Abstract:Moomoo Broker Review 2025: Explore its regulatory status, key features, and functionality to determine if this trading app is a good fit for your investment needs.

As the world of online trading continues to evolve, investors seek platforms that combine ease of use, global market access, and robust regulatory oversight. Moomoo, a trading app gaining popularity across Asia and beyond, presents itself as a competitive option for modern traders. This detailed moomoo broker review for 2025 examines the companys regulatory standing, key features, and overall credibility—using verifiable facts from official documentation.

Regulatory Standing: Is Moomoo Legit?

One of the most crucial factors when choosing a broker is regulatory oversight. Regulatory credentials not only ensure operational transparency but also the safety of investor funds.

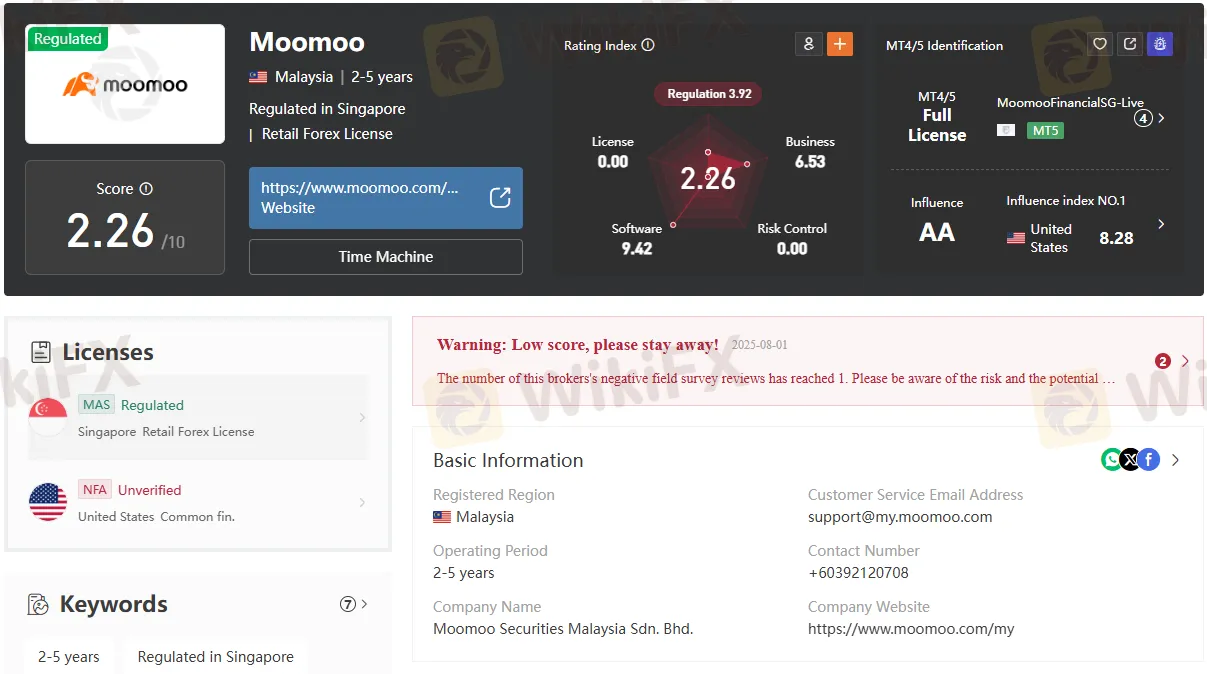

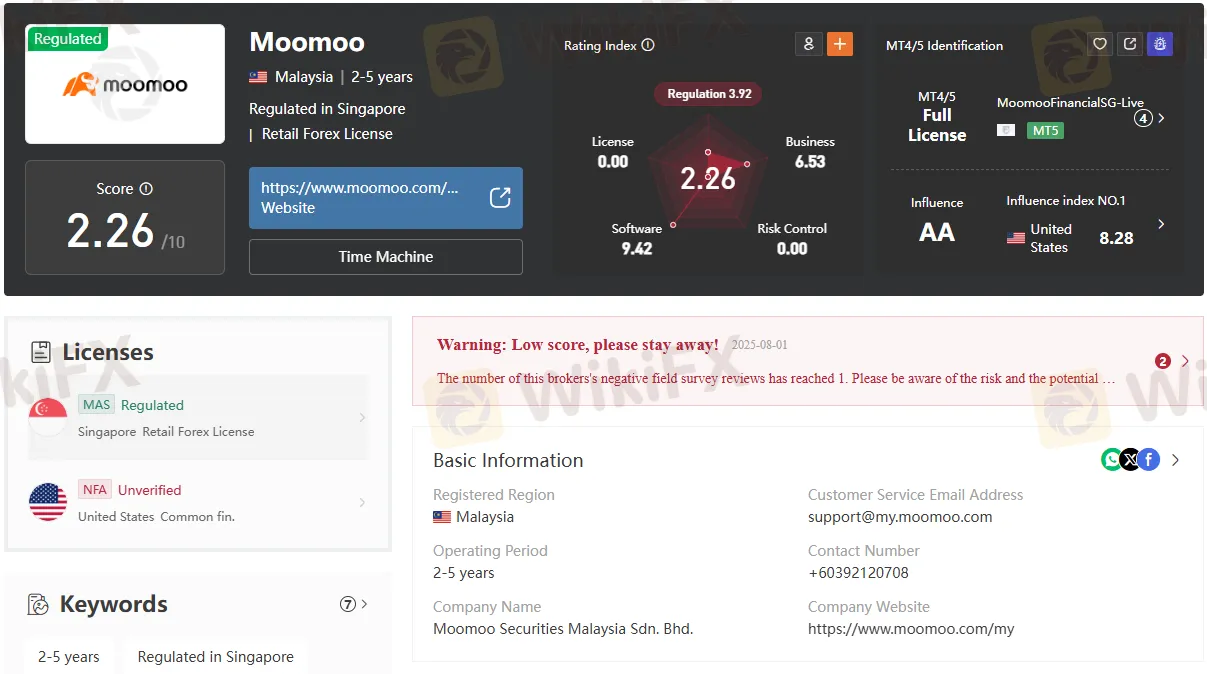

- Monetary Authority of Singapore (MAS): Moomoo Financial Singapore Pte. Ltd. is fully regulated by the Monetary Authority of Singapore under license number CMS101000. The MAS is well regarded internationally for its strict financial standards, and Moomoo operates in Singapore with a “Retail Forex License.” This status is clearly marked as “Regulated,” providing confidence for users seeking a compliant trading environment¹.

- National Futures Association (NFA), USA: Futu Futures Inc., associated with Moomoo‘s parent company, holds a “Common Financial Service License” under NFA license number 0523957 in the United States. However, it is important to note that the NFA marks the registration as “Unverified.” This means that, as of this review, Futu Futures Inc. is not recognized as a fully verified participant under NFA’s regulatory scheme. Investors should consider this when evaluating Moomoos US-related offerings and protections.

Features and Functionality

Moomoo offers a visually appealing, feature-rich trading experience tailored for both beginners and seasoned investors. It provides access to global markets, including the US, Hong Kong, and Singapore equities, as well as ETFs and options trading.

- User Interface & Tools:

- The app offers advanced charting, free Level 2 data for select markets, and a community feature for crowdsourced investment ideas.

- Educational Resources:

- Moomoo invests heavily in investor education through articles, tutorials, and webinars aimed at empowering its user base.

- Global Expansion:

- Its presence in Singapore, backed by solid regulation, is a testament to the app's commitment to international standards. However, those engaging its services via the US arm should conduct extra due diligence given the “Unverified” NFA registration.

What Sets Moomoo Apart?

- Highly Regulated in Singapore: Full MAS regulation is a strong indicator of trustworthiness for users in Singapore and the surrounding region.

- Range of Markets: Access to multiple stock exchanges through a single account.

- Technology and Analytics: Advanced market data and analytics are included in the standard offering, setting it apart in a crowded marketplace.

Considerations

- Regulatory Gaps in the US: The lack of NFA verification for its US entity is a matter of concern for those seeking robust US regulatory coverage.

- Transparency: Some company addresses and contact details are provided, but there is limited sharing of institutional email contacts on public records.

Conclusion

Moomoo stands out for its strong regulatory position in Singapore and innovative trading features, making it a compelling choice for tech-savvy investors in regulated markets. However, potential US clients should be cautious and seek additional assurances due to the current “Unverified” status with the NFA. As always, investors should conduct independent research and consider both regulatory credentials and personal trading needs before committing their funds.

For those based in Singapore and similar jurisdictions, Moomoos MAS-regulated structure offers peace of mind and a forward-thinking trading platform experience¹. For others, particularly in the US, further clarification surrounding regulatory status is advisable before opening an account.

Download the WikiFX app now to access real-time broker information, including Moomoos regulatory status and more, ensuring you make informed trading decisions.