Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

Zeven Global presents itself as an online trading platform offering access to various financial instruments and account types. However, based on WikiFX verification results and publicly available information, the broker shows multiple risk indicators that investors should carefully consider before engaging with its services.

WikiFX data indicates that Zeven Global does not hold a valid forex regulatory license, which places its overall risk profile under close scrutiny from an investor-protection perspective.

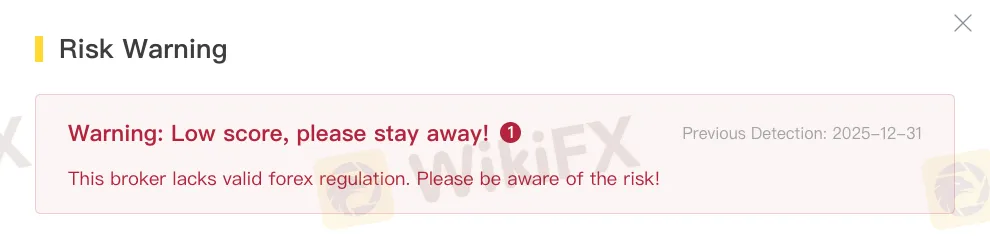

WikiFX has issued a risk warning for Zeven Global, citing its low safety score and lack of effective regulatory authorisation.

As of the latest update, Zeven Global has received a WikiFX Global Score of 1.92 out of 10, categorised as Danger. This assessment reflects weaknesses in key areas that are commonly used to evaluate broker reliability and operational safety.

Score Overview:

While certain business or technical features may appear functional, the absence of regulatory oversight significantly affects the platforms overall safety evaluation.

According to WikiFX records, there is no evidence that Zeven Global is authorised or supervised by any recognised financial regulator. Without regulatory oversight, the platform is not required to comply with standard safeguards such as client fund segregation, capital adequacy rules, or independent dispute-resolution mechanisms.

As a result, investors may face increased uncertainty if operational issues arise, including matters related to withdrawals, account handling, or transparency of services.

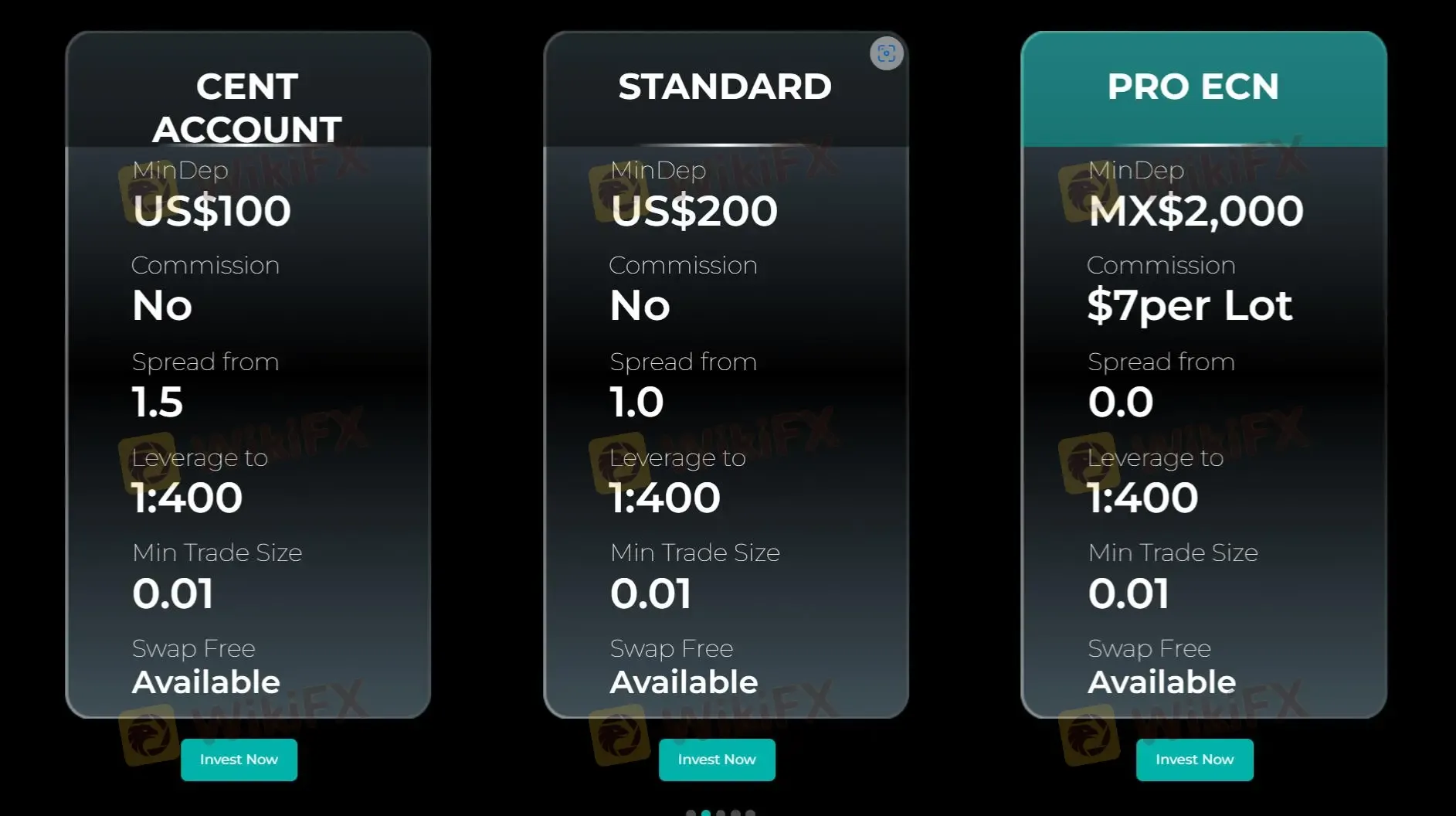

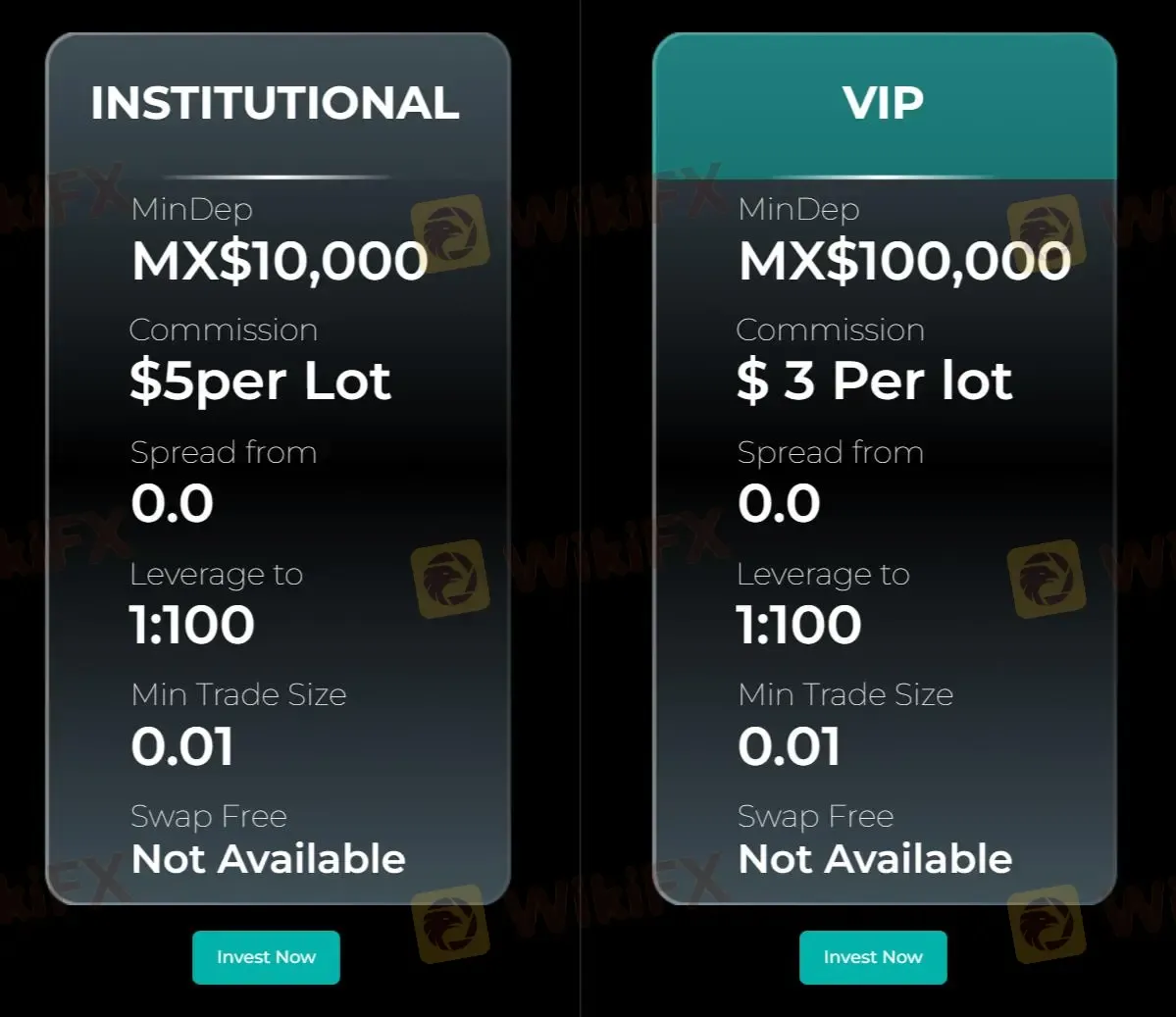

Zeven Global claims to offer trading access across several asset classes, including forex, indices, commodities, and cryptocurrencies. The platform promotes multiple account types—such as Cent, Standard, Pro ECN, Institutional, and VIP—each with different minimum deposit levels, spreads, and commission structures.

The broker also advertises the use of trading tools and software features intended to support market analysis and order execution. However, the availability of trading tools alone does not mitigate the risks associated with operating outside a regulated framework.

Available information suggests that Zeven Global supports several payment methods, including bank cards and electronic payment services. While multiple funding options may offer convenience, WikiFX notes that payment accessibility does not substitute for regulatory protection.

In the absence of oversight, there is no independent mechanism ensuring that client funds are handled in line with recognised investor-protection standards.

From a risk-control standpoint, the following factors remain relevant:

Taken together, these elements suggest that Zeven Global carries elevated operational and compliance risks when compared with regulated brokers.

WikiFX is a global forex broker information platform focused on regulatory verification, risk alerts, and data-based broker assessments. By consolidating official regulatory disclosures, on-site investigations, and structured scoring models, WikiFX helps investors better understand potential risks before choosing a trading platform.

Reviewing a brokers regulatory status and independent safety evaluation remains an important step in managing trading risk.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.