WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Want to feel at ease amid forex market volatility? Consider exploring forex options that work as derivatives based on underlying currency pairs. With multiple flexible alternatives, forex options trading is the approach you need to adopt to navigate the seemingly complex forex market. Read this article for more insights.

Want to feel at ease amid forex market volatility? Consider exploring forex options that work as derivatives based on underlying currency pairs. Trade forex options involve using a wide range of strategies that can be employed in currency trading. Now, the strategy the traders may employ depends greatly on the option type they select and the broker or platform through which they can access it. Forex options are traded in a decentralized market, making them more flexible than options traded on centralized exchanges.

Options traded in the forex market are different from those in stocks or other financial markets. Forex options trading allows you to trade without actual asset delivery. These options trade over the counter (OTC), allowing traders to choose prices and expiration dates that align with their profit or hedging strategy. What makes forex trade options more appealing is the lack of obligation for traders to fulfill the contractual terms. Forex options are attractive because they limit downside risk to just the premium paid, while offering unlimited upside potential.

Forex options trading will be used to hedge potential open positions in the forex cash market. This is also known as the physical and spot market. With trade forex options, traders can trade and gain by predicting the market movement based on political, economic, or any other developments.

Notwithstanding the benefits that forex options trading has to offer, traders will still have to deal with certain complexities. These options feature many dynamic parts that make value determination complicated. Traders may witness risks including interest rate differentials, the time horizon for expiration, market volatility, and the existing currency pairs price. Trading forex options may see high premium charges. The strike price and the expiration date help determine the premium. The best part is that forex options trading allows traders to realize some payoffs without any need to follow the process involved in purchasing a currency pair.

Retail forex traders have two types of currency options trading with both involving short-term trades of a currency pair while emphasizing its future interest rates. These are Traditional Vanilla Call or Put Option and Single Payment Option Trading Product.

This allows traders the right but not an obligation to purchase or sell any currency at the agreed price and on the date of execution. There will be one long currency pair and one short currency pair. The buyer needs to mention their purchase amount, purchase rate, and the expiration date. The seller responds by sharing a quoted premium for the trade. Traditional options may feature European or American-style expirations. Traders, however, gain the right and do not find themselves obligated to both call and put options. Should the current exchange rate put options out of the money, they will expire worthless.

Featuring a more flexible contract structure than a traditional option, a single payment option trading (SPOT) product offers binary or digital options. For instance, the buyer will speculate that EUR/USD will breach 1.3000 in 12 days. The buyer will thus get premium quotes based on the probability of this incident. With the occurrence of this event, the buyer gains profit. If it does not happen, the buyer will lose the premium paid for this. SPOT contracts involve a premium higher than those charged for traditional trade forex options contracts.

An investor feels that the Euro will surge against the USD and thus buys a currency call option on the Euro at a strike price of $115, as currency prices remain quoted at 100 times the exchange rate. As the investor enters into the contract, the spot price of the Euro remains equivalent to $110. So, if on the expiration date, the Euros spot price remains at $118. The currency option has, therefore, expired in the money. Investors receive a profit worth $300 (100 x ($118-$115), which is lower than the premium paid for the currency call option.

The strike price remains the lowest point at which options can be exercised. You cant exercise options if the strike price is not reached. However, exchanges usually sell options at varying strike prices, freeing you from one until you commit.

If the option fails to reach a point where it can be sold or purchased, it reaches the Out of the Money (OTM) stage.

Summing Up

Forex options trading is indeed a vital proposition for investors seeking both safe and profitable shores in an otherwise tumultuous forex market. Traders can also choose from different options - Traditional and SPOT to navigate the seemingly complex market. However, the success in forex options trading depends on your investment goals, risk appetite and knowledge.

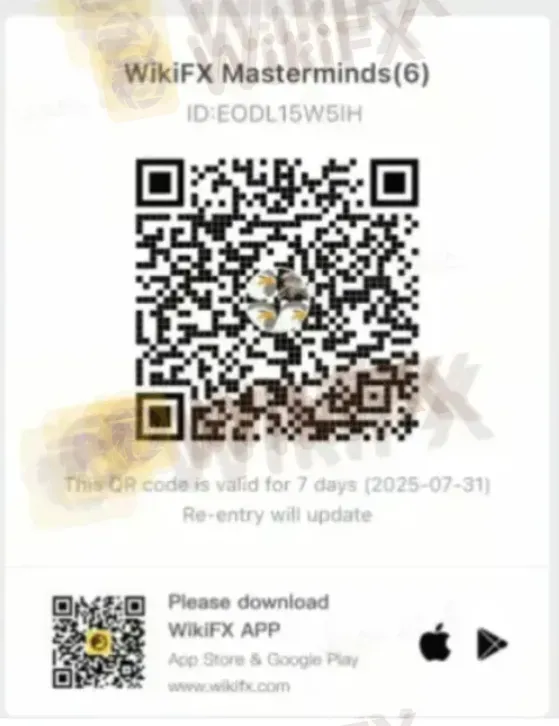

WikiFX Masterminds Is Now Live!

Join a growing community where forex insights take center stage for an informed trading journey.

Here is how you can join it.

1. Scan the QR code placed right at the bottom.

2. Install the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations, you have joined the community.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.