Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Juno Markets and its licenses.

When choosing a broker, regulation is often the first line of defense for any trader. In the case of Juno Markets, what may appear at first to be a well-established trading company reveals a number of concerning facts upon closer inspection. Although the broker holds some regulatory credentials, several red flags regarding its licensing status and offshore presence should not be overlooked.

While it does hold an Institution Forex Licence (STP) from the Australian Securities and Investments Commission (ASIC) under licence number 540205, this specific authorisation is restricted to institutional business only. This means that the broker cannot legally open accounts for individual retail traders under this licence, limiting the direct consumer protection benefits that ASIC regulation is known for.

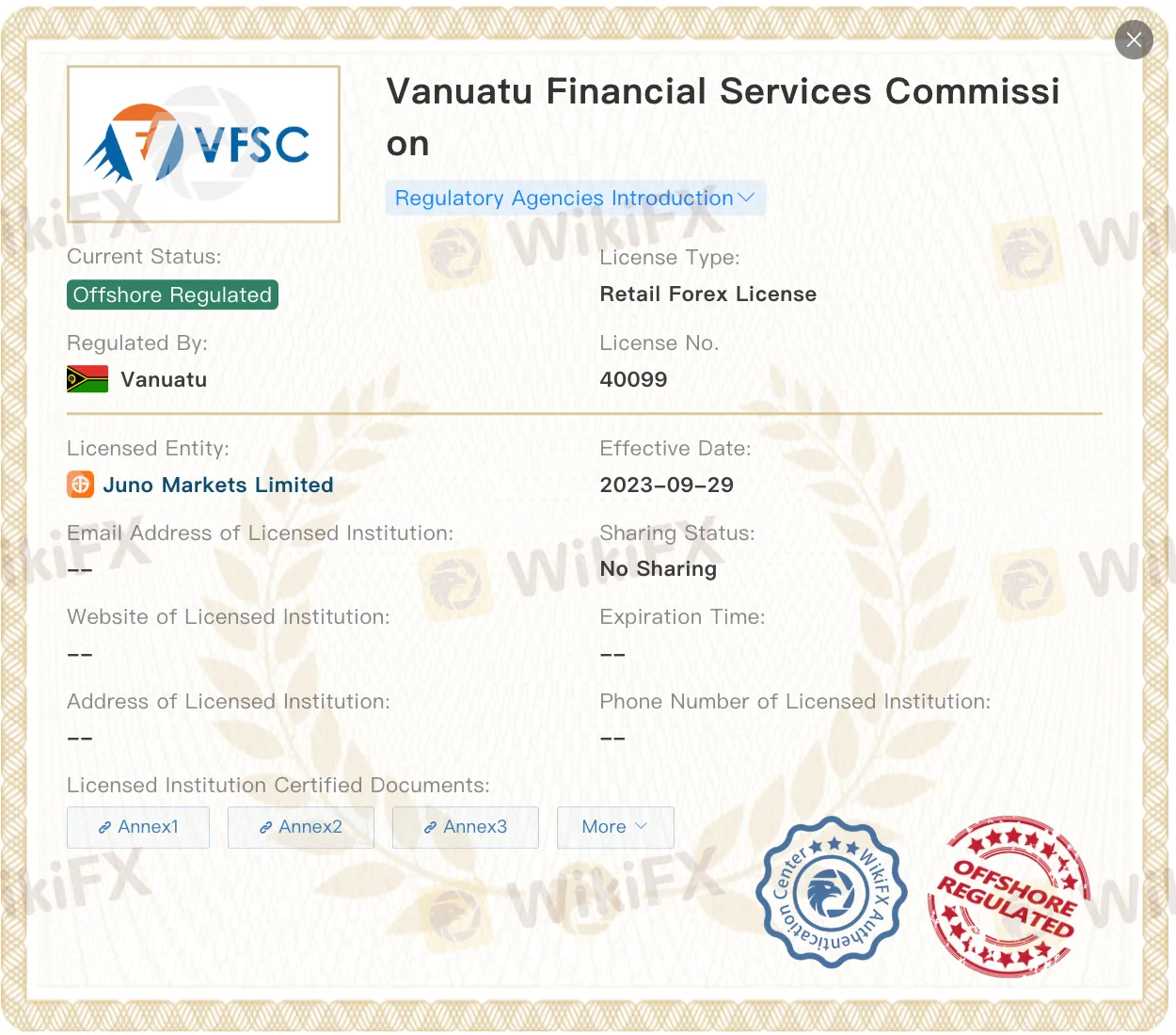

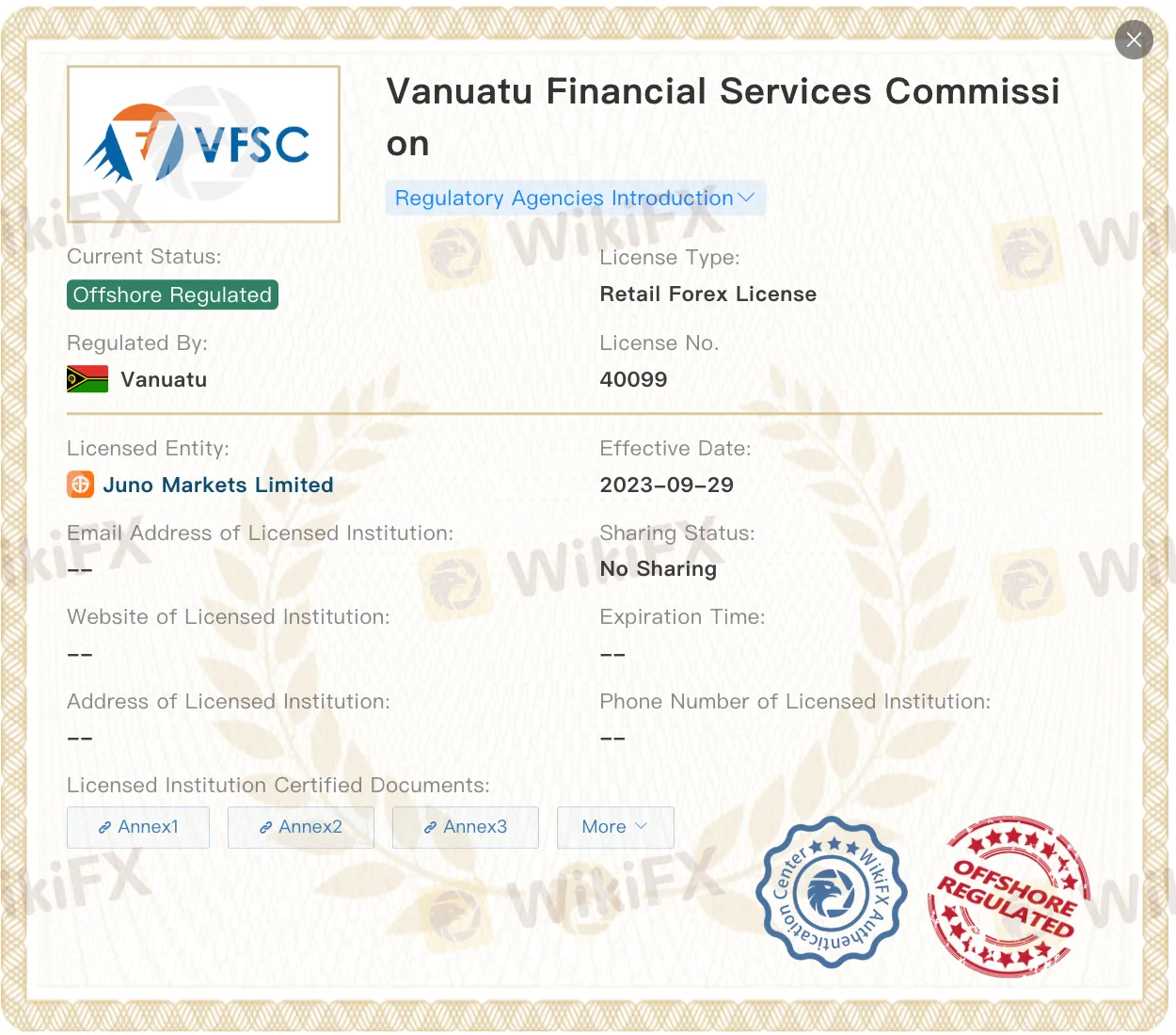

For retail accounts, Juno Markets possesses a licence from the Vanuatu Financial Services Commission (VFSC), number 40099. While this is a legal licence, the VFSC is an offshore regulator with lighter rules than ASIC or other top-tier authorities. Offshore regulation often has weaker investor protection, leaving traders with fewer options if disputes or problems arise.

Further complicating the picture is the fact that Juno Markets has been publicly disclosed by the Securities Commission Malaysia, an indication that Malaysian authorities have flagged its activities. Such disclosures often serve as cautionary notices, advising investors to proceed carefully due to potential compliance or authorisation concerns.

According to WikiFX, a platform that reviews brokers based on their regulatory background, platform operations, and user safety, Juno Markets scores just 5.94 out of 10. While this does not confirm that the broker is a scam, it certainly places it in a relatively riskier category that traders should approach with caution.