Abstract:Description: This article provides a thorough review of FXTM from multiple perspectives, including its basic introduction, fees, safety, account opening, and trading platforms.

Basic Introduction

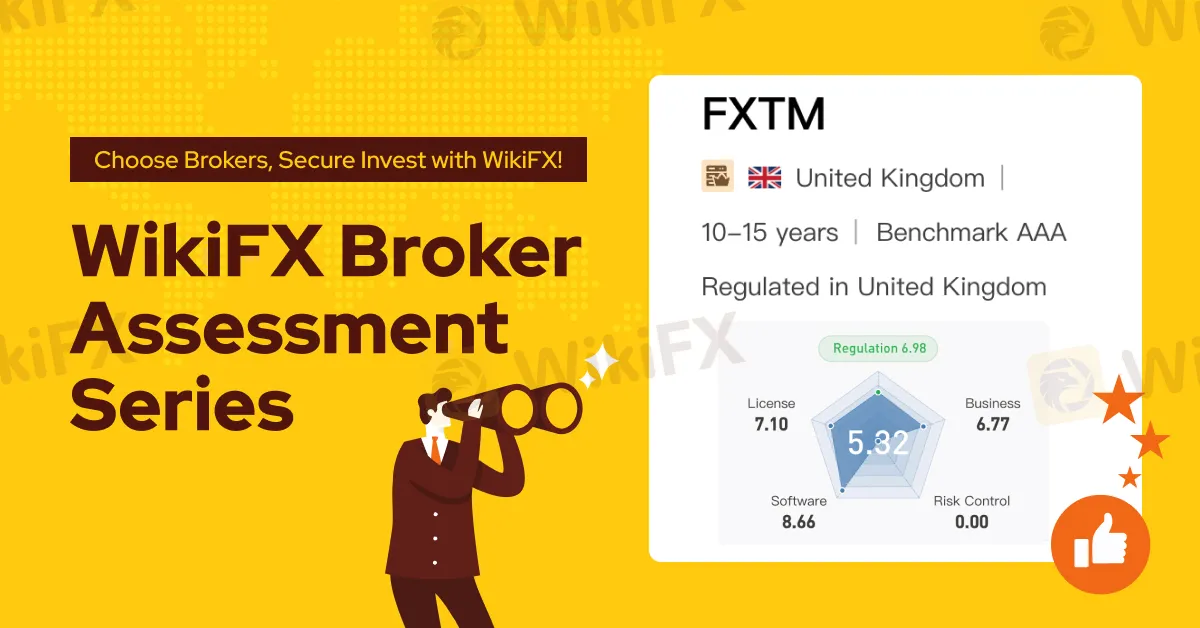

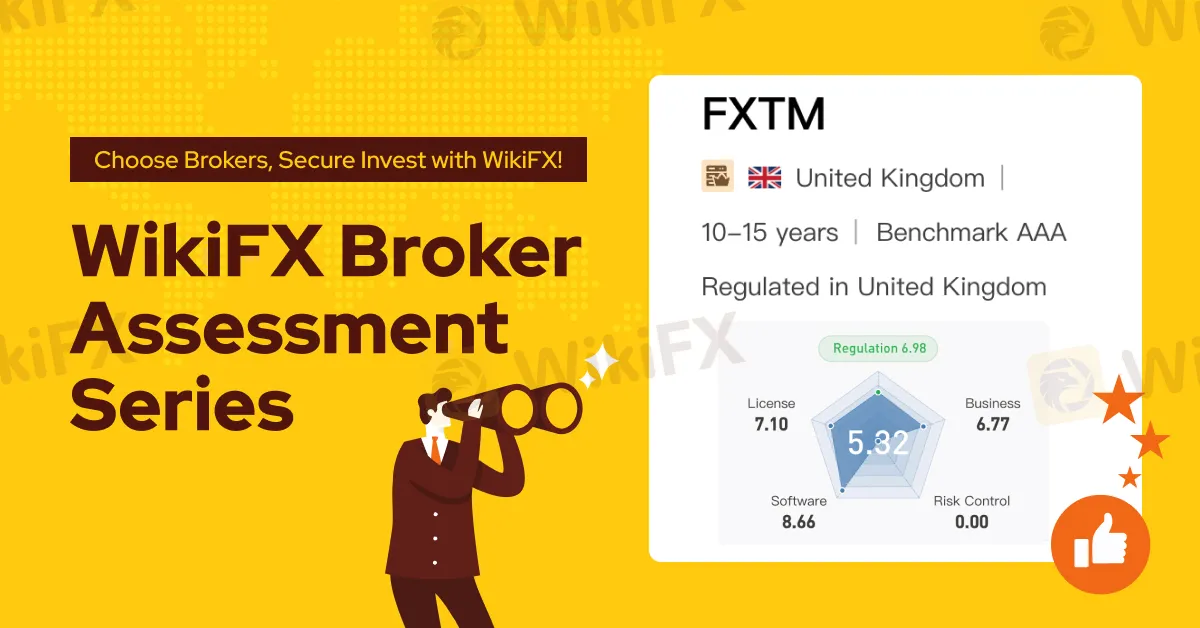

FXTM is a globally recognized CFD and forex broker, regulated by the UK's Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Mauritius Financial Services Commission (FSC). It's important to note that since March 2021, FXTM, under CySEC regulation, continues to offer services to professional clients in the region.

FXTM offers competitive forex trading fees, a seamless and fully digital account opening process, and provides fast, effective customer support.

Features

FXTM has become a popular choice among forex traders, attracting a large number of investors due to its low fees, digitalized account opening process, and excellent customer service. The account opening process is entirely online and fast, allowing users to complete registration in a short amount of time, eliminating the cumbersome steps typically involved in traditional account setups. Additionally, FXTM excels in customer service, offering efficient and professional support to ensure that clients receive timely assistance and solutions to any issues they may encounter. Whether you're a beginner or an experienced investor, FXTM provides a convenient and transparent trading experience to help you navigate the forex market effectively.

Fees

FXTM offers low-cost forex trading services. For forex transactions, FXTM charges a commission of $3.50 per lot, in addition to the spread costs (for example, the EUR/USD spread is 0.2). For CFDs on indices, FXTM charges a commission of $35 per million nominal value, along with spread costs (for instance, the S&P 500 CFD spread is 1.0). Withdrawal fees vary depending on the client's country of residence, the withdrawal method used, and the currency involved, with specific fees differing based on individual circumstances.

Trading Platforms

FXTM provides the MetaTrader 4 (MT4) mobile trading platform, which is available for both iOS and Android devices, offering a convenient mobile trading experience. Particularly notable is its design and user-friendliness, with all features easily accessible. The login process is simple and quick, requiring only one step, and the two-factor authentication (2FA) feature offers enhanced security, which should be a priority for any company to implement in order to bolster account safety.

In terms of features and design, FXTMs MetaTrader 4 mobile platform is almost identical to the desktop version, with the main difference being that the desktop platform allows users to set price alerts. This consistency across platforms ensures a seamless trading experience, whether on desktop or mobile.

Product Selection

FXTM offers a range of products including forex and CFDs, with non-EU clients also able to trade real stocks. These products sufficiently cover the primary investment needs of most individual investors, providing flexible investment choices suited to various types of traders. If you wish to explore the reliability of a specific broker, you can visit our website (https://www.WikiFX.com/en) for more information, or download the WikiFX app to find a broker you can trust, ensuring your trading experience remains safe and reliable.