Abstract:EC Markets has announced the official opening of its new office in central Limassol, Cyprus, reinforcing the company’s global marketing capabilities and strengthening its presence in one of Europe’s key financial hubs.

EC Markets has announced the official opening of its new office in central Limassol, Cyprus, reinforcing the company‘s global marketing capabilities and strengthening its presence in one of Europe’s key financial hubs.

Situated in a prime area of the city, the newly launched office will serve as EC Markets‘ dedicated Marketing Hub, bringing together creative development, brand strategy, and cross-team collaboration. The move underscores the broker’s focus on innovation and brand growth as it continues to expand its global footprint.

The opening was marked by a ribbon-cutting ceremony and celebratory evening on December 11, attended by company representatives and local dignitaries, including Demos Katsis, Deputy Mayor of Limassol.

According to EC Markets, the strategic location allows the firm to stay closely connected to global markets while developing marketing campaigns and initiatives that reflect its evolving brand identity. The Limassol office has been purpose-built to support the companys marketing teams, providing a collaborative environment where ideas are developed, stories are crafted, and the EC Markets brand continues to grow.

Limassol has become a major center for FX and CFD firms in recent years, thanks to its strong financial services ecosystem, international talent pool, and proximity to European and global markets. EC Markets‘ investment in the city further highlights Cyprus’s role as a key hub for the online trading industry.

About EC Markets

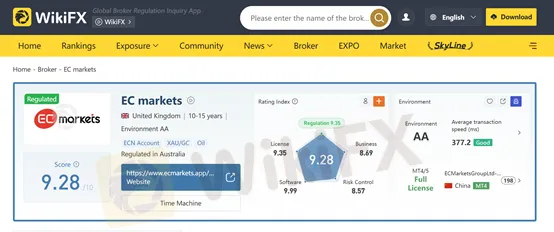

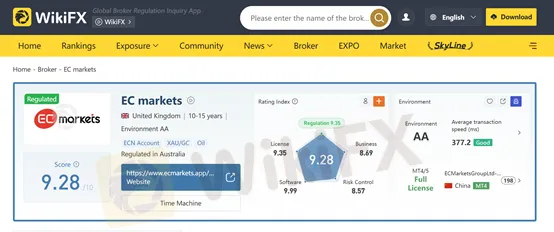

EC Markets, an Official Global Partner of Liverpool FC, operates through licensed subsidiaries in London (regulated by the UK Financial Conduct Authority), Australia (ASIC), South Africa (FSCA), and the United Arab Emirates (SCA). The group also maintains offshore entities in Seychelles and Mauritius.

The companys global operations are primarily managed from the UK, Cyprus, and Dubai, under the leadership of Group CEO Matt Smith, who is based in London.