Abstract:Selecting a regulated broker is the first and most crucial step for any trader seeking financial security. Regulation creates rules for accountability, protects clients’ capital, and resolves disputes. Classic Global Ltd is an online forex and CFD broker that makes certain claims about following rules and being registered. However, these claims need careful and independent checking. This article examines the company's registration, its claimed regulatory oversight, and what independent reviews and user experiences show.

Taking an active approach to research is essential in today's market. A simple Classic Global Ltd license check can be the difference between a safe trading experience and losing a lot of capital. This investigation aims to provide the clarity needed to make a smart decision.

Selecting a regulated broker is the first and most crucial step for any trader seeking financial security. Regulation creates rules for accountability, protects clients capital, and resolves disputes. Classic Global Ltd is an online forex and CFD broker that makes certain claims about following rules and being registered. However, these claims need careful and independent checking. This article examines the company's registration, its claimed regulatory oversight, and what independent reviews and user experiences show.

Taking an active approach to research is essential in today's market. A simple Classic Global Ltd license check can be the difference between a safe trading experience and losing a lot of capital. This investigation aims to provide the clarity needed to make a smart decision.

What This Investigation Covers

· Classic Global Ltd's official registration and regulatory claims.

· Checking these claims against official regulator databases.

· Analysis of warning signs and inconsistencies.

· A summary of third-party reviews and user-reported problems.

Breaking Down Regulatory Claims

We will now carefully examine the broker's registration and regulatory statements, comparing them directly with facts we can verify. Understanding the difference between a simple business registration and a real financial license is very important.

Claim 1: Saint Lucia Registration

Classic Global Ltd is actually registered as an International Business Company (IBC) in Saint Lucia. Public records from the Saint Lucia International Business and International Trust Registry (IFC) confirm this. The company's registration number is 2025-00608, with an official start date of August 20, 2025.

However, it is important to understand what this means. An IBC registration is a business formation certificate. It confirms the company legally exists in that location. It does not equal a financial services license. It does not give the company permission to offer forex or CFD trading, and it does not mean any oversight or regulation of these activities by a financial authority. This difference is a common confusion that untrustworthy companies often take advantage of.

Claim 2: FSRA “Compliance”

The broker's website vaguely mentions “regulatory compliance,” and third-party sources report that the company claims to be regulated by the Financial Services Regulatory Authority (FSRA) of Saint Lucia. This is a specific claim we can test.

Our checking process involved looking at the official public registry of the FSRA. The result is clear: there is no company named Classic Global Ltd listed as being licensed or authorized by the FSRA. Furthermore, it's important to note that Saint Lucia's regulatory system does not currently have specific rules for online forex trading activities. Therefore, the claim of being regulated by the FSRA for forex trading appears to be false and misleading.

Results from Independent Reviews

A consensus from multiple independent review organizations paints a clear picture of the broker's status. The findings consistently highlight the lack of real regulation as a main concern.

· TraderKnows:

· Assigns a “Suspected Fraud” status to the broker.

· Lists its license as “Unregulated and suspected of illegal operation.”

· Provides a score of just 1.15 out of 10.

· BrokersView / FastBull:

· In a direct response to an investor question, the platform concluded that Classic Global Ltd is an “untrustworthy platform.”

· It clearly states the broker “operates without authorization from any recognized financial regulatory body.”

· WikiFX:

· The platform's assessment shows a status of “No Regulation.”

· It attaches several risk tags, including “Suspicious Regulatory License” and “High potential risk.”

This consistent pattern of negative assessments from separate, expert sources is a major warning. For a complete and continuously updated view of these risk alerts, traders can find a detailed profile for Classic Global Ltd on the WikiFX platform.

Warning Signs in Operations

Beyond the main issue of regulation, a closer look at the company's corporate profile shows several other inconsistencies and warning signs. These operational red flags further damage the broker's credibility and indicate a high-risk environment for clients.

Warning Sign 1: Different Addresses

The company lists two different addresses, a common tactic among unregulated companies to hide their true operational base and make legal accountability more difficult.

The registered address is in an offshore location known for its light corporate services, while the stated operational and contact address is in Georgia. This separation makes it difficult for clients to determine where the business is actually managed and which country's laws would apply in a dispute, creating a major obstacle for any potential legal action.

Warning Sign 2: Impossible Timelines

One of the most obvious warning signs is the series of illogical and impossible dates associated with the company's formation.

· Founded: The broker's own materials claim it was “founded in 2025.”

· Incorporated: Official records show a start date of August 20, 2025.

· Domain Registered: The website domain, `classicglobal.io`, was registered on August 18, 2025.

These future dates are a serious credibility problem. A real company cannot be founded or registered in the future. That the company's entire corporate history—from domain registration to official incorporation—is scheduled to happen later in the current year suggests either a major, systematic error or an intentional attempt to create a fake corporate history. No established, trustworthy financial institution operates with such basic inconsistencies.

Warning Sign 3: Lack of Transparency

A characteristic of a reliable broker is clear, upfront disclosure of all trading conditions and costs. Classic Global Ltd fails this test. Key information essential for traders to make informed decisions is either missing or hard to find.

Examples of non-transparent information include:

· Specific details on spreads, commissions, and available leverage for their Standard, ECN, and VIP account types.

· Clear terms and conditions governing deposits and, most importantly, withdrawals.

· Information on potential fees for transactions or account inactivity, and the expected processing times for funding and withdrawals.

This lack of transparency prevents traders from accurately calculating potential costs and understanding the rules that govern their own funds. It is a common characteristic of operators who wish to keep discretionary control over client accounts and funds.

What Users are Saying

Theoretical risks become real when viewed through actual user experiences. Public complaints and formal allegations against Classic Global Ltd provide a serious look at the potential consequences of working with this broker.

Reports of Blocked Funds

Public complaint platforms, such as Şikayetvar in Turkey, contain detailed reports from individuals who have dealt with Classic Global Ltd. A recurring theme in these complaints is the sudden inability to access funds.

One user reported having a balance of approximately $55,000 in their account. Starting from November 21, 2025, the user was unable to log in, with the platform citing reasons like “leverage changes.” Another user with a balance over $7,000 reported a similar experience of being locked out. The common outcome in these reports is a complete breakdown of communication with the platform and the total inability to withdraw their capital. These are not minor trading disputes; they are allegations of complete fund seizure.

Formal Allegations of Fraud

The situation goes beyond individual complaints. The Turkish law firm Savun Hukuk Danışmanlık published an article titled “Classic Global LTD Forex Dolandırıcılığı,” which translates to “Classic Global LTD Forex Fraud.” The article is not just a warning but a direct accusation based on cases they are handling.

The law firm outlines a systematic pattern of behavior, which they describe as an “organized fraudulent operation.” The key accusations include:

· Using false promises of high returns and a secure platform to attract investors.

· Systematically creating obstacles and excuses to block client withdrawal requests.

· Interfering directly with client accounts to generate losses, and then blaming the user for the negative outcome.

When a law firm publicly accuses a broker of being an “organized fraudulent operation,” it represents one of the most serious accusations possible. Traders concerned about these issues can often find detailed summaries of such user complaints and legal warnings by looking up the Classic Global Ltd page on WikiFX.

Conclusion: A Clear Result

Our investigation into the Classic Global Ltd regulation status and overall trustworthiness has produced a clear and consistent set of findings. By putting together the company's own claims, checking them against official records, and analyzing operational data and user experiences, a high-risk profile emerges.

Summary of Findings

· Regulation: Classic Global Ltd is not verifiably regulated by any recognized financial authority. Its claim of FSRA oversight is not supported by the regulator's own public records. The company's IBC registration in Saint Lucia offers no investor protection.

· Credibility: The broker's profile is seriously damaged by major operational warning signs. These include using conflicting addresses in different countries and, most critically, a set of impossible future dates for its founding, incorporation, and domain registration.

· User Experience: The public record is marked by serious complaints from users who report being unable to access or withdraw their funds. These are made worse by formal, public allegations of “organized fraud” from a legal entity representing affected clients.

Final Recommendation for Traders

Given the complete absence of verifiable regulation, the wealth of evidence pointing to deceptive practices, and the serious nature of user complaints, we strongly advise traders to exercise extreme caution with Classic Global Ltd. The pattern of behavior is inconsistent with that of a trustworthy and reliable brokerage.

The process of performing a careful Classic Global Ltd license check reveals a story of high risk from start to finish. Before committing funds to a broker, a final review of its complete risk profile, including any new user feedback, is a crucial safety measure. Smart investors can do this to get the most up-to-date information.

*Disclaimer: The information presented in this article is based on publicly available data at the time of writing and is intended for informational purposes only. Financial markets involve significant risks, and traders should always conduct their own thorough and independent research before making investment decisions.*

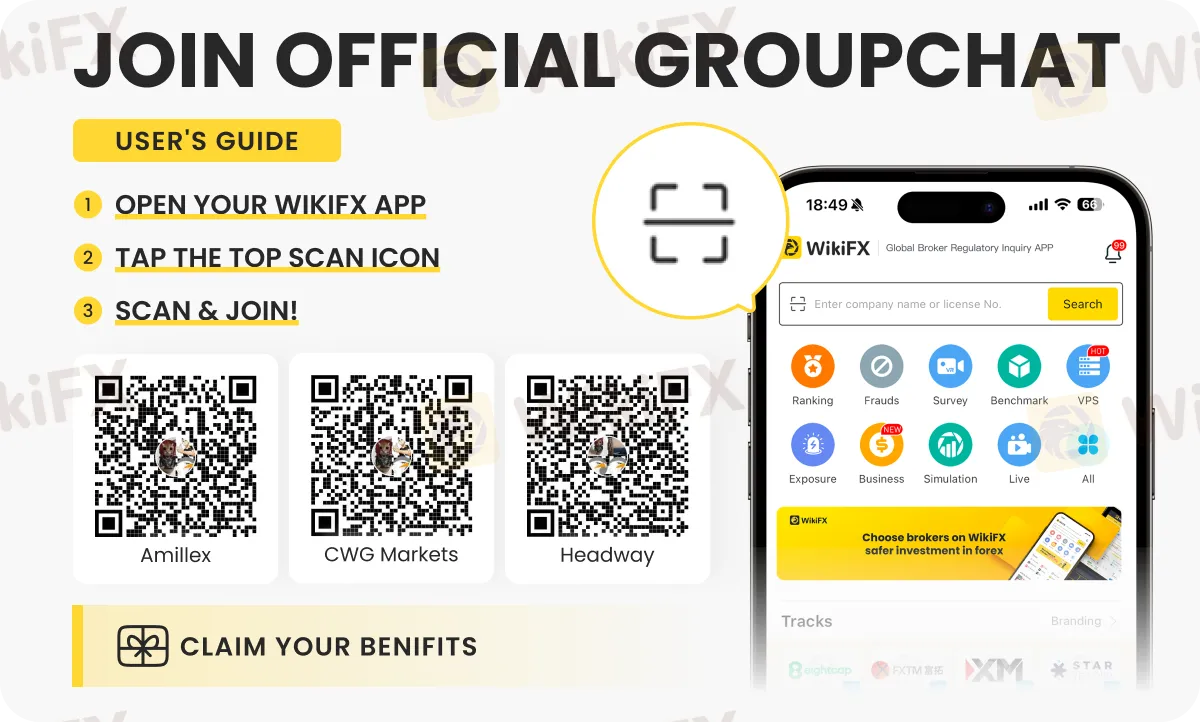

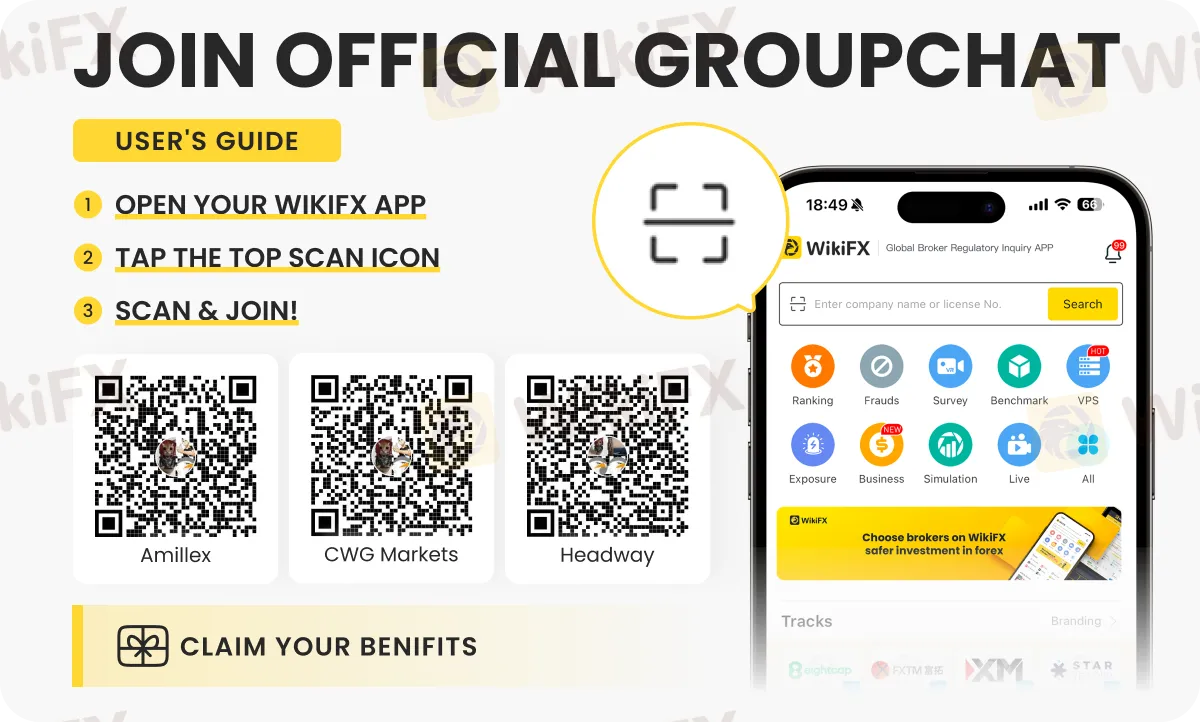

Want to know the latest trends shaping today's forex market? Join these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) today.