Abstract:MultiBank Group’s review reveals a complex domain portfolio and regulation challenges amid numerous complaints. Learn how to identify safe MultiBank trading platforms and avoid scams by understanding their regulatory status and suspicious child URLs.

MultiBank Group Websites and Child URLs to Watch

MultiBank Group, a broker regulated by various authorities including ASIC, BaFin, and CYSEC, has recently faced a surge in complaints related to its online presence. Investors and traders are advised to exercise caution due to multiple child URLs and subdomains linked to the group that may pose risks or scams. This article highlights the importance of identifying legitimate MultiBank Group websites amid numerous suspicious domains.

Rising Complaints and Regulatory Overview

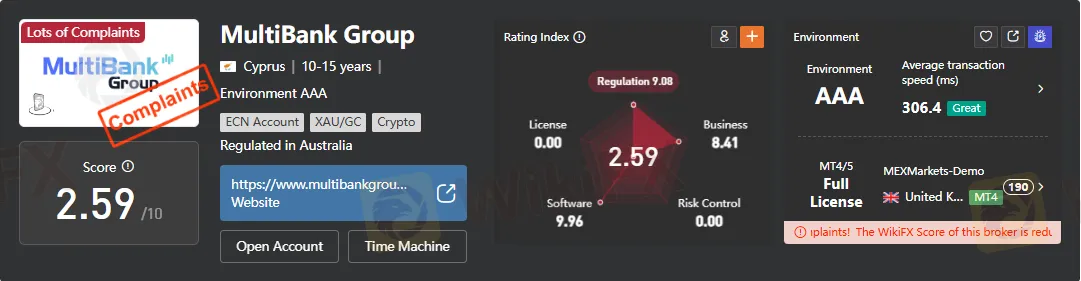

Despite robust regulation from respected bodies like Australia‘s ASIC and Germany’s BaFin, MultiBank Group has accumulated a concerning score of 2.59 out of 10 on broker rating platforms, signaling notable client dissatisfaction. The firm holds licenses in multiple jurisdictions but has also faced revocations and unverified statuses from some regulators, such as the FCA and DFSA, raising red flags.

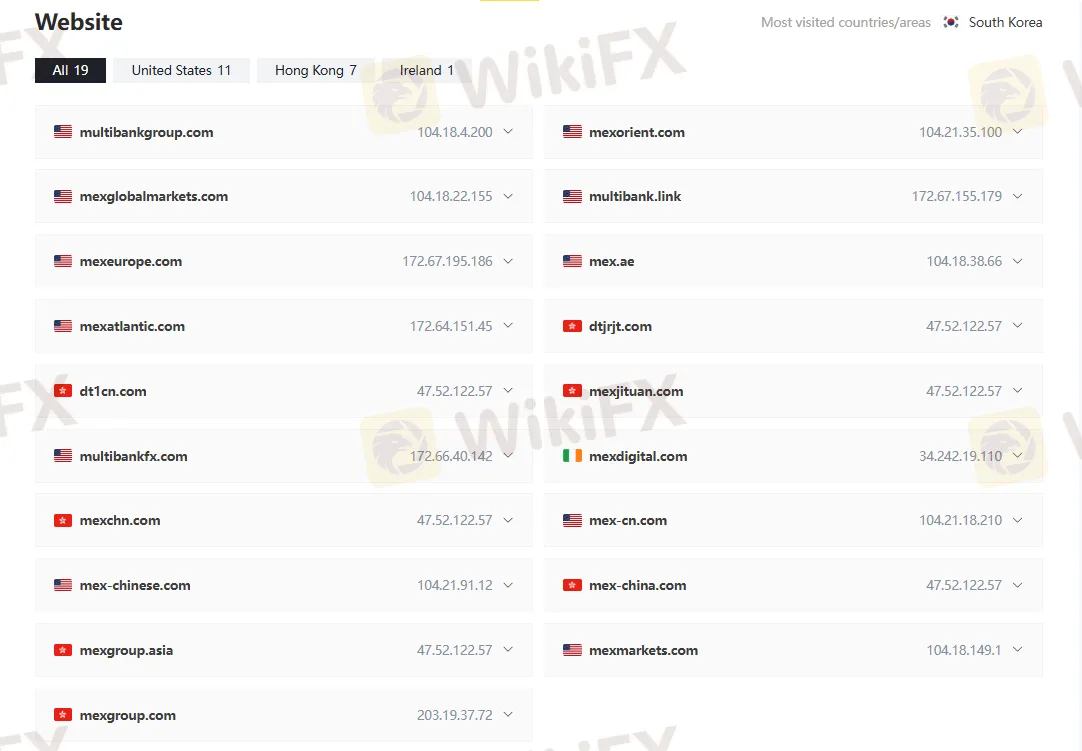

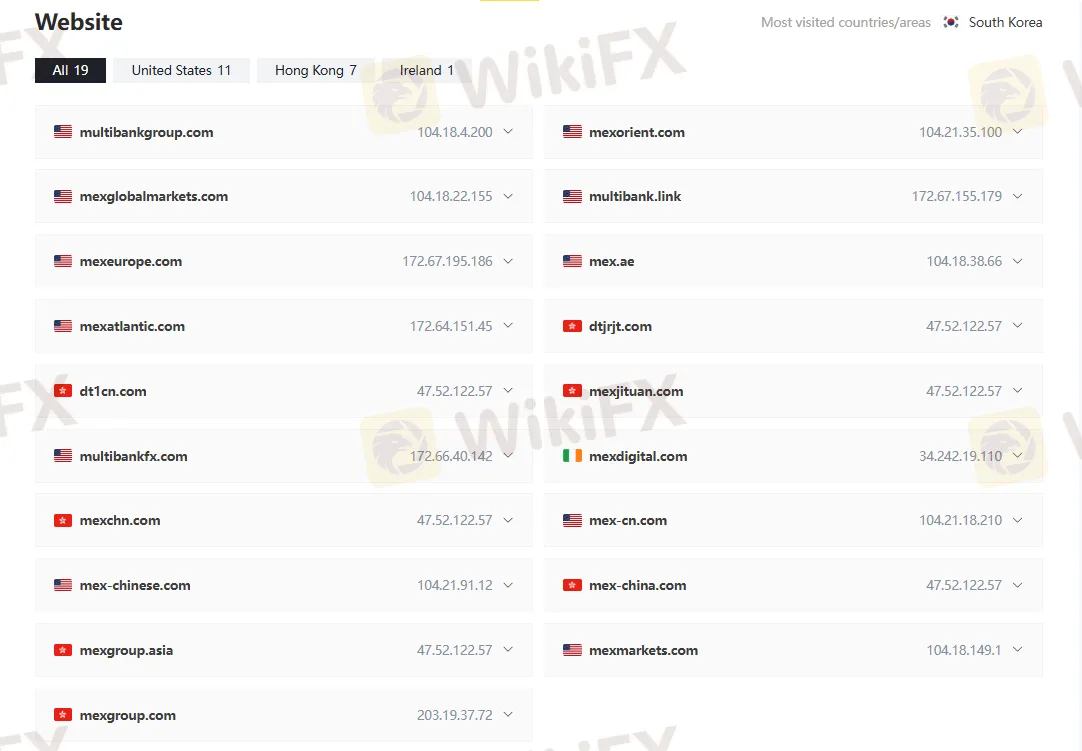

The broker‘s presence spans a wide range of domains and child URLs, including but not limited to mexglobalmarkets.com, multibankfx.com, mexorient.com, and mex-cn.com. Many of these URLs share IP addresses, and some are flagged with complaints, influencing the broker’s risk control score of 0.00 in recent assessments — further warning traders to be vigilant.

MultiBank Group Domain Portfolio and Online Presence Review

MultiBank Groups domain portfolio is extensive, with at least 19 known websites distributed across countries, including the United States, Hong Kong, Ireland, the UAE, and South Korea. Some child URLs originate from IPs flagged as suspicious or associated with complaints, as seen with multiple domains using the 47.52.122.57 IP address, linked to Hong Kong.

This scattered but expansive web of domains can mislead clients attempting to access the authentic MultiBank Group official site. Traders should prioritize MultiBanks legitimate platforms and recognize signs of scam URLs, such as inconsistent branding, questionable licensing notices, or unregulated domains.

How to Identify Legitimate MultiBank Websites

To safeguard investments, traders should:

- Verify regulatory status by checking official regulator websites (ASIC, BaFin, CYSEC, MAS).

- Cross-check the domain and IP address against trusted broker review platforms.

- Avoid child URLs with repeated complaints or revoked licenses.

- Use the verified MultiBank trading platforms linked directly from the official MultiBank Group website.

- Remain wary of subdomains offering inconsistent or unapproved services.

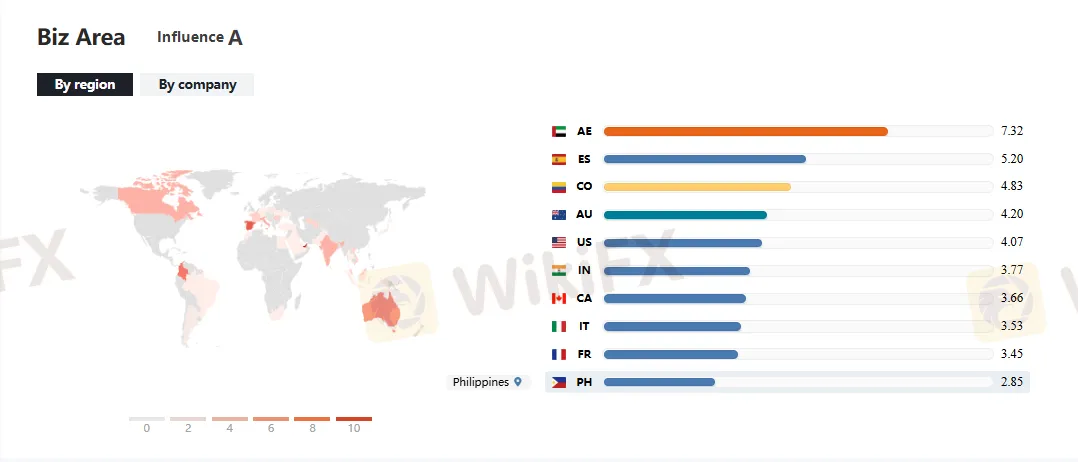

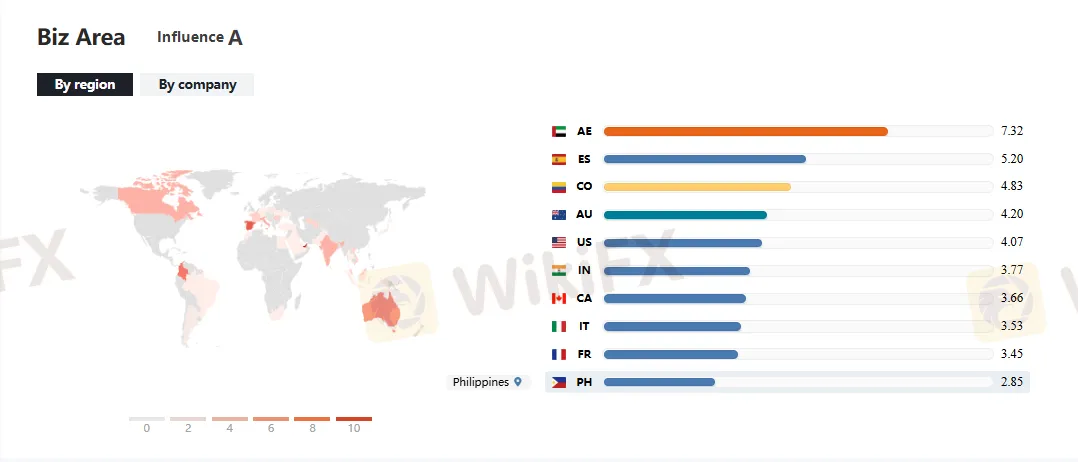

Geographical business influence data shows MultiBanks presence is highest in the United Arab Emirates, Spain, and Colombia, highlighting regions where vigilance is particularly needed.

Final Advice

Given the high volume of complaints and complex domain portfolio, it is crucial to always investigate a brokers negative cases via the WikiFX app before trading. Scan the QR code below to download and install the app on your smartphone for reliable broker risk ratings and scam alerts.