Abstract:RaiseFX Review reveals low WikiFX score, hidden withdrawal fees, and serious doubts about its trustworthiness.

Regulatory Standing of RaiseFX Broker

RaiseFX operates under the name Raise Global SA (Pty) Ltd, registered in South Africa. According to the attached regulatory file, the broker holds a license with the Financial Sector Conduct Authority (FSCA) under license number 50506, effective since October 6, 2020. However, its current status is marked as “Exceeded”, a designation that raises concerns about compliance and oversight.

The FSCA listing suggests that while RaiseFX Broker is technically regulated, its operational practices may have surpassed the boundaries of its license. This discrepancy is a red flag for traders who rely on regulatory bodies to ensure fair dealing and investor protection.

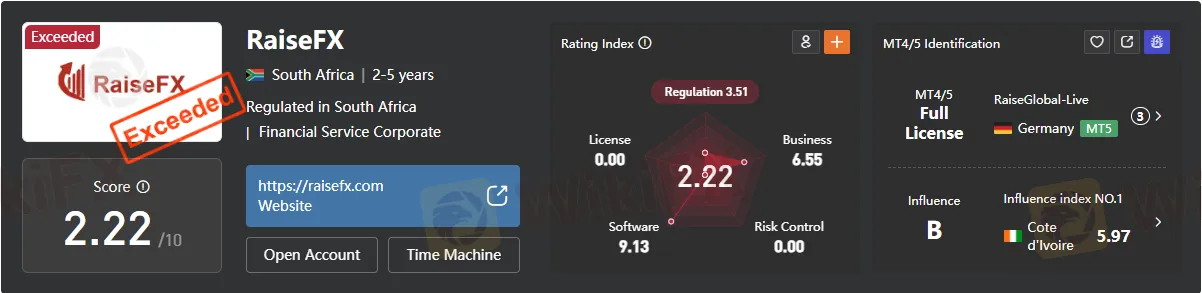

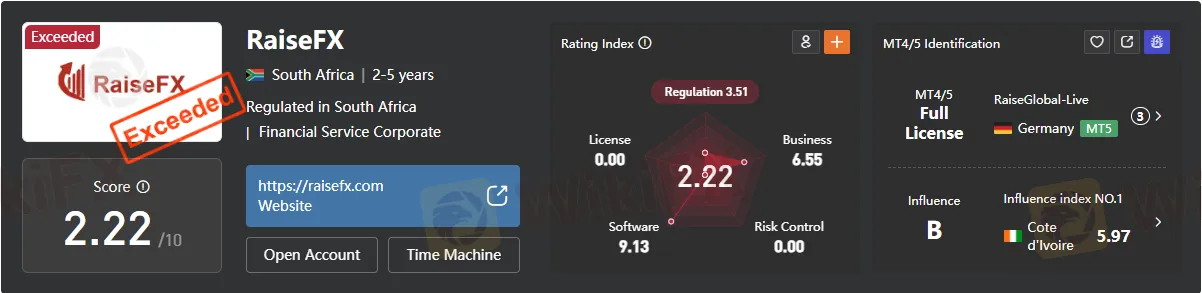

WikiFX Score and Credibility Issues

The brokers WikiFX score is alarmingly low at 2.22/10, placing it well below industry averages. Competitor brokers with similar FSCA oversight typically score between 6 and 8, reflecting stronger transparency and customer satisfaction.

The score breakdown highlights weaknesses in license validity (0.00) and risk control (Grade B), despite having a business index of 6.55. This imbalance suggests that while RaiseFX Broker has established infrastructure, its compliance and client protection measures remain questionable.

Trading Instruments and Platform Access

RaiseFX offers a wide range of instruments—over 500 assets across five categories:

- Forex: More than 60 currency pairs

- Commodities: Oil, metals, and agricultural contracts

- Stocks: Global equities including Amazon, Google, and Netflix

- Indices: Dow Jones, NASDAQ, DAX, CAC, and others

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and more than 80 crypto CFDs

The broker provides access through MetaTrader 5 (MT5) with a full license. Execution speed averages 232 ms, which is competitive compared to peers. However, the absence of MT4 servers limits flexibility for traders accustomed to the older platform.

Account Types and Accessibility

RaiseFX Broker offers:

- Real Accounts for live trading

- Demo Accounts for practice and education

- Islamic Accounts without swaps, catering to Muslim traders

This structure mirrors industry norms, but the brokers credibility issues overshadow these offerings. Competitors such as HotForex and Exness provide similar account types with stronger regulatory backing and higher trust scores.

Fees, Spreads, and Leverage

The broker advertises near-zero spreads on EUR/USD and zero commissions, with swaps as low as 0. However, the submitted case reports contradict this claim.

- Leverage: Ranges from 1:20 to 1:500, with maximum leverage available for forex and commodities.

- Spreads: EUR/USD spread recorded at 15 points, which is higher than the “approach 0” claim.

- Commissions: Listed at 0.24, despite promotional material suggesting zero fees.

This inconsistency between advertised and actual trading conditions undermines trust.

Reported Cases of Withdrawal Issues

User reviews reveal troubling withdrawal practices. One trader reported unexplained deductions:

- Withdrew $44 via TRC20, but received only $34. RaiseFX claimed it was an ERC20 network fee, despite proof of TRC20 usage.

- Another withdrawal of $178 resulted in $175 received, with inconsistent explanations from support.

These cases highlight hidden fees and poor customer service responses. Such practices are not typical of reputable brokers and suggest systemic issues in RaiseFXs operations.

Domain Registration and Transparency

The brokers domain raisefx.com was registered on September 16, 2019, with an expiration date set for September 16, 2029. The domain is protected under clientTransferProhibited status, hosted via Cloudflare servers.

While the long-term registration indicates commitment, the lack of transparency in licensed institution details (missing email, incomplete address, and placeholder phone numbers) raises further doubts about legitimacy.

Pros and Cons of RaiseFX Broker

Pros

- Wide range of tradable instruments (forex, stocks, crypto, indices, commodities)

- Full MT5 license with relatively fast execution speed

- Islamic account option available

- High leverage up to 1:500

Cons

- FSCA license marked as “Exceeded”

- Very low WikiFX score (2.22/10)

- Hidden withdrawal fees and unexplained deductions

- Inconsistent spread and commission claims

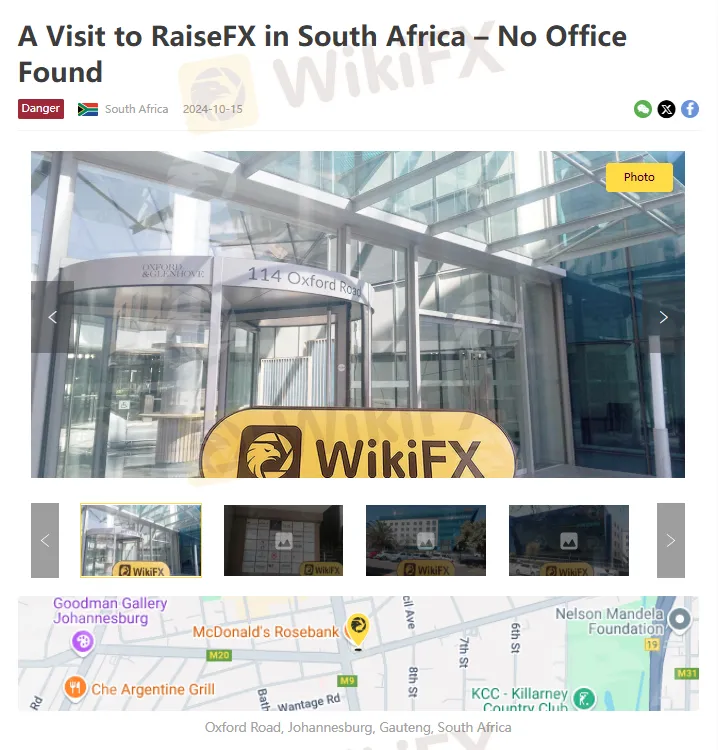

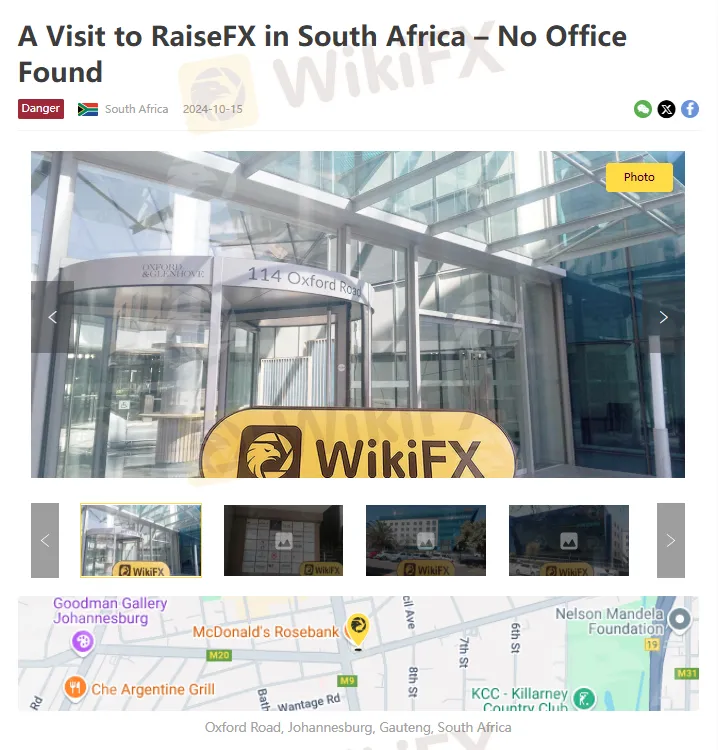

- No verified office found in South Africa during inspection

- Poor transparency in regulatory documentation

Comparison Against Competitors

Compared to HotForex and Exness, both regulated by multiple authorities and scoring above 7 on WikiFX, RaiseFX falls short in credibility. Competitors provide clearer fee structures, verified office locations, and stronger customer support. RaiseFX Brokers reliance on high leverage and promotional claims cannot compensate for its regulatory and trust deficits.

Bottom Line: Is RaiseFX Legit or Scam?

The evidence points to serious doubts about RaiseFXs trustworthiness. While the broker offers a broad selection of instruments and a licensed MT5 platform, its low WikiFX score, regulatory “Exceeded” status, and hidden withdrawal fees undermine its legitimacy.

Traders should approach RaiseFX Broker with caution. Competitor brokers with stronger regulatory standing and transparent practices present safer alternatives.

Final Verdict: RaiseFX Review concludes that the brokers operational inconsistencies and questionable regulatory compliance make it a high-risk choice for traders seeking reliability.