WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Gold reached its latest record high during quiet trade on Monday. The question for traders now is whether it can sustain momentum into the year end with depleting volumes.

Gold prices have moved back into the spotlight after breaking above the previous October high, a move that has caught the attention of many market watchers as the year draws to a close. Spot gold was the first to push past the record level on Monday, with futures following shortly after. There was no single headline or major event driving the breakout, but in this case, one may not have been necessary. Gold has been on a steady uptrend since its October low, and seasonal patterns, combined with thinner trading volumes heading into Christmas and year-end, have helped keep the bullish momentum intact.

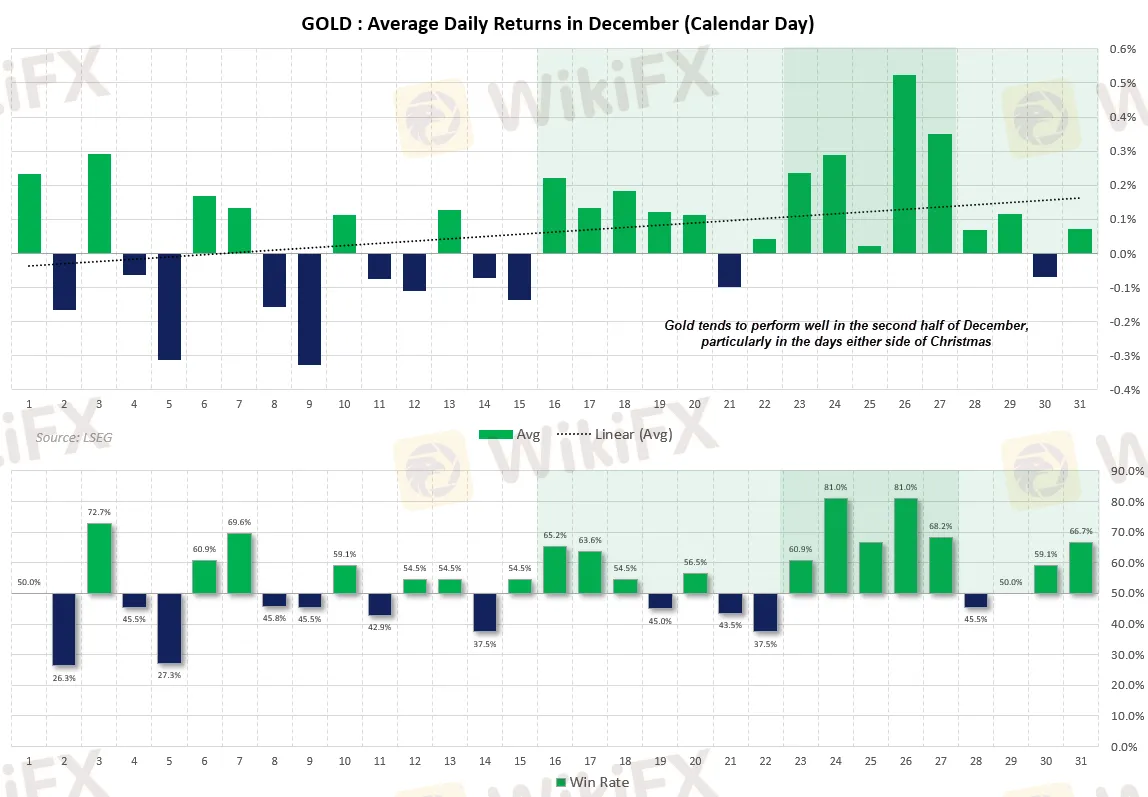

December has historically been a supportive month for gold, although the results are not always straightforward. Looking back over the past 50 years, gold has posted average and median gains of about 1.1% during the month, suggesting a generally positive bias. That said, the win rate sits at around 52%, which means gains are far from guaranteed every year. Still, when December is a winning month, the upside can be meaningful, with average returns close to 4.8%. In contrast, losing Decembers tend to see smaller declines, averaging around 2.9%. This uneven pattern reflects why traders often remain optimistic but cautious during this period.

With only about a week of real trading left before the year ends, some caution is still warranted. Gold has already climbed roughly 4.3% so far this December, and lower liquidity during the holiday period can sometimes lead to consolidation or short-term profit-taking. That said, there are no clear technical signs pointing to an immediate top. The 14-day RSI has only just moved into overbought territory, which is typical during a healthy uptrend rather than a warning signal on its own.

Seasonal trends also continue to favour the bulls. Historically, gold tends to perform well in the sessions around Christmas, with average daily returns leaning positive and win rates relatively high. This keeps the door open for another push higher before any end-of-year profit-taking comes into play. Looking beyond the holidays, the broader outlook for gold remains constructive, with any pullbacks likely to attract buyers looking to add on dips rather than exit the market altogether.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.