简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Common Questions About Zenstox: Safety, Fees, and Risks (2025)

Abstract:When a broker promises high returns and personalized account management, it is natural to feel a mix of excitement and skepticism. Zenstox, a brokerage established in 2022, has been aggressively marketing to traders in regions ranging from the Middle East (UAE, Saudi Arabia) to Latin America (Mexico, Brazil). However, newer doesn't always mean better.

When a broker promises high returns and personalized account management, it is natural to feel a mix of excitement and skepticism. Zenstox, a brokerage established in 2022, has been aggressively marketing to traders in regions ranging from the Middle East (UAE, Saudi Arabia) to Latin America (Mexico, Brazil). However, newer doesn't always mean better.

Before you commit your capital, it is crucial to look past the marketing and examine the hard data. Currently, Zenstox holds a WikiFX Score of 3.25, a rating that sits in the lower tier of trust. This low score suggests that while the company is operational, there are significant risk factors—primarily regarding user feedback and regulatory depth—that every trader needs to understand before opening a wallet.

Is Zenstox actually regulated?

Yes, but with significant caveats.

Zenstox is regulated by the Seychelles Financial Services Authority (FSA) under license number SD123. The organization name listed on the license is VIE FINANCE SEY LTD.

Understanding Offshore Regulation

While having a license is better than being completely unregulated, it is important to understand the distinction between “offshore” regulation (like Seychelles) and “Tier-1” regulation (like the FCA in the UK or ASIC in Australia).

The Seychelles FSA is a popular jurisdiction for forex brokers because the requirements for entry are generally less undeniable than in Europe or North America.

- Fund Safety: Tier-1 regulators often mandate that client funds be held in segregated bank accounts with strict insurance policies (like the FSCS in the UK) that protect traders if the broker goes bankrupt. Offshore licenses do not always guarantee this same level of insolvency protection.

- Operational Freedom: Regulators in the Seychelles allow brokers more flexibility. This is why you might see higher leverage offers or different promotional bonuses that are banned in stricter jurisdictions. However, this freedom comes at the cost of oversight. If a dispute arises between you and the broker, resolving it through an offshore court system can be incredibly difficult, expensive, and time-consuming for international clients.

In summary: Zenstox is a legal entity, but the safety net regarding your deposit is much thinner than what you would find with a top-tier regulated broker.

What problems are users reporting?

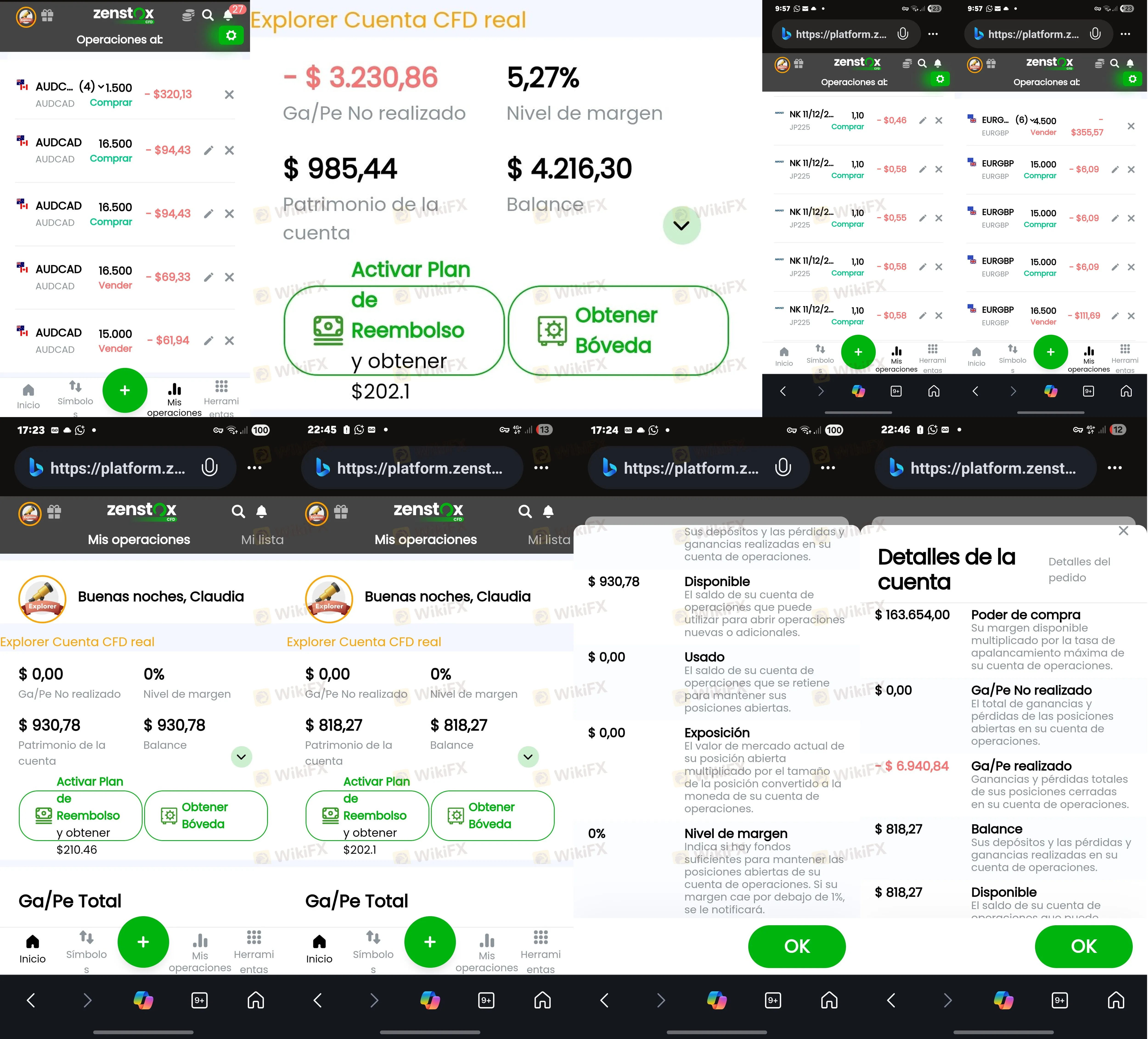

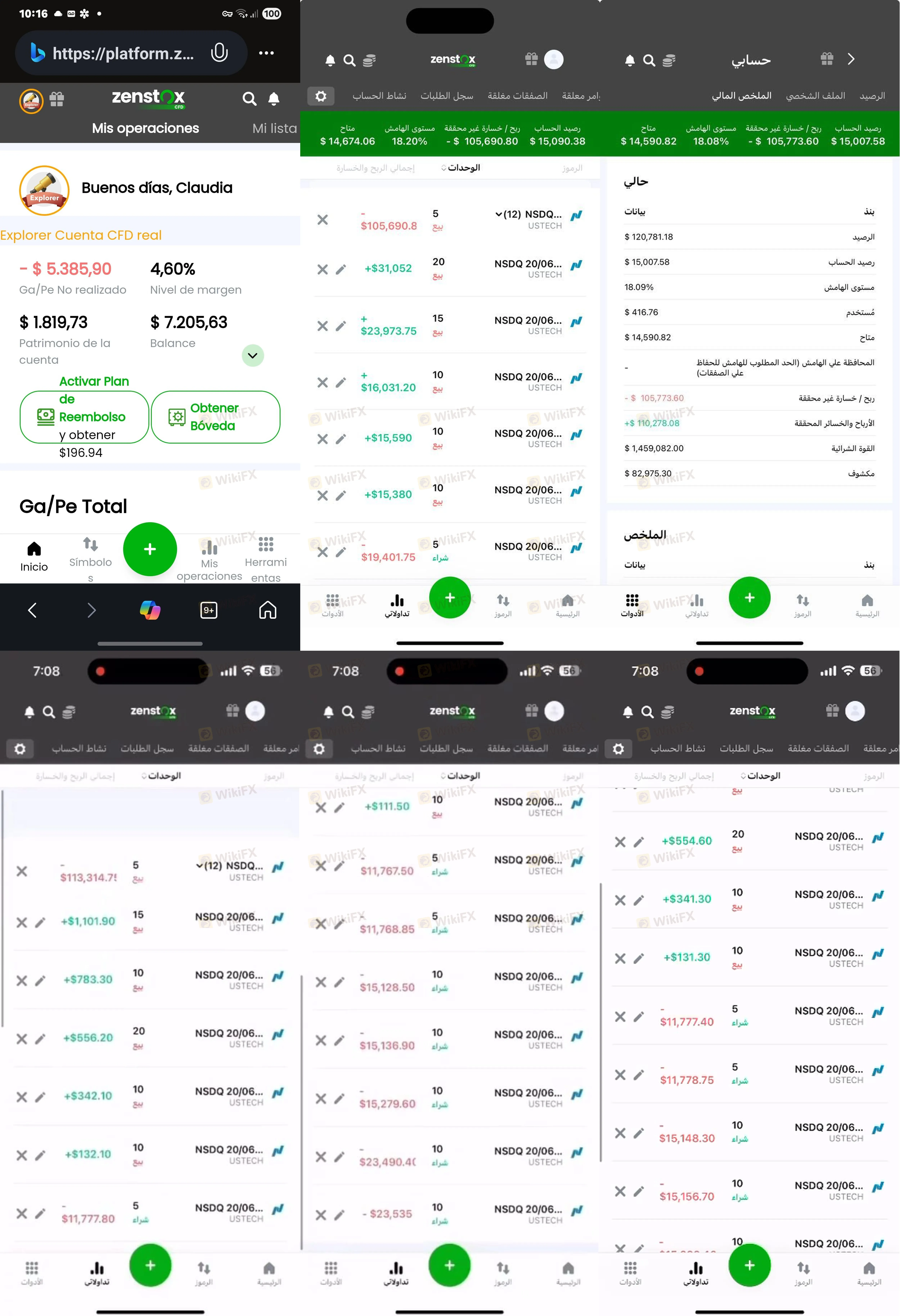

Detailed analysis of user feedback reveals a deeply concerning pattern that potential clients cannot ignore. There is a high volume of severe complaints coming specifically from the Middle East (Oman, UAE, Qatar) and Mexico.

A recurring narrative in the feedback involves “Boiler Room” tactics. Several users report being assigned “Account Managers” who initially build trust. Users often start with a small deposit (around $200), see rapid “profits” on their screen, and are then pressured to invest significantly larger sums to maximize these returns.

Specific complaints highlight the following issues:

- Withdrawal Bloackades: The majority of reports state that once a withdrawal is requested, the broker demands additional fees, claims more trading volume is required, or simply stops responding. For example, a user from the UAE reported transferring over $23,000 within 20 days, only to have all withdrawal requests rejected and the account eventually closed.

Aggressive Personnel: Users have named specific account managers (names like “Marco,” “Sarai Chavez,” and “Lamia Alali” appear in complaints) who use psychological pressure. One user from Mexico detailed how a manager convinced them to take out personal loans to deposit $7,000, promising a 300% return, which resulted in a total loss.

Fabricated Profits: A user from Egypt provided evidence of audio and video recordings where managers allegedly shouted and blackmailed them, forcing them to sign documents. The user claimed the profits displayed on the platform were manipulated to encourage more deposits, yet withdrawing even $1 was impossible.

What trading conditions does Zenstox offer?

Transparency is a key indicator of a broker's reliability, and unfortunately, Zenstox is lacking in this area regarding their technical trading environment.

obscure Trading Costs

The available data for Zenstox does not list specific spreads, commissions, or swap rates. When a broker does not publicly advertise their average spreads, it often indicates they operate a “Dealing Desk” (Market Maker) model.

- The Risk: Without transparent distinct spreads, traders are at risk of hidden costs. A broker might widen the spread during news events to hit stop-losses or manipulate pricing slightly against the trader. This lack of data makes it impossible to calculate the true cost of trading with them.

Software Uncertainty

While many established brokers proudly display their support for MetaTrader 4 (MT4) or MetaTrader 5 (MT5), Zenstoxs software information is currently unspecified.

- Why this matters: Standard platforms like MT4 provide an audit trail of trades. Proprietary, web-based platforms built by offshore brokers are sometimes “black boxes,” where the broker has total control over the price feed. Given the user complaints regarding “manipulated balances,” the lack of clarity on their software provider is a significant red flag.

Bottom Line: Should you trust Zenstox?

Based on the current data, Zenstox presents a very high risk to your capital.

While they hold an offshore license in the Seychelles, the sheer volume and severity of client complaints outweigh the legitimacy that license provides. The reports of blocked withdrawals, aggressive account managers pressuring clients into debt, and the inability to access funds after depositing are classic warning signs of a dangerous operation. The WikiFX Score of 3.25 reflects these dangers accurately.

Protect your money:

- Avoid brokers that use “Account Managers” to give financial advice or pressure you for deposits via WhatsApp.

- Do not deposit money into platforms that lack transparent spread and software information.

- If you have already deposited, do not send “tax fees” or “unlocking fees” to withdraw funds; this is typically a secondary stage of the scam.

Markets change fast, and regulation statuses can be revoked or updated overnight. To verify the current license status of this broker or to check for new user exposures before you deposit, search for Zenstox on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Understanding FX SmartBull Withdrawal & Deposit: Essential Information Before You Start Trading

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Understanding UPFOREX Money Transfers: Important Facts You Need to Know

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

Currency Calculator