Abstract:Being made to do a lot of back and forth for withdrawal access endlessly at Binarycent without any success? Receiving unsatisfactory replies from the forex broker officials on withdrawals? Is the bonus unremovable from your forex trade? Have you witnessed capital losses due to manipulative trades by the broker? All these clearly indicate scams at Binarycent, a Marshall Islands-based forex broker. Many have accused the broker of serious fraud allegations online. In this article, we have put their comments. Read on to find out.

Being made to do a lot of back and forth for withdrawal access endlessly at Binarycent without any success? Receiving unsatisfactory replies from the forex broker officials on withdrawals? Is the bonus unremovable from your forex trade? Have you witnessed capital losses due to manipulative trades by the broker? All these clearly indicate scams at Binarycent, a Marshall Islands-based forex broker. Many have accused the broker of serious fraud allegations online. In this article, we have put their comments. Read on to find out.

Sharing Trading Complaints Against Binarycent

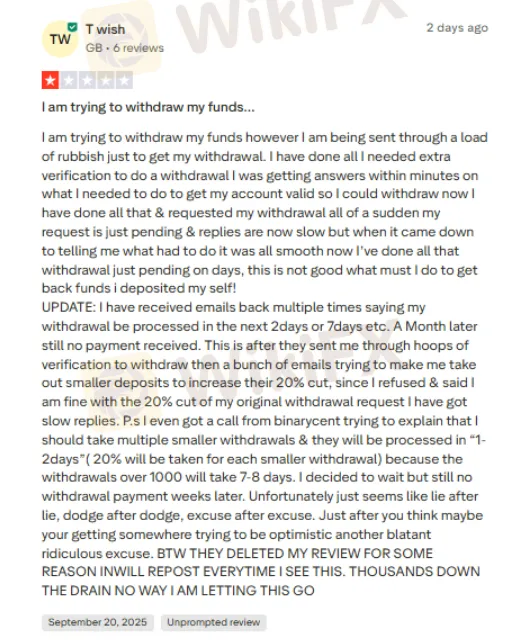

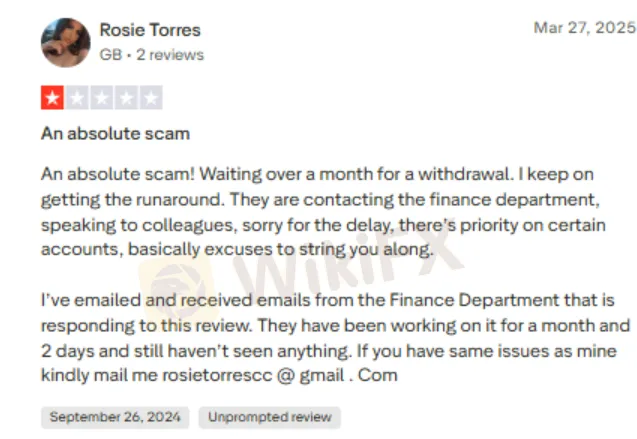

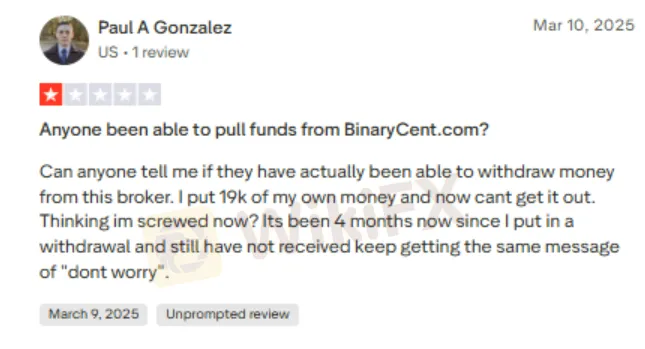

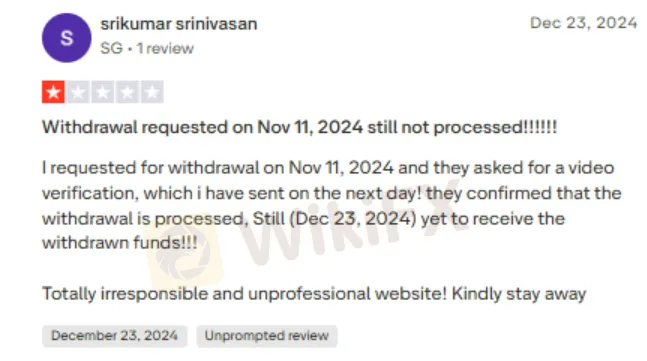

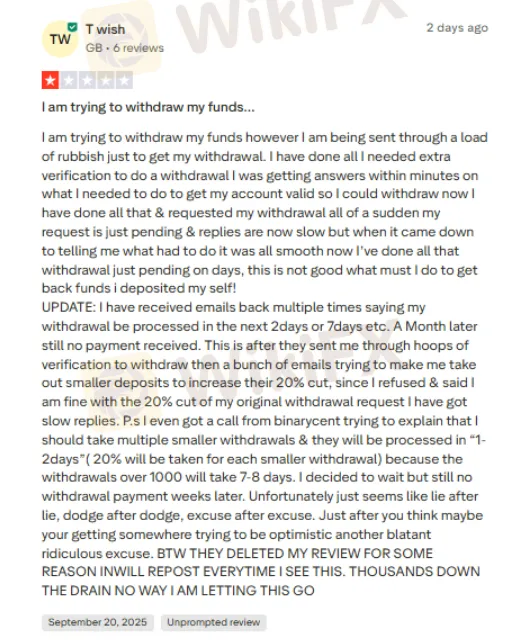

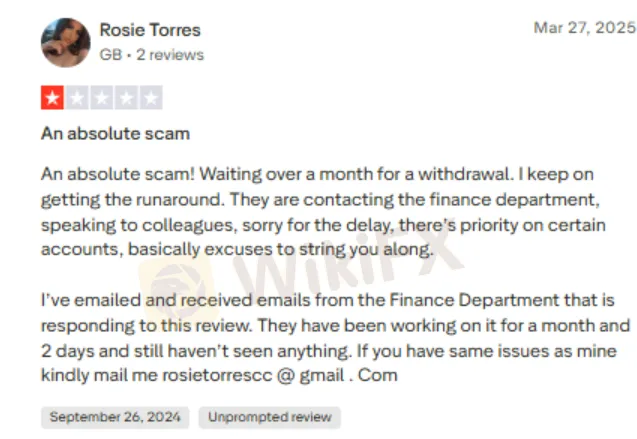

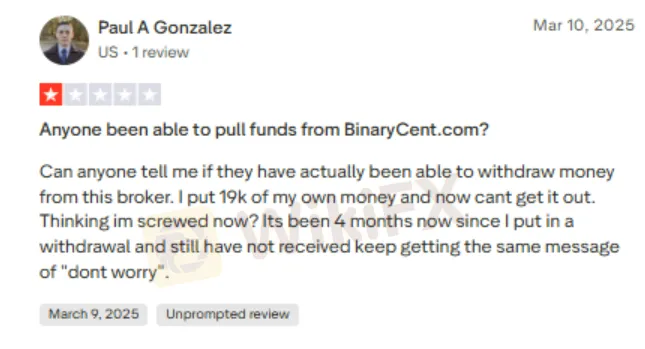

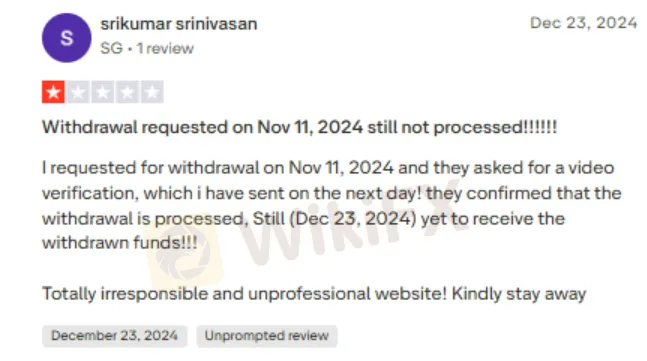

The Never-Ending Wait for Fund Withdrawal Access

Binarycent has been accused of delaying withdrawals for traders, just far too long. In between, traders go through a series of failed negotiations with the broker officials for quick withdrawals. The officials often give them promises, such as requesting a small number of withdrawals. However, they all turn out fake and unending. Here are some shocking withdrawal complaints.

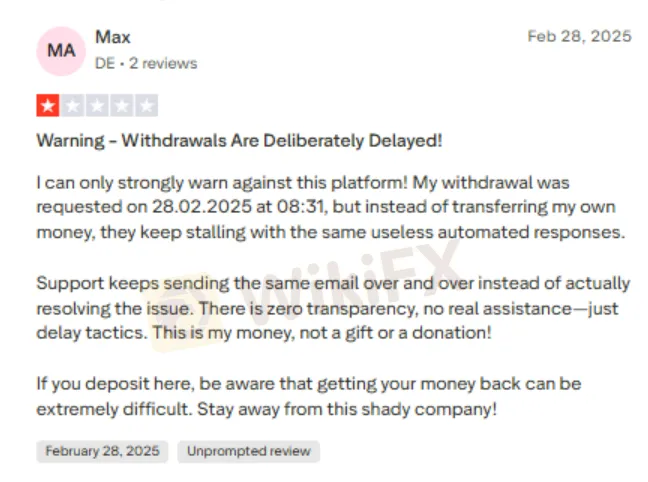

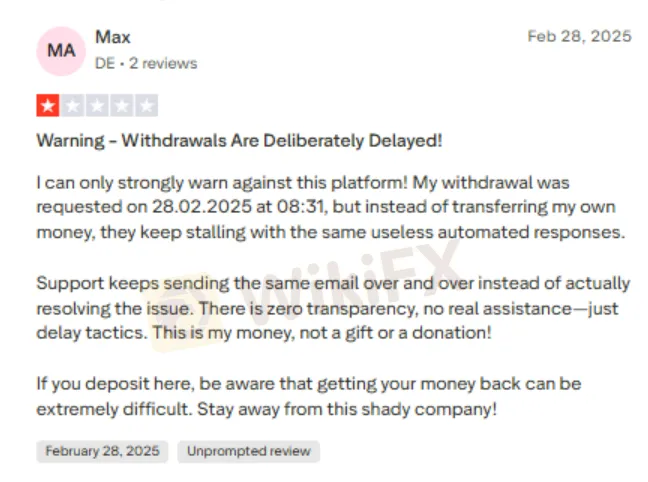

Deliberate Withdrawal Delay Claim

One trader has categorically mentioned that the broker deliberately delays withdrawals for its clients. The trader claimed that instead of transferring his money, the broker stalled the same using useless automated responses involving the same emails. Here is how the trader reviewed Binarycent.

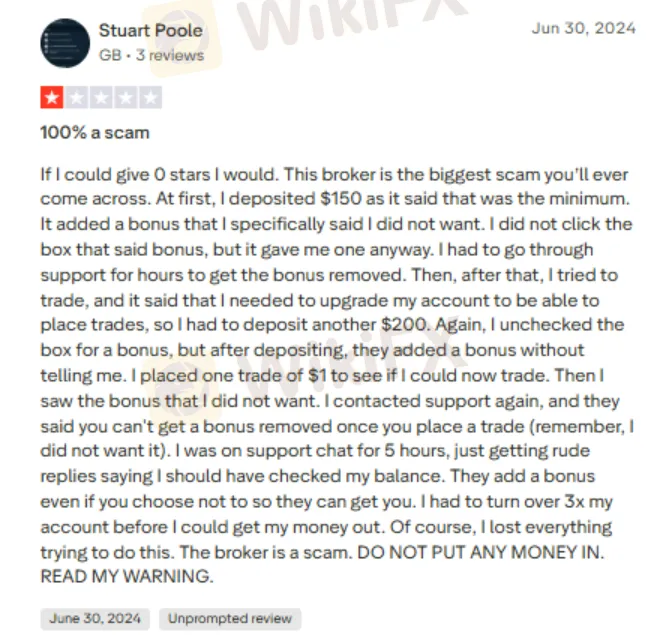

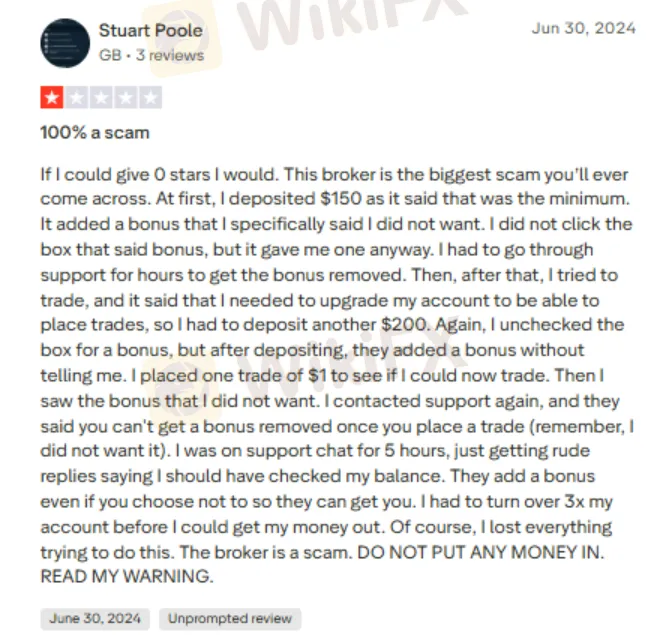

The Chaos from Unnecessary Bonus Addition

Some traders, despite not wanting a bonus, get it added to their trading account by the broker. One trader even unchecked the box for a bonus. Even then, the bonus was credited to the account after the trader placed a trade. The trader, after witnessing it, contacted the customer support team to get it removed. However, the trader was told that the bonus cannot be removed upon placing a trade. The trader had to turn his account 3X with subsequent deposits to withdraw the amount. However, the trader lost everything while trying to do so. Here is that stunning screenshot.

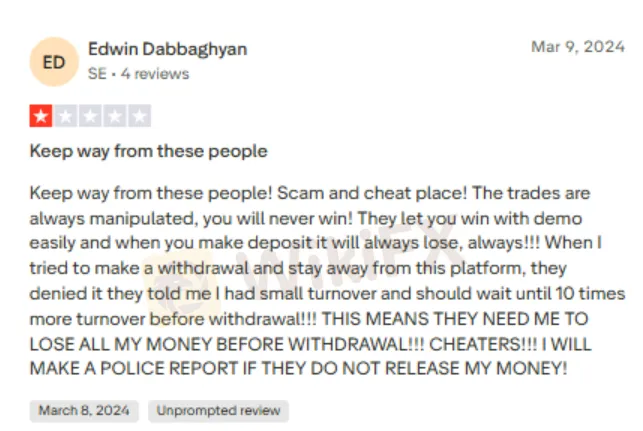

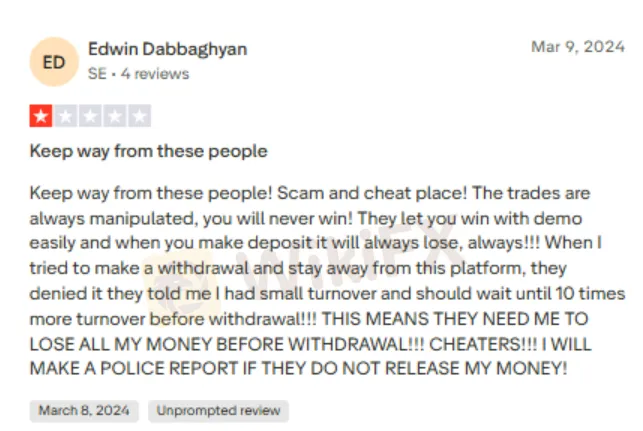

Manipulative Trades are on the Rise

Traders claim manipulation in their trading journey with Binarycent. Trades are sorted in a way that one can never win. Just to attract traders, the broker may allow them to win a demo. However, as they deposit, they will always lose, according to a trader. Here is the screenshot explaining this particular problem.

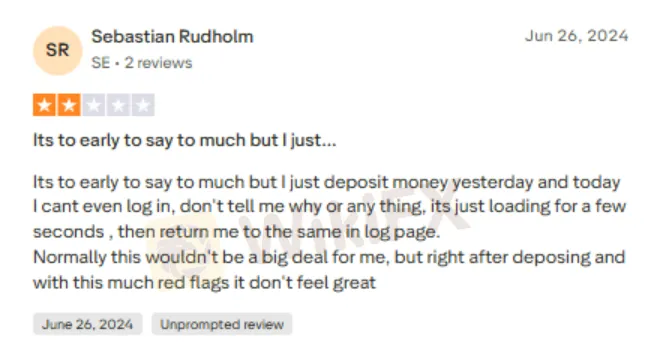

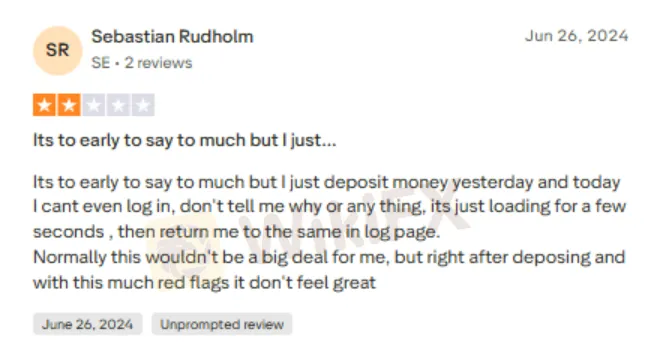

Login Issues Haunt Traders at Binarycent

Traders also witness login issues in the Binarycent trading platform. A trader recounted an experience of failing to log in after depositing an amount a day ago. The trading systems failure further adds to the problems traders witness at Binarycent. Sharing the screenshot explaining the login issue.

Why Have Complaints Piled Up Against Binarycent?

The growing scam complaints by traders have to do with the lack of regulatory status. Yes, the broker is not licensed by a competent financial authority, allowing it to carry on its own rules aimed at defrauding traders. After studying everything, the WikiFX team found serious wrongdoings in Binarycents operations. As a result, the score for it is just 1.56 out of 10.

For more scam alerts and other financial news, join WikiFX Masterminds.

Here is how you can be part of it -

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations on joining the community.