Abstract:FXPrimus is a CySEC-regulated forex broker offering MT4, MT5, and WebTrader with flexible leverage and diverse trading instruments since 2009.

FXPrimus stands as a longstanding participant in the retail forex and CFD trading scene, established in 2009 and regulated primarily by the Cyprus Securities and Exchange Commission (CySEC). This review investigates FXPrimuss regulatory standing, trading conditions, platform offerings, fees, and overall reliability for traders seeking a robust and trustworthy brokerage.

FXPrimus Regulation and Licensing Status

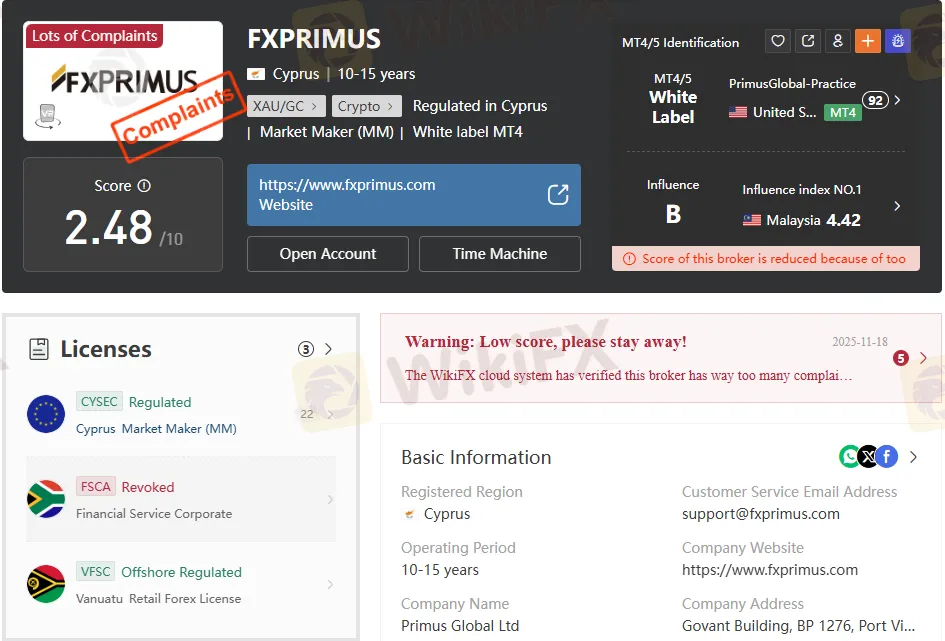

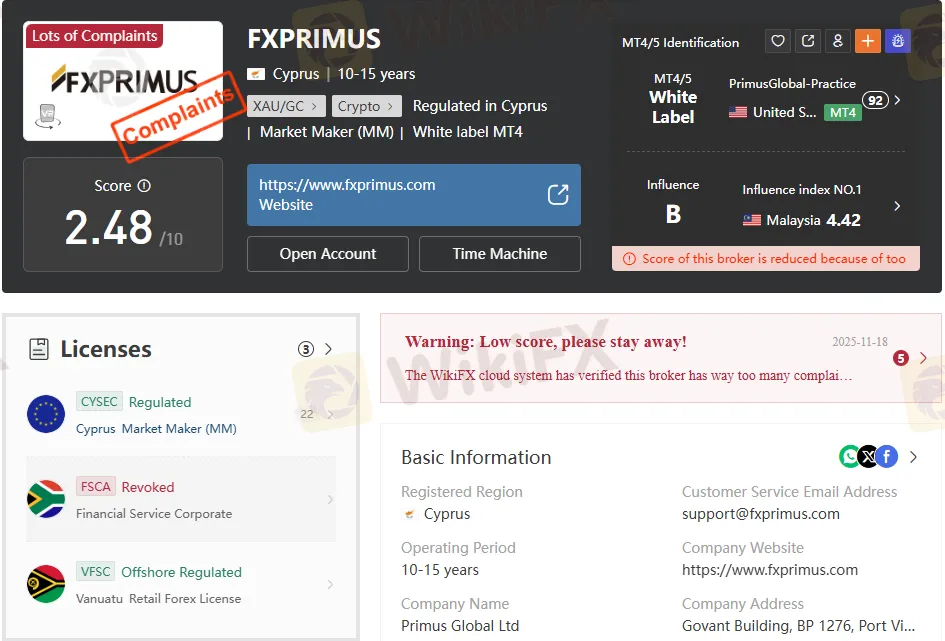

Regulation is a cornerstone when assessing FXPrimuss legitimacy. FXPrimus is authorized by CySEC, operating under license number 26114 through Primus Global Ltd, a Cyprus-based market maker. CySEC, established under Cyprus law in 2001, supervises investment firms to ensure investor protection and market integrity.

Besides CySEC, FXPrimus holds an offshore retail forex license from the Vanuatu Financial Services Commission (VFSC) through Primus Markets INTL Limited. However, its South African license via the Financial Sector Conduct Authority (FSCA) expired in January 2022, potentially reflecting regulatory tightening.

This regulatory mix ensures FXPrimus operates under tight European standards with CySEC, adding a layer of investor trust through established compliance frameworks. The expired FSCA license and offshore status in Vanuatu, however, advise caution for traders outside the EU jurisdiction.

Trading Instruments Available on FXPrimus

FXPrimus offers a diverse portfolio across multiple asset classes to cater to various trading preferences:

- Forex: Major, minor, and exotic currency pairs, with access to the worlds largest liquid market.

- Equities: Shares from global companies via CFDs.

- Energies: Crude oil contracts, futures, and non-expiring contracts.

- Precious Metals: Popular safe-haven assets like gold and silver.

- Indices: Major world stock market indices for broad market exposure.

- Cryptocurrencies: BTC, ETH, and other digital assets for volatile trading opportunities.

- Stocks: CFDs on company shares enabling profit from price movements without ownership.

This robust product range suits both retail and professional traders aiming to diversify their portfolios with multiple trading instruments.

FXPrimus Account Types and Minimum Deposits

FXPrimus caters to different trader needs with three account tiers differentiated by deposit size, leverage availability, spreads, and commissions:

Note that high leverage like 1:1000 on the Classic account, amplifies both potential profits and risks significantly. The account structure supports simulation via demo accounts, enabling trial without financial exposure.

Trading Platforms and Technology

Offering industry-standard platforms, FXPrimus supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and WebTrader, accessible across Windows, iOS, Android, and macOS devices. This multi-platform availability caters to both novice and seasoned traders:

- MT4: Best suited for beginners, featuring user-friendly interfaces and essential technical analysis tools.

- MT5: Preferred by advanced traders for increased asset coverage, enhanced charting, and algorithmic trading capability.

- WebTrader: Browser-based platform adaptable for quick access without software installation.

The broker maintains average execution speeds around 122.57 milliseconds, underscoring efficient trade processing. Technical support and system stability receive strong mentions, reflecting maturity in operational technology.

Spreads, Fees, and Commissions

FXPrimuss fee structure adopts transparency, with spreads and commissions varying by account type:

- PrimusCLASSIC: No commission fees, average spreads from 1.5 pips.

- PrimusPRO: Tight spreads from 0.3 pips, commission $8 per lot on MT5.

- PrimusZERO: Zero spreads starting point with $5 per lot commission.

This tiered fee design allows traders to balance cost versus trading style, from commission-free wider spread accounts to low spread with commission accounts for high-frequency traders.

Pros and Cons of FXPrimus Broker

Pros

- Regulation and oversight by CySEC.

- Diverse trading instruments, including crypto and energies.

- Flexible leverage up to 1:1000 for Classic accounts.

- Multiple account types catering to various trader levels.

- Support for popular MT4, MT5, and WebTrader platforms.

- Low minimum deposit of $15 on Classic accounts.

- Demo accounts for practice.

- Multiple customer support channels, including live chat and email.

Cons

- An expired FSCA license in South Africa raises questions in that region.

- An offshore license under Vanuatu with potentially lower regulatory oversight.

- High leverage carries increased risk exposure.

- Complaints were noted in some customer feedback platforms.

- Commission fees on Pro and Zero accounts may affect small-scale traders.

FXPrimus Domain and Registration Details

The broker's main address is registered at 25 Kolonakiou Street, Zavos Kolonakiou, Limassol, Cyprus. It operates primarily under Primus Global Ltd., a Cyprus-registered entity with strong European compliance credentials. The official domain is www.fxprimus.com, with active customer support emails and social media presence, maintaining trader communication and transparency

Bottom Line on FXPrimus

FXPrimus presents as a seasoned broker with significant regulatory credentials under CySEC, making it a credible choice for traders prioritizing European regulation and a wide array of instruments. The availability of multiple platforms and flexible account types adds versatility for different trader segments. However, caution is advised due to the expired FSCA license and the inherent risks of high leverage. Prospective clients should meticulously weigh these factors against their trading goals and risk tolerance before committing capital.