WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about CBCX and its licenses.

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. CBCX is a broker that holds recognized financial licenses in two different jurisdictions.

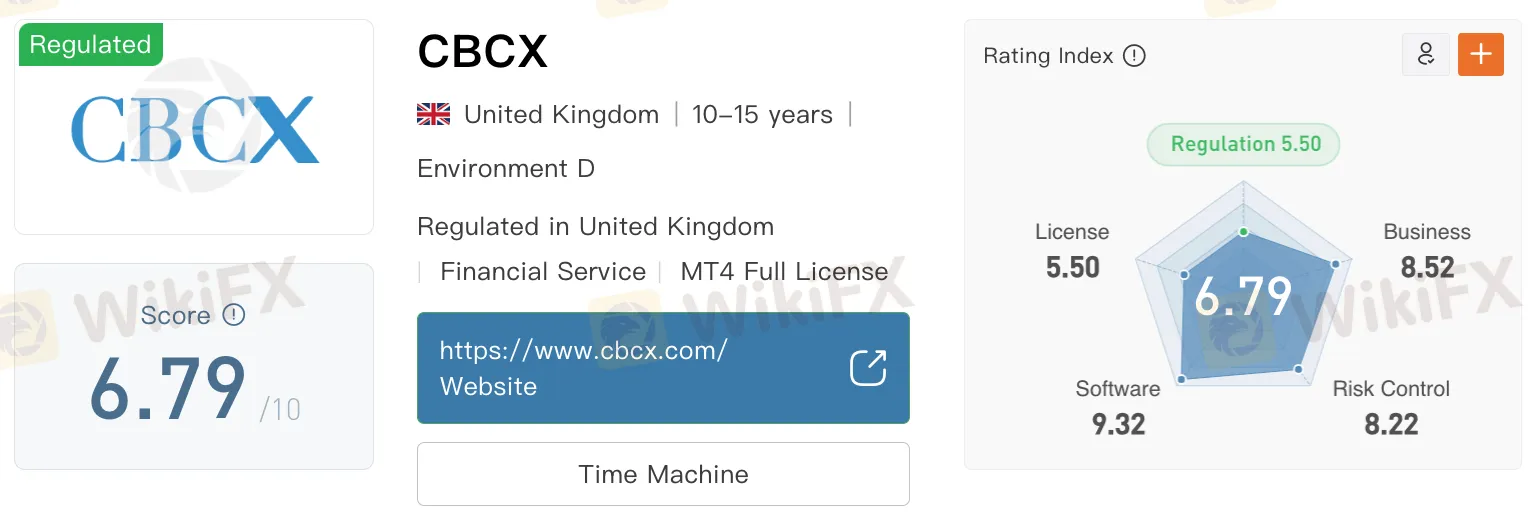

On WikiFX, CBCX holds a score of 6.79 out of 10. This rating reflects a generally stable regulatory framework and active operations, while also noting areas that may require closer review, particularly where a broker operates across multiple jurisdictions with different scopes of regulatory coverage.

CBCX is currently licensed by the Financial Conduct Authority (FCA) in the United Kingdom under license number 572911. The FCA is an independent financial regulatory body responsible for overseeing firms that provide financial services to consumers. FCA-regulated firms are required to comply with strict standards related to transparency, client fund protection, and operational conduct.

In addition to its FCA license, CBCX is also registered with South Africas Financial Sector Conduct Authority (FSCA) under license number 49700. The FSCA is responsible for regulating market conduct among financial institutions and aims to promote fair treatment for financial customers. However, it is noted that CBCX operates beyond the business scope permitted under its FSCA license, which is categorised as a non-forex financial services license. This means that while the broker is listed with the FSCA, it may be offering services not fully covered under its South African authorization.

In summary, CBCX has formal licenses from both the UK‘s FCA and South Africa’s FSCA, which indicates a certain level of regulatory presence. However, the brokers activities exceeding the scope of one of its licenses suggests that traders should take time to understand the specific services being offered and where they fall under regulatory supervision. As always, traders are encouraged to perform due diligence before engaging with any broker, especially when services are offered across multiple regions with varying rules and oversight levels.

Conducting due diligence before investing is crucial, and independent verification tools such as WikiFX can be instrumental in assessing the legitimacy of brokers and investment firms. The WikiFX mobile application, available on Google Play and the App Store, provides comprehensive insights into brokers regulatory status, customer reviews, and safety ratings. By leveraging such resources, investors can make informed decisions and avoid the financial devastation caused by fraudulent schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.