SparkFX Review 2025: Unverified Dubai Claims and Rising Risks in the Arab Market

An in-depth review of SparkFX (Score 1.82) investigating claims of a Dubai license, expansion into Arabic markets, and reports of unfair account bans.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

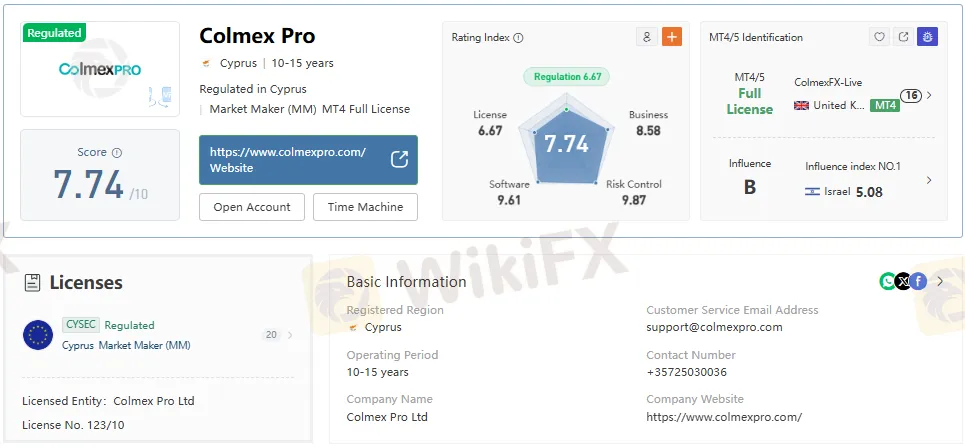

Abstract:Colmex Pro is a CYSEC-regulated Cyprus broker offering stocks, CFDs, and MT4; learn about licenses, fees, platform logins, and account requirements.

Colmex Pro is a Cyprus-based online broker regulated by the Cyprus Securities and Exchange Commission (CYSEC) under license number 123/10, offering access to stocks and CFDs with a minimum deposit from $1,000 and platforms including a proprietary app, web trader, and MetaTrader 4. Operating since 2009, the firms market maker license in Cyprus anchors client protection standards while enabling multi-asset access, including equities and stock CFDs, with on-site verification of a physical office in Limassol. Account tiers range from Margin to VIP with per-share pricing, overnight margin at 1:2, and financing fees tied to the Fed rate, positioning Colmex Pro toward experienced traders who value direct stock and CFD access on regulated infrastructure.

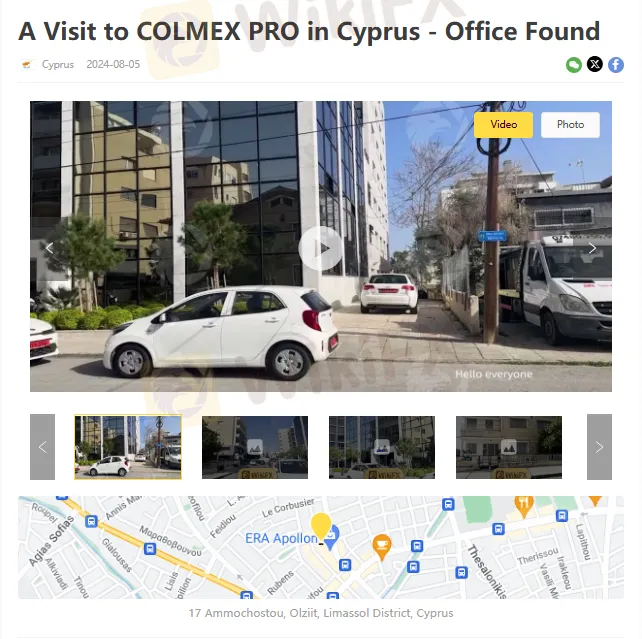

Colmex Pro Ltd holds CYSEC authorization as a Market Maker under license 123/10, with an effective date of 2010-10-19, signaling a long-standing regulatory footprint and adherence to Cyprus/EU investor protection regimes. The broker lists official domains (colmexpro.com, colmex.com), a Limassol business address on Makariou III Avenue & Sissifou, and published contact lines, supporting verifiable corporate presence and compliant disclosures. A third-party field survey report indicates the office was located on site in Cyprus in 2024, adding an extra layer of operational transparency for due diligence.

Five live account types—Margin, Bronze, Silver, Gold, and VIP—scale in minimum deposit from $1,000 (Margin) to $100,000 (VIP), with per-share fees decreasing as tiers rise. The Margin account shows a $2.50 minimum order and $0.007 per-share fee, while VIP lists $1.75 minimum order and $0.0035 per-share fee, each generally aligned to 1:2 overnight margin for equities. Personal account managers are available across tiers, while financing includes an overnight leverage fee above 1:1 at 0.022% + Fed Rate/365 and excess leverage surcharges at listed thresholds.

Colmex Pro supports a mobile app (iOS/Android), a desktop/web trader, and MetaTrader 4 for desktop and mobile, allowing both beginners and experienced traders to choose between “Lite” and “Pro” workflows. The proprietary Colmex Pro 2.0 environment advertises quick view switching and market depth in Pro view, while MT4 extends algorithmic and charting capabilities for currency and CFD trading segments. MT5 is not listed as supported, which may matter for traders seeking newer MQL5 features or built-in netting/hedging enhancements beyond MT4.

The broker emphasizes access to 3,000+ US stocks and 4,000+ CFDs alongside exposure to forex, indices, commodities, and stocks within a regulated framework. Cryptocurrencies, bonds, and futures are not shown as supported, indicating a focus on traditional equities and major CFD/FX instruments instead of broader derivatives coverage. A demo account is noted as available, which can support evaluation of execution, spreads, and platform usability before funding live tiers.

Equity trading costs are published per share and by account tier, with lower per-share fees in higher deposit bands (e.g., $0.007 Margin to $0.0035 VIP), plus fixed minimum order charges. For leveraged positions, the overnight leverage fee is noted as 0.022% plus the Fed Rate divided by 365 over 1:1, with excess leverage fees above higher thresholds, which can significantly impact multi-day strategies. The broker flags charged fees and limited trading condition detail as drawbacks compared to peers that disclose granular spreads, commissions, and financing tables by symbol.

Colmex Pro indicates online onboarding via its official domains with minimum deposits aligned to the chosen tier and support through live chat, forms, and published emails (support@colmexpro.com; info@colmexpro.com) and phone contact. The stated address in Limassol provides geographic anchoring for correspondence and regulatory checks, while WhatsApp and multi-channel touchpoints aid responsiveness for operational matters. Given the tiered structure and per-share model, prospective clients often begin with a demo, then select a tier that balances fee reductions with capital commitments.

Colmex Pro generally fits traders focused on direct US stock access and equity CFDs who prefer a regulated Cyprus environment and a per-share commission structure. Experienced participants who already use MT4 for FX/CFDs or who value a proprietary platform with Pro/Lite modes may find the toolset sufficient, despite the absence of MT5. Newer traders can trial the demo and weigh the $1,000 entry threshold against alternatives if looking for lower minimums or broader crypto/futures coverage.

For “Best Forex Brokers 2025” shortlists, Colmex Pros CYSEC license, MT4 availability, and multi-asset coverage earn credibility, but fee transparency granularity and minimum deposit size may influence rankings. In “Colmex Pro vs Competitors,” the per-share equity focus and stock universe breadth are strengths, yet lack of MT5, crypto, and futures can be disadvantages for multi-derivative traders. For “Colmex Pro Account Opening,” the primary friction points are documentation, the $1,000+ funding thresholds by tier, and clarity on financing costs for overnight strategies.

As a CYSEC market maker, Colmex Pro operates under Cyprus jurisdiction with an authorization history dating to 2010, and a corporate footprint registered in Limassol. The documentation lists authorized EU countries and maintains clear references to the Cyprus Securities and Exchange Commission, supporting auditability and oversight. Publicly available identifiers (license number, official websites, contact coordinates) allow independent cross-checking on the CYSEC database and broker comparison resources.

Colmex Pro combines CYSEC regulation, a physical office, and multi-platform access to stocks and CFDs with per-share pricing and overnight financing tied to benchmark rates. The offering targets traders seeking regulated access to US equities and mainstream CFDs on MT4 and proprietary platforms, with the tradeoff of higher minimums and no MT5. For safety-first, regulated forex trading and stock CFD exposure within Cyprus, Colmex Pro presents a defensible option—best validated by a demo and review of financing terms before funding.

Note: Check verified trader reviews and compare real trading costs to make an informed decision.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

An in-depth review of SparkFX (Score 1.82) investigating claims of a Dubai license, expansion into Arabic markets, and reports of unfair account bans.

Have you been made to take a loan from the Libertex official after losing in a trade? But did that also prove financially disastrous? Do you find varying experiences when depositing and withdrawing, with the former being smooth and the latter being worse? It is arguably the pattern for most traders as they share negative Libertex reviews online. In this article, we have discussed these complaints in greater detail. Read further!

Multibank Group broker review: regulated in Cyprus, Australia, and Germany, but facing revoked licenses and severe complaints.

FX LIVE CAPITAL holds a dangerous 2.11 score on WikiFX with zero valid regulations. User reviews expose account bans and missing funds. Read the full safety warning.