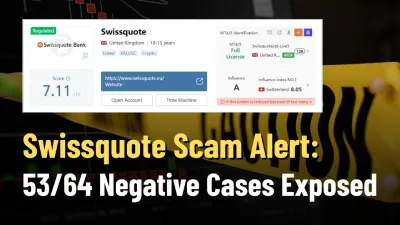

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:NAGA introduces UAE and Saudi Arabian stocks to its trading platform, offering zero commissions and expert tools like Autocopy to tap into booming Middle Eastern markets.

NAGA, a leading fintech platform, has expanded its offering by adding stocks from the UAE and Saudi Arabia, opening the door for investors to explore the dynamic Middle Eastern markets. This move aims to capitalize on growing global interest in the regions financial ecosystems, all under the trusted oversight of the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority.

A few top-performing stocks now accessible to NAGA users include:

NAGA's Autocopy trading system empowers users by enabling them to mirror trades made by seasoned investors, granting access to professional expertise without requiring advanced knowledge. Furthermore, NAGA is celebrating this milestone by offering zero commission on stock trading and copy trading with no fixed fees, making the platform even more appealing for novice and experienced traders alike.

The addition of UAE and Saudi equities aligns with broader market trends. For instance, Centroid Solutions‘ recent integration with SNB Capital allows streamlined access to Saudi Exchange (Tadawul), a vital hub for the region's growing financial activity. Similarly, Interactive Brokers’ entry into Saudi equities demonstrates heightened investor interest in the Gulf Cooperation Council (GCC) region.

The robust regulatory frameworks in both nations and rapidly expanding sectors like mining, banking, and technology make the Middle Eastern markets increasingly attractive for global investors.

In addition to its expanded stock offerings, NAGA has doubled down on financial education with a team of expert analysts to provide real-time insights and actionable knowledge. This team includes industry veterans like:

NAGAs financial literacy initiative combines webinars, eBooks, bite-sized daily videos, and live market insights, ensuring traders of all backgrounds can confidently navigate global markets.

The announcement comes on the heels of NAGA‘s “Your Go-to App for Everything Money” campaign, featuring Mike Tyson in a humorous “slice of life” ad showcasing the platform’s simplicity. The campaign builds on NAGAs recent successes, including a unified website, a partnership with Borussia Dortmund, and the launch of an innovative trading app via Telegram.

NAGA‘s expansion into UAE and Saudi Arabian equities signals its commitment to offering cutting-edge tools and opportunities in thriving global markets. With its robust trading platform, zero commissions, and expert-driven financial education, NAGA empowers investors to explore the dynamic potential of the Middle Eastern financial ecosystem. Whether you're a seasoned trader or a newcomer, this move underscores NAGA’s mission: to make investing simple, accessible, and impactful.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.