简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Yields Rise, Rate-Cut Odds Slide As ISM Services Survey Signal Inflation Fears

Abstract:After yesterday's mixed picture on Manufacturing (PMI up, ISM down), analysts expected both Services

After yesterday's mixed picture on Manufacturing (PMI up, ISM down), analysts expected both Services surveys this morning to show an upward bounce.

- S&P Global's Services PMI disappointed but did risefrom September's 54.2 to 54.8 (but that was less than expectedand less than the 55.2 preliminary print)

- ISM's Services PMI beat expectations, rising from 50.0 to 52.4, well above the 50.8 expectations.

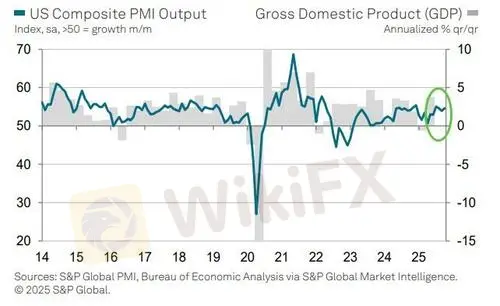

And this is happening amid a rise in 'hard' data (though admittedly based on housing and marginal labor data given the vacuum since the shutdown)

Across the PMI surveys, only ISM Manufacturing saw a decline MoM in October...

Under the hood,Prices surged to their highest in three years, new orders expanded at their fastest pace in a year and employment improved (though remained below 50)...

Octobers final PMI data add to signs that the US economy has entered the fourth quarter with strong momentum, according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

While growth is being driven principally by the financial services and tech sectors, Williamson says the survey is also picking up signs of improving demand from consumers.

However, the surge in prices paid is having some consequences

Business expectations about the year ahead have also fallen sharply and are now running at one of the lowest levels seen over the past three years, as Williamson notes “signs of spending caution from customers is accompanied by heightened political and economic uncertainty.”

However, Williamson points out that lower interest rates have helped offset some of the drags to business confidence, for which the October FOMC rate cut will have likely helped further.

Treasury yields are on the rise (likely driven by the inflation jump) and rate-cut odds are lower...

Hopefully we will get some 'hard' data reality (Payrolls and CPI) if the government reopens before the next FOMC meeting but for now we would say, this should not be weighted enough to warrant The Fed veering from its easing path.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Understanding FX SmartBull Withdrawal & Deposit: Essential Information Before You Start Trading

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Understanding UPFOREX Money Transfers: Important Facts You Need to Know

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

UPFOREX Review 2026: Is UPFOREX Safe or Scam? A Look at User Reviews and Warning Signs

Jane Street Under Fire: From India’s Market Ban to a $40 Billion Crypto Conspiracy

FXORO Review: Investigating Withdrawal Denial and Fund Scam Allegations

Currency Calculator