Spec Trading Blocks Withdrawals on Big Profits

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

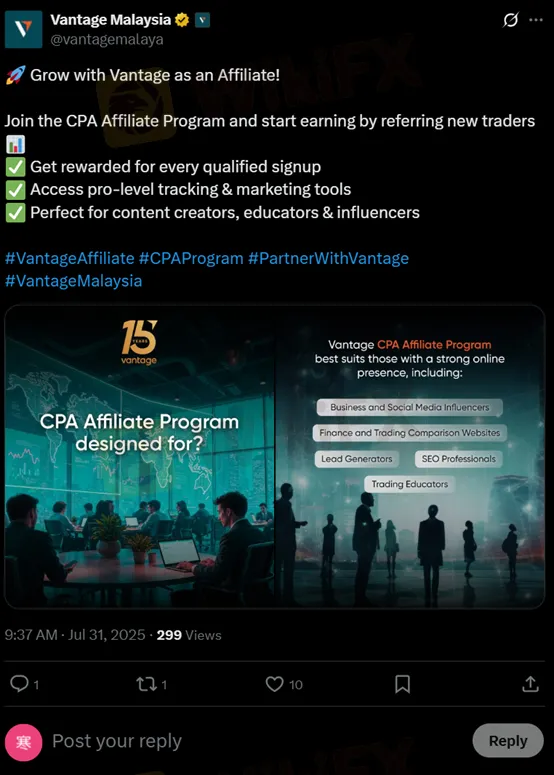

Abstract:Online forex broker Vantage, founded in 2009 and headquartered in Sydney, recently launched its new Cost-Per-Acquisition (CPA) affiliate program. Vantage recently celebrated its 15th anniversary and forms part of a broader suite of marketing initiatives aimed at expanding its referral network.

Online forex broker Vantage, founded in 2009 and headquartered in Sydney, recently launched its new Cost-Per-Acquisition (CPA) affiliate program. Vantage recently celebrated its 15th anniversary and forms part of a broader suite of marketing initiatives aimed at expanding its referral network.

Key Features of the Affiliate Program

Affiliates will earn a fixed commission for each trader they refer who meets predefined “qualified” criteria.

Vantage provides a dashboard with real-time tracking and link-management tools to help partners monitor performance and optimize campaigns.

According to Vantage, the program is especially well-suited to Business and Social Media Influencers and other B-terminal third parties.

These partners are expected to leverage their audiences and content channels to drive qualified traffic.

Marking its 15th year of operation, Vantage has rolled out a string of celebratory activities, from social-media countdowns to anniversary webinars featuring guest speakers. Historically, brokers often tie such milestones to limited-time offers (reduced spreads, deposit bonuses, VIP seminars) to boost client acquisition and retention.

About Vantage

Vantage was founded in2009 in Sydney, Australia. It has set up branches in various regions, such as the UK, Cayman Islands, and China. Vantage is a regulated broker; it is regulated by the Australian Securities & Investments Commission (ASIC) and the UKs Financial Conduct Authority (FCA).

WikiFX currently assigns Vantage a solid rating based on its regulatory standing, trading conditions, and user feedback.

Conclusion

While affiliate programs and anniversary campaigns can offer attractive incentives, WikiFX underscores that they are fundamentally marketing strategies.

After all, an affiliate program‘s shine should not blind participants to the underlying trading environment. Whether evaluating brokers for one’s trading or considering affiliate partnerships, deep due diligence remains essential.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

Received a withdrawal notification from GFS, but the amount could not be credited to your wallet despite numerous follow-ups with the Australia-based forex broker? Did you witness massive slippage in your stop-loss settings or pay high transaction fees charged by the broker? Did the broker delete and deactivate your trading account without any explanation? The Internet is flooded with negative GFS reviews for these and many more alleged trading activities by the broker. Let’s begin examining all of these in this article.

Multibank Group forex scam cases reveal denied $70K+ withdrawals in the UAE & Azerbaijan. Stay alert with the WikiFX App and avoid risky forex brokers.

Ingot Broker scam alert: Kenya victim lost $3K profit ($600 dep); Pakistan $3,200→$179 ($250 dep); HK halted post-2018. Avoid fraud—check WikiFX cases now!