简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Q2 GDP Revised Sharply Higher As Data Center Investments Sharply Boost Growth

Abstract:While the number mostly reflects a reversal of the tariff frontrunning seen in Q1 (which dragged GDP

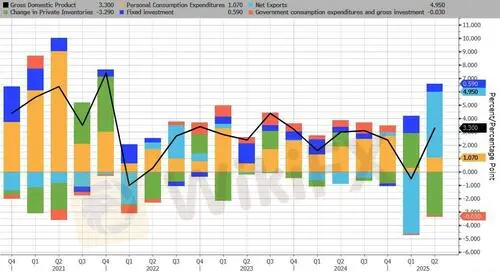

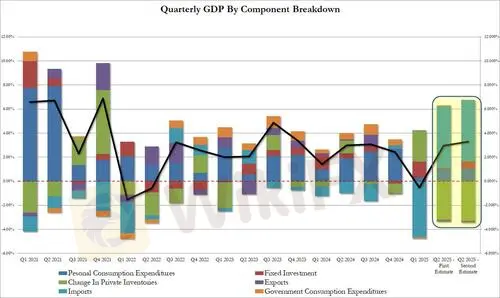

While the number mostly reflects a reversal of the tariff frontrunning seen in Q1 (which dragged GDP sharply lower due to a surge in imports), moments ago we got the BEA's first revision of the Q2 GDP print which already came in red hot at 3.0% one month ago... and was just revised even redder and even hotter to 3.3%, beating estimates of a 3.1% print...

... and the highest quarterly print since Q3 2023.

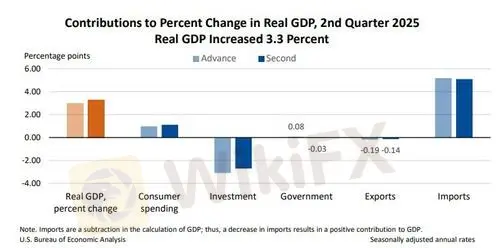

According to the BEA, the 0.3% upward revision from the original 3.0% print reflecting upward revisions to investment and consumer spending that were partly offset by a downward revision to government spending and an upward revision to imports.

Taking a closer look at the composition, we find the following:

- Personal Consumption increased to 1.07% of the bottom line GDP print, up from 0.98% in the original print

- Fixed Investment jumped substantially from just 0.08% to 0.59% of the bottom-line print. We warned one month ago that either this number suggested that hyperscalers were lying or the number would be revised substantially higher. It was the latter.

One concerning item in the GDP print: fixed investment just 0.08%.

Really? No data centers at all? Are hyperscalers lying?

— zerohedge (@zerohedge) July 30, 2025

- The change in private inventories was modest, from -3.17% of the final GDP number, to -3.29% as companies depleted stocks purchased during the tariff build up period.

- Net trade (exports and imports) added 4.95% to GDP, virtually unchanged from the 4.99% original print, and a mirror image of the -4.62% hit to GDP from Q1.

- Finally, government flipped from adding a modest 0.08% to GDP, to subtracting 0.03%

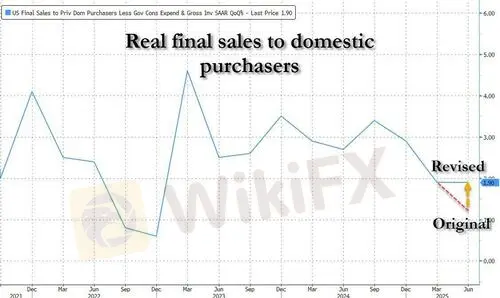

More important than the GDP print even was the sharp upward revision in real final sales to private domestic purchasers, the sum of consumer spending and gross private fixed investment, which surged 1.9% in the second quarter - largely thanks to the huge upward revision in fixed investment - and up 0.7% from the previous estimate.

Finally, the price index for gross domestic purchases increased 1.8% in the second quarter, revised down 0.1% from the previous estimate. The personal consumption expenditures (PCE) price index increased 2.0%, revised down 0.1% from the previous estimate. Excluding food and energy prices, the PCE price index increased 2.5%, the same as previously estimated.

Overall, this was a very solid GDP print, with the upward revision not due to another boost in spending but rather the all important investment on data centers, which also helped almost double Real Final Sales from

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Kudotrade Review: Safety, Regulation & Forex Trading Details

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Why Opofinance’s Dual Licensing Looks Weak, Not Reassuring

Is Toyar Carson Limited Legit? A 2026 Investigation into Scam Allegations

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Currency Calculator