WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Forex trading has become difficult nowadays due to the frequent frauds occurring every day. You can’t blindly trust any broker . They may appear genuine and authorized but end up being scams. That’s why it’s more important to stay aware. To stay alert and informed, you need to know about a particular FX broker called iFourX and recognize its red flags.

Forex trading has become increasingly difficult nowadays due to the frequent frauds occurring every day. You can‘t blindly trust any broker . They may appear genuine and authorized but end up being scams. Despite daily fraud alerts provided by financial regulators, investment scams continue to thrive. That’s why its more important to stay aware. To stay alert and informed, you need to know about a particular FX broker called iFourX and recognize its red flags.

1. Low Score

A Low score for any broker immediately raises concerns about its credibility. When we checked iFourX‘s score on WikiFX, it received a low score of 1.80 out of 10. This is one of the topmost red flags we’ve identified, and it's something you must not ignore.

2. No Regulation, No Safety

If a broker is not regulated, you cannot expect any kind of security from it. Only regulated brokers licensed by reputable authorities follow Forex trading rules and provide a safe environment for traders. Unregulated brokers often do not comply with any rules or standards and are far more likely to swindle your money.

Therefore, always avoid brokers that are not regulated by top authorities such as FCA, SEBI, or ASIC, among others.

3. Newly Built Website

Upon investigation, we discovered that this brokers website was only registered recently last year. This suggests that the broker is very new in the market and lacks sufficient experience. Newly launched websites, especially those without any verifiable trading history or client feedback, are red flags.

4. Tactic to Appear Legitimate

The broker attempts to appear credible by offering educational content, but it‘s nothing more than a superficial trick. On the website, there are two sections: one labeled “Education” and another called “Knowledge Base.” However, when you click on the Knowledge Base, you’ll find only a handful of words around 15 to 20 terms so-called glossary. In reality, its a tactic used by scam brokers to create an illusion of legitimacy without providing any real value.

5. Limited Information

One big concern is that the broker shares very little information about how it operates. This lack of transparency is not normal for trusted financial companies. iFourX seems to be hiding important details - common trick used by scam brokers.

6. WikiFX Issued Warning Against the Broker

During our investigation into this broker, we found that WikiFX has issued a warning against iFourX — a serious red flag you should not overlook. Warnings like this are crucial when choosing a broker, as they signal potential risk and unreliability. This kind of alert places iFourX in the category of potential Forex broker scams.

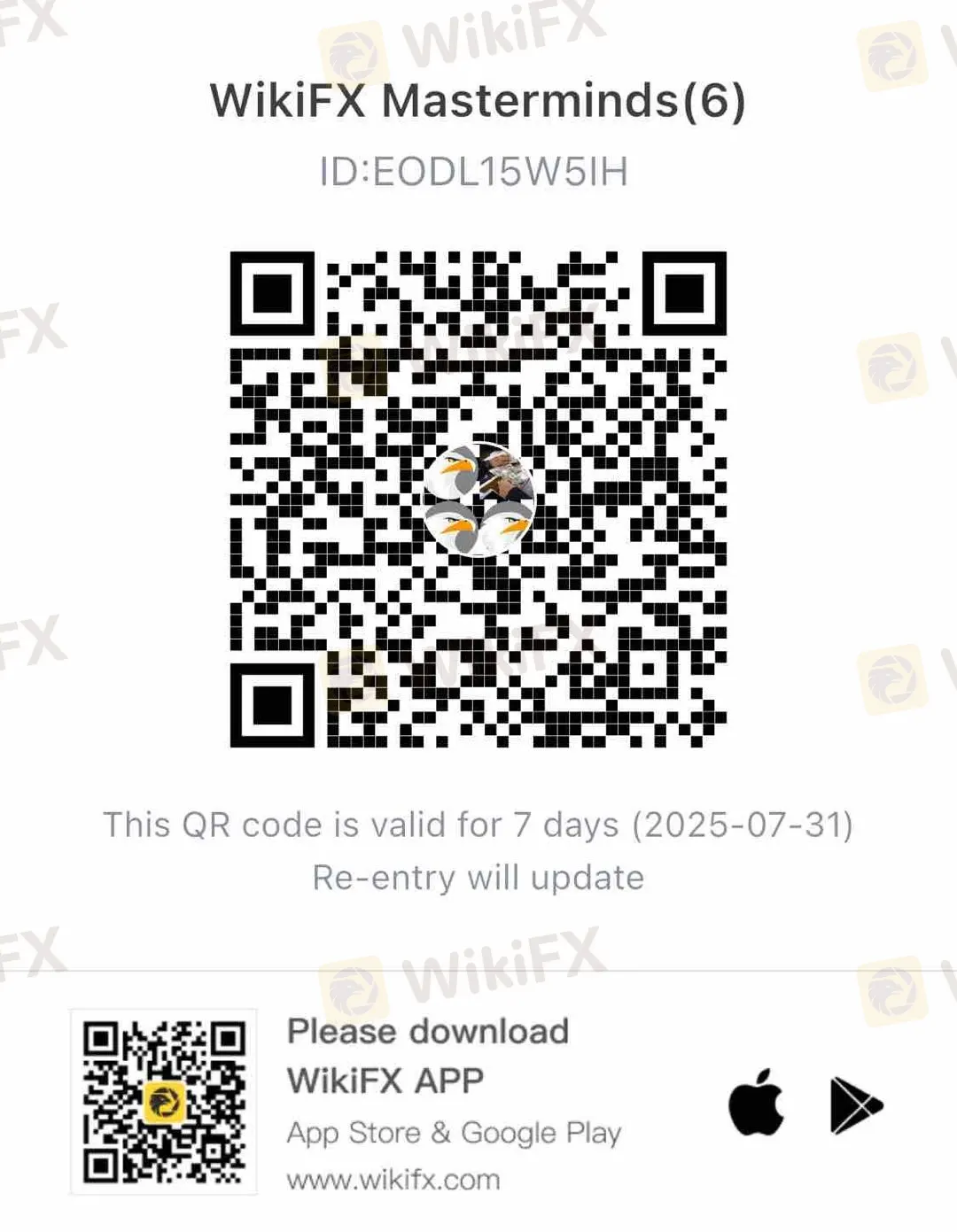

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.