Smart People, Costly Scams: Education Isn’t Enough

Sundramoorthy said investment scams continued to ensnare victims from all walks of life, including highly educated professionals accustomed to analytical and evidence-based thinking

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Even with all the warnings out there, many people still fall for Ponzi schemes. Some even fall for them more than once. Why do people keep falling for the same trap?

Even with all the warnings out there, many people still fall for Ponzi schemes. Some even fall for them more than once. These scams promise high returns with little or no risk. But in reality, they pay early investors using money from new ones, and eventually collapse, leaving many with huge losses.

So, why do people keep falling for the same trap?

Chasing Hope After a Loss

After losing money, many people feel desperate to recover it. When a new “opportunity” appears, it can feel like a way to fix everything. It is not just about getting back the money, but also their pride. Scammers know this. They offer exactly what people want to hear: a second chance, quick profits, and a better future.

Feeling Overconfident

People who‘ve been scammed before often believe it won’t happen again. They think they‘ve learned their lesson. But this overconfidence can be dangerous. Scams are always changing. Scammers become smarter and more convincing. If you’re too sure of yourself, you might miss the warning signs again.

Surrounding Yourself with the Wrong Crowd

Many scam victims are part of online groups or communities where everyone talks about how much money they‘re making. These places make it hard to see the truth. When everyone seems to agree it’s a good deal, it becomes easy to believe. Your brain will start ignoring anything that says otherwise, and this is called confirmation bias.

Staying Silent Out of Shame

A lot of people never tell anyone they‘ve been scammed. They feel embarrassed or afraid of being judged. But silence makes it easier to be scammed again. Talking about what happened, even just with one person, could effectively help you learn and stay alert. You’re not alone, and theres no shame in being tricked.

The Fear of Missing Out

Modern Ponzi schemes look very different today. They may use fancy websites, social media ads, and even cryptocurrency. They make you feel like you‘ll miss a great chance if you don’t act fast. This “fear of missing out,” or FOMO, is a powerful albeit costly trap.

How to Avoid Being Scammed Again

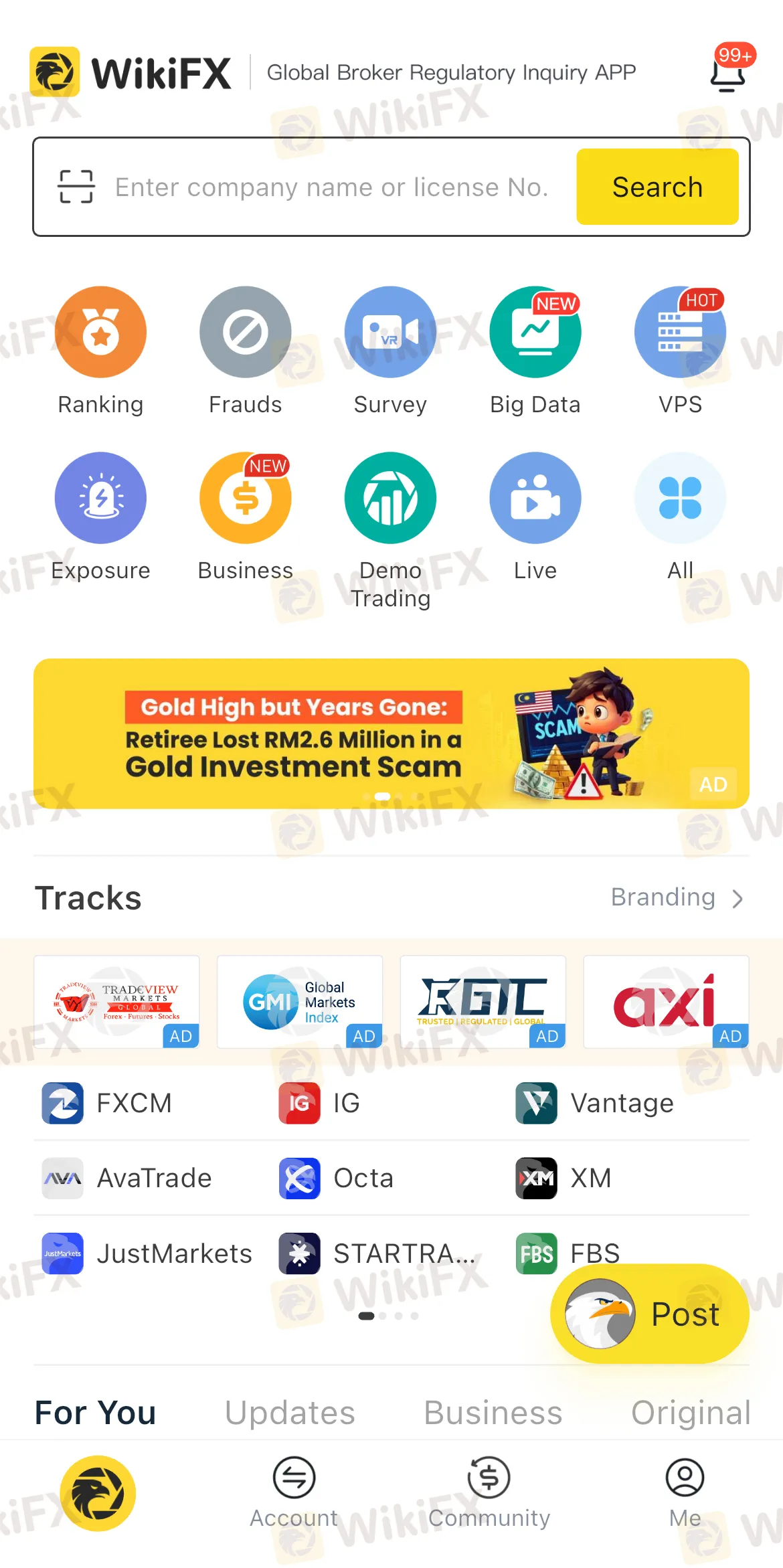

Conducting due diligence before investing is crucial, and independent verification tools such as WikiFX can be instrumental in assessing the legitimacy of brokers and investment firms. The WikiFX mobile application, available on Google Play and the App Store, provides comprehensive insights into brokers regulatory status, customer reviews, and safety ratings. By leveraging such resources, investors can make informed decisions and avoid the financial devastation caused by fraudulent schemes.

Most importantly, don‘t blame yourself. Falling for a scam doesn’t mean you‘re foolish, it means you’re human. But learning from it can save you from losing even more in the future.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Sundramoorthy said investment scams continued to ensnare victims from all walks of life, including highly educated professionals accustomed to analytical and evidence-based thinking

Police busted 97 online scam cases and seized more than RM5 million, in a series of integrated operations conducted in the capital throughout last year.

A 67-year-old former civil servant in Penang has lost more than RM1 million after being lured into a fraudulent online share investment scheme promoted through social media

Malaysia’s Securities Commission warns that complaints about unlicensed investment activities have doubled in five years—3,602 cases in 2024 and 2,039 in H1 2025—highlighting increasingly sophisticated scams targeting even professionals and seniors. Schemes often mimic legitimacy, then block withdrawals via “compliance” or “maintenance” excuses. The core defense is pre-investment verification and ongoing risk control.