Why Markets Pump When the News Dumps: The "Bad Is Good" Trap

The market is a game of psychology, not just economics. Trade what the chart is doing, not what the news anchor is saying.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Trading isn't about predicting the future; it's about waiting for the right odds.

Lets be honest. It feels personal, doesn't it?

You stare at the chart. Bitcoin or Gold is flying. Green candle after green candle. You watch it go up for an hour, sweating, thinking, “Im missing the move. Everyone is getting rich except me.”

So, you finally click BUY.

And exactly three seconds later, the market tanks. You are instantly in the red. You panic, you sell at a loss, and then—of course—the market shoots back up without you.

Ive coached thousands of traders, and this is the number one complaint I hear: “Coach, why do I always enter at the worst possible position?”

It‘s not bad luck. It’s not a conspiracy against you personally. It‘s psychology, and today we’re going to fix it.

The market is designed to manipulate your emotions. It exploits two things: your greed and your fear.

When a price is moving vertically, your brain screams FOMO (Fear Of Missing Out). You see momentum. You see “easy money.” But here is the hard truth I tell all my students:

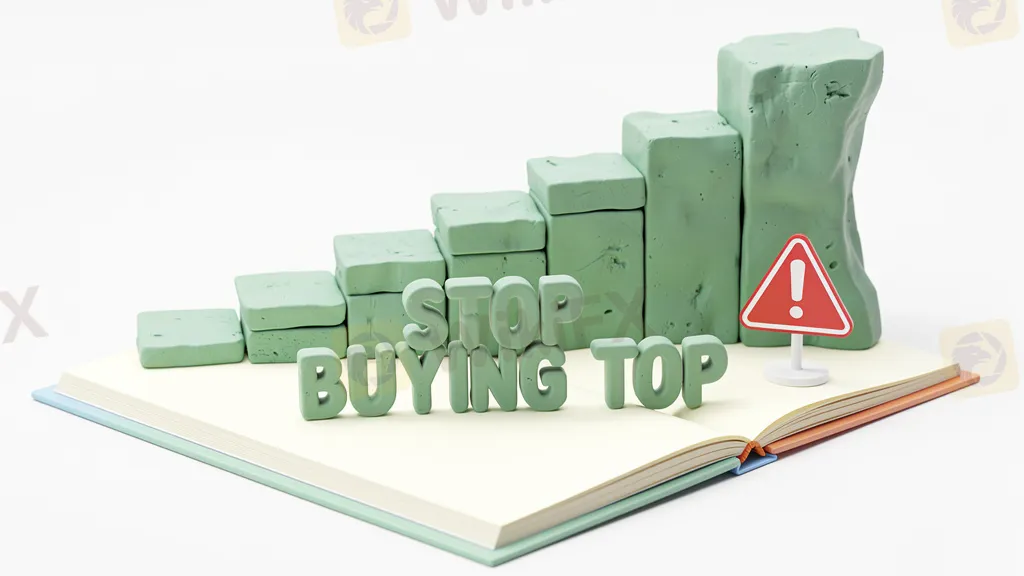

If it feels comfortable to buy, you are probably too late.

When the chart looks the safest—because it has been going up for hours—is exactly when the “Smart Money” (banks, institutions) is selling. They need someone to buy their heavy bags so they can take profits. That someone is you.

You are entering at the exact moment the exhausted buyers are leaving. You are providing their “exit liquidity.”

It usually comes down to one fatal error: Chasing the Bus.

Imagine you are at a bus stop. If the bus is already 50 meters down the road, speeding away, do you sprint after it? No. Youll just get tired and look foolish. You wait for the next bus.

Trading is the same.

Novice traders buy the pump. Professionals buy the pullback. If you missed the initial explosion, chasing it is financial suicide. You must wait for the price to cool off, retrace, and test a support level. If it never comes back? Let it go. There is always another trade tomorrow.

Sometimes, your timing isn't actually that bad, but your execution gets wrecked. This is a subtle trap many new traders don't realize until it's too late.

You might see a good price, click buy, but your trade fills at a much worse price. We call this “slippage,” or in worse cases, broker manipulation.

I‘ve seen volatile markets where shady brokers widen their spreads so much that you are instantly 20 pips in the hole the moment you open a trade. It’s impossible to win when you start that far behind.

This is why I constantly tell my community to do their homework. Before you trust a platform with your hard-earned deposit, look them up on WikiFX. You need to know if they have a history of slippage complaints or regulatory warnings. If a broker is playing games with your entry price, no amount of strategy can save you. Check their score on WikiFX first; don't let a scam broker steal your edge.

You want to stop being the guy who buys the top? Follow these three rules starting right now.

If a candle is currently gigantic and green, sit on your hands. Literally. Do not touch your phone. Never buy a vertical line. Wait for the candle to close and for the next few candles to show a slight drop (a “red” retracement).

It feels scary to buy when the chart is dropping (red candles). It goes against your survival instincts. But buying into support during a dip is how you get a good price. You want to buy wholesale, not retail.

You might be looking at a 5-minute chart thinking, “Wow, huge uptrend!” But if you zoom out to the 4-hour chart, you might see the price is hitting a massive resistance wall. Always check the “big picture” before you zoom in to pull the trigger.

Trading isn't about predicting the future; it's about waiting for the right odds.

When you chase a trade because youre afraid of missing out, you are gambling. When you wait for the price to come to your level, you are trading.

Stop trying to catch every move. The market is like a river—it flows endlessly. You don't need to drink the whole river; you just need one cup. Be patient, protect your capital, and stop donating your money to the institutions.

Disclaimer: The information provided here is for educational purposes only and does not constitute financial advice. Trading involves significant risk, and you can lose your invested capital. Always do your own research.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

The market is a game of psychology, not just economics. Trade what the chart is doing, not what the news anchor is saying.

I see it every single day. A student sends me a screenshot of their trading setup, asking why they got stopped out.

You’ve probably seen the screenshots on social media. Someone turns $500 into $5,000 in a single morning, and suddenly everyone wants to be a trader. But here is the cold reality: trading isn’t a single game. It’s a collection of different battlefields, and if you bring a knife to a gunfight, you’re going to lose your capital.

You’ve been there. You are staring at the EUR/USD chart. Your technical analysis is perfect. Support is holding, the RSI looks good, and you are 20 pips in profit.