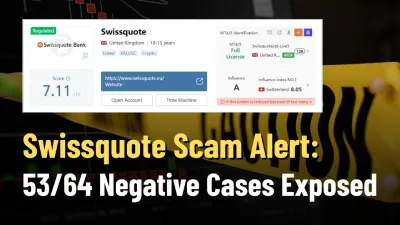

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Ever wondered what happens when your trades start going south—and your margin takes a hit? Meet ‘Stop Level Forex’—the trader’s emergency brake that kicks in just before things spiral out of control. Explore this story to know its significance.

Ever wondered what happens when your trades start going south—and your margin takes a hit? Meet ‘Stop Level Forex’—the trader‘s emergency brake that kicks in just before things spiral out of control. It’s a critical concept of margin trading involving existing equity and used margin. The balance between these two is called the margin level. Traders must ensure it does not go below 100%. You can open more trades and that too, simultaneously, with increased free margins. Suppose the margin level arrives at a predetermined percentage. In that case, brokers will make a margin call and ask traders to deposit funds into their trading account or close some positions until they restore the balance.

As the existing positions move against the traders, they tend to lose capital as the available equity starts to reduce. This is where stop level forex, or stop out, as it is often called, comes to help traders. As the margin level falls to 50%, your broker will start closing your positions until the restoration of the previous level.

As a trader, you would ask this question. If my margin level falls to ZERO, what will happen? The broker will immediately close active positions to prevent the trading account balance/s from falling into negative figures.

But is a negative trading account balance real? Yes, it is!

When trading CFDs, traders exercise the leverage option that allows them to borrow capital from the broker and widen their position. As traders open highly leveraged orders in a sharply fluctuating foreign exchange market, they may lose more capital than the prevailing trading account balance.

In case the account balance is negative, you owe it to the broker. Most brokers thus provide negative balance protection, enabling brokers to close orders partially if the trade moves against a highly leveraged position. If a broker says that it will never allow your funds to go negative, it will convert your negative balance to zero. No matter the unlikely event, such as software issues or market conditions, the broker will ensure it.

Firstly, traders should maintain a margin level of more than 100%. This will help them open new positions and maintain the current ones. If the open positions culminate in losses, the losses and the account balance with it start falling, further reducing the margin level.

As the margin level attains 100%, the forex broker will notify traders to refill or close some positions until the margin level exceeds 100% again. Even if traders fail to do so, brokers will do so on their behalf. The margin call level is the point where a broker can decide whether to close positions or not.

That point is 50%, and if it falls below this, the stop level forex concept will kick in. The stop level forex is a process involving the automatic closure of open positions. This happens as the available equity is insufficient to maintain even the ongoing positions, let alone opening new ones.

Generally, with a stop level forex, brokers initially look to close the most ineffective positions. Ineffective here means the positions that affect your account balance in the most severe manner. Brokers often close trades until the stop level and the margin call level are reached. Their act is justified. Because if losses continue to mount, traders will witness a negative account balance.

This example will have GBP/EUR as the currency pair. A forex trader has an available equity of 1,000 sterling. The margin required for gaining a 10,000-sterling position remained 2%. So, the used margin in this case equals 200 GBP. To compute the margin level, you should divide the available equity by the used margin and express it in percentage terms. Here, it will be (1,000/200)x100%=500%. Since the margin level here exceeds 500%, the trader can open new trade positions. However, with more trades, you consume more margin, leaving you with a reduced margin level. In case the trade went opposite as planned, lowering GBP/EUR prices.

The loss remained insignificant initially. But after a point, the price falls too much and empties the account balance. Soon, the loss for the trader went up to 800 GBP. The margin level thus dropped to 100% as the available equity fell to 200 GBP. So, the forex broker will send a margin call to the trader, who will have to refill the balance or close the position.

Heres something exciting for you! Join WikiFX Masterminds where you can connect with the Forex Intellectuals.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.