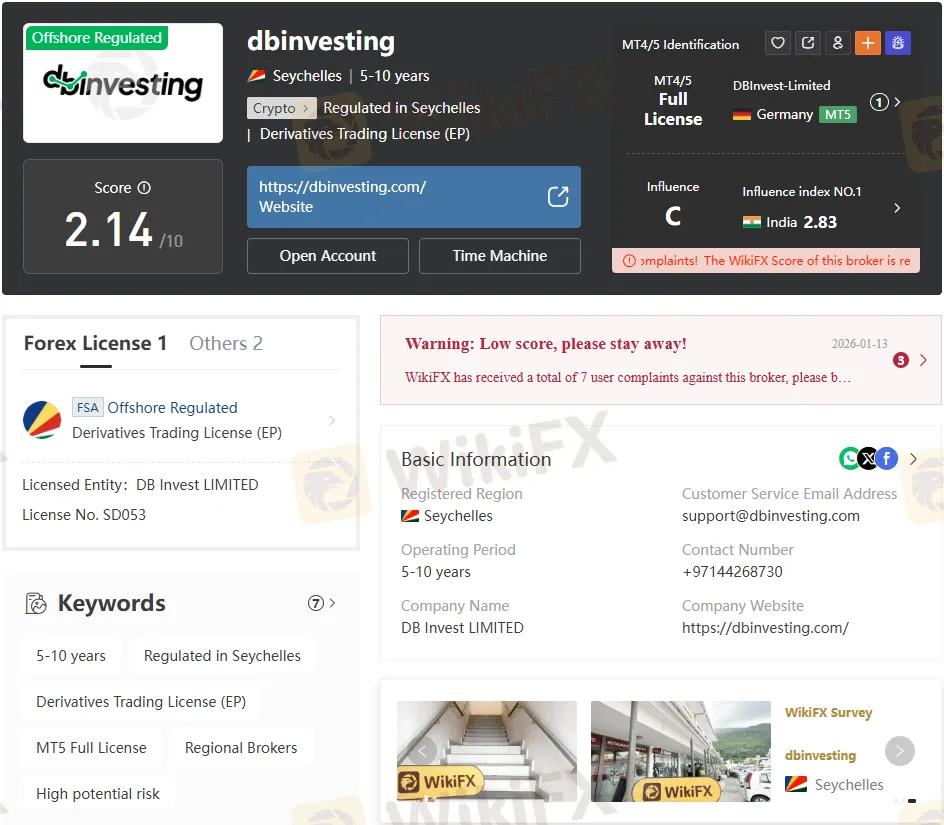

Abstract:DBInvesting regulation is offshore under Seychelles FSA, offering oversight but limited protection, with reported withdrawal risks for traders.

Introduction: Investigating DBInvesting Regulation

The legitimacy of any broker begins with its regulatory framework. DBInvesting presents itself as a multi-licensed entity, operating under the Seychelles Financial Services Authority (FSA), the UAE Securities and Commodities Authority (SCA), and Canadas FINTRAC. At first glance, this might suggest a diversified compliance structure. Yet, deeper analysis reveals inconsistencies, offshore reliance, and troubling user reports. This article dissects DBInvesting regulation, licenses, trading conditions, and reported cases to determine whether traders can safely engage with this broker.

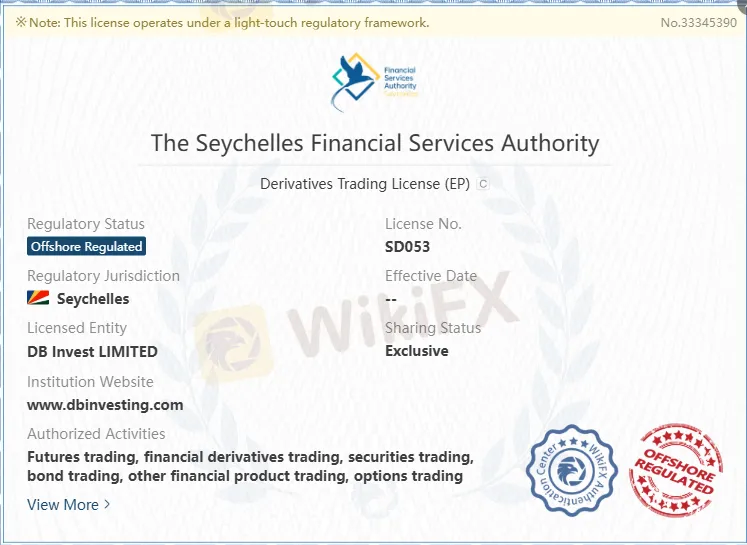

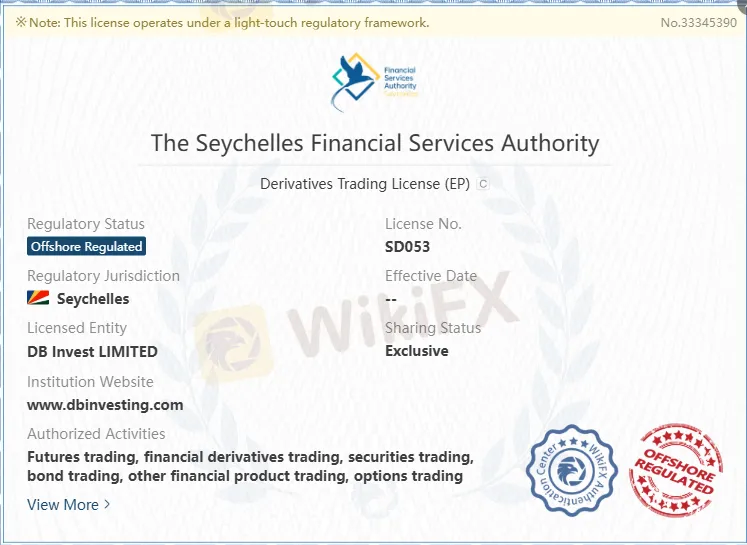

Offshore Oversight in Seychelles

The Seychelles FSA license, number SD053, is the primary authorization underpinning DBInvestings operations.

This license permits derivatives trading, futures, securities, bonds, and options. However, the FSA is widely regarded as a light-touch offshore regulator, offering limited investor protection compared to Tier-1 regulators such as the UK‘s FCA or Australia’s ASIC.

- License Type: Derivatives Trading License (EP) C

- Entity: DBInvest LIMITED

- Jurisdiction: Seychelles

- Authorized Activities: Futures, derivatives, securities, bonds, options

While technically regulated, the offshore nature of this license means enforcement is minimal. Traders should be aware that offshore regulation often lacks strict capital adequacy requirements, investor compensation schemes, or rigorous compliance monitoring.

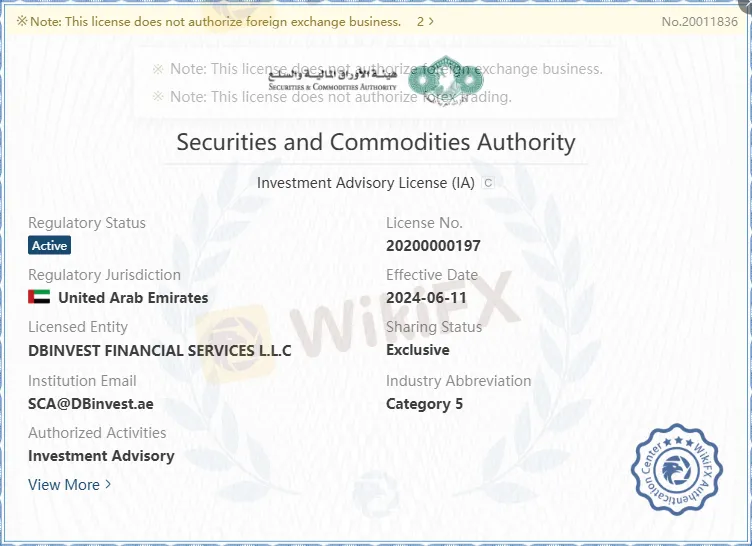

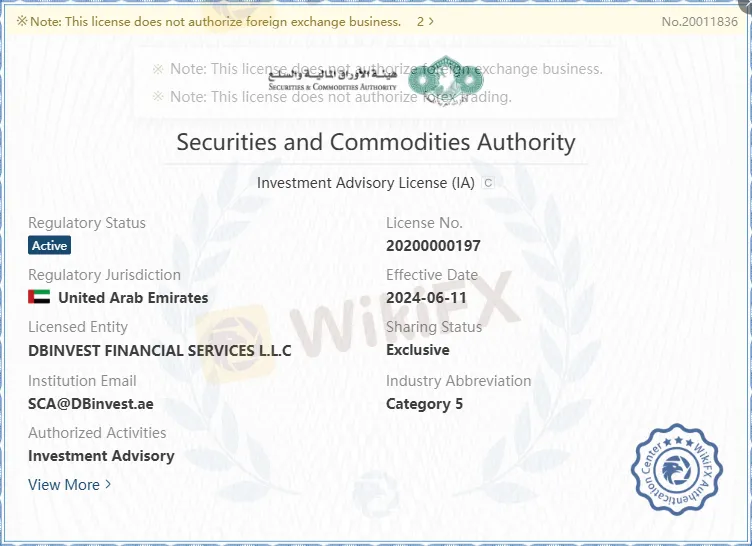

UAE Advisory License Without Forex Authorization

DBInvesting also holds an Investment Advisory License (IA) C from the UAEs Securities and Commodities Authority (SCA).

- License No.: 20200000197

- Entity: DBINVEST FINANCIAL SERVICES L.L.C

- Effective Date: June 11, 2024

- Category: 5 – Investment Advisory

This license is limited to advisory services and explicitly does not authorize forex trading. The absence of forex authorization raises questions about how DBInvesting markets its services in the UAE. Traders expecting full brokerage services under this license may be misled, as the scope is restricted to advisory functions.

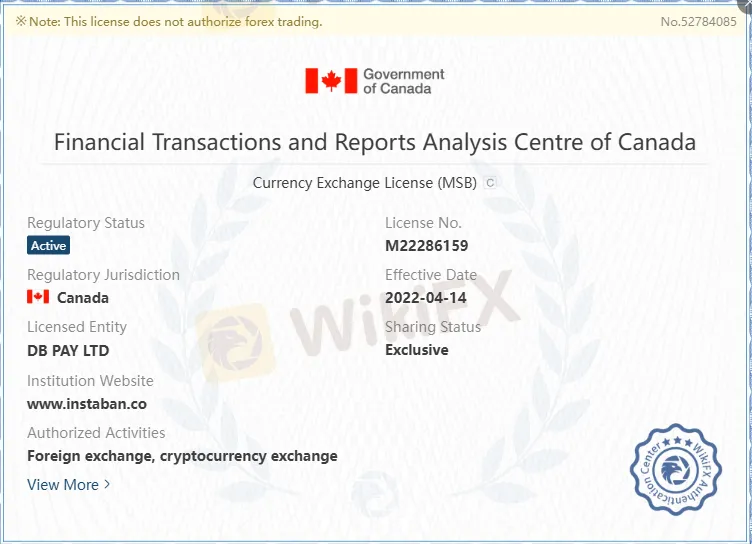

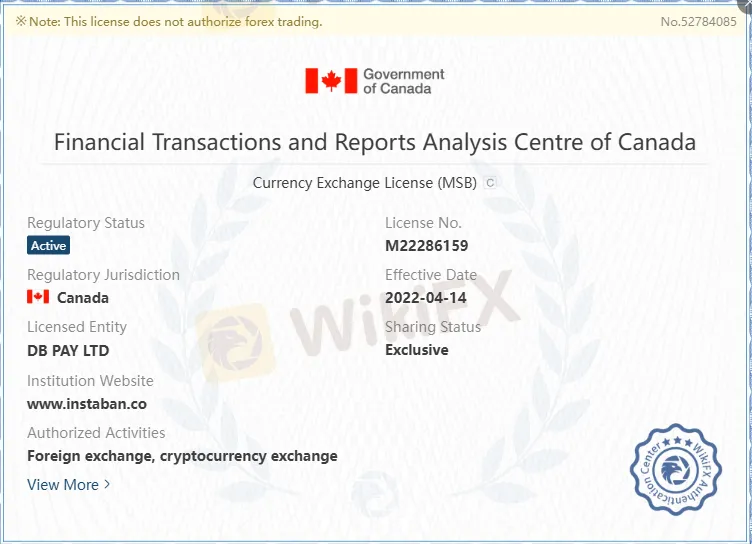

Canadian MSB License for Currency Exchange

A third license is registered under DB PAY LTD with Canadas FINTRAC.

- License No.: M22286159

- Effective Date: April 14, 2022

- Authorized Activities: Foreign exchange, cryptocurrency exchange

This license permits currency and crypto exchange but does not cover securities or derivatives trading. Once again, the scope of authorization is narrower than DBInvestings advertised services, creating a regulatory mismatch.

Physical Presence: Mixed Findings

Investigations into DBInvestings offices reveal inconsistencies across jurisdictions.

- Egypt: No physical presence found (October 2025).

- Cyprus: No physical presence found (December 2025).

- Seychelles: Office verified at Abby Centre, Office 15, Mahe (March 2024).

The absence of verifiable offices in Egypt and Cyprus contrasts with the confirmed Seychelles location. This reinforces the offshore-centric nature of DBInvesting regulation and raises concerns about transparency in its claimed global operations.

Trading Platforms and Technology

DBInvesting offers MetaTrader 5 (MT5) and Sirix WebTrader.

- MT5: Full license, average execution speed of 205 ms, supports multiple devices, advanced charting, and instant price tracking.

- Sirix WebTrader: Award-winning web-based platform with social trading integration, accessible via browser, designed for traders of all levels.

Compared to competitors:

- Axi: MT4 only.

- Equiti: MT4 and MT5.

- Grand Capital: iTrade and Webtrade.

DBInvestings dual-platform offering is competitive, but execution speed and server location (Seychelles) may affect latency for traders outside Africa.

Account Types and Minimum Deposits

DBInvesting provides several account structures:

- STP Account: $100 minimum, 1 pip spread, no commission.

- ECN Account: $100 minimum, 0.0 pip spread, $4 per lot commission.

- PRO Account: $10,000 minimum, 0.3 pip spread, $1.50 per lot commission.

- Islamic Account: $100 minimum, 1 pip spread, swap-free.

- Islamic+ Account: $10,000 minimum, 0.0 pip spread, swap-free.

Demo accounts are available, simulating real market conditions. The leverage offered is 1:1000, which significantly magnifies both profit potential and risk exposure.

Spreads and Commissions Breakdown

The ECN and Islamic+ accounts advertise ultra-tight spreads, but commission structures vary. Traders should weigh whether lower spreads justify higher per-lot fees.

Market Instruments Offered

DBInvesting Regulation permits trading across five asset classes:

- Forex: Major and minor currency pairs.

- Metals: Gold, silver, platinum, palladium.

- Indices: S&P 500, FTSE 100, DAX 30, Nikkei 225.

- Commodities: Oil, natural gas, agricultural products.

- Stocks: Global equities across major exchanges.

This multi-asset offering is broad, aligning with industry standards.

Copy Trading and Social Features

DBInvesting integrates copy trading via MT5 and Sirix.

- Leaders: Can act as signal providers, offering strategies publicly.

- Followers: Can replicate trades with replication speeds averaging 50 ms.

This feature appeals to novice traders but requires caution given the brokers regulatory limitations.

Deposits and Withdrawals

- Minimum Deposit: $100

- Payment Methods: VISA, Mastercard, SWIFT, SEPA, Perfect Money, Jeton, Fasa Pay

- Processing: Instant for cards and e-wallets; 1–3 days for bank transfers

- Fees: None reported

Withdrawal processes remain opaque, with multiple user complaints alleging blocked or delayed transactions. This is a critical red flag for traders considering DBInvesting.

Reported Cases of Fraud and Withdrawal Issues

Several cases documented in 2025 highlight troubling practices:

- Case 1: Profits erased after accusations of “bonus abuse.”

- Case 2: Withdrawals blocked, profits erased.

- Case 3: Larger withdrawals rejected under vague AML reviews.

- Case 4: Profits erased after accusations of autoclicker bot use.

- Case 5: Funds not returned.

- Case 6: Withdrawal of $16,900 denied, profits deducted under “bonus misuse.”

These reports suggest a pattern: DBInvesting allows losses but obstructs profitable withdrawals, citing arbitrary violations. Such practices undermine trust and highlight the risks of trading with offshore-regulated brokers.

Domain and Website Transparency

- Domain: dbinvesting.com

- Server Location: United States (IP: 13.249.153.41)

- Founded: 2018

- Registered Country: Seychelles

The offshore registration combined with a U.S.-based server location adds complexity to jurisdictional accountability. Traders may struggle to determine which authority has oversight in case of disputes.

Pros and Cons of DBInvesting

Pros:

- Multiple account types including Islamic options

- MT5 and Sirix WebTrader support

- High leverage up to 1:1000

- Demo accounts available

- Copy trading features

Cons:

- Offshore FSA regulation only

- UAE license excludes forex trading

- Reported withdrawal issues and fraud cases

- No physical presence in Egypt or Cyprus

- Risk of bonus-related disputes

Competitor Comparison

- Axi: FCA-regulated, MT4 platform, strong compliance.

- Equiti: Dual regulation, MT4/MT5, advanced analytics.

- Grand Capital: Multi-asset, innovative technologies, broader investment options.

Compared to these brokers, DBInvesting's regulation appears weaker, relying on offshore oversight and limited advisory licenses. Competitors offer stronger compliance and investor protection.

Bottom Line: Assessing DBInvesting Regulation

DBInvesting regulation is fragmented across Seychelles, UAE, and Canada, with each license covering only part of its advertised services. The offshore FSA license provides minimal investor protection, while the UAE and Canadian authorizations exclude forex and derivatives trading. Verified offices exist only in Seychelles, and multiple user reports document withdrawal denials and erased profits.

For traders, the risks are clear: while DBInvesting offers competitive spreads, high leverage, and modern platforms, its regulatory standing is insufficient to guarantee safety. Competitors with Tier-1 oversight provide stronger safeguards.

Final Assessment: DBInvesting regulation is not robust enough to be considered safe. Traders should exercise extreme caution and consider alternatives with stronger compliance frameworks.