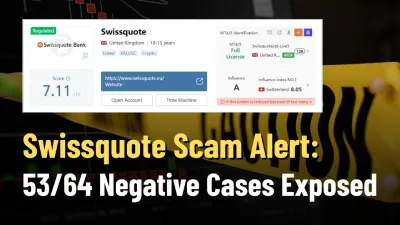

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:In this article, we will conduct a comprehensive examination of GTCFX, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2012, GTCFX operates as an online brokerage specializing in the trading of exchange-traded CFDs, distinguishing itself through its commitment to offering competitive spreads and fast execution. GTCFX now serves over 895,000 clients in more than 100 countries worldwide.

GTCFX provides a diverse range of over 27, 000 tradable assets, covering currency pairs, precious metals, stock CFDs, commodities, equity indices, and energies.

Additionally, GTCFX offers copy trading services, facilitating money managers and traders to enhance efficiency, profitability, and generate passive income.

Meanwhile, GTCFX features an introducing broker (IB) program, enabling individuals and businesses to earn commissions by referring new clients to the company.

Types of Accounts:

GTCFX offers three account options: the Standard Account, the Pro Account, and the ECN Account. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

GTCFX offers a range of payment options, including bank transfers, Visa, Mastercard, Neteller, FasaPay, Skrill and additional methods.

Trading Platforms:

GTCFX provides its clients with three advanced trading platforms, each catering to various trading needs.

Research and Education:

Although GTCFX does not offer educational resources to support traders, the broker provides a market news section, an economic calendar, market hours and holidays, as well as an A-Z glossary.

Customer Service:

GTCFX offers 24/7 customer service support in multiple languages, including English, French, Italian, Spanish, Korean, Japanese, Chinese, and more. Clients can contact GTCFX via email at support@gtcfx.com or by submitting an inquiry through the broker's question form. Additionally, trading clients have the option to reach out to GTCFX by phone through the brokers local offices, as listed below:

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned GTCFX a WikiScore of 8.11 out of 10.

Upon examining GTCFXs licenses, WikiFX found that the broker is regulated by the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) of the United Kingdom, the Securities and Commodities Authority of the United Arab Emirates, and the Vanuatu Financial Services Commission (VFSC). WikiFX has also verified the legitimacy of these licenses.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.