Abstract:NOZAX is a Montenegro-registered forex and multi-asset broker founded in 2017. It offers MetaTrader 5 access to forex, shares, indices, and commodities, and three account tiers (NZX ZERO, NZX CORE, NZX CENT).

NOZAX is a Montenegro-registered forex and multi-asset broker founded in 2017. It offers MetaTrader 5 access to forex, shares, indices, and commodities, and three account tiers (NZX ZERO, NZX CORE, NZX CENT). The broker advertises raw ECN-style spreads on its NZX ZERO account, institutional STP pricing on CORE/CENT, and a headline maximum leverage of 1:500. NOZAX states it is regulated in Montenegro by the local capital markets regulator. Traders should verify current licence details and weigh regulatory scope before funding an account.

Why does this review matter?

This NOZAX review explains account types, fees, leverage, and platform support so traders can quickly assess whether the brokers offering fits their needs. We keep the tone neutral and do not recommend investing — instead, we point out the facts and the checks every trader should perform before depositing.

At a glance — key facts

- Founded: 2017

- Headquarters/registration: Montenegro

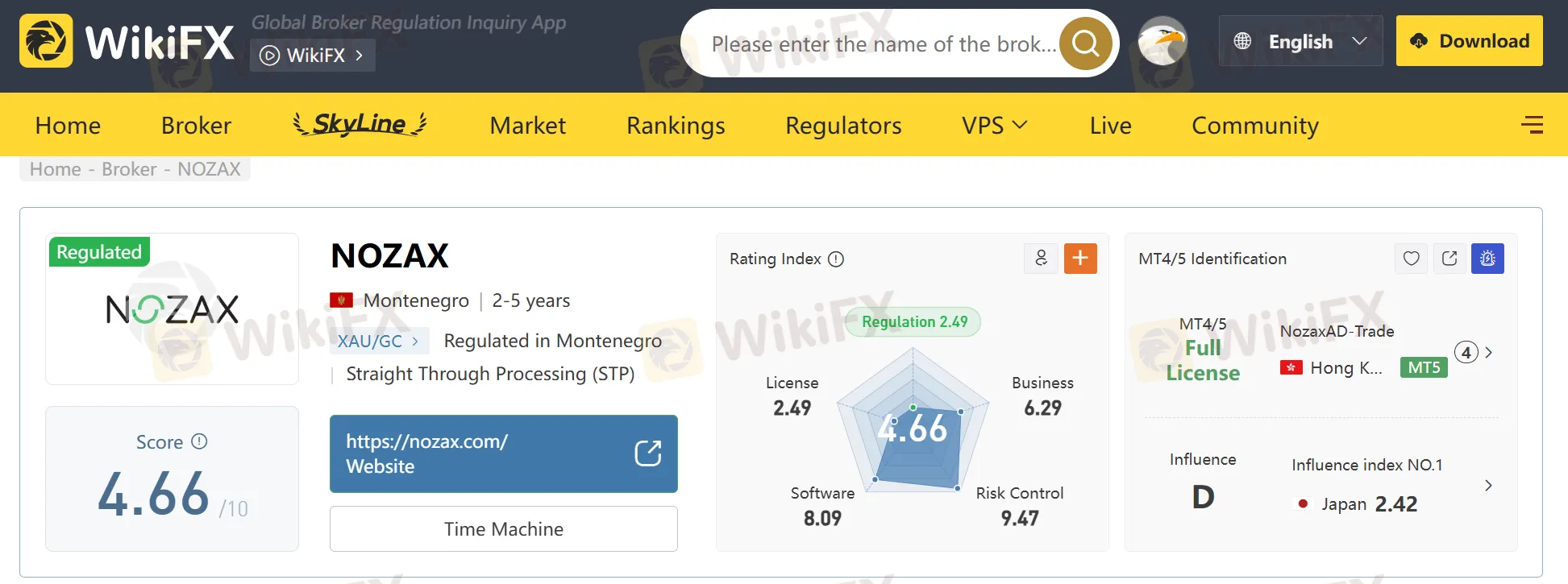

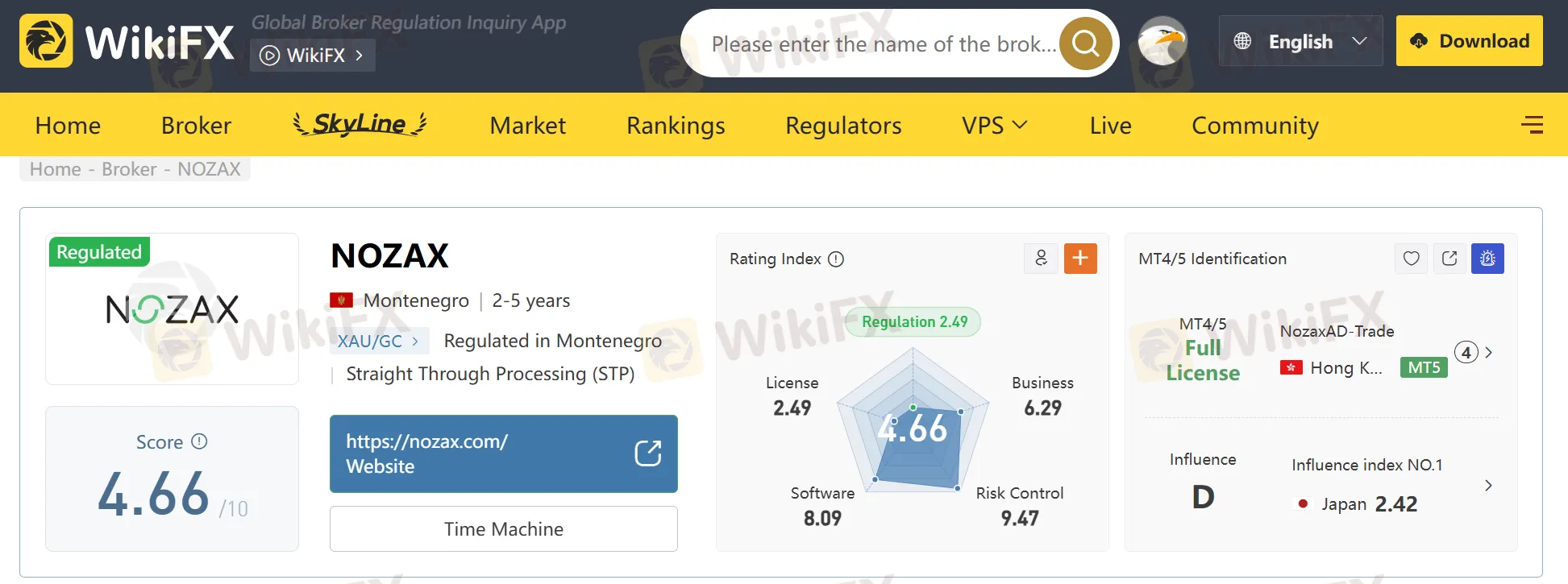

- Regulation: Registered with the Montenegro capital markets regulator (SCMN) — verify licence status.

- Platforms: MetaTrader 5 (MT5) — desktop & mobile

- Account types: NZX ZERO, NZX CORE, NZX CENT

- Leverage: Up to 1:500 (headline)

- Spreads & commissions: NZX ZERO — ECN spreads from 0.0 pips + commission (per-trade fee); NZX CORE/CENT — STP spreads, commission-free.

Platform & instruments

NOZAX supports MT5, a full-featured multi-asset trading platform with advanced charting, EAs, and order types. Instruments include major and minor forex pairs, select shares, indices, and commodities — suitable for traders who prefer a single platform for multiple asset classes.

Account types & pricing (what to expect)

- NZX ZERO — designed for higher-volume traders seeking the tightest spreads. Raw ECN spreads are advertised “from 0.0 pips” with a per-trade commission.

- NZX CORE — institutional STP spreads, no commission; for traders who prefer spread-based pricing.

- NZX CENT — micro/cent account for smaller balances or beginners; STP spreads and no commission.

Important: Published commission numbers can vary across listings. Always confirm the live fee schedule and how commissions are applied (per lot, per side, minimums) on NOZAXs official fee page.

Leverage & risk

NOZAX advertises a maximum leverage of 1:500, which amplifies both gains and losses. High leverage increases liquidation risk and is restricted in many major jurisdictions — check what leverage will actually be offered to your country and instrument before trading.

Regulation & client protection

NOZAX is registered in Montenegro and says it is overseen by the local capital markets regulator. This is different from being licensed by larger, well-known regulators (e.g., FCA, CySEC, ASIC). Regulatory scope matters: it affects supervision intensity, client money segregation rules, and available dispute/compensation mechanisms. Traders should verify licence numbers and current status directly with the regulator.

Deposits, withdrawals & support

NOZAX lists multiple deposit and withdrawal methods and claims responsive customer service. Public listings vary — best practice is to test with a small deposit and a withdrawal to confirm processing times, fees, and KYC steps in your jurisdiction.

Pros & cons

Pros

- MT5 on desktop and mobile.

- Multiple account choices (ECN and STP).

- Multi-asset offering (FX, shares, indices, commodities).

Cons/cautions

- Regulated in Montenegro — not the same protections as major global regulators.

- High maximum leverage (1:500) intensifies risk.

- Fee/commission details may vary by source — confirm on the official site.

Bottom line

NOZAX is a functioning Montenegro-registered broker offering MT5, raw spreads on an ECN account, and a range of instruments. We do not recommend or discourage using NOZAX. Instead, traders should:

- Verify the NOZAX license directly with Montenegros regulator.

- Read the brokers legal documents (terms, fee schedule, execution policy).

- Test the platform with a demo and perform a small live deposit/withdrawal to confirm processes.

- Consider whether you need a broker regulated by a major jurisdiction for extra protections.

Short FAQ

Is NOZAX regulated?

NOZAX is registered in Montenegro and states it is supervised by the local capital markets regulator. Confirm current license status with the regulator before opening an account.

What platform does NOZAX use?

NOZAX supports MetaTrader 5 (MT5) for desktop and mobile trading.

What accounts does NOZAX offer?

Three accounts: NZX ZERO (ECN/commission), NZX CORE (STP/spread), NZX CENT (cent account).

What is the maximum leverage?

NOZAX advertises up to 1:500 leverage; actual available leverage may vary by jurisdiction and instrument.