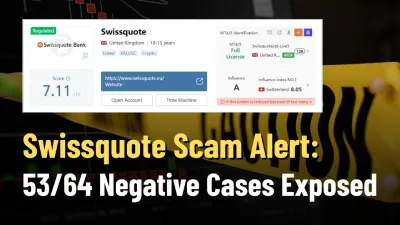

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Explore our detailed review of LunarCapital, an unregulated broker with a low WikiFX rating of 1.03. Learn about its offerings and regulatory concerns.

LunarCapital is a broker that raises significant concerns for potential traders due to its unregulated status and low WikiFX rating. Operating from the Trust Company Complex on Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands, LunarCapital does not provide any regulatory information on its official website. This lack of regulatory oversight is a major red flag for those considering trading with this broker.

LunarCapital does not disclose any details regarding its regulatory status, which is a critical factor in assessing the legitimacy and safety of a broker. The absence of regulatory oversight means there is no assurance that the broker adheres to industry standards or has the necessary safeguards to protect traders' funds. The lack of transparency about its regulatory status raises serious concerns about the broker's reliability and trustworthiness.

LunarCapital is headquartered at Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands MH96960. The broker's official website is lunarcapital.org, and it can be contacted via email at support@lunarcapital.email. The lack of detailed contact information and physical presence in a well-regulated financial center adds to the skepticism surrounding this broker.

LunarCapital offers a diverse range of trading instruments, including:

Despite the variety of trading instruments available, the broker's unregulated status overshadows its offerings.

The WikiFX App offers several features designed to assist traders in making informed decisions:

In conclusion, LunarCapital's lack of regulation and its low rating on WikiFX suggest significant risks for potential traders. The absence of regulatory oversight combined with the broker's poor reliability rating indicates that traders should exercise caution and consider more reputable and regulated alternatives. Leveraging tools and insights from the WikiFX App can help traders navigate the risks and make more informed choices in their trading endeavors.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.