简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Classic Global Ltd Comprehensive Review (2025 Update): Read This Before You Invest

Abstract:Is Classic Global Ltd a safe and trustworthy broker for your investments? After our detailed 2025 investigation, the answer is clearly no. This platform is not a real brokerage company. It shows all the warning signs of a dangerous, unregulated financial operation that exists only to take investors' money. All evidence strongly suggests it is an advanced scam.

Urgent Safety Warning

Is Classic Global Ltd a safe and trustworthy broker for your investments? After our detailed 2025 investigation, the answer is clearly no. This platform is not a real brokerage company. It shows all the warning signs of a dangerous, unregulated financial operation that exists only to take investors' money. All evidence strongly suggests it is an advanced scam.

This complete review will break down the fake image of Classic Global Ltd step by step. We will examine its false claims about regulation, reveal the dishonest nature of its trading conditions and software, explain how its withdrawal system traps users, and look at real user experiences. Our goal is to give you the important information you need to protect your money. If Classic Global Ltd has contacted you or you are thinking about investing with them, you must read this article immediately.

What They Claim About Regulation vs. What's Actually True

The foundation of any trustworthy broker is proven regulation by a top-level financial authority. This is absolutely required. Unregulated brokers operate outside the law and offer no protection for your money. Classic Global Ltd uses common tricks to create a false sense of safety, which we will now reveal.

Claim: UK FCA Regulation

Classic Global Ltd often hints at or directly claims to be based in the United Kingdom, using the strong reputation of the UK's Financial Conduct Authority (FCA). They may show a UK Companies House registration for “CLASSIC GLOBAL LTD” (company number 13066363) as proof they are legitimate.

This is a major lie. Registering a company name in the UK is a simple, cheap paperwork process that can be done online for a few pounds. It provides zero financial oversight and is absolutely not the same as being authorized and regulated by the FCA. An FCA license is a difficult, expensive, and ongoing process that requires brokers to meet strict money requirements, keep client funds separate, and follow consumer protection rules.

Our check of the official FCA register confirms that Classic Global Ltd is not authorized to offer financial services in the UK. Operating without this license is illegal.

Claim: US NFA Membership

Another common trick used by Classic Global Ltd is to claim registration with the US National Futures Association (NFA). They show an NFA ID number to potential clients as proof they follow US regulations.

This is a deliberate misrepresentation of the facts. Our investigation shows that Classic Global Ltd holds a “Non-Member” status with the NFA. This is an important difference that scam operators hope you will miss. A “Non-Member” ID is just a tracking number used for companies that are not under NFA oversight; it gives no regulatory status and offers zero protection to investors. For a forex broker to legally operate in the US, it must be a registered “NFA Member.” Classic Global Ltd is not. This is not regulation; it is false advertising.

The WikiFX Verdict

Third-party checking platforms are valuable tools for cutting through these lies. The well-known broker verification service, WikiFX, gives Classic Global Ltd a terrible score of 1.14 out of 10. This score puts it firmly in the lowest-rated, highest-risk category.

The platform gives a direct and clear warning to all investors: “The platform has a short establishment time, its license is suspect, and it has been identified as a fake trader. There is currently no valid regulation, please stay away!”

Before you trust any broker with your money, take 30 seconds to check their license on a trusted platform like WikiFX. A simple search can save you from a potential scam.

For maximum clarity, here is a summary of the broker's regulatory status.

| Regulatory Body | Classic Global's Claim | Verified Status | Regulatory Level |

| UK FCA | Implied Regulation | *NOT AUTHORIZED* | *None (Illegal Operation)* |

| US NFA | “NFA Registered” | *NON-MEMBER* | *None (False Advertising)* |

| Canada FINTRAC | “MSB Registered” | MSB is for money services, not a forex license | *None (Misleading)* |

The claim of being registered with Canada's FINTRAC as a Money Services Business (MSB) is another misleading statement. This registration is for anti-money laundering purposes and is not a license to operate as a forex or CFD broker. It provides no investor protection whatsoever.

Trading Conditions and Software

The illusion of profitable trading is what drives the scam. Classic Global Ltd creates a trading environment designed not for your success, but to trick you into putting in more money. The entire system lacks transparency and has dangerous technical warning signs.

Dangerously High Leverage

The platform attracts traders with promises of high leverage, often ranging from 1:100 to as high as 1:500. For someone new to trading, this may sound like a great opportunity to increase profits. However, it is a double-edged sword that mainly increases risk.

Respected, top-level regulators understand this danger. Authorities in the UK, EU, and Australia limit leverage for regular clients at 1:30 for major forex pairs. The US limit is 1:50. When an unregulated broker like Classic Global Ltd offers leverage far beyond these limits, it is not a benefit—it is a clear signal that they are not concerned with protecting you from huge losses. In fact, their business model often depends on you losing your money quickly.

Manipulated Trading Software

The profits and losses you see on your screen when using Classic Global Ltd are likely not real. These platforms typically use one of two types of manipulated software to create a fake trading environment that they control completely.

One method is using a white-label, or “fake,” version of the popular MetaTrader 5 (MT5) platforms. They buy a basic version of the software but do not connect it to the live interbank market where real trading happens. Instead, they control the data feed and the server. This gives them backend access to change price charts (K-lines), create artificial slippage, and even decide the outcome of your trades to make sure you eventually lose. You might see a sudden, unexplainable price spike that destroys your position, an event that never happened on the real market.

The second method involves their own apps. Victims are often told to download an app through a direct link or QR code, avoiding the official Apple App Store or Google Play Store. These apps are “closed systems” or “internal disks.” The entire experience, from the account balance to the charts, is completely fake. The money you deposit is never actually used for trading; it goes directly into the scammers' pockets.

The software warning signs can be summarized as follows:

• *No connection to the live interbank market.*

• *Backend access for the broker to manipulate K-lines.*

• *Frequent “slippage” or “glitches” that always result in user losses.*

The Withdrawal Trap

The ultimate goal of the Classic Global Ltd operation is to get your money and never give it back. The deposit and withdrawal process is where the scam's final, brutal phase plays out, often following the “pig-butchering” scam model where trust is built over time before the “slaughter.”

Red Flag Deposit Methods

The first sign of trouble appears during the deposit process. A legitimate broker will always have you deposit funds into a separate corporate bank account held in the company's name.

Classic Global Ltd, however, frequently tells clients to send money to personal bank accounts or to transfer funds through cryptocurrency, most commonly USDT (Tether). This is a huge red flag. Using personal accounts or crypto allows them to bypass financial regulations, hide the money trail, and make the funds virtually untraceable and impossible to recover once sent. If a “broker” asks you to send money to an individual's account, you are dealing with a scam.

Real User Withdrawal Nightmares

The moment of truth arrives when a user tries to withdraw their funds, especially after seeing significant “profits” in their account. This is when the trap springs shut. The internet is full of horror stories from victims, which generally fall into a few predictable patterns.

*Case Study 1: The “Romance Scam” Funnel.* “I met someone on Instagram who seemed kind and successful. We talked for weeks, building what I thought was a real connection. They eventually introduced me to trading on Classic Global Ltd, calling it their secret to success. I started small, and they even let me withdraw $500 to prove it was real. Trusting them, I invested my life savings of $50,000. When I tried to withdraw my profits, they froze my account. A 'customer service' agent told me I had to pay a 20% 'personal income tax' in advance to release my funds. Desperate, I paid the tax. After that, my 'friend' and the customer service agent both disappeared. The website became inaccessible.”

*Case Study 2: The “Technical Glitch” Excuse.* “My account showed a profit of over $15,000. I submitted a withdrawal request for $10,000. The next day, the request was rejected, and the platform showed an error message. I contacted support, and they told me my account was under a 'risk control review' for 'abnormal trading activity.' They were vague and unhelpful. After a few days of back-and-forth, they stopped replying to my emails entirely. I can still log in and see my money, but I can't access it. It's a digital prison.”

The Endless Withdrawal Fees

If your account is frozen or your withdrawal is blocked, you will be contacted by a “customer service agent” who has a solution—for a price. This is the final squeeze, where the scammers try to get even more money from their victims by creating a series of fake fees. These include:

• *A 20% “Personal Income Tax” or “Capital Gains Tax”*

• *A “Risk Margin” or “Security Deposit” to prove the funds are legitimate*

• *An “Account Unfreezing Fee” to lift the risk control*

• *A “VIP Channel Fee” to speed up the withdrawal*

It is important to understand that these are all fake charges. They are lies designed to exploit your desperation. Paying these fees will not release your money. The scammers will either create another fee or simply disappear. The original investment and any additional fees paid are gone forever.

Facing withdrawal issues or being asked for strange fees? This is a classic scam tactic. Stop sending money immediately. You can cross-reference these tactics and check your broker's complaint history on verification sites like WikiFX.

Classic Global Ltd Pros and Cons Assessment

To provide a balanced view, we objectively analyze the pros and cons of using any brokerage. However, in the case of Classic Global Ltd, this exercise leads to a stark and telling conclusion.

The 'Pros'

After a thorough and objective review of Classic Global Ltd's operations, regulatory standing, and user feedback, we can identify zero legitimate advantages or “pros” to using this platform. Any perceived benefits, such as a user-friendly interface, high leverage, or initial small profits, are not genuine features. They are calculated elements of a deceptive strategy designed to lure you into a financial trap. The platform offers no value and no legitimate service.

The Cons: A Red Flag Checklist

The “cons” of Classic Global Ltd are not minor problems; they are a collection of critical failures that define it as a fraudulent entity. We have compiled these failures into a universal checklist that you can use to identify scam brokers in the future.

*The Ultimate Broker Red Flag Checklist:*

• [✓] *No Verifiable Regulation:* Claims regulation but is not listed on official regulator (FCA, ASIC, CySEC) websites.

• [✓] *Uses Misleading IDs:* Promotes an NFA “Non-Member” ID or a simple business registration as a license.

• [✓] *Guarantees High Profits:* Promises unrealistic, risk-free, or guaranteed returns.

• [✓] *Pressures You to Deposit More:* “Teachers,” “analysts,” or “friends” constantly push for larger investments.

• [✓] *Uses Personal Bank Accounts/Crypto for Deposits:* Avoids official corporate accounts and uses untraceable methods like USDT.

• [✓] *Blocks Withdrawals:* Your withdrawal request is endlessly delayed, ignored, or rejected for vague reasons.

• [✓] *Demands Extra Fees for Withdrawal:* Asks for a “tax,” “margin,” or “fee” before releasing your own funds.

• [✓] *Website/Contact Info is Unprofessional:* Lacks a physical address or real phone number, and often uses multiple, short-lived website URLs like `www.classicgloballtd.com` and `www.classic-global.io`.

Classic Global Ltd meets every single item on this list.

Conclusion and Final Verdict

After examining every aspect of Classic Global Ltd's operation, from its deceptive regulatory claims to its predatory withdrawal practices, the conclusion is clear and must be stated in the simplest possible terms.

Overall Evaluation: Scam

Classic Global Ltd is not a real broker. It is a fraudulent operation. It is a scam platform, expertly designed to steal your money under the appearance of a legitimate investment opportunity. The evidence is conclusive: the use of fake regulatory credentials, the manipulated trading software, the consistent pattern of blocking all significant withdrawals, and the endless user complaints all point to a criminal enterprise.

Our Professional Recommendation

Based on our findings, our professional advice is clear:

• DO NOT DEPOSIT ANY MONEY with Classic Global Ltd under any circumstances.

• If you have already deposited funds, DO NOT PAY ANY ADDITIONAL FEES. Do not send them money for “taxes,” “security deposits,” or “unfreezing fees.” This is a tactic to get more money from you, and it will not result in you getting your original investment back.

• Immediately stop all contact with anyone associated with the platform. Report the incident to your local law enforcement, your bank (to attempt a chargeback if possible), and your national cybercrime reporting agency.

The Golden Rule of Trading

The painful experience of victims of scams like Classic Global Ltd holds a powerful lesson for all investors. The single most important step you can take to protect yourself is also the simplest: NEVER invest with a broker without first checking their regulatory status with an independent source.

Make it a habit. Before you even create an account or provide any personal information, go to a trusted third-party verification service like WikiFX. Check their license, read real user reviews, and see their risk rating. This single step is your best defense against scams like Classic Global Ltd.

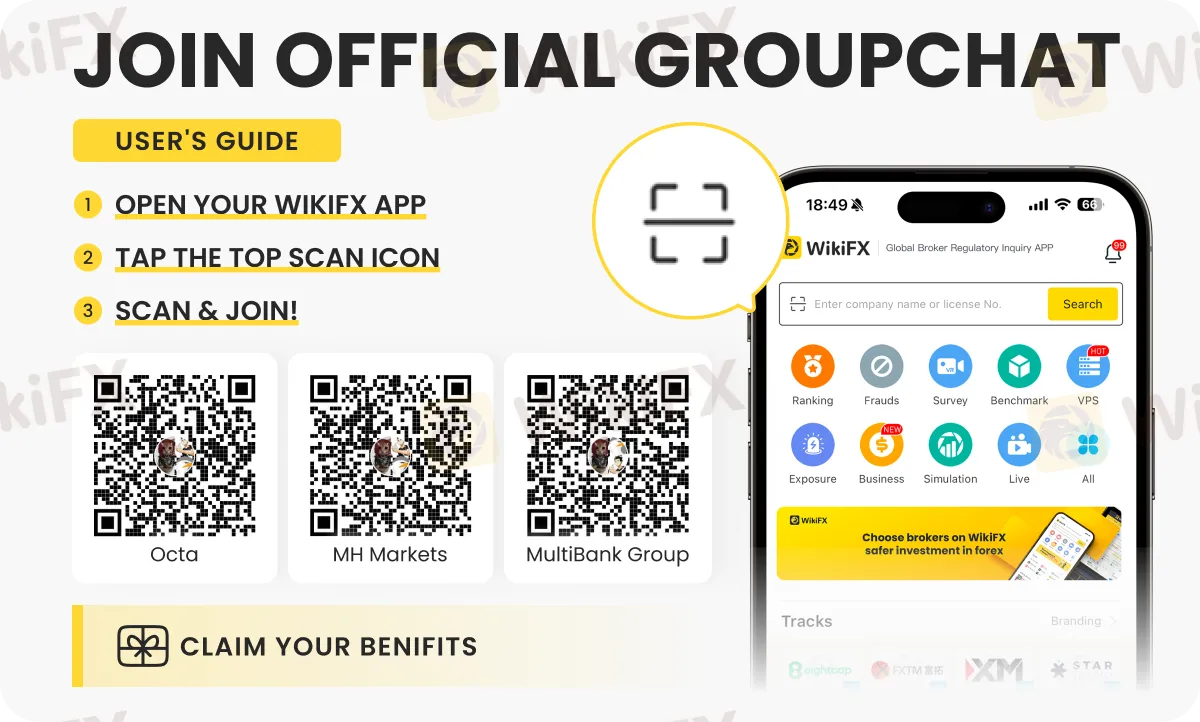

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

UPFOREX Review 2026: Is UPFOREX Safe or Scam? A Look at User Reviews and Warning Signs

The micro-documentary "Let Trust Be Seen" is officially launched today!

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Jane Street Under Fire: From India’s Market Ban to a $40 Billion Crypto Conspiracy

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

Currency Calculator