WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about XS and its licenses.

XS positions itself as a globally licensed broker, holding authorisations from multiple well-known regulatory bodies. At first glance, the list of licences suggests a commitment to compliance, with recognised authorities such as the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), the Labuan Financial Services Authority, and the Cyprus Securities and Exchange Commission (CySEC) appearing on its records. However, a closer look reveals a mix of fully verified approvals, exceeded licence scopes, and unverified authorisations, raising questions about the brokers overall regulatory strength.

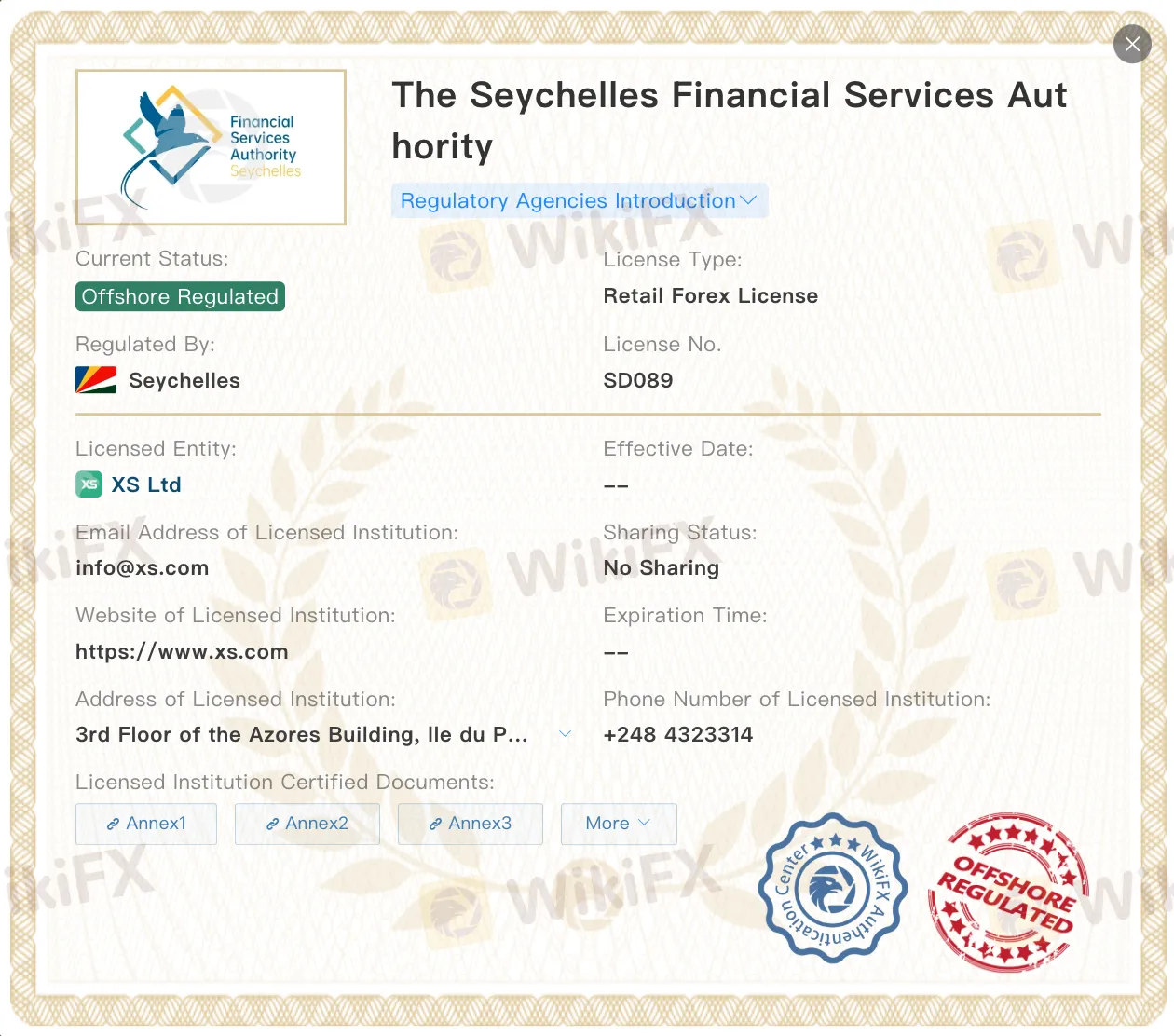

In Australia, XS holds an Institution Forex Licence (STP) under licence number 000374409, issued by ASIC. This is one of the most reputable regulators globally, known for its strict oversight of financial services providers. Similarly, its Retail Forex Licence from the Seychelles FSA under licence number SD089 allows it to operate in offshore markets, and while the FSA does impose certain standards, it is generally considered a lighter-touch regulator compared to ASIC.

XS is also licensed by the Labuan FSA under licence number MB/21/0081, granting it permission to operate under a Straight Through Processing (STP) model in Malaysias Labuan International Business and Financial Centre, which is a mid-tier jurisdiction with defined compliance requirements.

Concerns emerge when looking at the brokers South Africa FSCA licence (number 53199). While the FSCA is a legitimate market conduct regulator, official records indicate that XS exceeds the authorised business scope of its licence. This means the company may be offering services beyond what the FSCA has permitted, which could be an operational risk that traders should not ignore.

Another point of caution is the brokers CySEC licence (number 412/22). While CySEC is a respected European regulator under ESMA guidelines, this licence is marked as unverified, leaving uncertainty about whether it is active, suspended, or still pending full approval.

According to WikiFX, XS has a WikiScore of 6.56/10, a middling score that reflects both the strength of its top-tier licences and the weaknesses from its exceeded and unverified authorisations. For traders, this means that while parts of XSs operations are well-regulated, others operate in a grey area that could affect client protection.

For those considering opening an account, understanding which branch of XS you are dealing with, and under which licence, is essential. Different jurisdictions have different rules for client fund protection, dispute resolution, and operational conduct, meaning your level of safety can vary significantly depending on where your account is registered.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.