Abstract:An in-depth review of SparkFX (Score 1.82) investigating claims of a Dubai license, expansion into Arabic markets, and reports of unfair account bans.

Targeting the Arab World Through Aggressive Marketing

In recent months, SparkFX (operating via spkfx.com) has aggressively ramped up its promotional activities, with a noticeable strategic pivot toward Arabic-speaking regions. A review of their social media presence, particularly on Facebook and Telegram, reveals a steady stream of Arabic content designed to attract investors from the Middle East.

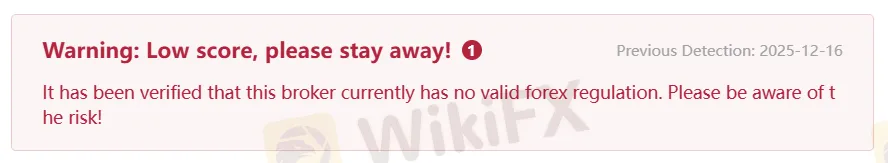

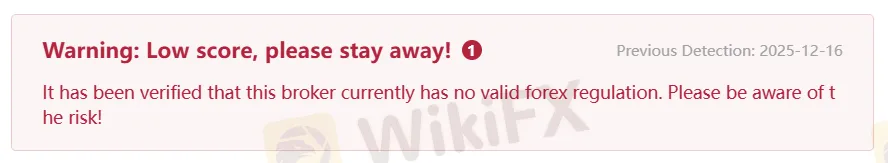

However, a significant disconnect exists between this polished marketing façade and the broker's fundamental safety metrics. According to the latest assessment by WikiFX, SparkFX holds a comprehensive score of just 1.82 out of 10. This rating places it firmly in the “Danger” category, signaling that the platform lacks the robust compliance infrastructure required to ensure the safety of client funds.

The Reality Behind the Dubai License Claims

One of the primary selling points for brokers targeting the MENA region is local licensure, which usually offers traders a layer of security and legal recourse. Reports suggest that SparkFX has been positioning itself as a licensed entity in Dubai to gain credibility with its new audience.

Verification efforts paint a concerning picture. There are no public records linking SparkFX to a valid license from the Dubai Financial Services Authority (DFSA) or other reputable UAE regulatory bodies. WikiFX data reinforces this by showing a score of 0.00 for both the Regulation and License indices. The system has issued a specific warning stating that the broker currently has “no valid forex regulation,” suggesting that any claims of Dubai licensure are unsubstantiated and effectively leave investors without legal protection.

Account Suspensions Caused by Multiple Device Usage

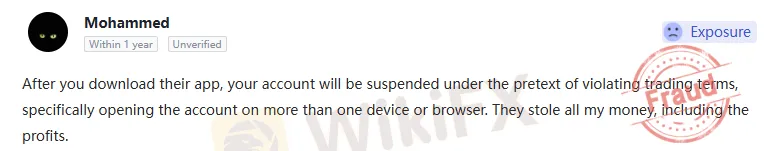

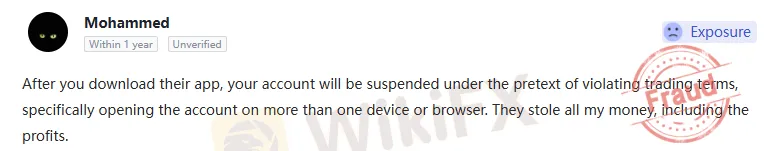

Beyond the regulatory vacuum, the practical experience of traders on the platform raises serious questions about operational fairness. A particularly troubling complaint comes from a user named Mohammed, whose experience highlights how restrictive terms can be used to freeze capital.

Mohammed reported that his trading account was suspended shortly after he downloaded the broker's app. When he sought an explanation, SparkFX support cited a violation of trading terms, specifically accusing him of “opening the account on more than one device or browser.” In the modern financial landscape, accessing a trading account via both a smartphone and a laptop is a standard practice for nearly every trader. Using such a common workflow as a justification to suspend an account—and seize both the principal and profits—indicates a trading environment where the odds may be stacked against the client.

Final Verdict and Safety Recommendations

The evidence surrounding SparkFX paints a clear picture of a high-risk entity. The combination of a low safety score, lack of verifiable regulation, and documented instances of unfair account closures suggests significant danger for retail investors.

Traders are strongly advised to approach this platform with extreme caution. The risk of capital loss due to regulatory loopholes or arbitrary policy enforcement is high. The safest course of action is to choose brokers that hold verified licenses from recognized Tier-1 authorities to ensure your funds are protected by law.