简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HFM Investigation: The "Account Archived" Trap and the Mystery of Vanishing Profits

Abstract:It starts with a winning streak. You trade normally, accumulate a balance of $7,400 or perhaps $19,000, and hit the withdrawal button. Then, silence. You try to log in, but your access is revoked. You receive a cryptic email stating your account has been "Archived" or that your profits were erased due to "erratic prices."

By WikiFX Senior Investigative Journalist

It starts with a winning streak. You trade normally, accumulate a balance of $7,400 or perhaps $19,000, and hit the withdrawal button. Then, silence. You try to log in, but your access is revoked. You receive a cryptic email stating your account has been “Archived” or that your profits were erased due to “erratic prices.”

This isnt a hypothetical scenario. According to a massive influx of 100 recent complaints lodged with WikiFX, this is the reality for traders dealing with HFM (formerly HotForex). While the broker waves its Tier-1 licenses like a flag of legitimacy, the data on the ground paints a picture of systemic profit cancellation, aggressive slippage, and a “digital shredder” policy that leaves successful traders with zero balance.

The Regulatory Dual Reality

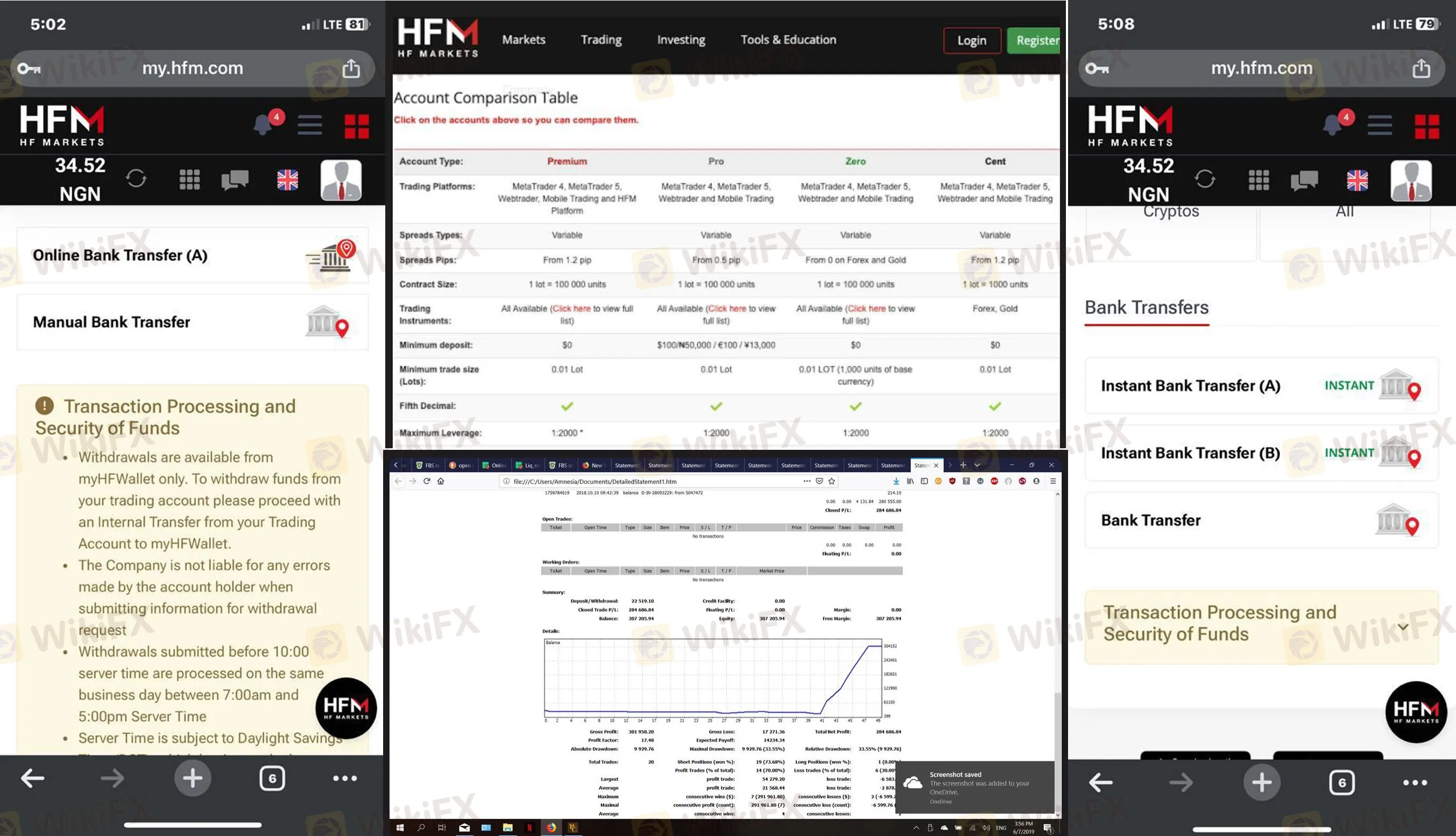

HFM presents itself as a global fortress, backed by reputable regulators like the UK's FCA and Cyprus's CYSEC. However, a regulator's seal is only as good as the enforcement behind it. While HFM holds valid licenses, they also appear on regulatory blacklists in Southeast Asia for operating without authorization.

The following table represents the complete regulatory footprint of HFM as found in our database. Note the disparity between their European status and their standing in Asian markets.

HFM Regulatory Audit

| Regulator | License Type | Status | License No. | Region |

|---|---|---|---|---|

| Cyprus Securities and Exchange Commission (CYSEC) | STP License | Regulated | 183/12 | Cyprus |

| Financial Conduct Authority (FCA) | STP License | Regulated | 801701 | United Kingdom |

| Financial Sector Conduct Authority (FSCA) | STP License | Regulated | 46632 | South Africa |

| Dubai Financial Services Authority (DFSA) | STP License | Regulated | F004885 | UAE |

| Seychelles Financial Services Authority (FSA) | Retail Forex License | Offshore Regulated | SD015 | Seychelles |

| Badan Pengawas Perdagangan Berjangka Komoditi (BAPPEBTI) | Unauthorized | Blocked/Unauthorized | N/A | Indonesia |

| Securities Commission Malaysia (SCM) | Unauthorized | Investor Alert List | N/A | Malaysia |

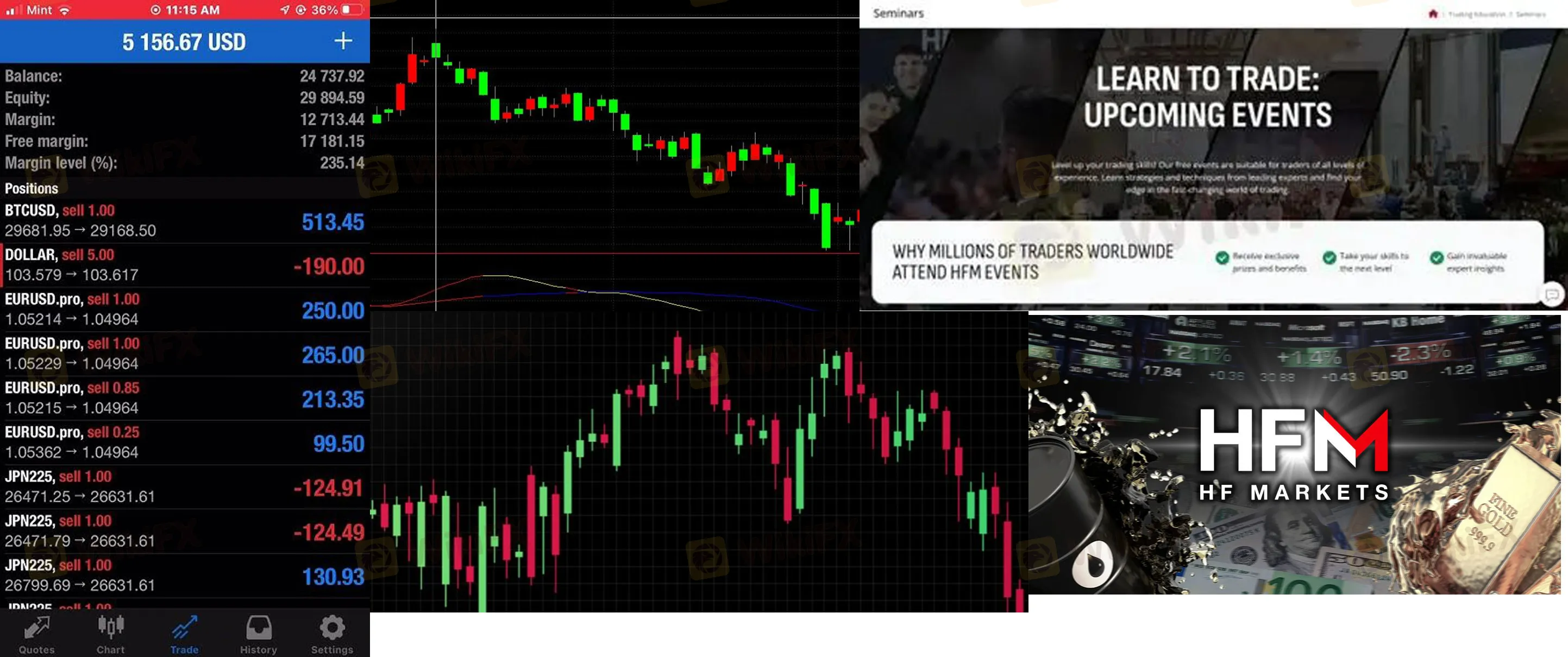

The “Profit Cancellation” Protocol

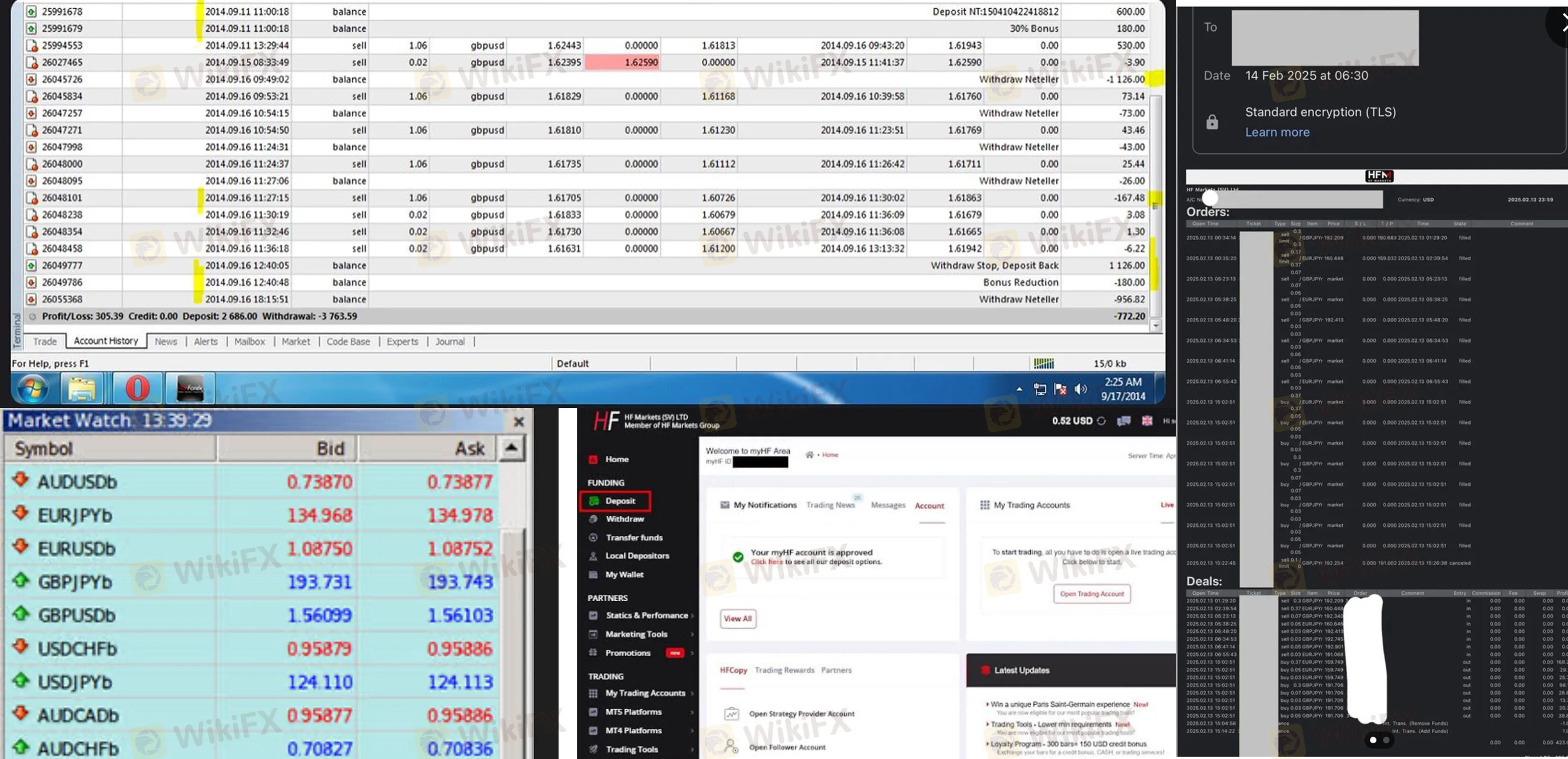

The most alarming trend in the recent data is the retroactive cancellation of profits. We are not talking about small adjustments; we are seeing 5-figure sums wiped out overnight.

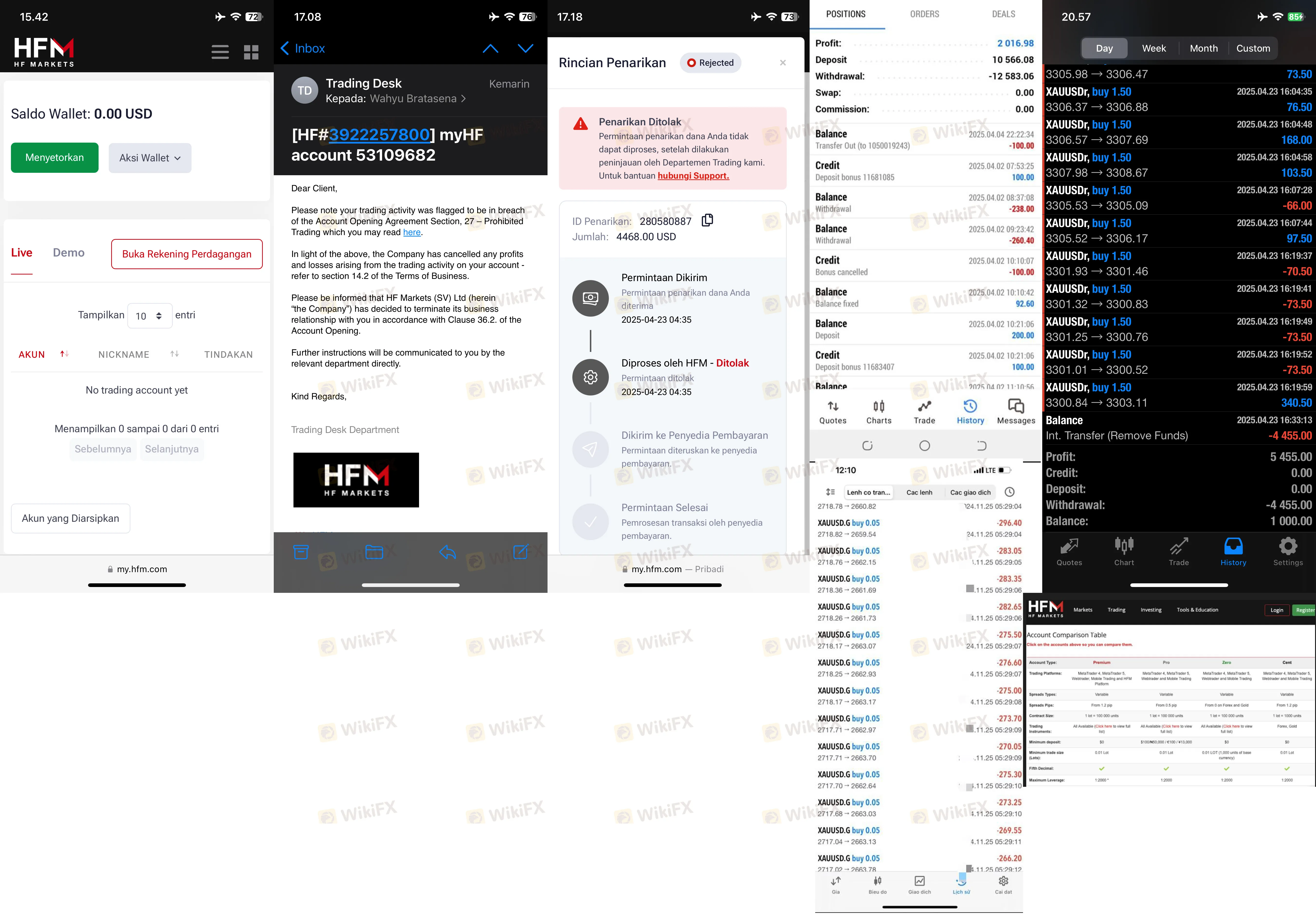

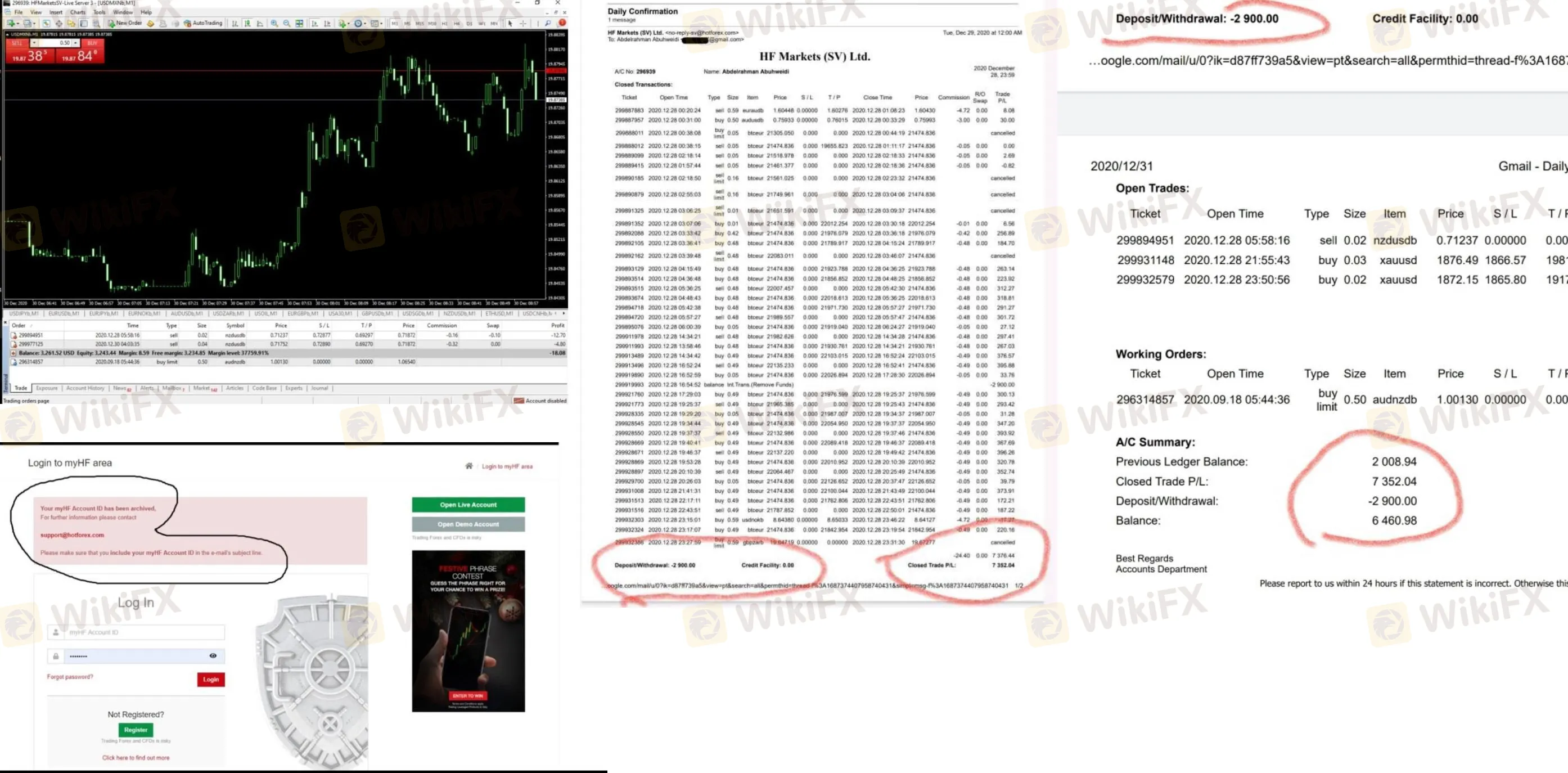

In Case 66, a trader from India reported making a legitimate profit of $19,000. HFM suddenly adjusted the account, removing the entire profit without a clear explanation, citing only an “adjustment.” Similarly, in Case 77, a user using an EA (Expert Advisor) grew an account to over $7,400. When they attempted to withdraw $4,468, the request was rejected, the account was banned, and HFM claimed “prohibited trading” without offering evidence.

The excuse is almost always identical. HFM claims the trader utilized “abusive strategies” or traded on “erratic prices.” In Case 44, a user trading BTCEUR was told their trades were invalid due to pricing errors. The traders counter-argument is irrefutable: “It is HFM's responsibility to provide accurate pricing. I cannot be held accountable for trading on prices that their platform approved.”

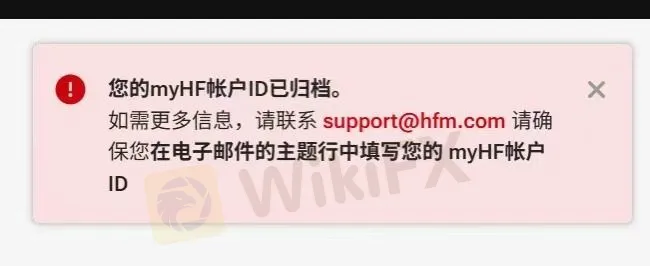

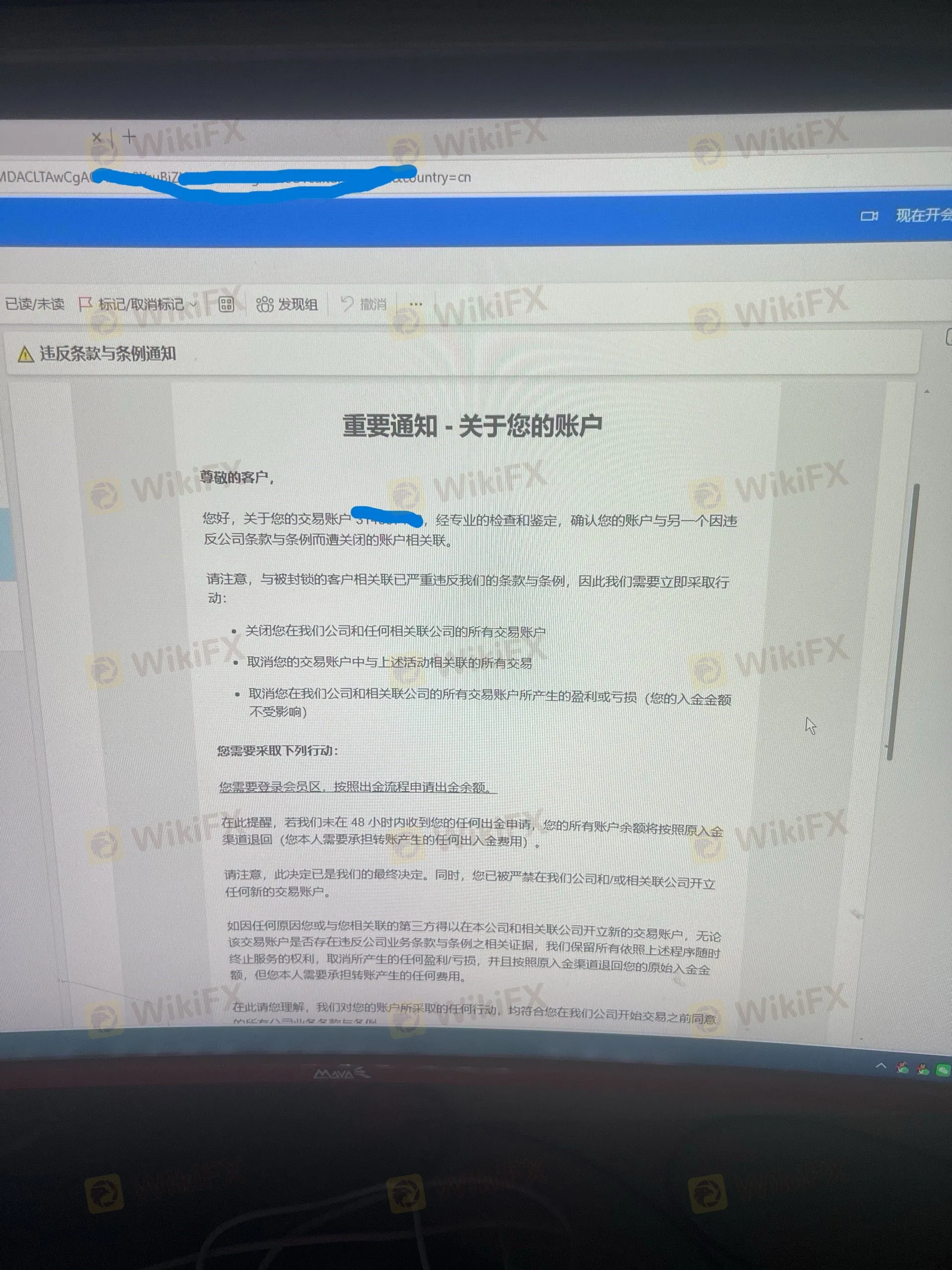

The “Account Archived” Blackout

When a trader questions these deductions, HFM appears to trigger a “nuclear option”: Account Archiving.

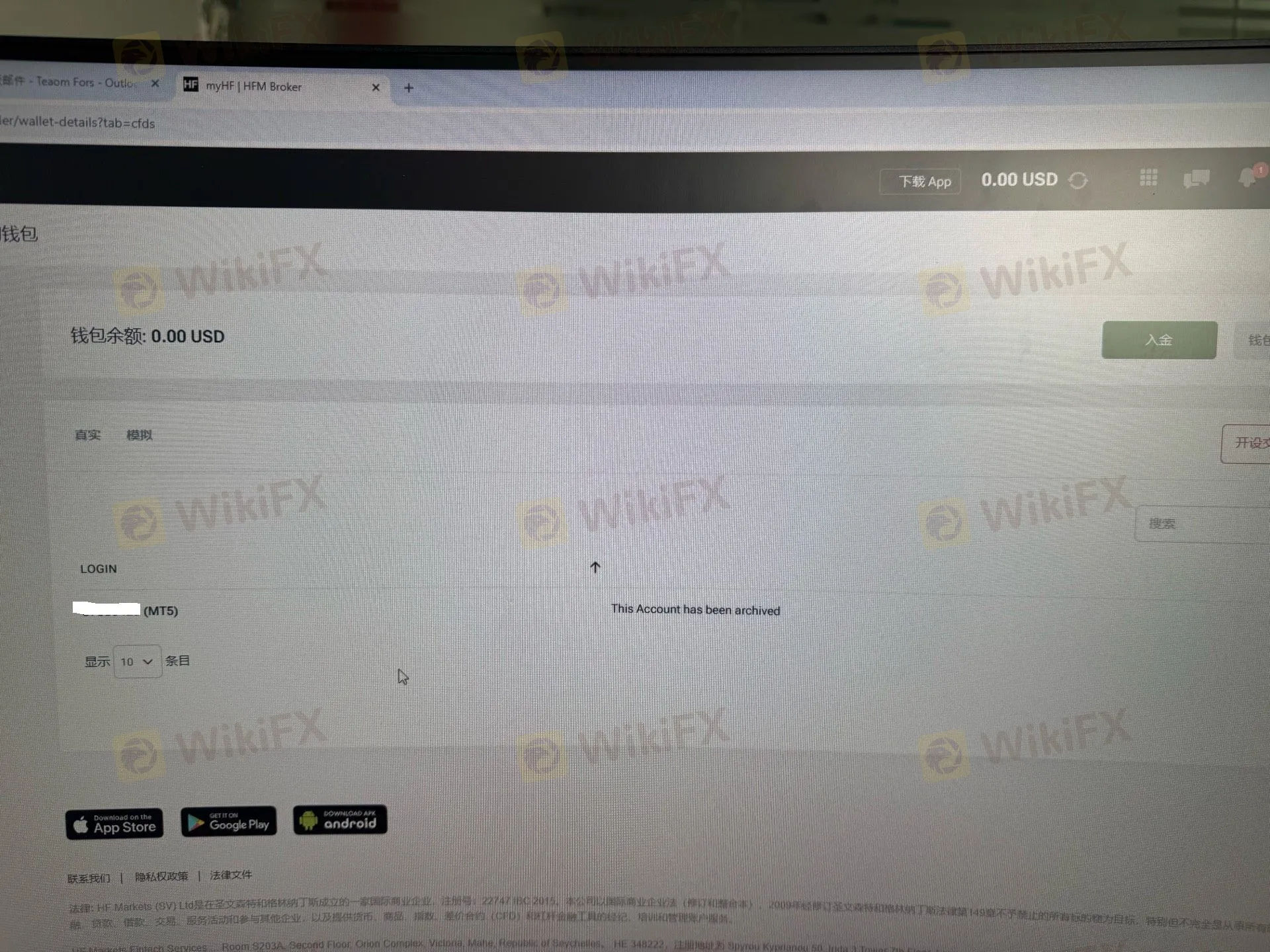

Multiple reports from China, India, and Vietnam (Cases 1, 2, 5, 9, 30, 40) describe the same sequence of events. A user complains about a withdrawal, and shortly after, their account is “forced archived” (Case 5). This effectively locks the user out of the platform, preventing them from accessing transaction history or gathering evidence for a dispute.

In Case 2, a Chinese investor stated their funds were “illegally swallowed” before the account was forcibly archived. This tactic serves a dual purpose: it stops the immediate withdrawal and removes the trader's ability to prove they ever owned the funds. It is a digital erasure of liability.

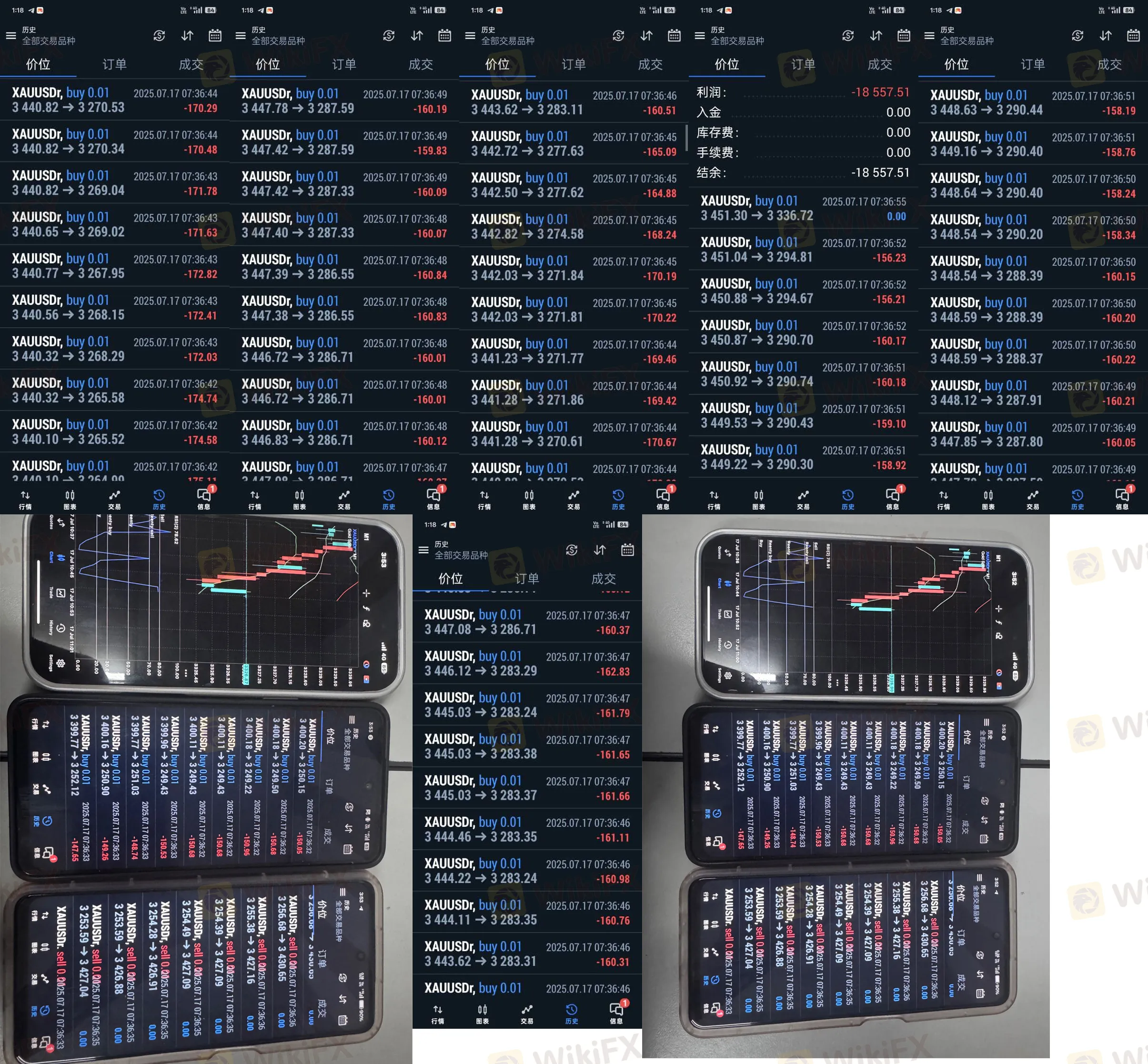

100 Pips of Manipulation

For those who are not banned, the trading environment itself appears hostile. Complaints regarding massive slippage—far beyond normal market volatility—are rampant.

The most egregious evidence comes from Case 21 in Malaysia. The trader documented a specific event largely ignored by HFM support. On July 17, at 7:36 AM platform time, their positions were forcibly closed. The price discrepancy was mathematical insanity:

- Buy Order: Closed at 3249, despite the market price being 3400.

- Sell Order: Closed at 3427, despite the market price being 3254.

That is a difference of over 100 pips against the client in both directions simultaneously. The trader noted that the market day's high was only 3352, yet their sell order was closed at a phantom price of 3427. This isn't slippage; this is price fabrication.

Similarly, in Case 56, a trader in Thailand placed a long order on GBP/USD at 1.2750. The system accepted the order but executed it three seconds later at 1.2780—a 30-pip slippage that instantly put the trade into a $600 loss.

The Withdrawal Maze & Hidden Deductions

If you survive the “archiving” and the slippage, you face the final boss: The Withdrawal Department.

Dozens of cases (Case 8, 12, 28, 29, 38) detail a system designed to frustrate traders into giving up. In Case 29, a trader requested a $100 withdrawal. Despite HFM claiming “no fees,” only $52 arrived. Nearly 50% of the funds vanished into the banking ether.

In Case 36, an Indian trader deposited over $200. HFM claimed the receiver never got the payment. This dispute has dragged on from December 2024 to May 2025, with the trader providing full bank proofs and HFM simply stopping their replies. Case 38 introduces the “Technical Error” excuse, where a withdrawal of 321 ZAR was cancelled, credited back, but allegedly sent twice, leaving the trader in a debt loop caused by the broker's own system failure.

Verdict

The disparity between HFM's marketing profile and the user experience is cavernous. While they hold licenses in the UK and Cyprus, the influx of 185 complaints within three months suggests that for many retail traders—especially in Asia and emerging markets—the protection of these licenses feels non-existent.

The recurrence of “profit cancellation” followed by “account archiving” suggests a systemic risk management strategy that prioritizes the broker's revenue over client integrity. When a broker decides that your winning trades are “erratic” and deletes your balance, you are not trading in a market; you are playing a rigged game.

WikiFX Risk Warning:

Forex and CFD trading involves a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

Privacy Disclaimer:

The cases and images cited in this article are derived from public user complaints submitted to the WikiFX Exposure center. We do not guarantee the authenticity of every individual claim, but analyze patterns based on the aggregate data provided.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

UPFOREX Review 2026: Is UPFOREX Safe or Scam? A Look at User Reviews and Warning Signs

The micro-documentary "Let Trust Be Seen" is officially launched today!

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Jane Street Under Fire: From India’s Market Ban to a $40 Billion Crypto Conspiracy

Currency Calculator