Doctor loses RM880,000 in fake share investment scam

A doctor in Pahang lost over RM880,000 in a fake share scheme promising high returns

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:For Islamic traders and investors, one of the most relevant and frequently asked questions is whether forex trading is halal (permissible) or haram (forbidden) in Islam? In this article, we will explore both sides of the debate. Keep reading to uncover the truth and make Informed & Faith-conscious decisions about your investments.

For Islamic traders and investors, one of the most relevant and frequently asked questions is whether forex trading is halal (permissible) or haram (forbidden) in Islam? In this article, we will explore both sides of the debate. Keep reading to uncover the truth and make Informed & Faith-conscious decisions about your investments.

What is Forex Trading?

Forex (foreign exchange) trading involves the exchange of one currency for another with the aim of making a profit due to market fluctuations. On the surface, this sounds similar to any trade buying at a low price and selling at a high price.

Islamic Finance and Its Core Principles

In Islamic finance, all financial activities must follow Shariah law, which focuses on fairness, honesty, and avoiding harm or exploitation. This means that things like interest (riba), high uncertainty (gharar), and gambling or risky speculation (maisir) are not allowed.

To stay within Islamic guidelines, investors should avoid deals that involve unclear terms, high risk, or interest-based earnings. Investments should be backed by real assets or clear ownership, and trading should not feel like gambling. Shariah-compliant investing is about using your money in a way that is ethical, productive, and socially responsible.

What Do Scholars Say About Forex Trading?

Lets know what Islamic scholars say about Forex trading from both conservative and modern perspectives . Some said, forex Trading Is Haram (Prohibited) .

Perspective 1: Forex trading is haram, based on these reasons

Many traditional scholars and Islamic finance boards say forex trading is haram, based on these reasons:

1. Involvement of Riba (Interest)

Any trade involving interest (riba) is clearly forbidden in Islam. In forex trading, interest is often charged or paid on overnight positions, even if labeled differently.- Mufti Taqi Usmani, leading Islamic scholar and jurist of Pakistan

2. Speculation and Gambling (Maisir)

Forex is not actual currency exchange but a speculative game. When it becomes pure speculation, it falls under Maisir, which is haram.- Darul Uloom Deoband, India

3. No Physical Possession (Qabd)

The transaction must involve real possession and delivery of currency. Most retail forex platforms do not offer this; it's all digital balances without actual ownership.- Islamic Fiqh Academy, OIC ruling, 2006

4. Leverage and Margin Trading

Leverage-based trading involves borrowing money to make trades, which creates a loan with interest (riba) and excessive risk (gharar). This is clearly prohibited.- Sheikh Saleh Al-Fawzan, Saudi Islamic scholar and member of the Council of Senior Scholars

Read this Imporant Article- www.wikifx.com/en/newsdetail/202507318774488195.html

Perspective 02 : Forex Trading Is Halal With Conditions

Some modern Islamic scholars and Islamic finance boards argue that forex trading can be halal, if done properly and ethically:

Conditions That Make Forex Potentially Halal:

1. Immediate settlement (spot trading)

2. No riba (interest-free / swap-free accounts)

3. No excessive speculation or gambling

4. Clear terms, no deception or uncertainty (gharar)

5. No leverage or borrowing money with interest

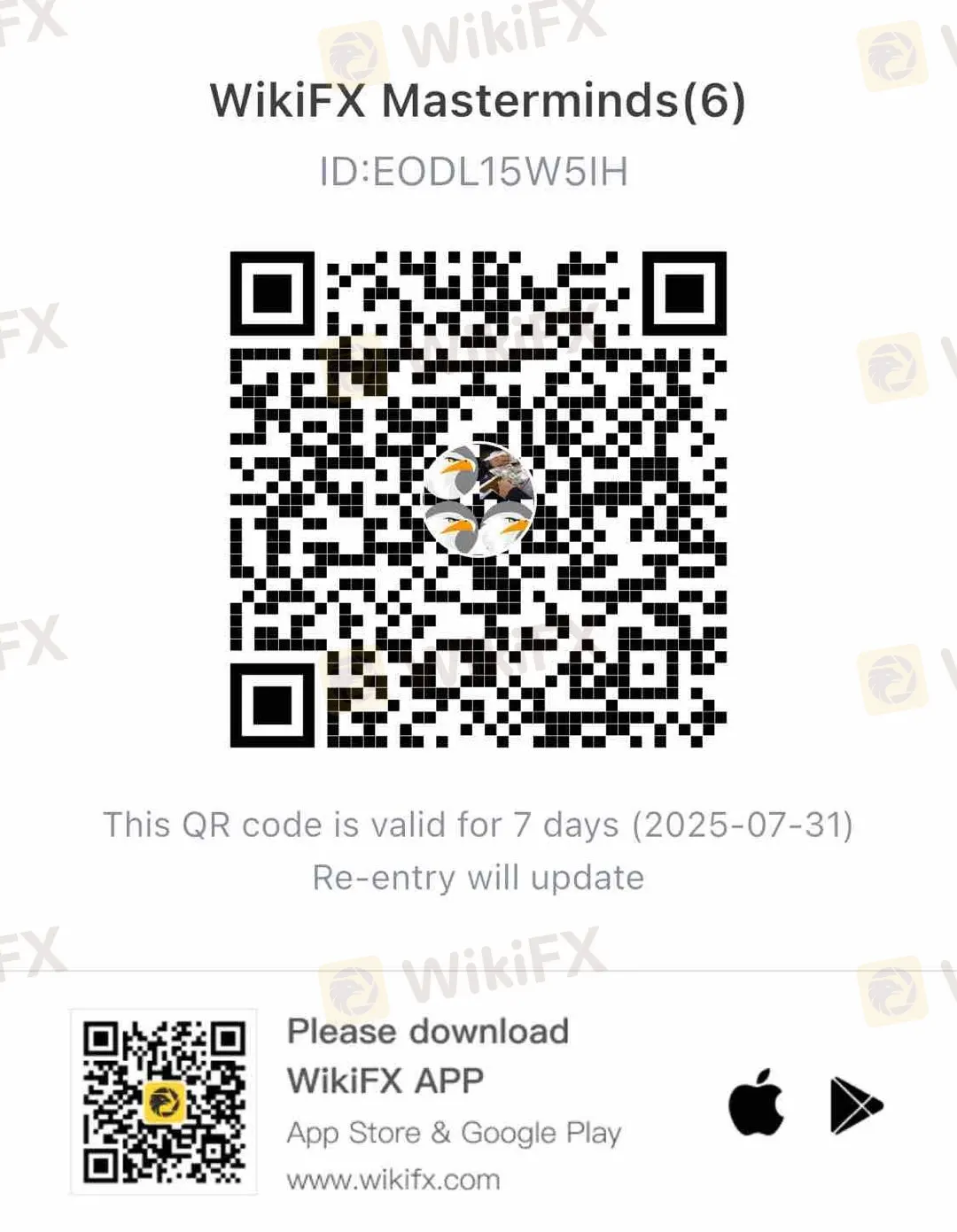

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

A doctor in Pahang lost over RM880,000 in a fake share scheme promising high returns

FIBO Group has grabbed attention from traders for mostly the wrong reasons, as traders have accused the broker of causing financial losses using malicious tactics. Whether it is about withdrawal access, deposit disappearance, trade manipulation, or awful customer support service, the broker is receiving flak from traders on all aspects online. Our team accumulated a list of complaints against the FIBO Group broker. Let’s screen these with us in this FIBO Group review article.

Do you have to pay taxes or margin when seeking fund withdrawals from GMO-Z.com, a Thailand-based forex broker? Do you witness heavy slippage when trading on the broker’s platform? These are some complaints traders have made against the broker. In this GMO-Z.com review article, we have explained these complaints. Take a look!

WikiFX Golden Insight Award uniting industry forces to build a safe and healthy forex ecosystem, driving industry innovation and sustainable development, launches a new feature series — “Voices of the Golden Insight Awards Jury.” Through in-depth conversations with distinguished judges, this series explores the evolving landscape of the forex industry and the shared mission to promote innovation, ethics, and sustainability.