Abstract:City Index operates under FCA oversight via GAIN Capital UK Limited (FRN 113942); learn how to verify its license and avoid clone scams.

Introduction

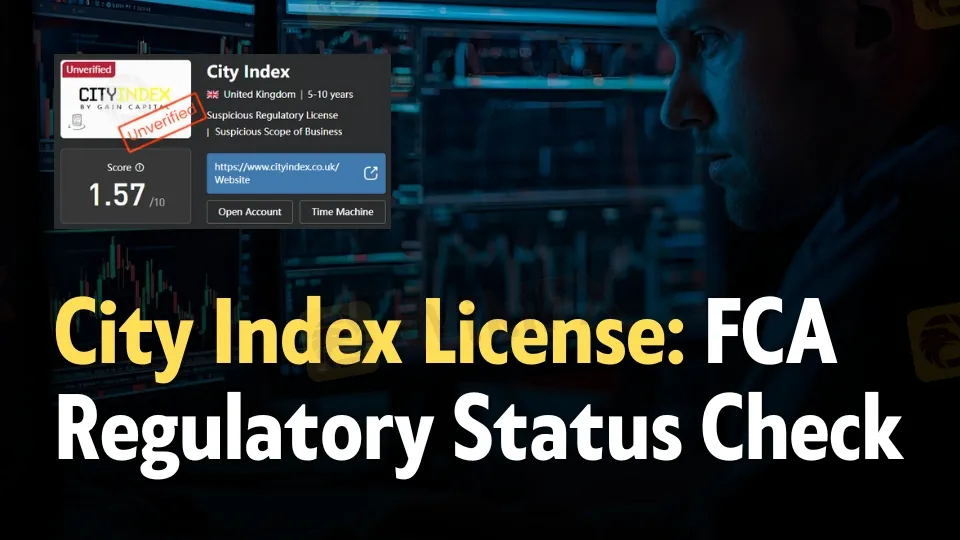

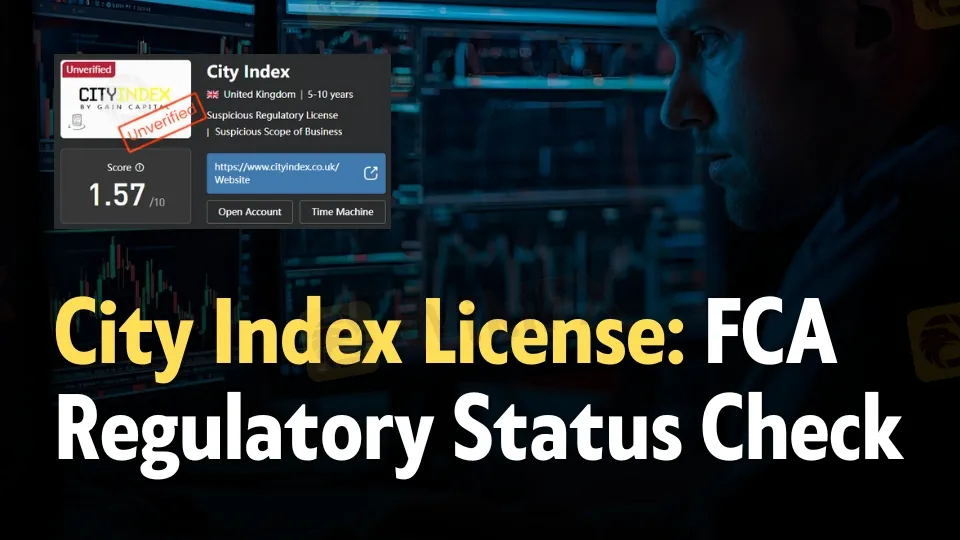

City Index operates in the UK under the FCA‘s regulatory framework through GAIN Capital UK Limited with Firm Reference Number 113942, which appears as an authorised firm on the FCA Register and is the core data point for any license check. While third‑party watchdogs may flag “unverified” or “suspicious clone” labels, the definitive reference is the FCA’s own register entry, where GAIN Capital UK Limited is shown as authorised for specific regulated activities under FRN 113942. Because clone warnings are a persistent risk in retail trading, the safest verification method is to cross‑check the exact firm name, FRN 113942, and approved domains against the FCA register and FCA warning list, rather than relying solely on aggregator ratings.

What the FCA Register Shows

The FCA Register lists GAIN Capital UK Limited with FRN 113942 as an authorised firm, confirming City Index‘s UK regulatory footing under that legal entity. Multiple independent broker reviews and industry profiles corroborate that City Index’s UK business sits within GAIN Capital UK Limited and references the same FCA FRN 113942 for license verification. Historical coverage further traces this licensing lineage through City Indexs evolution under GAIN Capital and later StoneX Group, but the core UK authorisation point remains FRN 113942 for GAIN Capital UK Limited.

Reconciling “Unverified” and “Clone” Flags

Some risk-intelligence sites label City Index as “unverified” or a “suspicious clone,” often tied to inaccessible domains, mismatched contact details, or off‑register entities—this is distinct from the genuine FCA‑authorised firm. The FCA itself frequently posts clone warnings where fraudsters reuse real firms names and FRNs, which can create confusion; for example, FCA notices describe clones of authorised “GAIN Capital” entities to alert the public. The correct approach is to treat any “unverified” or “clone” label as a prompt to confirm the official FCA entry (firm name: GAIN Capital UK Limited; FRN: 113942) and ensure the website and contacts match what the authorised firm discloses.

How to Verify the License

- Confirm the firm name and FRN: Search “GAIN Capital UK Limited FRN 113942” on the FCA Register and ensure the firm shows as authorised with current permissions.

- Match contact details: Compare the website, phone, and address used by City Index against the details shown on the FCA entry and the brokers official channels to avoid clone confusion.

- Check FCA warnings: Review the FCAs warning list for any clone alerts that might be using the City Index or GAIN Capital names, and avoid any mismatched contact points.

What Regulation Implies for Clients

An FCA‑authorised UK firm must meet conduct, capital, and client‑money rules, including segregating client funds and adhering to product governance and leverage restrictions for CFDs. FCA oversight also integrates consumer protections such as eligibility for the Financial Services Compensation Scheme up to £85,000 if the authorised entity fails, subject to scheme rules and coverage criteria. Independent reviewers highlight that selecting the FCA‑regulated City Index entity provides the UKs stricter investor protections compared with offshore entities and should be prioritised when jurisdiction is an option.

Parent Group and Global Footprint Context

City Index has operated for decades in the UK market and became part of GAIN Capital, later within the StoneX Group, anchoring its UK authorisation under GAIN Capital UK Limited. Third‑party industry analyses and broker reviews point to multi‑jurisdiction regulation across the UK (FCA), Australia (ASIC), and Singapore (MAS), with the UK license validated by FRN 113942. This cross‑border structure explains why different names—City Index, GAIN Capital UK Limited, and StoneX—appear across documentation, but the UK license check always centers on FRN 113942 on the FCA Register.

Beware of Clones and Misdirected Domains

FCA warning pages show that fraudsters often copy authorised firm details and FRNs, mixing genuine and fake contact data to appear legitimate. If a “City Index” or “GAIN Capital” website or email diverges from the FCA‑listed information or the brokers official domain, treat it as a red flag and validate everything against the FCA register. Risk‑rating portals sometimes flag “suspicious clone” when they detect off‑brand domains or inaccessible pages; use that as a trigger to reconfirm the official FCA entry for FRN 113942.

Expert Commentary and Practical Tips

Experienced compliance practitioners recommend checking three points: the FCA FRN, the permissions scope, and the matching of official contact channels—discrepancies often indicate a clone. The FCAs own guidance emphasises that authorisation status must be verified on the register and that clone firms are common; never rely solely on an FRN quoted in an email or on an unfamiliar site. For day‑one diligence, bookmark the FCA register entry for GAIN Capital UK Limited (FRN 113942) and use it as the canonical reference before funding any account claiming to be “City Index UK.”

Conclusion: Status and Verification Bottom Line

In the UK, City Index operates under the FCA authorisation of GAIN Capital UK Limited, FRN 113942, and that entry on the FCA Register is the authoritative license proof. Any conflicting “unverified” labels or clone alerts should trigger enhanced checks of firm name, FRN, and contact details against the FCA site and official broker channels before proceeding.