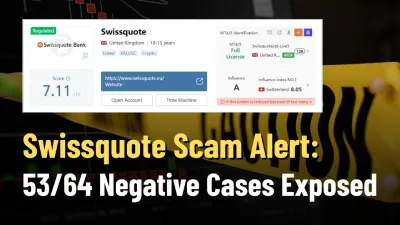

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

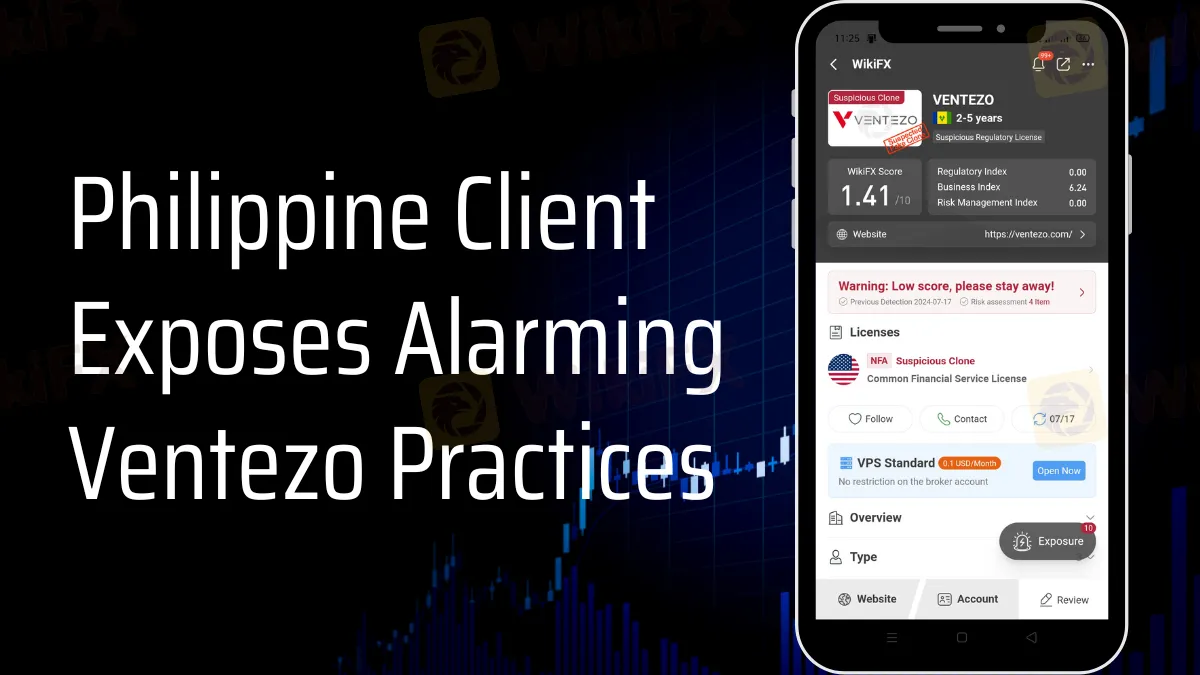

Abstract:A Filipino client alleges unauthorized withdrawals and unresponsive support from broker Ventezo, raising concerns about the firm's integrity.

A Filipino client of the broker Ventezo has come forward with allegations of unauthorized withdrawals and a lack of accountability from the company's representatives. This exposé aims to shed light on the troubling practices within Ventezo, highlighting the experiences of affected individuals and the responses from the company's support team.

Ventezos Troubling Actions

A Filipino client who wishes to remain anonymous recently discovered that almost $150 was withdrawn from their account without authorization. Despite not logging into the account, the client received an email confirming the completion of the withdrawal. This incident prompted immediate inquiries with Ventezo's chat support, only to find that the company's Philippine Country Manager had already transferred the funds. However, the client has not received the money, leading to severe discrepancies between the systems updates and the actual transfer status.

The client, acting on behalf of their mother, another Ventezo client, has also raised significant concerns regarding the non-release of withdrawn funds. Despite receiving official email confirmations from Ventezo, the funds have yet to be deposited into their bank account. The repeated follow-ups with Ventezos support team have been met with claims that the funds were transferred, yet there is no evidence of this in the client's bank account.

Another related case of Ventezo

Lack of Accountability and Support

Ventezos chat representative, LLIA, and the Philippine Country Manager, Ms. Elenita Canoy, have failed to provide satisfactory explanations or resolutions to the issues raised by the clients. The support team's responses have been inconsistent, and their assurances have proven unreliable. The client's efforts to escalate the matter, including sending a demand letter to Ventezo's owner via WhatsApp, have gone unanswered, further aggravating their concerns about the company's integrity and transparency.

Clients Demand Justice

The affected clients are demanding accountability and transparency from Ventezo. They seek the immediate release of their funds and a thorough investigation into the unauthorized withdrawals. The clients also call for better communication and support from Ventezos representatives to ensure such incidents do not recur.

Ventezo Limited, headquartered at 703 Clover Business Center, Victory Square, Kaliningrad Region, Russia, has yet to respond to these serious allegations. The company's lack of responsiveness and the discrepancies in its transaction reports raise significant questions about its operational practices and the safety of client funds.

Industry Implications

This exposé highlights the critical need for regulatory oversight in the brokerage industry, especially for firms operating in multiple countries. Clients rely on brokers to manage their investments with integrity and transparency. Incidents like these undermine trust in the industry and call for stricter regulations to protect investors from potential fraud and mismanagement.

Regulatory bodies in the Philippines and other jurisdictions must take these allegations seriously and investigate Ventezos practices. Protecting investors should be a top priority to ensure that brokers adhere to ethical standards and provide reliable services to their clients.

Conclusion

The alarming practices of Ventezo, as revealed by their Filipino clients, demand immediate attention from regulatory authorities and industry watchdogs. The unauthorized withdrawals, non-release of funds, and lack of accountability from Ventezos representatives paint a troubling picture of the firm's operations. Clients like the anonymous whistleblower and their mother deserve justice and the assurance that their investments are secure.

As the investigation into Ventezos practices unfolds, potential clients must exercise caution and thoroughly research brokers before entrusting them with their funds. Transparency, accountability, and effective support are essential qualities that every brokerage firm must uphold to maintain the trust and confidence of its clients.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.