简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FPG EURUSD Market Report December 16, 2025

Abstract:On the EURUSD H1 chart, the pair is currently entering a sideways consolidation phase, highlighted by the green zone. This consolidation follows a previously strong and impulsive bullish rally shown i

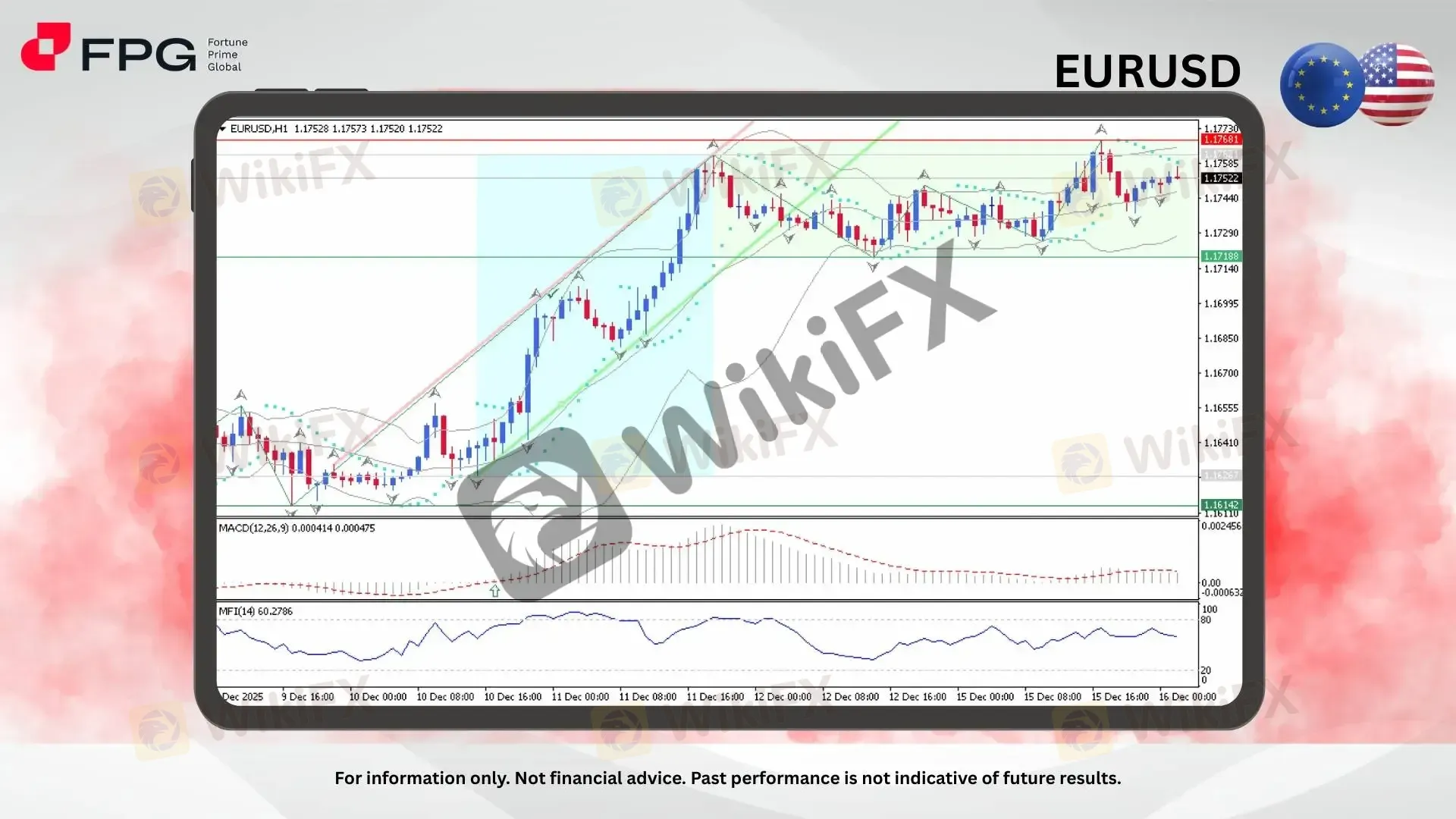

On the EURUSD H1 chart, the pair is currently entering a sideways consolidation phase, highlighted by the green zone. This consolidation follows a previously strong and impulsive bullish rally shown in the blue zone, where price surged aggressively from 1.1627 to 1.1762. After reaching that peak, bullish momentum began to cool, and EURUSD started oscillating within a relatively flat channel structure. The current price is trading around 1.1752, suggesting the market is digesting prior gains while awaiting fresh directional catalysts.

Price is currently trading near the upper Bollinger Band but no longer expanding, indicating volatility compression after the bullish impulse. Parabolic SAR has started to cluster closer to price, reflecting a transition from trending conditions into consolidation. MACD (12,26,9) remains above the zero line, confirming the broader bullish bias, but histogram bars are flattening, signaling slowing momentum rather than continuation. Money Flow Index (14) is holding around 60, showing neutral-to-moderate buying pressure without overbought conditions, reinforcing the idea of balance between buyers and sellers during this sideways phase.

The current sideways movement likely reflects a temporary equilibrium between bullish and bearish forces after the strong rally. From a fundamental perspective, this condition can also be interpreted as a waiting zone, where market participants pause before committing to more aggressive positions. Historically, such consolidation phases often precede sharp directional moves, especially around high-impact economic releases. Traders should remain alert and closely monitor todays key economic events for potential volatility expansion.

Market Observation & Strategy Advice

1. Current Position: EURUSD is currently trading around 1.1752, moving sideways within a narrow range after a strong bullish run, indicating short-term indecision.

2. Resistance Zone: Key resistance is located near 1.1768 – 1.1773, which represents a supply zone where previous bullish attempts were rejected. A clean breakout above this zone could revive bullish continuation.

3. Support Zone: Immediate support is seen around 1.1719 – 1.1720, aligning with the lower boundary of the consolidation range.

4. Indicators: MACD remains positive but flat, MFI stays in neutral territory, and Parabolic SAR reflects consolidation — all confirming a non-trending, range-bound condition.

5. Trading Strategy Suggestions:

Range trading setup: Buy near 1.1720 and sell near 1.1768 while price remains within consolidation, using tight risk management.

Bullish breakout strategy: Buy on a confirmed H1 breakout above 1.1773, targeting 1.1810 – 1.1850.

Risk management: Reduce position size ahead of major economic releases due to potential volatility spikes.

Market Performance:

Forex Last Price % Change

USD/JPY 155.06 −0.09%

GBP/USD 1.3371 +0.01%

Today's Key Economic Calendar:

AU: Westpac Consumer Confidence Change

UK: Unemployment Rate

DE: HCOB Manufacturing PMI Flash

UK: S&P Global Manufacturing & Services PMI Flash

EU: Balance of Trade

DE: ZEW Economic Sentiment Index

US: Building Permits Prel

US: Housing Starts

US: Non Farm Payrolls

US: Retail Sales MoM

US: Unemployment Rate

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Kudotrade Review: Safety, Regulation & Forex Trading Details

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Toyar Carson Limited Review: A Detailed Look at a Risky Broker

Warning: VexPro Withdrawal Complaints

USD Resilience: Strong Data Cushions Political Volatility as Trump Targets Fed

FXPN Review 2026: Is This Forex Broker Safe?

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Italy’s Financial Regulator Expands Crackdown on Unauthorised Investment Websites

Currency Calculator