简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Afrimarkets Stripped of License: FSCA Cracks Down on South African Broker Amid Misconduct Scandal

Abstract:South Africa's FSCA has permanently revoked Afrimarkets' license following investigations into misappropriated funds and unrealistic promises. WikiFX flags the broker as "Danger" with a 1.41 score.

The Hammer Falls: FSCA Revokes Afrimarkets' License

The regulatory noose has tightened around the South African online trading sector, culminating in a decisive blow against Afrimarkets Capital (Pty) Ltd (FSP 52813). Following an extensive investigation into alleged misconduct, the Financial Sector Conduct Authority (FSCA) has officially and permanently stripped the broker of its financial services provider license.

This final ruling marks the end of a turbulent saga that began on July 4, 2025, when the regulator first provisionally suspended the broker's operations. What started as a temporary measure to protect the public has now evolved into a permanent ban, confirming the regulator's worst fears regarding the company's business practices.

WikiFX Analysis: A “Danger” Signal

The regulatory collapse of Afrimarkets is reflected in its catastrophic standing on independent review platforms. According to the latest data from WikiFX (as of December 16, 2025), Afrimarkets holds a dismal score of 1.41 out of 10.

The broker's profile is a sea of red flags: it scores 0.00 in Regulation, 0.00 in License, and 0.00 in Risk Control. This quantitative data supports the FSCA's qualitative findings—that the broker is operating without the necessary compliance framework to protect client assets.

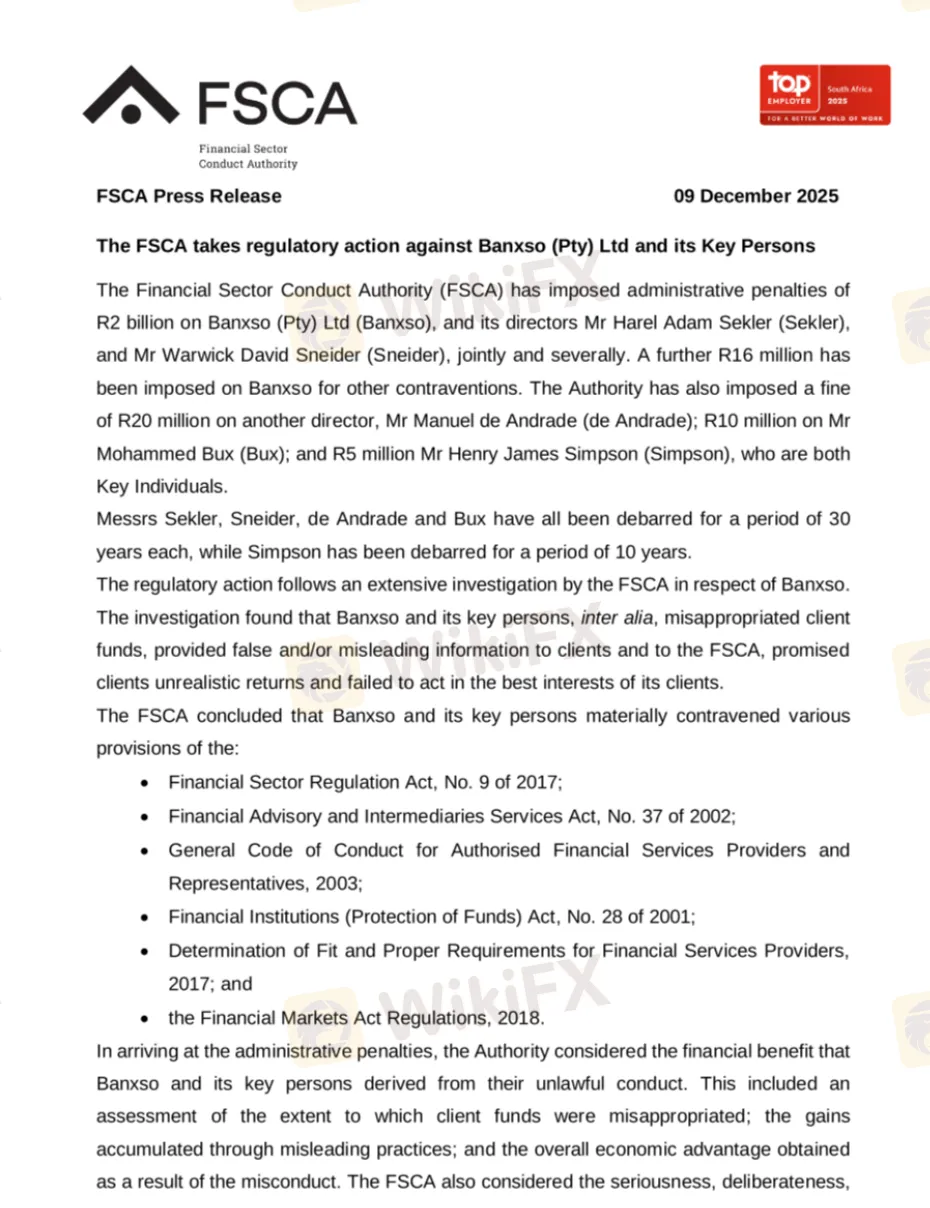

Misconduct and the Banxso Connection

The FSCAs investigation revealed that Afrimarkets misappropriated client funds, provided unauthorized advice, and lured investors with promises of “unrealistic returns.” Crucially, the regulator highlighted a direct link between Afrimarkets and Banxso (Pty) Ltd, citing shared directors and nearly identical business models.

Just like its affiliate, Banxso has faced the full wrath of the regulator. In a parallel enforcement action, the FSCA imposed a staggering R2 billion administrative penalty on Banxso and debarred its key directors—including Harel Adam Sekler and Warwick David Sneider—for a period of 30 years.

Operational Collapse and Failed Defenses

For Afrimarkets clients, the regulatory order had immediate, tangible consequences. Bank accounts were frozen without warning, rendering deposits and withdrawals impossible. While the company initially attempted to downplay the suspension as merely “part of a regulatory process” and denied any wrongdoing, these defenses collapsed when the provisional ban was made permanent. Traders were left stranded, forced to manually manage their own positions amidst the operational paralysis.

Final Verdict

The permanent revocation of Afrimarkets' license, coupled with the massive fines levied against its partner Banxso, sends an undeniable message. With a WikiFX score of 1.41 and a confirmed regulatory ban, this entity poses an extreme risk to capital. Investors are urged to avoid this network entirely and prioritize brokers with verified, clean regulatory records.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Currency Calculator