简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Manufacturing Surveys Mixed In October; Prices Down, Production Up

Abstract:Amid the month-long vacuum of macro data, thanks to the shutdown, 'soft' survey data has become almo

Amid the month-long vacuum of macro data, thanks to the shutdown, 'soft' survey data has become almost the only leg left standing to judge the economy by (absent the housing data).

Following better-than-expected prints across Europe, and beats in Brazil and Canada, this morning's S&P Global US Manufacturing PMI rose more than expected to 52.5 (52.2 exp), up from 52.0 - tracking hard data higher.

BUT...

...as usual in the baffle 'em with bullshit world, ISM's US Manufacturing PMI missed expectations,falling from 49.1 to 48.7 (worse than the 49.5 exp) - the 8th straight month of contraction (below 50)

Source: Bloomberg

according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Indeed, ISM shows prices falling fast and new orders and employment improving MoM (though both below 50 - contracting).

The index of prices paid for raw materials fell 3.9 points to 58, the lowest since the start of the year. Since a recent peak in April, during the height of the tariffs rollout, the price gauge has dropped nearly 12 points...

Source: Bloomberg

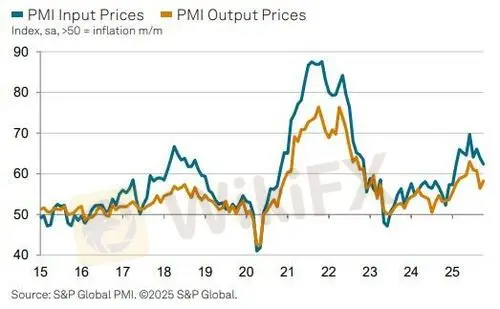

Tariffs remained a key source of higher input costs during October with S&P Global's latest data showing another round of historically elevated inflation – albeit the lowest since February.

Selling prices were raised markedly in response, and to a quicker degree than Septembers recent low.

Finally, Williamson notes that business confidence among producers of consumer goods is now down to its lowest for two years“as firms growing increasingly worried about household spending in the US and falling sales to consumers in export markets.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Currency Calculator