简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Classic Global Ltd Regulated? Finding Out the Truth About Their License Claims

Abstract:If you are looking for information about Classic Global Ltd Regulation, you probably want to know if this platform is safe for your money. Let's be completely clear from the beginning: Classic Global Ltd works without any real financial regulation and shows many signs of being a well-planned online scam. It is not a real broker. The worries that brought you to this page are completely right, and your money is in serious danger with this company.

If you are looking for information about Classic Global Ltd Regulation, you probably want to know if this platform is safe for your money. Let's be completely clear from the beginning: Classic Global Ltd works without any real financial regulation and shows many signs of being a well-planned online scam. It is not a real broker. The worries that brought you to this page are completely right, and your money is in serious danger with this company.

This article will give you a detailed look into whether Classic Global Ltd is regulated. We will carefully break down their false license claims, show you the warning signs that prove they are fraudulent, and give you a clear guide on how to spot and protect yourself from these harmful platforms. Our goal is to give you the clear answer you need and the tools to keep your investments safe in the future.

The Quick Answer

For those who need the main facts right away, this summary brings together our findings. Classic Global Ltd is a high-risk company that should be completely avoided. Their business is built on lies, from their regulation claims to their withdrawal processes.

The low trust score directly shows these serious problems. An important piece of proof is the broker's rating on independent checking platforms. As of early 2025, Classic Global Ltd has a very low WikiFX score of 1.14 out of 10, putting it clearly in the category of a fraudulent operation.

Here is a clear breakdown of the main risk factors:

| Risk Factor | Assessment |

| Overall Regulatory Status | Unregulated. Works without oversight from any trusted financial authority. |

| US NFA Claim | False. Registered as a “Non-Member,” which is not a license and gives no authority. |

| UK FCA/Companies House Claim | Misleading. A basic UK company registration is not a financial license from the FCA. |

| Withdrawal Process | High-Risk / Predatory. Known for blocking withdrawals and demanding fake fees. |

| User Feedback | Overwhelmingly Negative. Filled with reports of fraud and lost money. |

Breaking Down the Lies

Scam brokers like Classic Global Ltd are experts at creating a fake appearance of being legitimate. They understand that potential investors look for signs of regulation, so they create a story using half-truths and complete lies. Let's break down their specific claims and expose the reality behind them.

The US NFA “Regulated” Lie

This is one of the most common and misleading tricks used by offshore, unregulated brokers. Classic Global Ltd claims to be regulated in the United States by the National Futures Association (NFA). They may even provide an NFA ID number to appear credible. However, a check of the NFA's official database shows a critical detail: they are registered as a “Non-Member.”

What does “Non-Member” mean? It means they are not subject to NFA oversight, examination, or regulation. This status is often used for companies that are exempt or are simply listed in a database without being authorized to do business. A real forex broker operating in the US must be registered as an “NFA Member.” By claiming regulation based on a non-member status, Classic Global Ltd is deliberately misleading investors. Your money has zero protection under US law with this company.

The UK “Registered” Trick

Another layer of their deception involves the United Kingdom. Investigation shows a company named “CLASSIC GLOBAL LTD” is indeed registered with the UK's Companies House under number 13066363. Fraudulent brokers present this as proof of their UK presence and legitimacy.

This is a classic misdirection. Registering a company in the UK is a simple, cheap administrative process that can be completed online by anyone, anywhere in the world. It provides no financial oversight whatsoever. The only authority for regulating forex brokers in the UK is the Financial Conduct Authority (FCA). Classic Global Ltd is not authorized or regulated by the FCA. Therefore, its claim of being a UK-based, regulated company is false. It is merely a shell company, not a licensed financial institution.

The Canadian FINTRAC Fake

To cast a wider net, some versions of this scam claim registration with FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) as a Money Services Business (MSB). While this may sound official, an MSB registration is purely for anti-money laundering (AML) and counter-terrorism financing reporting. It is not a license to operate as a forex or CFD broker, nor does it provide any investor protection or oversight of trading activities. Real Canadian brokers are regulated by the Canadian Investment Regulatory Organization (CIRO).

Warning Signs in Their Operations

Beyond the false regulatory claims, the day-to-day operations of Classic Global Ltd are filled with warning signs that clearly show “scam.” These red flags provide a practical checklist for identifying fraudulent brokers.

Unprofessional Online Presence

Real financial firms invest heavily in a stable, professional, and transparent online presence. Classic Global Ltd does the opposite. Their websites are often built from cheap, basic templates and are notoriously unstable. It is common for their domain names (like www.classicgloballtd.com or www.classic-global.io) to become inaccessible without warning as they attempt to avoid negative reviews and angry victims. Furthermore, they provide no verifiable physical address or reliable phone number, typically relying only on an anonymous support email address. This lack of transparency is a deliberate tactic to make them untraceable.

Harmful Trading Conditions

The trading environment itself is a major red flag. Classic Global Ltd often advertises excessively high leverage, sometimes as high as 1:500. Reputable regulators in jurisdictions like the UK, Europe, and the US have strict caps on leverage for retail clients (often 1:30) to protect them from catastrophic losses. High leverage is a bait used by unregulated brokers to attract inexperienced traders with the promise of large profits from small deposits.

Moreover, the trading platform they provide is highly suspect. These companies frequently use pirated or white-label versions of MetaTrader 4 (MT4) or MT5. This means they control the server and can manipulate the price feed. Users report seeing abnormal price spikes or drops that do not appear on legitimate market feeds, often designed to trigger stop-losses or liquidate profitable positions. In some cases, victims are lured into downloading a proprietary app that is nothing more than a simulated trading game, where the numbers on the screen are completely fabricated.

The Withdrawal Trap

This is the most painful and definitive proof of the scam. While deposits are easy, withdrawals are systematically blocked. The process follows a predictable, predatory pattern:

1. The user submits a withdrawal request, often after seeing significant “profits” in their account.

2. The broker's “customer service” or “analyst” contacts the user, denying the request and citing an unexpected issue.

3. They then demand payment for a series of fabricated fees. Common examples include a “20% personal income tax,” a “risk margin,” an “account unfreezing fee,” or a “VIP channel fee” to expedite the process.

4. The broker applies immense pressure, threatening that the account will be permanently frozen or the funds forfeited if the fees are not paid.

It is crucial to understand that these fees are entirely fake. They are the final stage of the scam, designed to extract as much money as possible from the victim. Paying these fees will not result in a successful withdrawal. The broker will either invent another fee or simply cease all communication.

Illegal Deposit Methods

A final, critical red flag is how they collect your money. Real brokers use segregated corporate bank accounts, where client funds are kept separate from the company's operational funds. Classic Global Ltd, like most scams, directs users to deposit funds via highly irregular and untraceable methods. The two most common are direct transfers to personal bank accounts of unknown individuals and cryptocurrency transfers, particularly USDT (Tether). These methods are used because they are difficult to trace and nearly impossible to reverse, ensuring your money is gone for good once sent.

Stories from Victims

The theoretical risks become starkly real when we examine the experiences of those who have lost money to Classic Global Ltd. The complaints and user reports paint a consistent picture of a well-organized fraudulent operation, often employing a specific psychological manipulation script known as the “Pig-Butchering Scam.”

The “Pig-Butchering” Script

This term, a direct translation from the Chinese “杀猪盘” (shā zhū pán), describes a long-con romance and investment fraud. It has become the signature method for scams like Classic Global Ltd. The process is chillingly methodical:

> Scenario 1: The Romance Scam Angle. A victim meets an attractive and seemingly wealthy person on a dating app or social media platform like Instagram or WhatsApp. The scammer spends weeks or even months building a deep emotional connection and trust—the “fattening the pig” phase. Once trust is established, the scammer casually mentions their success in forex or crypto trading and “recommends” a supposedly exclusive platform: Classic Global Ltd. They guide the victim through opening an account and making a small initial investment. To build confidence, this first small investment may even yield a quick profit that the victim is allowed to withdraw.

>

> Convinced of the opportunity's legitimacy and trusting their new “friend” or “lover,” the victim is then persuaded to invest a much larger sum. Once this large deposit is made, the “slaughtering” begins. The withdrawal requests are denied, the fabricated fees are demanded, and the once-charming scammer either becomes aggressive or vanishes completely.

The Manipulated Platform

Even for users who are not targeted through a romance scam, the outcome is the same. Many reports detail a fraudulent trading environment designed to ensure the client loses.

> Scenario 2: The Manipulated Platform. A user deposits funds and begins trading. They notice that the price movements on their Classic Global Ltd MT4/MT5 platform do not align with the broader market. Sudden, inexplicable spikes or drops appear out of nowhere, precisely timed to wipe out their positions. When they complain to customer service, they are told it was a moment of “extreme market volatility” or that it was their own fault. In reality, the broker, controlling the platform's backend, is engineering these losses.

The user reviews section on platforms like WikiFX is filled with these exact stories for Classic Global Ltd. Comparing this to a highly-rated, legitimate broker on WikiFX shows a night-and-day difference in user feedback, highlighting the importance of community-sourced reviews in due diligence.

Your Protection Against Scams

To conclude, our investigation confirms that Classic Global Ltd is not a legitimate or regulated broker. It is a fraudulent company that uses a web of deceit, including fake regulatory claims, predatory withdrawal tactics, and psychological manipulation, to steal from unsuspecting investors. Under no circumstances should you deposit funds with this platform. If you have already done so and are facing withdrawal issues, do not pay any additional fees, as this will only result in further losses.

Protecting your money is the most important part of trading. The existence of scams like Classic Global Ltd underscores the critical need for thorough research. We strongly advise that you never deposit funds with any broker without first verifying its regulatory status and user reviews.

Make it a non-negotiable step in your process: Before you even consider opening an account, search for the broker on WikiFX. A low score or a warning of “No valid regulation” is an immediate deal-breaker. This simple, free check is your best defense against platforms like Classic Global Ltd. By leveraging independent verification tools and maintaining a healthy skepticism, you can navigate the financial markets safely and avoid becoming another victim.

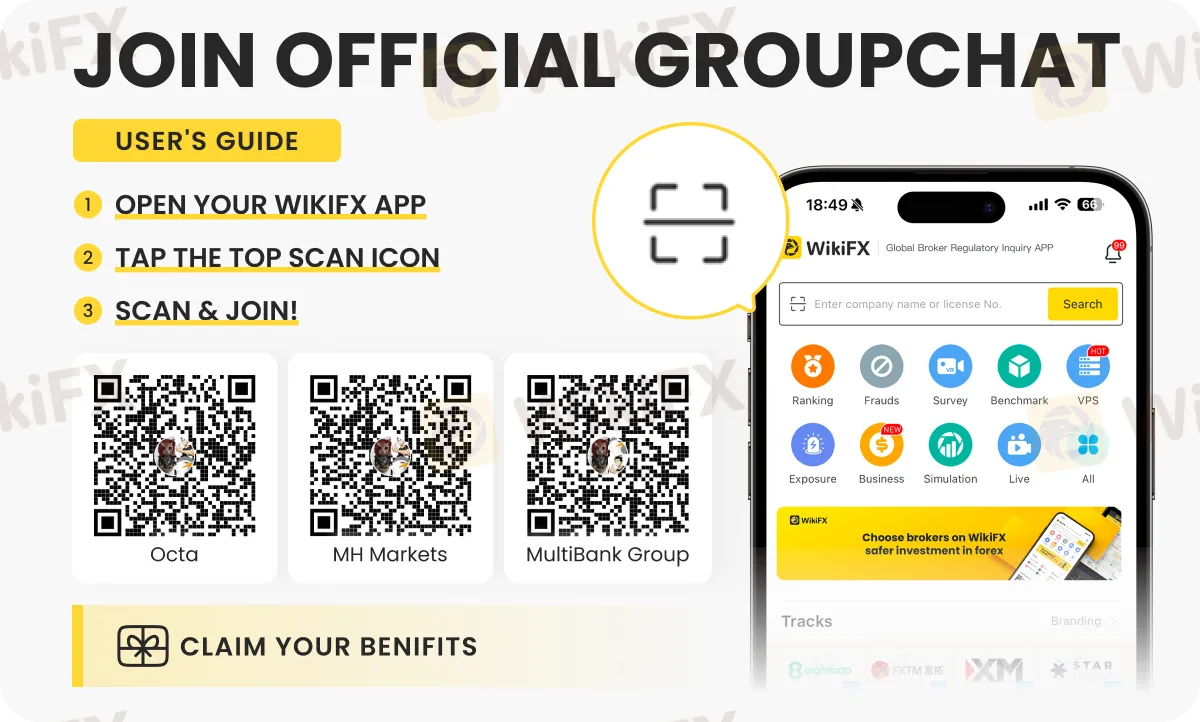

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

UPFOREX Review 2026: Is UPFOREX Safe or Scam? A Look at User Reviews and Warning Signs

The micro-documentary "Let Trust Be Seen" is officially launched today!

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Jane Street Under Fire: From India’s Market Ban to a $40 Billion Crypto Conspiracy

Currency Calculator