简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bull Waves User Reputation: Looking at 680+ Reviews and Complaints to Answer: Safe or Scam?

Abstract:This article goes deeper than basic reviews. We will take a close look at Bull Waves, which works under the name Equitex Capital Limited and is regulated by the Seychelles Financial Services Authority (FSA). We will examine hundreds of real user reviews, look at patterns in official complaints, and check the broker's rules and regulations. Our goal is to give you the clear information you need to make a choice that keeps your money safe and fits your comfort level with risk.

When traders look at a new platform, the most important question is always about safety. You're asking, Is Bull Waves safe or a scam? and many others are asking the same thing. Bull Waves is fairly new in the busy CFD trading world, starting in 2023. This has led to lots of online discussion. There are both good reviews and serious warnings, which makes things confusing. We need a clear, fact-based answer.

This article goes deeper than basic reviews. We will take a close look at Bull Waves, which works under the name Equitex Capital Limited and is regulated by the Seychelles Financial Services Authority (FSA). We will examine hundreds of real user reviews, look at patterns in official complaints, and check the broker's rules and regulations. Our goal is to give you the clear information you need to make a choice that keeps your money safe and fits your comfort level with risk.

Quick Summary

Before we look at all the details, it's important to share the main findings first. For traders who need a fast answer, these points show the biggest risks with Bull Waves. Our detailed research found several warning signs that any potential user should know about.

These main findings come from looking at how the broker operates, its regulatory status, and real user experiences. They form the basis of our final judgment about whether the broker can be trusted.

• Weak Offshore Regulation: Bull Waves is run by Equitex Capital Limited, which has a license from the Seychelles FSA under license number SD185. The Seychelles FSA is considered a weak, offshore regulatory body. This “red level” classification means it gives much less client protection, oversight, and legal help compared to top-level regulators like the UK's FCA or Australia's ASIC.

• Very New Broker: The company started in 2023. As of 2025, it has less than two years of operating history. This short track record makes it impossible to check if it's reliable and consistent through different market conditions.

• Serious Complaint Patterns: A review of user feedback shows serious claims, with the most common and worrying issue being withdrawal problems, unexplained delays, and trouble accessing funds and profits.

• Conflicting User Reviews: Bull Waves' online reputation is sharply split, with two different Trustpilot profiles showing very different scores. This major difference is a significant warning sign that needs more investigation.

Given these initial warning signs, an important first step for any trader is to check the broker's current regulatory status and review user alerts on your own. Platforms like [WikiFX](https://www.wikifx.com/) bring this information together, offering a real-time check on brokers like Bull Waves.

The Two Sides of Bull Waves

One of the most unusual and concerning things we found in our analysis is the broker's conflicting online reputation, specifically on Trustpilot. Having two separate profiles with dramatically different ratings creates a confusing and untrustworthy picture. This is a unique warning sign that a quick check might miss.

Profile 1: The “Great” Reputation

The main profile, connected to the website `bullwaves.com`, has a “Great” rating of 4.1 out of 5 stars from over 688 reviews. The feedback on this page is mostly positive. Users often praise the platform's features and support staff.

Common positive comments include things like:

• “Bullwaves has been outstanding, from excellent customer service to fast withdrawals.”

• “The customer service and quick withdrawals are something I cannot fault.”

This profile shows a picture of a reliable and responsive broker, which has attracted many users.

Profile 2: The “Poor” Reputation

In sharp contrast, a second profile for `www.bullwaves.global` exists with a “Poor” rating of 2.2 out of 5 stars from 15 reviews. The feedback here is mostly negative and describes serious issues that match complaints found on other financial forums. These complaints are much more serious than typical trading problems.

Our Analysis: What This Means

Having two such different profiles is a major concern and needs careful thought. There are several possible explanations, none of which look good for the broker's trustworthiness:

1. Possibility of a Fake Website: The `.global` website could be an unrelated fake site set up by scammers to copy the real broker. However, the complaints often describe processes and interactions specific to the broker's known practices, making this less certain.

2. Possibility of Fake Reviews: It is a common trick for new, offshore-regulated brokers to aggressively ask for positive reviews or even use fake ones to build a seemingly credible reputation quickly. The high number of generic positive reviews on the main profile, when compared with the specific, serious complaints on the second, suggests the high score may not be completely real.

3. Confusion and Risk: Regardless of the reason, having two profiles creates significant confusion for potential clients. It makes it impossible to figure out the true user experience. When a broker's online identity is split and contradictory, it naturally increases the risk for traders.

Our conclusion for this section is clear: the high 4.1-star rating cannot be trusted completely. The serious, specific complaints on the second profile, though fewer in number, represent a pattern of risk that cannot be ignored.

A Deep Look into Bull Waves Complaints

Moving beyond review scores, we analyzed the content of user complaints across multiple platforms to find repeating patterns. These patterns show the practical risks traders may face when dealing with Bull Waves. The most serious issues consistently relate to fund access and account management.

Complaint 1: Withdrawal Issues

This is the most critical and frequently mentioned complaint. Delays, excuses, and outright refusal to process withdrawals are a sign of high-risk brokers. With weak offshore regulation, users have very little effective help when a broker fails to return their funds.

One user detailed their experience:

> “I filled in the wrong bank details... it took me over a month to finally withdraw to a crypto wallet.”

Another, more serious case from a user of the `.global` website, states:

> “My withdrawal request of $33,491.50 submitted on April 17th is still 'pending' after months... they say 'please be patient' or that it's with compliance. This looks like a scam.”

This pattern suggests that even if a withdrawal is eventually processed, it can be a lengthy and stressful battle. For large amounts, the risk of non-payment appears to be significant.

Complaint 2: Account Closure

Another alarming pattern involves the random closure of trading accounts and the taking of profits, often under vague justifications. This is particularly dangerous for traders who become profitable.

A user reported this exact scenario:

> “They are a fraud company, they closed my account and confiscated my profit without giving any valid reason. They accused me of 'market abuse' but provided absolutely zero proof to support the claim.”

This indicates that the broker's terms and conditions might contain rules that allow them to take user funds under unclear reasons like “abusive trading strategies.” This creates a conflict of interest where a trader's success could put their money at risk from the broker itself.

Complaint 3: Misleading Bonuses

The use of “credit” or “non-depositable” bonuses is another harmful practice reported by users. These bonuses artificially increase a trader's margin, encouraging larger positions. However, they can be removed without warning, causing a sudden margin call and account liquidation.

One trader described losing a significant amount this way:

> “They give fake credit bonuses which will be removed in the middle of your trade and wipe out your entire funds... please stay away from them, I lost £1000 in a few minutes.”

This practice takes advantage of a trader's understanding of leverage and margin, using the bonus as a tool to speed up losses.

Complaint 4: Unresponsive Support

When financial issues arise, responsive customer support is essential. Our research, which included direct testing, found that Bull Waves' support did not live up to its claims. The advertised 24/7 live chat was not available during testing, and direct email inquiries to `support@bullwaves.com` went unanswered. For a trader trying to resolve a pending withdrawal or a closed account, this lack of communication is a massive problem, leaving them with no answers and no help.

Weighing the Good and Bad

To provide a complete picture, it's fair to acknowledge the benefits Bull Waves advertises. However, it's critical to weigh these “pros” against the significant underlying “cons” and real-world risks we have documented. The following table shows how the broker's weaknesses often undermine its advertised strengths.

| Advertised Pros | Underlying Cons & Real-World Risks |

| ✅ Diverse trading instruments (280+) | ⚠️ The ability to profit from these instruments is questionable if those profits are at risk due to documented withdrawal issues and potential profit confiscation. |

| ✅ Advanced MT5 Platform | ⚠️ A world-class platform is rendered ineffective if the broker controlling the account feed and processing withdrawals is untrustworthy. |

| ✅ Social & Copy Trading Features | ⚠️ Copying other traders on a high-risk platform simply exposes your capital to the same fundamental broker risks, such as withdrawal failure or arbitrary account closure. |

| ✅ Zero-Commission Accounts | ⚠️ Trading costs can still be high. The Classic account has wide spreads starting from 1.6-2.0 pips on major pairs, and a fast-triggering inactivity fee of $10 is charged after just 30 days. |

| ✅ Segregated Accounts & Negative Balance Protection | ⚠️ While these are standard features, their enforcement under a weak offshore regulator (Seychelles FSA) is far less reliable than with a top-tier regulator that conducts regular audits. |

This table highlights a critical lesson: attractive features can be misleading if the broker's basic trustworthiness is in question. Before putting in funds, cross-checking these claims against independent regulatory databases is essential. A quick search for Bull Waves on a verification platform like [WikiFX](https://www.wikifx.com/) can show if their license is still valid and if new user alerts have been posted.

Final Answer: Safe or Scam?

We return to the central question: Is Bull Waves safe or a scam? While applying the legal definition of a “scam” is complex, our analysis shows that Bull Waves has multiple, serious characteristics commonly associated with high-risk and untrustworthy operations. The evidence points to a dangerous combination of factors. The weak offshore regulation by the Seychelles FSA provides a minimal safety net for traders. The broker's very short operational history since 2023 means it has not proven its stability or reliability over time. Most importantly, the documented pattern of serious user complaints regarding fund withdrawals, profit taking, and unresponsive support creates a significant and real risk to your money.

Furthermore, the broker's own disclosure states that 75.2% of retail investor accounts lose money when trading CFDs with this provider. When this high industry-standard risk is combined with the additional broker-specific risks we have identified, it paints an exceptionally dangerous picture. Based on this comprehensive evidence, we categorize Bull Waves as a high-risk broker. The potential for financial loss is not limited to market movements but extends to broker-side issues. For traders who prioritize the safety and accessibility of their funds, we cannot recommend using Bull Waves. The documented risks associated with its regulation, short history, and user complaints far outweigh any of its advertised benefits. Far safer, well-established, and top-tier regulated alternatives are readily available.

The Safest Next Step

Protecting your money starts before you ever place a trade. The most powerful tool you have is independent research. This analysis of Bull Waves serves as an example of why this process is so important.

The golden rule of online trading is to never put money with a broker without first doing your own verification. A broker's website is a marketing tool; it will not advertise its own weaknesses or regulatory warnings. You must rely on independent sources that check public records and gather real user experiences.

Here is a simple process to follow for any broker:

1. Find the Regulator and License Number: Find this information on the broker's website. For Bull Waves, this was the Seychelles FSA, license number SD185.

2. Use a Comprehensive Verification Tool: This is the most critical step. An independent platform can instantly validate the license and show you information the broker doesn't want you to see.

The most efficient way to do this check is by using a dedicated broker verification platform. We strongly recommend using [WikiFX](https://www.wikifx.com/). Simply go to their site and search for 'Bull Waves' or any other broker you are considering. You will see their regulatory status, license details, user reviews, and any official warnings all in one place. This simple, free check is the single most important step you can take to protect your trading money from high-risk operations. Taking a few minutes to verify a broker can save you from months of stress and potential financial loss. Trade smart by choosing safe.

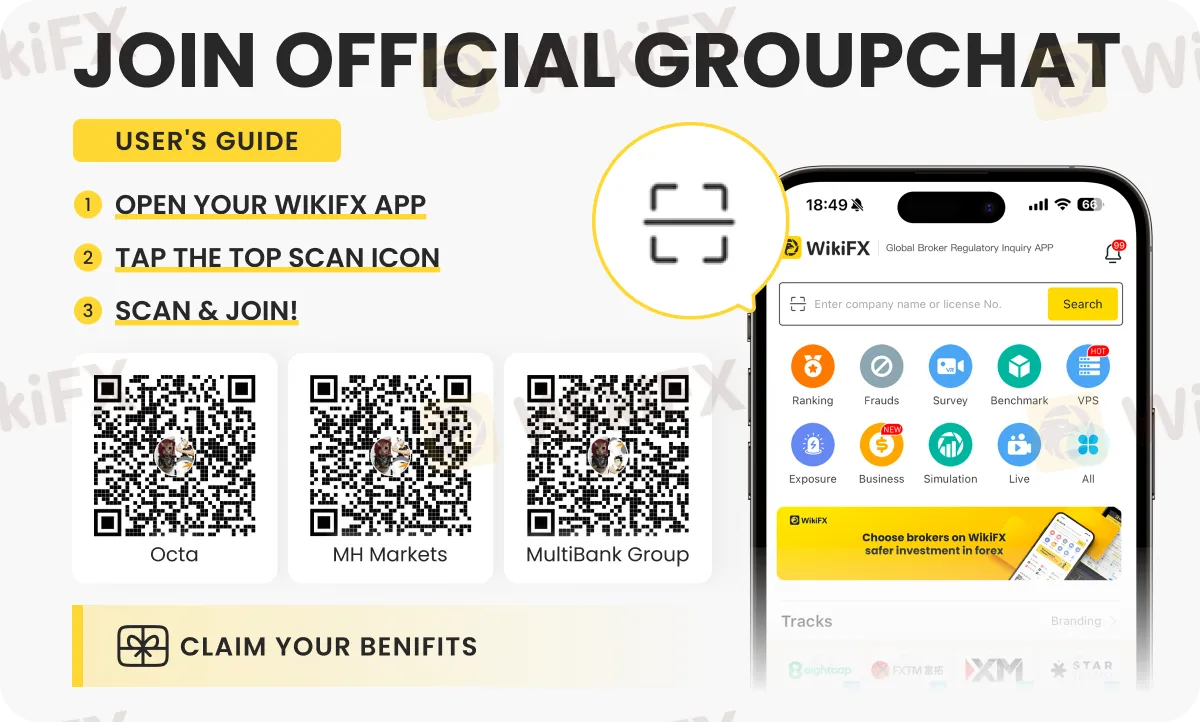

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

BitPania Review 2026: Is this Broker Safe?

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

What Causes Stagflation?

EU Says Trump's Tariff Workaround Violates Trade Deal

ALPEX TRADING Review 2025: Is This Forex Broker Safe?

VAHA Detailed Analysis

Currency Calculator